|

Feeder Cattle

Feeder cattle, in some countries or regions called store cattle, are young cattle mature enough either to undergo backgrounding or to be fattened in preparation for slaughter. They may be steers (castrated males) or heifers (females who have not dropped a calf). The term often implicitly reflects an intent to sell to other owners for fattening (finishing). Backgrounding occurs at backgrounding operations, and fattening occurs at a feedlot. Feeder calves are less than 1 year old; feeder yearlings are between 1 and 2 years old. Both types are often produced in a cow-calf operation. After attaining a desirable weight, feeder cattle become finished cattle that are sold to a packer (finished cattle are also called fattened cattle, fat cattle, fed cattle, or, when contrasted with carcasses, live cattle). Packers slaughter the cattle and sell the meat in carcass boxed form. Feedlots producing live cattle for slaughter will typically purchase feeder cattle calves and feed to grow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fat Cattle And Alfalfa In The Pecos Valley, New Mexico (NYPL B12647398-74445)

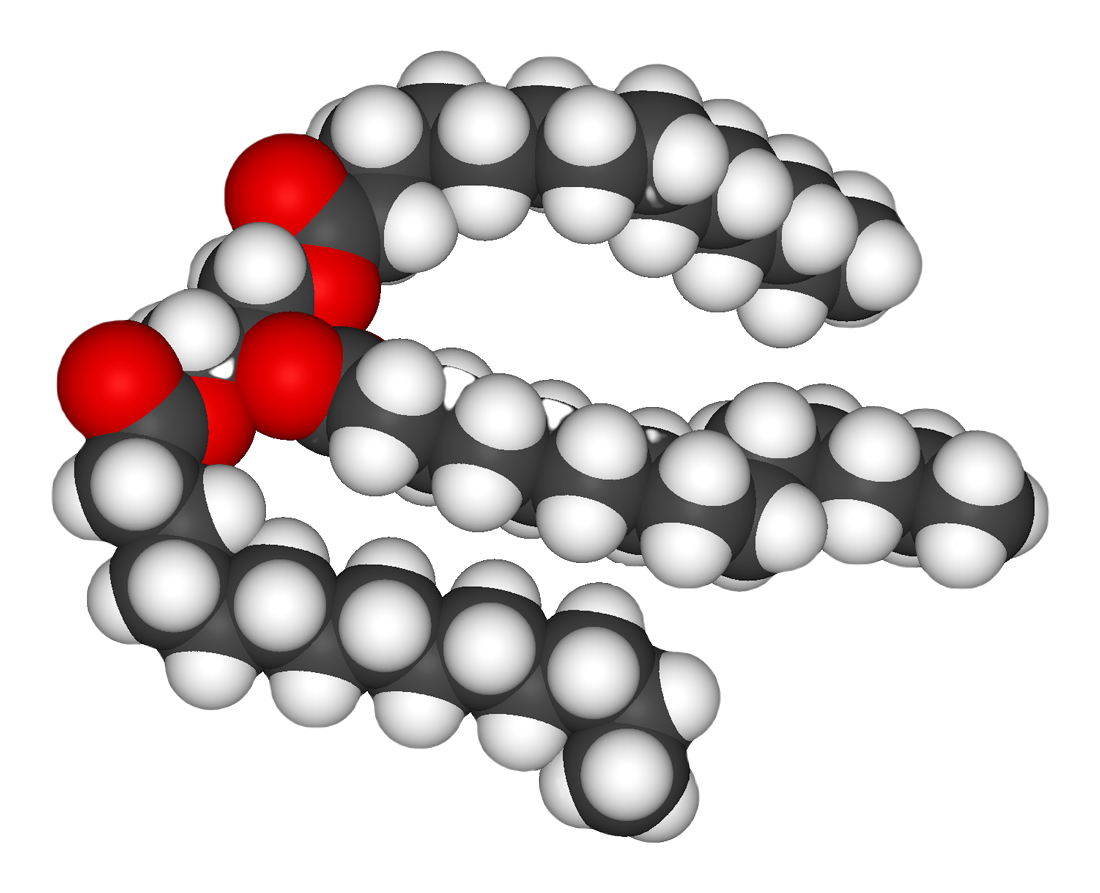

In nutrition, biology, and chemistry, fat usually means any ester of fatty acids, or a mixture of such compounds, most commonly those that occur in living beings or in food. The term often refers specifically to triglycerides (triple esters of glycerol), that are the main components of vegetable oils and of fatty tissue in animals; or, even more narrowly, to triglycerides that are solid or semisolid at room temperature, thus excluding oils. The term may also be used more broadly as a synonym of lipid—any substance of biological relevance, composed of carbon, hydrogen, or oxygen, that is insoluble in water but soluble in non-polar solvents. In this sense, besides the triglycerides, the term would include several other types of compounds like mono- and diglycerides, phospholipids (such as lecithin), sterols (such as cholesterol), waxes (such as beeswax), and free fatty acids, which are usually present in human diet in smaller amounts. Fats are one of the three main macr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brahman Cow

The Brahman is an American breed of zebuine-taurine hybrid beef cattle. It was bred in the United States from 1885 using cattle originating in India, imported at various times from the United Kingdom, India, and Brazil. These were mainly Gir, Guzerá and Nellore stock, with some Indu-Brasil, Krishna Valley and Ongole. The Brahman has a high tolerance of heat, sunlight and humidity, and good resistance to parasites. It has been exported to many countries, particularly in the tropics; in Australia it is the most numerous breed of cattle. It has been used in the creation of numerous taurine-indicine hybrids, some of which – such as the Brangus and Brahmousin – are established as separate breeds. History Zebuine (Asian humped) cattle were present in the United States from 1849, when a single bull of Indian origin was imported from the United Kingdom to South Carolina. In 1885 a pair of grey bulls was brought directly from India to Texas; one was large, weighing over , the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Soybean Meal

Soybean meal is used in food and animal feeds, principally as a protein supplement, but also as a source of metabolizable energy. Typically 1 bushel (i.e. 60 lbs. or 27.2 kg) of soybeans yields 48 lbs. (21.8 kg) of soybean meal. Most soybean meal is defatted, produced as a co-product of soybean oil extraction. Some, but not all, soybean meal contains ground soybean hulls. Soybean meal is heat-treated during production, to denature the trypsin inhibitors of soybeans, which would otherwise interfere with protein digestion.Stein, H. H., L. L. Berger, J. K. Drackley, G. C. Fahey Jr, D. C. Hernot and C. M. Parsons. 2008. Nutritional properties and feeding values of soybeans and their coproducts. Soybeans chemistry, production, processing, and utilization. AOCS Press, Urbana, IL. pp. 613-660.Soybean Feed Industry Guide. 2010. 1st Ed. https://cigi.ca/wp-content/uploads/2011/12/2010-Soybean-Feed-Industry-Guide.pdf Major kinds of soybean meal Three main kinds of soyb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corn

Maize (; ''Zea mays''), also known as corn in North American English, is a tall stout Poaceae, grass that produces cereal grain. It was domesticated by indigenous peoples of Mexico, indigenous peoples in southern Mexico about 9,000 years ago from wild teosinte. Native Americans planted it alongside beans and Cucurbita, squashes in the Three Sisters (agriculture), Three Sisters polyculture. The leafy Plant stem, stalk of the plant gives rise to male inflorescences or tassels which produce pollen, and female inflorescences called ear (botany), ears. The ears yield grain, known as Corn kernels, kernels or seeds. In modern commercial varieties, these are usually yellow or white; other varieties can be of many colors. Maize relies on humans for its propagation. Since the Columbian exchange, it has become a staple food in many parts of the world, with the List of most valuable crops and livestock products, total production of maize surpassing that of wheat and rice. Much maize is u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fed Cattle

Fed cattle refers to cattle leaving a cattle feedlot, after fattening on a concentrated ration, that are ready to be sold to a packing plant for slaughter. Beef cattle are typically sold to packers at about 1,100 pounds, which yields a carcass weight of about 660 pounds. See also * Feeder cattle * Live cattle References United States Department of Agriculture {{Agri-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lean Hog

Lean Hog is a type of hog (pork) futures contract that can be used to hedge and to speculate on pork prices in the US. Lean Hog futures and options are traded on the Chicago Mercantile Exchange (CME), which introduced Lean Hog futures contracts in 1966. The contracts are for 40,000 pounds of Lean Hogs, and call for cash settlement based on the CME Lean Hog Index, which is a two-day weighted average of cash markets. Minimum tick size for the contract is $0.025 per pound, with each tick valued at $10 USD. Trades on the contract are subject to price limits of $0.0375 per pound above or below the previous day's contract settlement price, with an exception that there shall be no daily price limits in the expiring month contract during the last 2 Trading Days. Below are the Contract Specifications for Lean Hog futures on the CME: Lean Hog futures prices are widely used by U.S. pork producers as reference prices in marketing contracts for selling their hogs. Usage of marketing contract ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Live Cattle

Live cattle is a type of futures contract that can be used to hedge and to speculate on fed cattle prices. Cattle producers, feedlot operators, and merchant exporters can hedge future selling prices for cattle through trading live cattle futures, and such trading is a common part of a producer's price risk management program. Conversely, meat packers, and merchant importers can hedge future buying prices for cattle. Producers and buyers of live cattle can also enter into production and marketing contracts for delivering live cattle in cash or spot markets that include futures prices as part of a reference price formula. Businesses that purchase beef as an input could also hedge beef price risk by purchasing live cattle futures contracts. Contract Description Live cattle futures and options are traded on the Chicago Mercantile Exchange (CME), which introduced live cattle futures contracts in 1964. Contract prices are quoted in U.S. cents per pound. Minimum tick size for the contrac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio (finance)

In finance, a portfolio is a collection of investments. Definition The term "portfolio" refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial professionals, hedge funds, banks and other financial institutions. It is a generally accepted principle that a portfolio is designed according to the investor's risk tolerance, time frame and investment objectives. The monetary value of each asset may influence the risk/reward ratio of the portfolio. When determining asset allocation, the aim is to maximise the expected return and minimise the risk. This is an example of a multi-objective optimization problem: many efficient solutions are available and the preferred solution must be selected by considering a tradeoff between risk and return. In particular, a portfolio A is dominated by another portfolio A' if A' has a greater expected gain and a lesser risk than A. If no portfolio dominates A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Fund

An investment fund is a way of investment, investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification (finance), diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investors

An institutional investor is an entity that pools money to purchase security (finance), securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, state-owned enterprise, government-linked companies, Insurance, insurers, pension funds, sovereign wealth funds, charitable organization, charities, hedge funds, real estate investment trusts, registered investment adviser, investment advisors, financial endowment, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist shareholder, Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under management, Assets under Management (AuM). Institutional investors appear to be more sophisticated than ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trader (finance)

A trader is a person, firm, or entity in finance who buys and sells financial instruments, such as forex, cryptocurrencies, stocks, bonds, commodities, derivatives, and mutual funds, indices in the capacity of agent, hedger, arbitrager, or speculator. Duties and types The word "trader" appeared as early as 1863 in a universal dictionary as "trading man." Traders work for financial institutions as foreign exchange or securities dealers in the cash market and in the futures market, or for their own account as proprietary traders. They also include stock exchange traders, but not stockbrokers or lead brokers. Traders buy and sell financial instruments traded in the stock markets, derivatives markets and commodity markets, comprising the stock exchanges, derivatives exchanges, and the commodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, including: * Bond trader. * Floor trader. *Hedge fund trader. * High-frequency trader. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |