|

Expected Value (other)

Expected value is a term used in probability theory and statistics. It may also refer to: Physics * Expectation value (quantum mechanics) In quantum mechanics, the expectation value is the probabilistic expected value of the result (measurement) of an experiment. It can be thought of as an average of all the possible outcomes of a measurement as weighted by their likelihood, and as ..., the probabilistic expected value of the result (measurement) of an experiment Decision theory and quantitative policy analysis * Expected value of perfect information, the price that one would be willing to pay in order to gain access to perfect information * Expected value of sample information, the expected increase in utility that a decision-maker could obtain from gaining access to a sample of additional observations before making a decision * Expected value of including uncertainty, the expected difference in the value of a decision based on a probabilistic analysis versus a decision b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, expectation operator, mathematical expectation, mean, expectation value, or first Moment (mathematics), moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean, mean of the possible values a random variable can take, weighted by the probability of those outcomes. Since it is obtained through arithmetic, the expected value sometimes may not even be included in the sample data set; it is not the value you would expect to get in reality. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by Integral, integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expectation Value (quantum Mechanics)

In quantum mechanics, the expectation value is the probabilistic expected value of the result (measurement) of an experiment. It can be thought of as an average of all the possible outcomes of a measurement as weighted by their likelihood, and as such it is not the ''most'' probable value of a measurement; indeed the expectation value may have zero probability of occurring (e.g. measurements which can only yield integer values may have a non-integer mean), like the expected value from statistics. It is a fundamental concept in all areas of quantum physics. Operational definition Consider an Operator_(physics), operator A. The expectation value is then \langle A \rangle = \langle \psi , A , \psi \rangle in Bra ket notation, Dirac notation with , \psi \rangle a Normalization (statistics), normalized state vector. Formalism in quantum mechanics In quantum theory, an experimental setup is described by the observable A to be measured, and the Quantum state, state \sigma of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value Of Perfect Information

In decision theory, the expected value of perfect information (EVPI) is the price that one would be willing to pay in order to gain access to perfect information. A common discipline that uses the EVPI concept is health economics. In that context and when looking at a decision of whether to adopt a new treatment technology, there is always some degree of uncertainty surrounding the decision, because there is always a chance that the decision turns out to be wrong. The expected value of perfect information analysis tries to measure the expected cost of that uncertainty, which “can be interpreted as the expected value of perfect information (EVPI), since perfect information can eliminate the possibility of making the wrong decision” at least from a theoretical perspective. Equation The problem is modeled with a payoff matrix ''Rij'' in which the row index ''i'' describes a choice that must be made by the player, while the column index ''j'' describes a random variable that th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

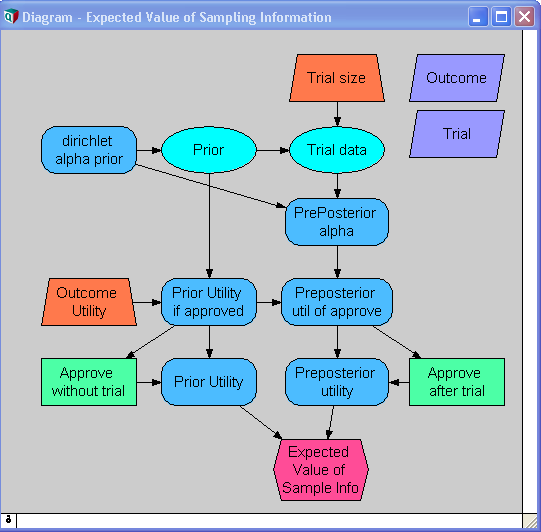

Expected Value Of Sample Information

In decision theory, the expected value of sample information (EVSI) is the expected increase in utility that a decision-maker could obtain from gaining access to a sample of additional observations before making a decision. The additional information obtained from the sample may allow them to make a more informed, and thus better, decision, thus resulting in an increase in expected utility. EVSI attempts to estimate what this improvement would be before seeing actual sample data; hence, EVSI is a form of what is known as ''preposterior analysis''. The use of EVSI in decision theory was popularized by Robert Schlaifer and Howard Raiffa in the 1960s. Formulation Let : \begin d\in D & \mbox D \\ x\in X & \mbox X \\ z \in Z & \mbox n \mbox \langle z_1,z_2,..,z_n \rangle \\ U(d,x) & \mbox d \mbox x \\ p(x) & \mbox x \\ p(z, x) & \mbox z \end It is common (but not essential) in EVSI scenarios for Z_i=X, p(z, x)=\prod p(z_i, x) and \int z p(z, x) dz = x, which is to say that each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value Of Including Uncertainty

{{disambig ...

Expected may refer to: *Expectation (epistemic) *Expected value *Expected shortfall *Expected utility hypothesis *Expected return *Expected loss See also *Unexpected (other) *Expected value (other) Expected value is a term used in probability theory and statistics. It may also refer to: Physics * Expectation value (quantum mechanics) In quantum mechanics, the expectation value is the probabilistic expected value of the result (measurement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Commercial Value

Expected commercial value (ECV), also known as estimated commercial value,Steven Bragg (2020)R&D funding decisions/ref> is a prospect-weighted value for a "project" with unclear conclusions; it is similar to expected net existing value (ENPV). In general ECV is used as a supplementary capital budgeting technique, in that it allows an analyst to compare each project's expected value against its net present value as usually calculated, i.e. using planned and contracted costs. The company can thereby maximize the value and worth of its portfolio of projects, while working within its budget constraints. As with ENPV, developments are defined to represent different project outcomes, with each scenario being assigned a possibility. A project value is computed for each scenario, and the expected commercial value is obtained by multiplying each situation's value by the scenario odds and adding the results. Depending on the procedures used to estimate the value of the project under each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |