|

Fiscal Sociology

Fiscal sociology is the sociology of public finance, particularly tax policy. As a field, it seeks to explore the relationship that taxation constitutes between citizens and the state, including the cultural and historical factors that determine compliance with taxation. Joseph Schumpeter's 1918 work "The Crisis of the Tax State" is a founding text of fiscal sociology, though Schumpeter himself borrowed the term from the Austrian sociologist Rudolf Goldscheid's 1917 ("State Socialism or State Capitalism"). Since the 1990s, "new fiscal sociology" has analysed the foundational role of taxation as a cause, and not just an effect, of the emergence of modernity Modernity, a topic in the humanities and social sciences, is both a historical period (the modern era) and the ensemble of particular socio-cultural norms, attitudes and practices that arose in the wake of the Renaissancein the "Age of Reas .... References Further reading * * * * * * Economic sociology Poli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sociology

Sociology is a social science that focuses on society, human social behavior, patterns of Interpersonal ties, social relationships, social interaction, and aspects of culture associated with everyday life. It uses various methods of Empirical research, empirical investigation and critical analysis to develop a body of knowledge about social order and social change. While some sociologists conduct research that may be applied directly to social policy and welfare, others focus primarily on refining the Theory, theoretical understanding of social processes and phenomenology (sociology), phenomenological method. Subject matter can range from Microsociology, micro-level analyses of society (i.e. of individual interaction and agency (sociology), agency) to Macrosociology, macro-level analyses (i.e. of social systems and social structure). Traditional focuses of sociology include social stratification, social class, social mobility, sociology of religion, religion, secularization, S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

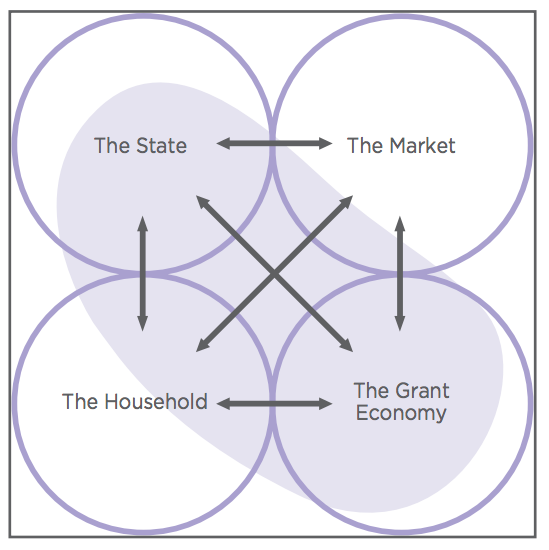

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. Economist Jonathan Gruber has put forth a framework to assess the broad field of public finance. Gruber suggests public finance should be thought of in terms of four central questions: # When should the government intervene in the economy? To which there are two central motivations for government intervention, Market failure and redistribution of income and wealth. # How might the government intervene? Once the decision is made to intervene the government must ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Policy

Tax policy includes the guidelines developed by a government regarding how taxes are imposed, in what amounts, and on whom. It has both microeconomic and macroeconomic aspects. The macroeconomic aspect concerns the overall quantity of taxes to collect, which can inversely affect the level of economic activity; this is one component of fiscal policy. The microeconomic aspects concern issues of fairness (whom to tax) and allocative efficiency (i.e., which taxes will have how much of a distorting effect on the amounts of various types of economic activity). A country’s tax framework is a key policy instrument that is intended to positively influence the country's economy. Tax policies have significant economic consequences for both a national economy and particular groups within the economy (e.g., households, firms and banks). Tax policies are often designed with the intention of stimulating economic growth—although economists' opinions differ significantly about which polici ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citizen

Citizenship is a "relationship between an individual and a state to which the individual owes allegiance and in turn is entitled to its protection". Each state determines the conditions under which it will recognize persons as its citizens, and the conditions under which that status will be withdrawn. Recognition by a state as a citizen generally carries with it recognition of civil, political, and social rights which are not afforded to non-citizens. In general, the basic rights normally regarded as arising from citizenship are the right to a passport, the right to leave and return to the country/ies of citizenship, the right to live in that country, and to work there. Some countries permit their citizens to have multiple citizenships, while others insist on exclusive allegiance. Determining factors A person can be recognized or granted citizenship on a number of bases. Usually, citizenship based on circumstances of birth is automatic, but an application may be required. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State (polity)

A state is a centralized political organization that imposes and enforces rules over a population within a territory. There is no undisputed definition of a state. One widely used definition comes from the German sociologist Max Weber: a "state" is a polity that maintains a monopoly on the legitimate use of violence, although other definitions are not uncommon.Cudworth et al., 2007: p. 95Salmon, 2008p. 54 Absence of a state does not preclude the existence of a society, such as stateless societies like the Haudenosaunee Confederacy that "do not have either purely or even primarily political institutions or roles". The level of governance of a state, government being considered to form the fundamental apparatus of contemporary states, is used to determine whether it has failed. In a federal union, the term "state" is sometimes used to refer to the federated polities that make up the federation. (Other terms that are used in such federal systems may include “province”, � ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joseph Schumpeter

Joseph Alois Schumpeter (; February 8, 1883 – January 8, 1950) was an Austrian-born political economist. He served briefly as Finance Minister of German-Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship. Schumpeter was one of the most influential economists of the early 20th century, and popularized the term "creative destruction", which was coined by Werner Sombart. Early life and education Schumpeter was born in Triesch, Habsburg Moravia (now Třešť in the Czech Republic, then part of Austria-Hungary) in 1883 to German-speaking Catholic parents. Both of his grandmothers were Czech. Schumpeter did not acknowledge his Czech ancestry; he considered himself an ethnic German. His father owned a factory, but he died when Joseph was only four years old. In 1893, Joseph and his mother moved to Vienna. Schumpeter was a loyal supporter of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rudolf Goldscheid

Rudolf Goldscheid (12 August 1870 – 6 October 1931) was an Austrian writer and sociologist, co-founder of the German Sociological Association, known for his theory of human economy (german: Menschenökonomie, link=no) and for developing the topic of fiscal sociology. He has been described as "the founder of scientific sociology in Vienna", though he never had a job with a university. Life Rudolf Goldscheid was born in Vienna on 12 August 1870 as the fifth child of a Jewish family of merchants. After graduating from a Viennese secondary school, in 1891 he enrolled at Friedrich Wilhelm University in Berlin to study philosophy and sociology, but quit without a degree in 1894. He remained in Germany for some years, writing novels and plays using the pseudonym Rudolf Golm, and married Marie Rudolph in Leipzig in 1898, returning to Vienna soon afterwards. Politically, Goldscheid was a pacifist and social democrat, a member of the Social Democratic Party of Austria and contributor to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modernity

Modernity, a topic in the humanities and social sciences, is both a historical period (the modern era) and the ensemble of particular socio-cultural norm (social), norms, attitudes and practices that arose in the wake of the Renaissancein the "Age of Enlightenment, Age of Reason" of 17th-century thought and the 18th-century "Age of Enlightenment, Enlightenment". Some commentators consider the era of modernity to have ended by 1930, with World War II in 1945, or the 1980s or 1990s; the following era is called postmodernity. The term "contemporary history" is also used to refer to the post-1945 timeframe, without assigning it to either the modern or postmodern era. (Thus "modern" may be used as a name of a particular era in the past, as opposed to meaning "the current era".) Depending on the field, "modernity" may refer to different time periods or qualities. In historiography, the 16th to 18th centuries are usually described as early modern, while the long 19th century correspond ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Sociology

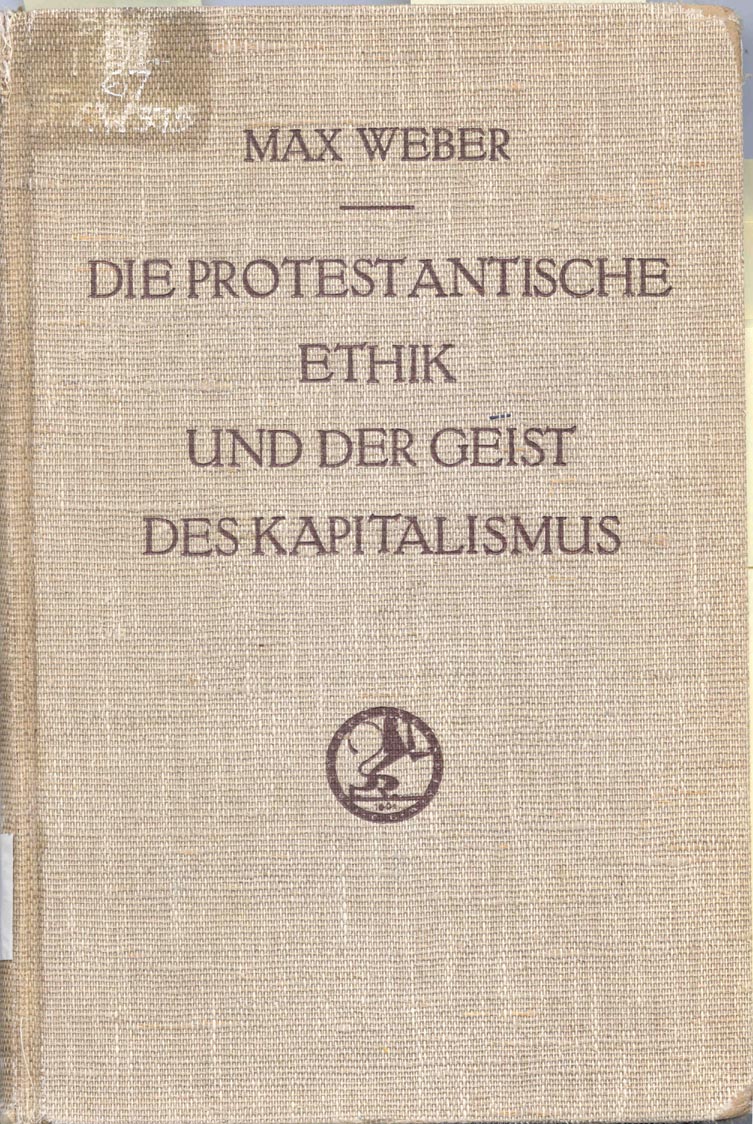

Economic sociology is the study of the social cause and effect of various economic phenomena. The field can be broadly divided into a classical period and a contemporary one, known as "new economic sociology". The classical period was concerned particularly with modernity and its constituent aspects, including rationalisation, secularisation, urbanisation, and social stratification. As sociology arose primarily as a reaction to capitalist modernity, economics played a role in much classic sociological inquiry. The specific term "economic sociology" was first coined by William Stanley Jevons in 1879, later to be used in the works of Émile Durkheim, Max Weber and Georg Simmel between 1890 and 1920. Weber's work regarding the relationship between economics and religion and the cultural "disenchantment" of the modern West is perhaps most iconic of the approach set forth in the classic period of economic sociology. Contemporary economic sociology may include studies of all mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Political Sociology

Political sociology is an interdisciplinary field of study concerned with exploring how governance and society interact and influence one another at the micro to macro levels of analysis. Interested in the social causes and consequences of how power is distributed and changes throughout and amongst societies, political sociology's focus ranges across individual families to the State as sites of social and political conflict and power contestation. Introduction Political sociology was conceived as an interdisciplinary sub-field of sociology and politics in the early 1930s throughout the social and political disruptions that took place through the rise of Communism, Fascism, and World War II. This new area drawing upon works by Alexis de Tocqueville, James Bryce, Robert Michels, Max Weber, Émile Durkheim, and Karl Marx to understand an integral theme of political sociology; power. Power's definition for political sociologists varies across the approaches and conceptual fram ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)