|

Forward Freight Agreement

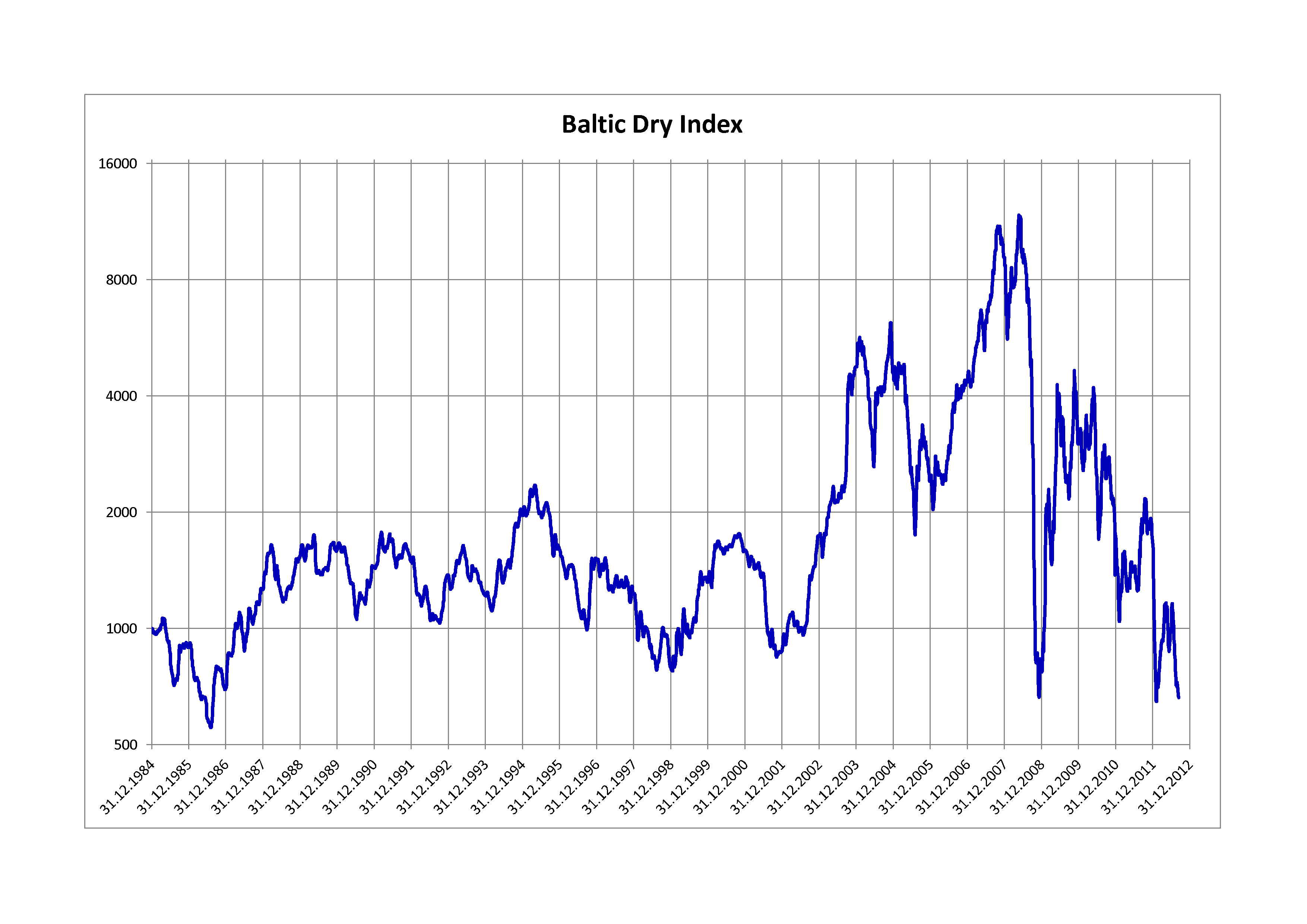

A forward freight agreement (FFA) is a financial forward contract that allows ship owners, charterers and speculators to hedge against the volatility of freight rates. It gives the contract owner the right to buy and sell the price of freight for future dates. FFAs are built on an index composed of a shipping route for tanker or a basket of routes for dry bulk, contracts are traded ‘over the counter’ on a principal-to-principal basis and can be cleared through a clearing house. Freight futures contracts settle over the average price of spot freight during the corresponding month. Given freight is intangible, there is no physical delivery. Rather, the contracts settle in cash against the arithmetic average price of spot freight published by the Baltic Exchange. The Baltic Exchange, on a daily basis, publishes a number of freight assessments for various shipping routes reflecting the prevailing level of shipping rates. Such assessments for the corresponding vessel classes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Contract

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on at the time of conclusion of the contract, making it a type of derivative instrument.John C Hull'', Options, Futures and Other Derivatives (6th edition)'', Prentice Hall: New Jersey, USA, 2006, 3 The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the ''delivery price'', which is equal to the forward price at the time the contract is entered into. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the value date where the securities themselves are exchanged. Forwards, like other derivative securities, can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment. The word hedge is from Old English ''hecg'', originally any fence, living or artificial. The first known use of the wor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tanker (ship)

A tanker (or tank ship or tankship) is a ship designed to transport or store liquids or gases in bulk. Major types of tankship include the oil tanker, the chemical tanker, and gas carrier. Tankers also carry commodities such as vegetable oils, molasses and wine. In the United States Navy and Military Sealift Command, a tanker used to refuel other ships is called an oiler (or replenishment oiler if it can also supply dry stores) but many other navies use the terms tanker and replenishment tanker. Tankers were first developed in the late 19th century as iron and steel hulls and pumping systems were developed. As of 2005, there were just over 4,000 tankers and supertankers or greater operating worldwide. Description Tankers can range in size of capacity from several hundred tons, which includes vessels for servicing small harbours and coastal settlements, to several hundred thousand tons, for long-range haulage. Besides ocean- or seagoing tankers there are also specialized ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dry Bulk Cargo

Bulk cargo is commodity cargo that is transported unpackaged in large quantities. Description Bulk cargo refers to material in either liquid or granular, particulate form, as a mass of relatively small solids, such as petroleum/crude oil, grain, coal, or gravel. This cargo is usually dropped or poured, with a spout or shovel bucket, into a bulk carrier ship's hold, railroad car/railway wagon, or tanker truck/ trailer/semi-trailer body. Smaller quantities can be boxed (or drummed) and palletised; cargo packaged in this manner is referred to as breakbulk cargo. Bulk cargo is classified as liquid or dry. The Baltic Exchange is based in London and provides a range of indices benchmarking the cost of moving bulk commodities, dry and wet, along popular routes around the seas. Some of these indices are also used to settle Freight Futures, known as FFA's. The most famous of the Baltic indices is the Baltic Dry Indices, commonly called the BDI. This is a derived function of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Over-the-counter (finance)

Over-the-counter (OTC) or off-exchange trading or pink sheet trading is done directly between two parties, without the supervision of an exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, providing transparency, and maintaining the current market price. In an OTC trade, the price is not necessarily publicly disclosed. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivatives of such products. Products traded traditional stock exchanges, and other regulated bourse platforms, must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in stock exchange-based equities trading. The OTC market does not have this limitation. Parties m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing House (finance)

A clearing house is a financial institution formed to facilitate the exchange (i.e., '' clearance'') of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms (also known as member firms or participants). Its purpose is to reduce the risk of a member firm failing to honor its trade settlement obligations. Description After the legally binding agreement (i.e., ''execution'') of a trade between a buyer and a seller, the role of the clearing house is to centralize and standardize all of the steps leading up to the payment (i.e. '' settlement'') of the transaction. The purpose is to reduce the cost, settlement risk and operational risk of clearing and settling multiple transactions among multiple parties. In addition to the above services, central counterparty clearing (CCP) takes on counterparty risk by stepping in between the original buyer and seller of a financial contract, such as a derivative. The role of the CCP is to perfo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baltic Exchange

The Baltic Exchange (incorporated as The Baltic Exchange Limited) is a membership organisation for the maritime industry, and freight market information provider for the trading and settlement of physical and derivative contracts. It was located at 24–28 St Mary Axe, London, until the building was destroyed by a bomb in 1992. The Baltic Exchange moved into a new building at 38 St Mary Axe on 15 May 1995. It is now located at 107 Leadenhall St and has further offices in Europe, across Asia, and in the United States. Overview Its international community of 650 member companies encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic. Baltic Exchange members are responsible for a large proportion of all dry cargo and tanker fixtures as well as the sale and purchase of merchant vessels. The Baltic Exchange traces its roots back to 1744 and the Virginia and Baltick Coffee House in Threadneedle Street. ( English co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capesize

Capesize ships are the largest dry cargo ships with ball mark dimension: about 170,000 DWT (deadweight tonnage) capacity, 290 m long, 45 m beam (wide), 18m draught (under water depth). They are too large to transit the Suez Canal ( Suezmax limits) or Panama Canal ( Neopanamax limits), and so have to pass either Cape Agulhas or Cape Horn to traverse between oceans. When the Suez Canal was deepened in 2009, it became possible for some capesize ships to transit the Canal and so change categories. Routes Major capesize bulk trade routes include: Brazil to China, Australia to China, South Africa to China and South Africa to Europe. Classification Ships in this class are bulk carriers, usually transporting coal, ore and other commodity raw materials. The term ''capesize'' is not applied to tankers. The average size of a capesize bulker is around , although larger ships (normally dedicated to ore transportation) have been built, up to . The large dimensions and deep draf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panamax

Panamax and New Panamax (or Neopanamax) are terms for the size limits for ships travelling through the Panama Canal. The limits and requirements are published by the Panama Canal Authority (ACP) in a publication titled "Vessel Requirements". These requirements also describe topics like exceptional dry seasonal limits, propulsion, communications, and detailed ship design. The allowable size is limited by the width and length of the available lock chambers, by the depth of water in the canal, and by the height of the Bridge of the Americas since that bridge's construction. These dimensions give clear parameters for ships destined to traverse the Panama Canal and have influenced the design of cargo ships, naval vessels, and passenger ships. Panamax specifications have been in effect since the opening of the canal in 1914. In 2009, the ACP published the New Panamax specification which came into effect when the canal's third set of locks, larger than the original two, opened o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Handymax

Handymax and Supramax are naval architecture terms for the larger bulk carriers in the Handysize class. Handysize class consists of Supramax (50,000 to 60,000 DWT), Handymax (40,000 to 50,000 DWT), and Handy (<40,000 DWT). The ships are used for less voluminous cargoes, and different cargoes can be carried in different holds. Larger capacities for dry bulk include Panamax, and Very Large Ore Carriers and Chinamax

Chinamax is a standard of ship measurements that allow conforming ships to use various harbours when fully lad ...

[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Energy Exchange

European Energy Exchange (EEX) AG is a central European electric power and related commodities exchange located in Leipzig, Germany. It develops, operates and connects secure, liquid and transparent markets for energy and related products, including power derivative contracts, emission allowances, agricultural and freight products. History The EEX emerged as a result of a merger between LPX Leipzig Power Exchange and the Frankfurt-based EEX in 2002. Deutsche Börse Group's derivatives business unit Eurex acquired the majority share in the EEX in March 2011. Ownership and subsidiaries EEX AG is majority owned by Deutsche Börse. It holds shares in the following companies: * EEX Asia, Cleartech (Cleartrade Exchange Pte Ltd.) (100%) * EEX CEGH Gas Exchange Services GmbH (51%) * EEX Link GmbH (100%) * enermarket GmbH (40%) * EPEX SPOT SE (51%) * European Commodity Clearing AG (100%) * Grexel Systems ltd (100%) * KB Tech Ltd. (100%) * Nodal Exchange Holdings, LLC (100%) * Power Ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Singapore Exchange

The Singapore Exchange Limited (SGX) is a Singaporean investment holding company that provides different services related to securities and derivatives trading and others. SGX is also a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges Federation. Structure SGX operates several different divisions, each responsible for handling specific businesses. * SGX ETS (Electronic Trading System): provides global trading access to SGX markets where 80 percent of the customers are from outside Singapore. * SGX DT (Derivatives Trading): provides derivatives trading. * SGX ST (Securities Trading): provides securities trading. * SGX DC (Derivatives Clearing): subsidiary for clearing and settlement operations. * SGX AsiaClear: offers clearing services for over-the-counter (OTC) oil swaps and forward freight agreements. * SGX Reach: an electronic trading platform. * Central Depository Pte Ltd: subsidiary responsible for securities clearing, settlement and d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)