|

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus:Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on these elements. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating "what ought to be"; between economic theory and applied economics; between ratio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Theorem Of Asset Pricing

The fundamental theorems of asset pricing (also: of arbitrage, of finance), in both financial economics and mathematical finance, provide necessary and sufficient conditions for a market to be arbitrage-free, and for a market to be complete. An arbitrage opportunity is a way of making money with no initial investment without any possibility of loss. Though arbitrage opportunities do exist briefly in real life, it has been said that any sensible market model must avoid this type of profit.Pascucci, Andrea (2011) ''PDE and Martingale Methods in Option Pricing''. Berlin: Springer-Verlag The first theorem is important in that it ensures a fundamental property of market models. Completeness is a common property of market models (for instance the Black–Scholes model). A complete market is one in which every contingent claim can be replicated. Though this property is common in models, it is not always considered desirable or realistic. Discrete markets In a discrete (i.e. finite state) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indifference Price

In finance, indifference pricing is a method of pricing financial securities with regard to a utility function. The indifference price is also known as the reservation price or private valuation. In particular, the indifference price is the price at which an agent would have the same expected utility level by exercising a financial transaction as by not doing so (with optimal trading otherwise). Typically the indifference price is a pricing range (a bid–ask spread) for a specific agent; this price range is an example of good-deal bounds. Mathematics Given a utility function u and a claim C_T with known payoffs at some terminal time T, let the function V: \mathbb \times \mathbb \to \mathbb be defined by : V(x,k) = \sup_ \mathbb\left \left(X_T + k C_T\right)\right/math>, where x is the initial endowment, \mathcal(x) is the set of all self-financing portfolios at time T starting with endowment x, and k is the number of the claim to be purchased (or sold). Then the indiffer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a single consumer's preference ordering over a choice set but is not comparable across consumers. This concept of utility is personal and based on choice rather than on pleasure received, and so is specified more rigorously than the original concept but makes it less useful (and controversial) for ethical decisions. Utility function Consider a set of alternatives among which a person can make a preference ordering. The utility obtained from these alternatives is an unknown function of the utilities obtained from each alternative, not the sum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pierre De Fermat

Pierre de Fermat (; between 31 October and 6 December 1607 – 12 January 1665) was a French mathematician who is given credit for early developments that led to infinitesimal calculus, including his technique of adequality. In particular, he is recognized for his discovery of an original method of finding the greatest and the smallest ordinates of curved lines, which is analogous to that of differential calculus, then unknown, and his research into number theory. He made notable contributions to analytic geometry, probability, and optics. He is best known for his Fermat's principle for light propagation and his Fermat's Last Theorem in number theory, which he described in a note at the margin of a copy of Diophantus' ''Arithmetica''. He was also a lawyer at the '' Parlement'' of Toulouse, France. Biography Fermat was born in 1607 in Beaumont-de-Lomagne, France—the late 15th-century mansion where Fermat was born is now a museum. He was from Gascony, where his father, Do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blaise Pascal

Blaise Pascal ( , , ; ; 19 June 1623 – 19 August 1662) was a French mathematician, physicist, inventor, philosopher, and Catholic writer. He was a child prodigy who was educated by his father, a tax collector in Rouen. Pascal's earliest mathematical work was on conic sections; he wrote a significant treatise on the subject of projective geometry at the age of 16. He later corresponded with Pierre de Fermat on probability theory, strongly influencing the development of modern economics and social science. In 1642, while still a teenager, he started some pioneering work on calculating machines (called Pascal's calculators and later Pascalines), establishing him as one of the first two inventors of the mechanical calculator. Like his contemporary René Descartes, Pascal was also a pioneer in the natural and applied sciences. Pascal wrote in defense of the scientific method and produced several controversial results. He made important contributions to the study of fluid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

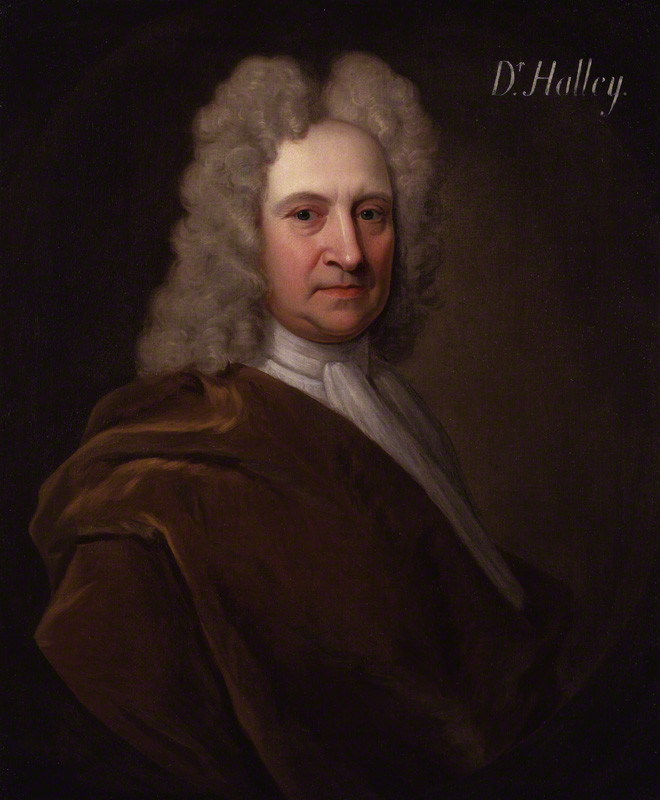

Edmond Halley

Edmond (or Edmund) Halley (; – ) was an English astronomer, mathematician and physicist. He was the second Astronomer Royal in Britain, succeeding John Flamsteed in 1720. From an observatory he constructed on Saint Helena in 1676–77, Halley catalogued the southern celestial hemisphere and recorded a transit of Mercury across the Sun. He realised that a similar transit of Venus could be used to determine the distances between Earth, Venus, and the Sun. Upon his return to England, he was made a fellow of the Royal Society, and with the help of King Charles II of England, Charles II, was granted a master's degree from University of Oxford, Oxford. Halley encouraged and helped fund the publication of Isaac Newton's influential ''Philosophiæ Naturalis Principia Mathematica'' (1687). From observations Halley made in September 1682, he used Newton's laws of motion to compute the periodicity of Halley's Comet in his 1705 ''Synopsis of the Astronomy of Comets''. It was named afte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Johan De Witt

Johan de Witt (; 24 September 1625 – 20 August 1672), ''lord of Zuid- en Noord-Linschoten, Snelrewaard, Hekendorp en IJsselvere'', was a Dutch statesman and a major political figure in the Dutch Republic in the mid-17th century, the First Stadtholderless Period, when its flourishing sea trade in a period of globalization made the republic a leading European trading and seafaring power – now commonly referred to as the Dutch Golden Age. De Witt controlled the Dutch political system from around 1650 until shortly before his murder and cannibalisation by a pro-Orangist mob in 1672. As a leading republican of the Dutch States Party, de Witt opposed the House of Orange-Nassau and the Orangists and preferred a shift of power from the central government to the regenten. However, his neglect of the Dutch army (as the regents focused only on merchant vessels, thinking they could avoid war) proved disastrous when the Dutch Republic suffered numerous early defeats in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)