|

FTSE Developed Europe Index

The FTSE Developed Europe Index is an index of European stocks, part of the FTSE Global Equity Index Series. It is a subset of the FTSE Europe Index. The FTSE Eurobloc Index is a subset of it. The FTSE Developed Europe Ex UK Index The FTSE Developed Europe ex UK Index comprises large (45%) and mid (55%) cap stocks covering 15 Developed markets in Europe excluding the UK. It was launched on June 30, 2000. The Base Date is December 31, 1986. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalisation. Stocks are free-float weighted. The index follows the Industry Classification Benchmark. Constituents of the FTSE Developed Europe ex UK Index {, class="wikitable" , - ! Country ! Constituents ! Market Cap(USDbn)(%) ! Weight , - , Austria , 11 , 73 , 1.14 , - , Belgium/Luxembourg , 16 , 144 , 2.26 , - , Denmark , 12 , 110 , 1.73 , - , Finland , 11 , 161 , 2.53 , - , France , 72 , 1,503 , 23.57 , - , ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSE Global Equity Index Series

The FTSE Global Equity Index Series is a series of stock market indices provided by FTSE Group. It was launched in September 2003, and provides coverage of over 16,000 stocks in 48 countries. The series comprises various global and local indexes, including: * FTSE Global Total Cap Index, a global index covering approximately 16,000 stocks from micro cap to large cap * FTSE Global All Cap Index, a global index covering approximately 9,000 stocks from small cap to large cap * FTSE All-World Index, a global index covering approximately 4,000 mid cap and large cap stocks Several of the indices in the series are used by The Vanguard Group as bases of their mutual funds and '' ETFs.'' Overview of indexes These are some of the most important indexes managed by FTSE: FTSE All-World Index The FTSE All-World index started in 1986 as the ''FT-Actuaries World Index''. The All-World series is sub-divided into three segments: *Developed *Advanced Emerging *Emerging Markets The Base Date i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industry Classification Benchmark

The Industry Classification Benchmark (ICB) is an industry classification taxonomy launched by Dow Jones and FTSE in 2005 and now used by FTSE International and STOXX. It is used to segregate markets into sectors within the macroeconomy. The ICB uses a system of 11 industries, partitioned into 20 supersectors, which are further divided into 45 sectors, which then contain 173 subsectors. The ICB is used globally (though not universally) to divide the market into increasingly specific categories, allowing investors to compare industry trends between well-defined subsectors. The ICB replaced the legacy FTSE and Dow Jones classification systems on 3 January 2006, and is used today by the NASDAQ, NYSE and several other markets around the globe. All ICB sectors are represented on the New York Stock Exchange except Equity Investment Instruments (8980) and Nonequity Investment Instruments (8990). Dow Jones divested itself of its 50% interest in the ICB in 2011 and announced it was cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

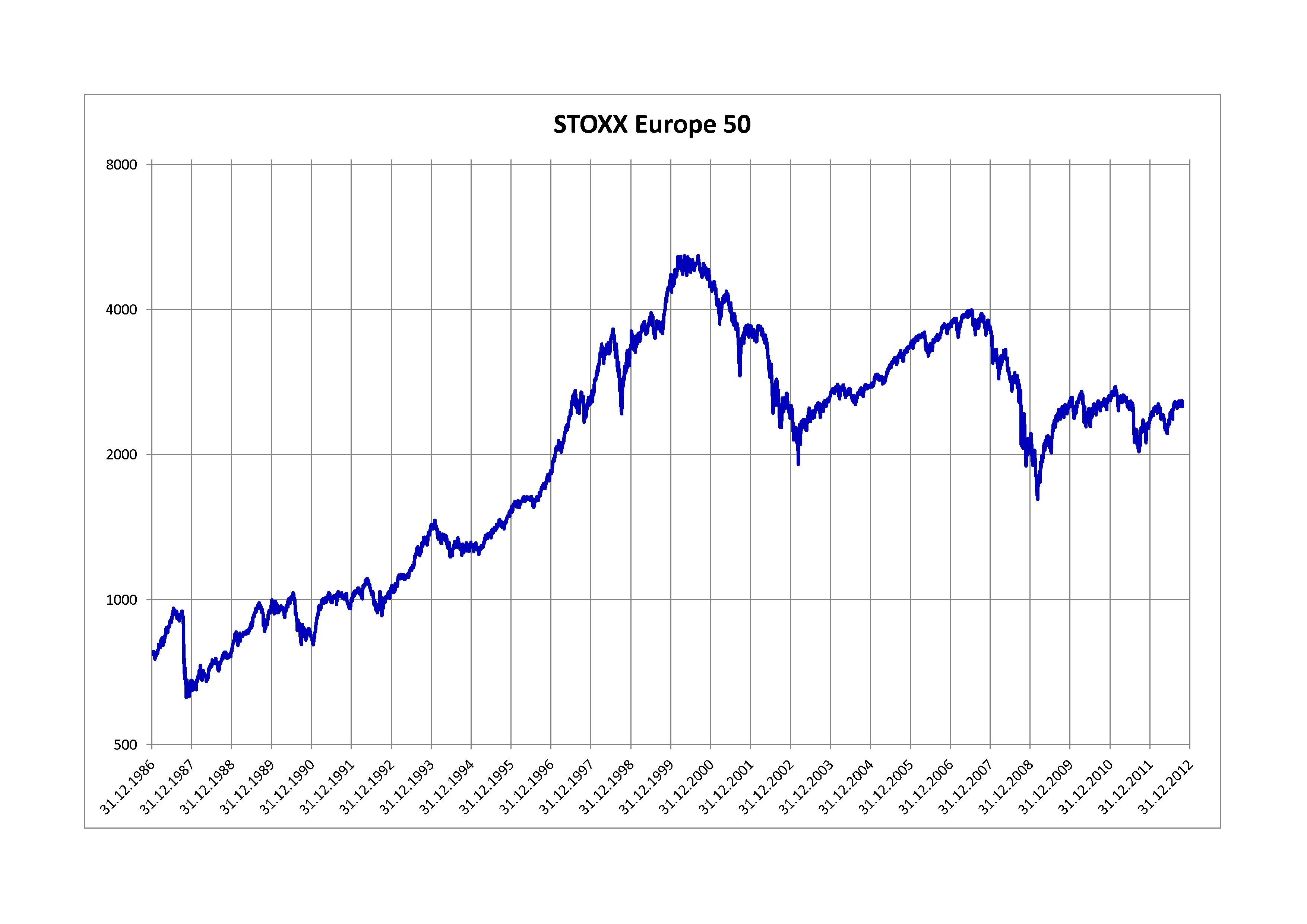

Stoxx Europe 50

The STOXX Europe 50 is a stock index of European stocks designed by STOXX Ltd., an index provider owned by Deutsche Börse Group and SIX Group. The index was introduced in February 1998. The STOXX Europe 50 index provides a blue-chip representation of supersector leaders in Europe covering almost 50% of the free-float market capitalization of the European stock market. The index covers 50 stocks from 18 European countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. The index is weighted quarterly according to free-float market capitalization with components capped at a maximum of 10% and is reviewed annually in September. It is licensed to financial institutions to serve as underlying for a wide range of investment products such as exchange-traded funds (ETFs), futures, options, and structured products worldwide. Versions excludi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |