|

Forward Curve

The forward curve is a function graph in finance that defines the prices at which a contract for future delivery or payment can be concluded today. For example, a futures contract forward curve is prices being plotted as a function of the amount of time between now and the expiry date of the futures contract (with the spot price being the price at time zero). The forward curve represents a term structure of prices. Forward interest rate A forward interest rate is a type of interest rate that is specified for a loan that will occur at a specified future date. As with current interest rates, forward interest rates include a term structure which shows the different forward rates offered to loans of different maturities. According to the unbiased expectations hypothesis, forward interest rates predict spot interest rates at the time the loan is actually made, but many analysts dispute whether this is true, as it ignores durational risk. This figure is part of the lending & credit in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Graph Of A Function

In mathematics, the graph of a function f is the set of ordered pairs (x, y), where f(x) = y. In the common case where x and f(x) are real numbers, these pairs are Cartesian coordinates of points in two-dimensional space and thus form a subset of this plane. In the case of functions of two variables, that is functions whose domain consists of pairs (x, y), the graph usually refers to the set of ordered triples (x, y, z) where f(x,y) = z, instead of the pairs ((x, y), z) as in the definition above. This set is a subset of three-dimensional space; for a continuous real-valued function of two real variables, it is a surface. In science, engineering, technology, finance, and other areas, graphs are tools used for many purposes. In the simplest case one variable is plotted as a function of another, typically using rectangular axes; see '' Plot (graphics)'' for details. A graph of a function is a special case of a relation. In the modern foundations of mathematics, and, typicall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seasonality

In time series data, seasonality is the presence of variations that occur at specific regular intervals less than a year, such as weekly, monthly, or quarterly. Seasonality may be caused by various factors, such as weather, vacation, and holidays and consists of periodic, repetitive, and generally regular and predictable patterns in the levels of a time series. Seasonal fluctuations in a time series can be contrasted with cyclical patterns. The latter occur when the data exhibits rises and falls that are not of a fixed period. Such non-seasonal fluctuations are usually due to economic conditions and are often related to the "business cycle"; their period usually extends beyond a single year, and the fluctuations are usually of at least two years. Organisations facing seasonal variations, such as ice-cream vendors, are often interested in knowing their performance relative to the normal seasonal variation. Seasonal variations in the labour market can be attributed to the entrance of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electricity Economics

Electricity is the set of physical phenomena associated with the presence and motion of matter that has a property of electric charge. Electricity is related to magnetism, both being part of the phenomenon of electromagnetism, as described by Maxwell's equations. Various common phenomena are related to electricity, including lightning, static electricity, electric heating, electric discharges and many others. The presence of an electric charge, which can be either positive or negative, produces an electric field. The movement of electric charges is an electric current and produces a magnetic field. When a charge is placed in a location with a non-zero electric field, a force will act on it. The magnitude of this force is given by Coulomb's law. If the charge moves, the electric field would be doing work on the electric charge. Thus we can speak of electric potential at a certain point in space, which is equal to the work done by an external agent in carrying a unit of positiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backwardation

Normal backwardation, also sometimes called backwardation, is the market condition where the price of a commodity's forward or futures contract is trading below the ''expected'' spot price at contract maturity. The resulting futures or forward curve would ''typically'' be downward sloping (i.e. "inverted"), since contracts for further dates would typically trade at even lower prices. In practice, the expected future spot price is unknown, and the term "backwardation" may refer to "positive basis", which occurs when the current spot price exceeds the price of the future. The opposite market condition to normal backwardation is known as contango. Contango refers to "negative basis" where the future price is trading above the expected spot price. Note: In industry parlance backwardation may refer to the situation that futures prices are below the ''current'' spot price. Backwardation occurs when the difference between the forward price and the spot price is less than the cost of ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contango

Contango is a situation where the futures price (or forward price) of a commodity is higher than the ''expected'' spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more owfor a commodity o be receivedat some point in the future than the actual expected price of the commodity t that future point This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers (commodity producers and commodity holders) are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market. The opposite market condition to contango is known as backwardation. "A market is 'in backwardation' when the futures price is below the ''expected'' spot price for a particular commodity. This is favorable for inv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Types of investments include Stock, equity, Bond (finance), debt, Security (finance), securities, real estate, infrastructure, currency, commodity, Exonumia, token, derivatives such as put and call Option (finance), options, Futures contract, futures, Forward contract, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder. Types of investors There are two types of investors: retail investors and institutional investors. Retail investor * Individual investors (including Trust law, trusts on behalf of individuals, and umbr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Gas

Natural gas (also called fossil gas or simply gas) is a naturally occurring mixture of gaseous hydrocarbons consisting primarily of methane in addition to various smaller amounts of other higher alkanes. Low levels of trace gases like carbon dioxide, nitrogen, hydrogen sulfide, and helium are also usually present. Natural gas is colorless and odorless, so odorizers such as mercaptan (which smells like sulfur or rotten eggs) are commonly added to natural gas supplies for safety so that leaks can be readily detected. Natural gas is a fossil fuel and non-renewable resource that is formed when layers of organic matter (primarily marine microorganisms) decompose under anaerobic conditions and are subjected to intense heat and pressure underground over millions of years. The energy that the decayed organisms originally obtained from the sun via photosynthesis is stored as chemical energy within the molecules of methane and other hydrocarbons. Natural gas can be burned fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electricity

Electricity is the set of physical phenomena associated with the presence and motion of matter that has a property of electric charge. Electricity is related to magnetism, both being part of the phenomenon of electromagnetism, as described by Maxwell's equations. Various common phenomena are related to electricity, including lightning, static electricity, electric heating, electric discharges and many others. The presence of an electric charge, which can be either positive or negative, produces an electric field. The movement of electric charges is an electric current and produces a magnetic field. When a charge is placed in a location with a non-zero electric field, a force will act on it. The magnitude of this force is given by Coulomb's law. If the charge moves, the electric field would be doing work on the electric charge. Thus we can speak of electric potential at a certain point in space, which is equal to the work done by an external agent in carrying a unit of p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Market

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

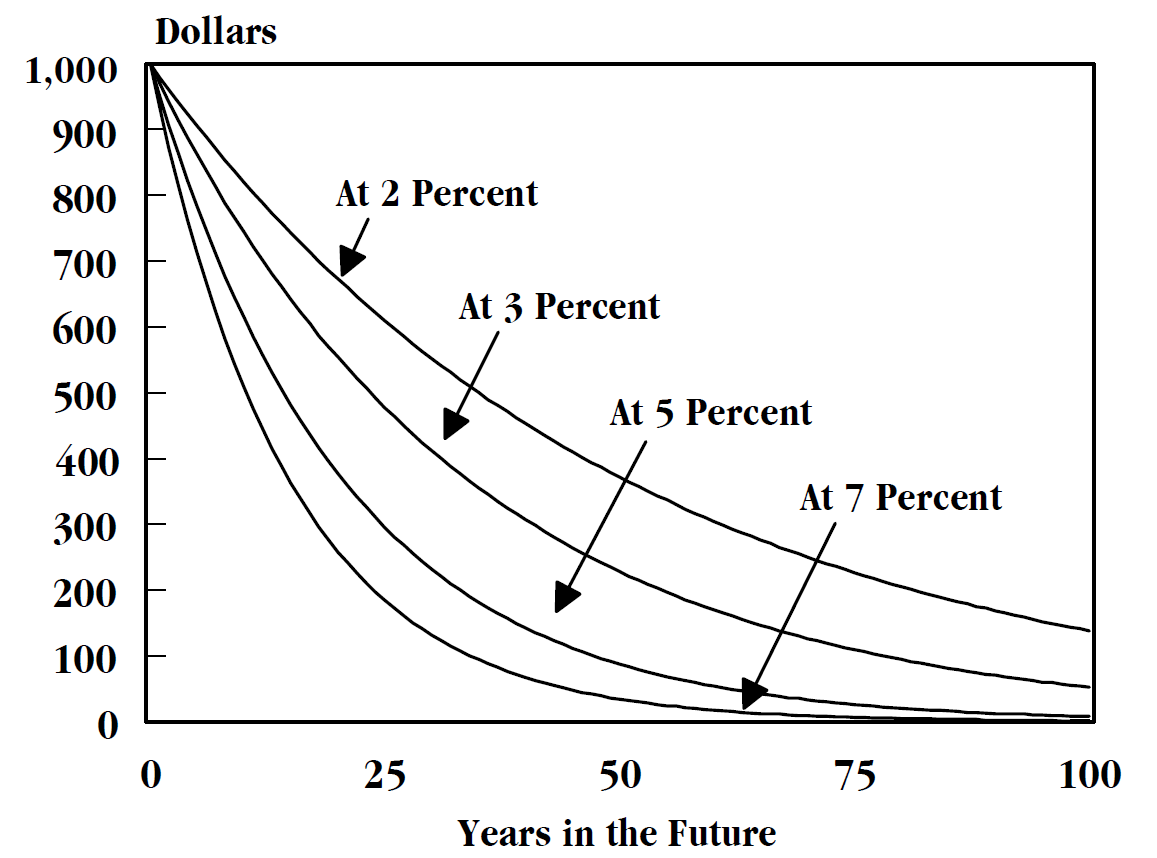

Time Value Of Money

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing money. As such, it is among the reasons why interest is paid or earned: interest, whether it is on a bank deposit or debt, compensates the depositor or lender for the loss of their use of their money. Investors are willing to forgo spending their money now only if they expect a favorable net return on their investment in the future, such that the increased value to be available later is sufficiently high to offset both the preference to spending money now and inflation (if present); see required rate of return. History The Talmud (~500 CE) recognizes the time value of money. In Tractate Makkos page 3a the Ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |