|

Fuel Taxes In Australia

The main fuel tax in Australia is an excise tax, to which Goods and Services Tax ("GST") is added. Both taxes are levied by the federal government. In Australia the GST (currently 10%) is applied on top of the fuel excise tax. In some cases, businesses may be entitled to exemptions or rebates for fuel excise tax, including tax credits and certain excise-free fuel sources. The "double dipping" (GST imposed on the excise tax) was fully compensated for by lowering the excise at the time the GST was introduced in 2001. While the excise stopped being indexed for inflation in 2001, indexation was reintroduced in 2014 (see History below). The tax collected is added to general revenue. From April 1 to October 1, the fuel excise was lowered or cut by 50% by the federal budget 2022 to 22.1c per litre for all fuels. Excise tax rates The excise tax on commonly used fuels in Australia as of February 1, 2022: * $0.442 per litre on unleaded petrol fuel (including standard, blended ( E10) and p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transport

Transport (in British English), or transportation (in American English), is the intentional movement of humans, animals, and goods from one location to another. Modes of transport include air, land (rail and road), water, cable, pipeline, and space. The field can be divided into infrastructure, vehicles, and operations. Transport enables human trade, which is essential for the development of civilizations. Transport infrastructure consists of both fixed installations, including roads, railways, airways, waterways, canals, and pipelines, and terminals such as airports, railway stations, bus stations, warehouses, trucking terminals, refueling depots (including fueling docks and fuel stations), and seaports. Terminals may be used both for interchange of passengers and cargo and for maintenance. Means of transport are any of the different kinds of transport facilities used to carry people or cargo. They may include vehicles, riding animals, and pack animals. Vehicles may incl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Australia

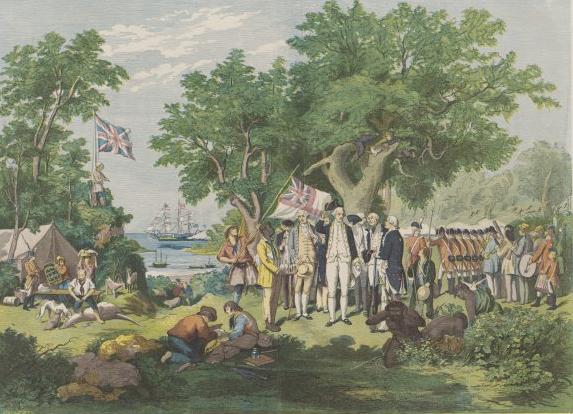

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission. Australia maintains a relatively low tax burden in comparison with other wealthy, developed nations, at 27.8% of GDP in 2018. History When the first Governor, Governor Phillip, arrived in New South Wales in 1788, he had a Royal Instruction that gave him power to impose taxation if the colony needed it. The first taxes in Australia were raised to help pay for the completion of Sydney's first gaol and provide for the orphans of the colony. Import duties were put on spirits, wine and beer and later on luxury goods. After 1824 the Government of New South Wales raised extra revenue from customs and excise duties. These were the most important sources of revenue for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Queensland

) , nickname = Sunshine State , image_map = Queensland in Australia.svg , map_caption = Location of Queensland in Australia , subdivision_type = Country , subdivision_name = Australia , established_title = Before federation , established_date = Colony of Queensland , established_title2 = Separation from New South Wales , established_date2 = 6 June 1859 , established_title3 = Federation , established_date3 = 1 January 1901 , named_for = Queen Victoria , demonym = , capital = Brisbane , largest_city = capital , coordinates = , admin_center_type = Administration , admin_center = 77 local government areas , leader_title1 = Monarch , leader_name1 = Charles III , leader_title2 = Governor , leader_name2 = Jeannette Young , leader_title3 = Premier , leader_name3 = Annastacia Palaszczuk ( ALP) , legislature = Parliament of Queensland , judiciary = Supreme Court of Queensland , national_representation = Parliament of Australia , national_representation_type ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ha V New South Wales

''Ha v New South Wales''. is a High Court of Australia case that dealt with section 90 of the Australian Constitution, which prohibits States from levying excise. Facts The plaintiffs were charged under the ''Business Franchise Licences (Tobacco) Act 1987'' (NSW) with selling tobacco in New South Wales without a licence. The Act provided for a licence fee, which consisted of a fixed amount, plus an amount calculated by reference to the value of tobacco sold during the 'relevant period'. The 'relevant period' was defined as 'the month commencing 2 months before the commencement of the month in which the licence expires'. The plaintiffs argued that the licence fee imposed by the Act was an excise and hence invalid due to section 90 of the Constitution. Decision A slim majority of the Court (Brennan CJ, McHugh, Gummow and Kirby JJ) ruled in favour of the plaintiffs, adopting the broad view of an excise per ''Matthews v Chicory Marketing Board (Vic)''.. They ruled an excise was a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High Court Of Australia

The High Court of Australia is Australia's apex court. It exercises Original jurisdiction, original and appellate jurisdiction on matters specified within Constitution of Australia, Australia's Constitution. The High Court was established following passage of the ''Judiciary Act 1903''. It derives its authority from Chapter III of the Australian Constitution, which vests it responsibility for the judiciary, judicial power of the Commonwealth. Important legal instruments pertaining to the High Court include the ''Judiciary Act 1903'' and the ''High Court of Australia Act 1979''.. Its bench is composed of seven justices, including a Chief Justice of Australia, Chief Justice, currently Susan Kiefel. Justices of the High Court are appointed by the Governor-General of Australia, Governor-General on the Advice (constitutional law), advice of the Prime Minister of Australia, Prime Minister and are appointed permanently until their mandatory retirement at age 70, unless they retire ea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. Overview A CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically. Sub-indices and sub-sub-indices can be computed for different categories and sub-categories of goods and services, being combined to produce the overall index with weights reflecting their shares in the total of the consumer expenditures covered by the index. It is one of several price indices calculated by most national statistical agencies. The annual percentage change in a CPI is used as a measure of inflation. A CPI can be used to index (i.e. adjust for the effect of inflation) the real value of wages, salaries, and pensions; to regulate prices; and to deflate monetary magnitudes to show changes in real values. In most c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clean Fuels

Clean fuel may refer to type of fuel used for transport or a type of fuel used for cooking and lighting. With regards to cooking, the Sustainable Development Goal 7 aims to "Ensure access to affordable, reliable, sustainable and modern energy for all." Clean fuel there is defined by the emission rate targets and specific fuel recommendations (i.e. against unprocessed coal and kerosene) included in the normative guidance WHO guidelines for indoor air quality. Clean fuel is one component of sustainable energy. Transport Clean fuels used for transport can be biofuels that have lower greenhouse gas emission rates, such as ethanol or biodiesel biogas. Liquefied petroleum gas (LPG) is another example. Cooking and lighting Clean fuels used for cooking and lighting can include biogas, LPG, electricity, ethanol, natural gas. Furthermore, clean-burning stoves, solar cookers and alcohol-fuel stoves are cooking solutions that typically deliver high performance in terms of reducing in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aviation

Aviation includes the activities surrounding mechanical flight and the aircraft industry. ''Aircraft'' includes fixed-wing and rotary-wing types, morphable wings, wing-less lifting bodies, as well as lighter-than-air craft such as hot air balloons and airships. Aviation began in the 18th century with the development of the hot air balloon, an apparatus capable of atmospheric displacement through buoyancy. Some of the most significant advancements in aviation technology came with the controlled gliding flying of Otto Lilienthal in 1896; then a large step in significance came with the construction of the first powered airplane by the Wright brothers in the early 1900s. Since that time, aviation has been technologically revolutionized by the introduction of the jet which permitted a major form of transport throughout the world. Etymology The word ''aviation'' was coined by the French writer and former naval officer Gabriel La Landelle in 1863. He derived the term from the v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incentive Schemes

In general, incentives are anything that persuade a person to alter their behaviour. It is emphasised that incentives matter by the basic law of economists and the laws of behaviour, which state that higher incentives amount to greater levels of effort and therefore, higher levels of performance. Divisions Incentives can be broken down into two categories; intrinsic incentives and extrinsic incentives. The motivation of people's behaviour comes from within. In activities, they are often motivated by the task itself or the internal reward rather than the external reward. There are many internal rewards, for example, participating in activities can satisfy people's sense of achievement and bring them positive emotions. An intrinsic incentive is when a person is motivated to act in a certain way for their own personal satisfaction. This means that when a person is intrinsically incentivised, they perform a certain task to please themselves and are not seeking any external reward, nor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)