|

Foreign Exchange Risk

Foreign exchange risk (also known as FX risk, exchange rate risk or currency risk) is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company. The exchange risk arises when there is a risk of an unfavourable change in exchange rate between the domestic currency and the denominated currency before the date when the transaction is completed. Foreign exchange risk also exists when the foreign subsidiary of a firm maintains financial statements in a currency other than the domestic currency of the consolidated entity. Investors and businesses exporting or importing goods and services, or making foreign investments, have an exchange-rate risk but can take steps to manage (i.e. reduce) the risk. History Many businesses were unconcerned with, and did not manage, foreign exchange risk under the international Bretton Woods system. It was not until the switch to floating exchange rates, following the collapse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. Modern portfolio theory initiated by Harry Markowitz in 1952 under his thesis titled "Portfolio Selection" is the discipline and study which pertains to managing market and financial risk. In modern portfolio theory, the variance (or standard deviation In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean ( ...) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorith ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Fisher Effect

The international Fisher effect (sometimes referred to as Fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. The hypothesis specifically states that a spot exchange rate is expected to change equally in the opposite direction of the interest rate differential; thus, the currency of the country with the higher nominal interest rate is expected to depreciate against the currency of the country with the lower nominal interest rate, as higher nominal interest rates reflect an expectation of inflation. Derivation of the International Fisher effect The International Fisher effect is an extension of the Fisher effect hypothesized by American economist Irving Fisher. The Fisher effect states that a change in a country's expected inflation rate will result in a proportionate change in the country's interest rate :(1+i) = (1+r) \times (1+E pi where :i is t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Contract

In finance, a forward contract, or simply a forward, is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract, making it a type of derivative instrument.John C Hull'', Options, Futures and Other Derivatives (6th edition)'', Prentice Hall: New Jersey, USA, 2006, 3 The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the ''delivery price'', which is equal to the forward price at the time the contract is entered into. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the value date where the securities themselves are exchanged. Forwards, like other derivative securities, can be used to hedge ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Derivative

A foreign exchange derivative is a financial derivative whose payoff depends on the foreign exchange rates of two (or more) currencies. These instruments are commonly used for currency speculation and arbitrage or for hedging foreign exchange risk. History Foreign exchange transactions can be traced back to the fourteenth Century in England. The development of foreign exchange derivatives market was in the 1970s with the historical background and economic environment. Firstly, after the collapse of the Bretton Woods system, in 1976, the International Monetary Fund held a meeting in Jamaica and reached the Jamaica agreement. When the floating exchange-rate system replaced a fixed exchange-rate system, many countries relaxed control of interest rates and the risk of financial market increased. In order to reduce and avoid risks and achieve the purpose of hedging, modern financial derivatives were created. Secondly, economic globalization promoted the globalization of financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less. As short-term securities became a commodity, the money market became a component of the financial market for assets involved in short-term borrowing, lending, buying and selling with original maturities of one year or less. Trading in money markets is done over the counter and is wholesale. There are several money market instruments in most Western countries, including treasury bills, commercial paper, banker's acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal funds, and short-lived mortgage- and asset-backed securities. The instruments bear differing maturities, currencies, credit risks, and structures. A market can be described as a money market if it is composed of highly liquid, short-term assets. Money market funds typically invest in government se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility. There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the most commonly used types of market risk are: * '' Equity risk'', the risk that stock or stock indices (e.g. Euro Stoxx 50, etc.) prices or their implied volatility will change. * ''Interest rate risk'', the risk that interest rates (e.g. Libor, Euribor, etc.) or their implied volatility will change. * '' Currency risk'', the risk that foreign exchange rates (e.g. EUR/USD, EUR/GBP, etc.) or their implied volatility will change. * '' Commodity risk'', the risk that commodity prices (e.g. corn, crude oil) or their implied volatility will change. * '' Margining risk'' results from uncertain future cash outflows due to margin calls covering adverse value changes of a given position. * '' Shape risk'' * '' Holding period risk'' * '' Basi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Requirement

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital adequacy ratio of equity as a percentage of risk-weighted assets. These requirements are put into place to ensure that these institutions do not take on excess leverage and risk becoming insolvent. Capital requirements govern the ratio of equity to debt, recorded on the liabilities and equity side of a firm's balance sheet. They should not be confused with reserve requirements, which govern the assets side of a bank's balance sheet—in particular, the proportion of its assets it must hold in cash or highly-liquid assets. Capital is a source of funds, not a use of funds. From the 1880s to the end of the First World War, the capital-to-assets ratios globally declined sharply, before remaining relatively steady during the 20th century. Reg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank For International Settlements

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1930 it is the oldest international financial institution. Its initial purpose was to oversee the settlement of World War I war reparations. The BIS carries out its work through its meetings, programmes and through the Basel Process, hosting international groups pursuing global financial stability and facilitating their interaction. It also provides banking services, but only to central banks and other international organizations. The BIS is based in Basel, Switzerland, with representative offices in Hong Kong and Mexico City. History Background International monetary cooperation started to develop tentatively in the course of the 19th century. An early case was a £400,000 loan in gold coins, in 1825 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss of investment/capital. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by $1 million or more over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Semivariance

In spatial statistics the theoretical variogram, denoted 2\gamma(\mathbf_1,\mathbf_2), is a function describing the degree of spatial dependence of a spatial random field or stochastic process Z(\mathbf). The semivariogram \gamma(\mathbf_1,\mathbf_2) is half the variogram. For example, in gold mining, a variogram will give a measure of how much two samples taken from the mining area will vary in gold percentage depending on the distance between those samples. Samples taken far apart will vary more than samples taken close to each other. Definition The semivariogram \gamma(h) was first defined by Matheron (1963) as half the average squared difference between a function and a translated copy of the function separated at distance h. Formally :\gamma(h)=\frac\iiint_V \left[f(M+h) - f(M) \right]^2dM, where M is a point in the geometric field V, and f(M) is the value at that point. The triple integral is over 3 dimensions. h is the separation distance (e.g., in meters or km) o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Absolute Deviation

The average absolute deviation (AAD) of a data set is the average of the absolute deviations from a central point. It is a summary statistic of statistical dispersion or variability. In the general form, the central point can be a mean, median, mode, or the result of any other measure of central tendency or any reference value related to the given data set. AAD includes the mean absolute deviation and the '' median absolute deviation'' (both abbreviated as MAD). Measures of dispersion Several measures of statistical dispersion are defined in terms of the absolute deviation. The term "average absolute deviation" does not uniquely identify a measure of statistical dispersion, as there are several measures that can be used to measure absolute deviations, and there are several measures of central tendency that can be used as well. Thus, to uniquely identify the absolute deviation it is necessary to specify both the measure of deviation and the measure of central tendency. The st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

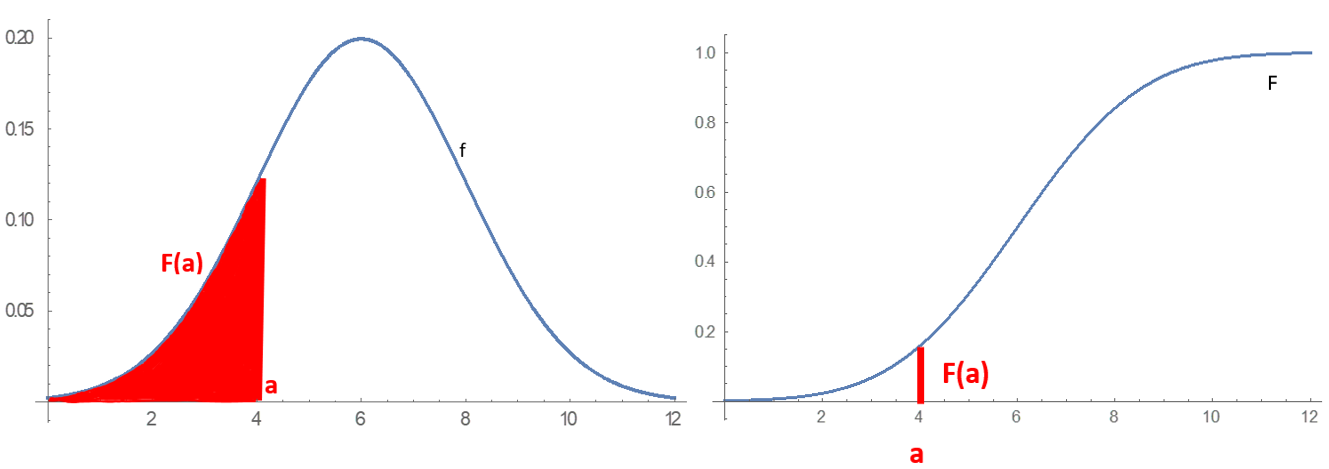

Probability Distribution

In probability theory and statistics, a probability distribution is a Function (mathematics), function that gives the probabilities of occurrence of possible events for an Experiment (probability theory), experiment. It is a mathematical description of a Randomness, random phenomenon in terms of its sample space and the Probability, probabilities of Event (probability theory), events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that fair coin, the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A prob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |