|

Federal Budget Of Russia

The Federal budget of Russia (russian: Федеральный бюджет России) is the leading element of the budget system of Russia. The federal budget is a major state financial plan for the fiscal year, which has the force of law after its approval by the Russian parliament and signed into law by the President of Russia. That the federal budget is the primary means of redistribution of national income and gross domestic product through it mobilized the financial resources necessary to regulate the country's economic development, social policy and the strengthening of the national defense. The share of federal budget accounts for a significant portion of the distribution process, which is the allocation of funds between sectors of the economy, manufacturing and industrial areas, regions of the country. The right of the Russian Federation for an independent federal budget is enshrined by Article 71 of the Russian Constitution and the Budget Code of Russia that regu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget System Of Russia

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Russian Financial Crisis

The Great Recession in Russia was a crisis during 2008–2009 in the Russian financial markets as well as an economic recession that was compounded by political fears after the war with Georgia and by the plummeting price of Urals heavy crude oil, which lost more than 70% of its value since its record peak of US$147 on 4 July 2008 before rebounding moderately in 2009. According to the World Bank, Russia's strong short-term macroeconomic fundamentals made it better prepared than many emerging economies to deal with the crisis, but Russia's underlying structural weaknesses and high dependence on the price of a single commodity made the crisis' impact more pronounced than would otherwise be the case. In late 2008 during the onset of the crisis, Russian markets plummeted and more than $1 trillion had been wiped off the value of Russia's shares, although Russian stocks rebounded in 2009 becoming the world's best performers, with the MICEX Index having more than doubled in value a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budgets By Country

The list is mainly based on CIA World Factbook for the year 2016 and 2019. The Chinese, Brazilian, Indian, and United States government budgets are the figures reported by the International Monetary Fund. The table includes information from government's budgets; namely revenues, expenditures and the resulting deficits or surpluses. The countries are ranked by their budget revenues in fiscal year 2016. Both sovereign states and dependent territories are included. List ''These figures are given as millions USD, unless otherwise specified.'' See also * List of countries by government budget per capita * List of countries by tax revenue to GDP ratio * List of countries by government spending as percentage of GDP Europe: * List of sovereign states in Europe by budget revenues * List of sovereign states in Europe by budget revenues per capita United States: * List of U.S. state budgets This is a list of U.S. state government budgets as enacted by each state's legislature. Note ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

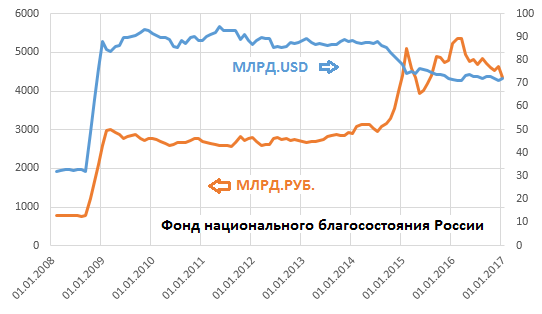

Russian National Wealth Fund

The Russian National Wealth Fund is Russia's sovereign wealth fund. It was created after the Stabilization Fund of the Russian Federation was split into two separate investment funds on 30 January 2008. Fund structure The two funds are the Reserve Fund, which is invested abroad in low-yield securities and used when oil and gas incomes fall, and the National Wealth Fund, which invests in riskier, higher return vehicles, as well as federal budget expenditures. The Reserve Fund was given $125 billion and the National Wealth Fund was given $32 billion. The fund is controlled by the Ministry of Finance. One of the fund's main responsibilities is to support the Russian pension system.Ukraine bailout could derail Putin's drive to boost Russian econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Military Budget Of Russia

The military budget of Russia is the portion of the overall budget of Russia that is allocated for the funding of the Russian Armed Forces. This military budget finances employee salaries and training costs, the maintenance of equipment and facilities, support of new or ongoing operations, and development and procurement of new weapons, equipment, and vehicles. According to estimates for the 21 years from 2000, Russia increased its military budget from $9.23bn to $65.9bn, or more than 700 percent. Moscow spends more on the military than any country of the European Union. History In 1988 military spending was a single line item in the Soviet Union state budget, totaling 21 billion rubles (68.8 billion 1988 U.S. dollars). Given the size of the military establishment, however, the actual figure was considered to be far higher. However, in the wake of the breakup of the Soviet Union and the emergence of Russian Federation as an independent state, between 1991 and 1997 Russia's defence ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Account Chamber Of Russia

Accounts Chamber of the Russian Federation (russian: Счётная палата Российской Федерации) is the parliamentary body of financial control in the Russian Federation. History The prototype of the Accounts Chamber of the Russian Federation was the Chamber-collegium established by Peter I in 1718 for the management of state taxes and some sectors of the state economy. Prior to that time, the treasury of Russian tsars was a mess. The founder of the Court of Auditors Petr Lukich Aksenov. In 1719, he introduced to the Russian government the written balance of income and expenditure of money in the state treasury, and gave the Emperor a weekly report of capital flows. Moreover, Petr Aksenov defined the form of accounting for the Chambers-collegium and teach it local clerk and officials from all Russia. In 1725, the Senate determined Peter Aksenov kamerirom, and in 1731 Secretary. From 1811 to 1918 in Russian Empore exists office of State Comptroller. Then ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Export Duties

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties (i.e. tariffs) and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation. Each country has its own laws and regulations for the import and export of goods into and out of a country, enforced by their respective customs authorities; the import/export of some goods may be restricted or forbidden entirely. A wide range of penalties are faced by those who break these laws. Overview Taxation The traditional function of customs has been the assessment and collection of customs duties, which is a tariff or tax on the importation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mineral Extraction

Mining is the extraction of valuable minerals or other geological materials from the Earth, usually from an ore body, lode, vein, seam, reef, or placer deposit. The exploitation of these deposits for raw material is based on the economic viability of investing in the equipment, labor, and energy required to extract, refine and transport the materials found at the mine to manufacturers who can use the material. Ores recovered by mining include metals, coal, oil shale, gemstones, limestone, chalk, dimension stone, rock salt, potash, gravel, and clay. Mining is required to obtain most materials that cannot be grown through agricultural processes, or feasibly created artificially in a laboratory or factory. Mining in a wider sense includes extraction of any non-renewable resource such as petroleum, natural gas, or even water. Modern mining processes involve prospecting for ore bodies, analysis of the profit potential of a proposed mine, extraction of the desired materials, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mineral Resources

Natural resources are resources that are drawn from nature and used with few modifications. This includes the sources of valued characteristics such as commercial and industrial use, aesthetic value, scientific interest and cultural value. On Earth, it includes sunlight, atmosphere, water, land, all minerals along with all vegetation, and wildlife. Natural resources is a part of humanity's natural heritage or protected in nature reserves. Particular areas (such as the rainforest in Fatu-Hiva) often feature biodiversity and geodiversity in their ecosystems. Natural resources may be classified in different ways. Natural resources are materials and components (something that can be used) that can be found within the environment. Every man-made product is composed of natural resources (at its fundamental level). A natural resource may exist as a separate entity such as fresh water, air, as well as any living organism such as a fish, or it may be transformed by extractivist ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Benefits

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployment, unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary. Unemployment benefits are generally given only to those registering as becoming unemployed through no fault of their own, and often on conditions ensuring that they seek work. In British English unemployment benefits are also colloquially referred to as "the dole"; receiving benefits is informally called "being on the dole". "Dole" here is an archaic expression meaning "one's allotted portion", from the synonymous Old English word ''dāl''. History The first modern u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small And Medium Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by international organizations such as the World Bank, the European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs sometimes outnumber large companies by a wide margin and also employ many more people. For example, Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees account for about 62% of total employment. The United States' SMEs generate half of all U.S. jobs, but only 40% of GDP. Developing countries tend to have a lar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Household

A household consists of two or more persons who live in the same dwelling. It may be of a single family or another type of person group. The household is the basic unit of analysis in many social, microeconomic and government models, and is important to economics and inheritance. Household models include families, blended families, shared housing, group homes, boarding houses, houses of multiple occupancy (UK), and single room occupancy (US). In feudal societies, the royal household and medieval households of the wealthy included servants and other retainers. Government definitions For statistical purposes in the United Kingdom, a household is defined as "one person or a group of people who have the accommodation as their only or main residence and for a group, either share at least one meal a day or share the living accommodation, that is, a living room or sitting room". The introduction of legislation to control houses of multiple occupations in the UK Housing Act (200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_respondents_in_East_Africa.png)