|

Equalization Payments

Equalization payments are cash payments made in some federal systems of government from the federal government to subnational governments with the objective of offsetting differences in available revenue or in the cost of providing services. Many federations use fiscal equalisation to reduce the inequalities in the fiscal capacities of sub-national governments arising from the differences in their geography, demography, natural endowments and economies. The level of equalisation sought can vary, however. The payments are generally calculated based on the magnitude of the subnational "fiscal gap": essentially the difference between fiscal need and fiscal capacity. Fiscal capacity and fiscal need are not equivalent to measures of fiscal revenue and expenditure, as making them so would induce perverse incentives to subnational governments to reduce fiscal effort. Australia Australia introduced a formal system of horizontal fiscal equalisation (HFE) in 1933 to compensate states/terr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perverse Incentive

A perverse incentive is an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers. The cobra effect is the most direct kind of perverse incentive, typically because the incentive unintentionally rewards people for making the issue worse. The term is used to illustrate how incorrect stimulation in Stimulus (economics), economics and politics can cause unintended consequences. Examples of perverse incentives The original cobra effect The term ''cobra effect'' was coined by economist Horst Siebert based on an anecdote of an occurrence in British Raj, India during British rule. The British government, concerned about the number of venomous Indian cobra, cobras in Delhi, offered a Bounty (reward), bounty for every dead cobra. Initially, this was a successful strategy; large numbers of snakes were killed for the reward. Eventually, however, enterprising people began to breed cobras for the income. When the government became aware ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

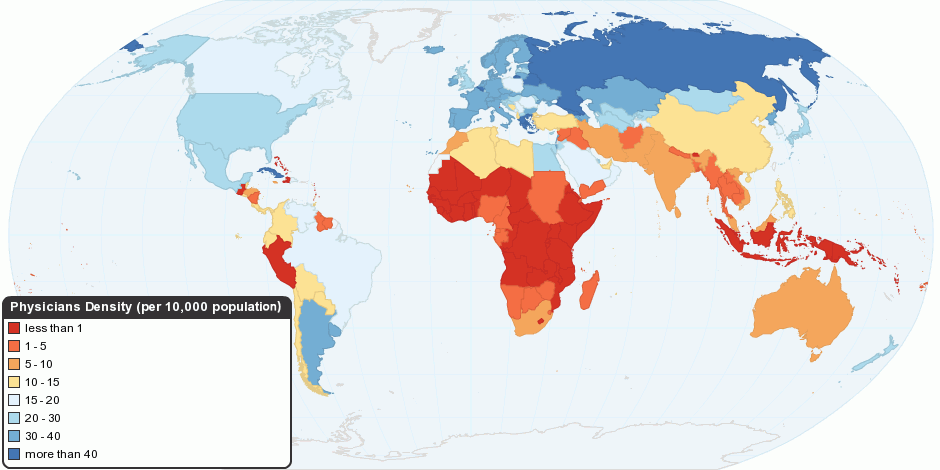

Health Care

Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration or cure of disease, illness, injury, and other physical and mental impairments in people. Health care is delivered by health professionals and allied health fields. Medicine, dentistry, pharmacy, midwifery, nursing, optometry, audiology, psychology, occupational therapy, physical therapy, athletic training, and other health professions all constitute health care. It includes work done in providing primary care, secondary care, and tertiary care, as well as in public health. Access to health care may vary across countries, communities, and individuals, influenced by social and economic conditions as well as health policies. Providing health care services means "the timely use of personal health services to achieve the best possible health outcomes". Factors to consider in terms of health care access include financial limitations (such as insurance cov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation And Redistribution

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Economics

Public economics ''(or economics of the public sector)'' is the study of government policy through the lens of economic efficiency and equity. Public economics builds on the theory of welfare economics and is ultimately used as a tool to improve social welfare. Welfare can be defined in terms of well-being, prosperity, and overall state of being. Public economics provides a framework for thinking about whether or not the government should participate in economic markets and if so to what extent it should do so. Microeconomic theory is utilized to assess whether the private market is likely to provide efficient outcomes in the absence of governmental interference; this study involves the analysis of government taxation and expenditures. This subject encompasses a host of topics notably market failures such as, public goods, externalities and Imperfect Competition, and the creation and implementation of government policy. Broad methods and topics include: * the theory ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Federalism

As a subfield of public economics, fiscal federalism is concerned with "understanding which functions and instruments are best centralized and which are best placed in the sphere of decentralized levels of government" (Oates, 1999). In other words, it is the study of how competencies (expenditure side) and fiscal instruments (revenue side) are allocated across different (vertical) layers of the administration. An important part of its subject matter is the system of transfer payments or grants by which a central government shares its revenues with lower levels of government. Federal governments use this power to enforce national rules and standards. There are two primary types of transfers, conditional and unconditional. A conditional transfer from a federal body to a province, or other territory, involves a certain set of conditions. If the lower level of government is to receive this type of transfer, it must agree to the spending instructions of the federal government. An exampl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Imbalance

Fiscal imbalance is a mismatch in the revenue powers and expenditure responsibilities of a government. In the literature on fiscal federalism, two types of fiscal imbalances are measured: Vertical Fiscal Imbalance and Horizontal Fiscal Imbalance. When the fiscal imbalance is measured between the two levels of government (Center and States or Provinces) it is called Vertical Fiscal Imbalance. When the fiscal imbalance is measured between the governments at the same level it is called Horizontal Fiscal imbalance. This imbalance is also known as regional disparity. While Horizontal Fiscal Imbalance requires equalization transfers, Vertical Fiscal Imbalance is a structural issue and thus needs to be corrected by reassignment of revenue and expenditure responsibilities between the two senior order of the governments. Horizontal Fiscal Imbalances as Differences in Net Fiscal Benefits A horizontal fiscal imbalance (HFI) emerges when sub-national governments have different abilities to r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weimar Constitution

The Constitution of the German Reich (german: Die Verfassung des Deutschen Reichs), usually known as the Weimar Constitution (''Weimarer Verfassung''), was the constitution that governed Germany during the Weimar Republic era (1919–1933). The constitution declared Germany to be a democratic parliamentary republic with a legislature elected under proportional representation. Universal suffrage was established, with a minimum voting age of 20. The constitution technically remained in effect throughout the Nazi era from 1933 to 1945, though practically it had been repealed by the Enabling Act of 1933 and thus its various provisions and protections went unenforced for the duration of Nazi rule. The constitution's title was the same as the Constitution of the German Empire that preceded it. The German state's official name was ''Deutsches Reich'' until the adoption of the 1949 Basic Law. Origin Following the end of World War I, a German National Assembly gathered in the town of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare (financial Aid)

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Education

Education is a purposeful activity directed at achieving certain aims, such as transmitting knowledge or fostering skills and character traits. These aims may include the development of understanding, rationality, kindness, and honesty. Various researchers emphasize the role of critical thinking in order to distinguish education from indoctrination. Some theorists require that education results in an improvement of the student while others prefer a value-neutral definition of the term. In a slightly different sense, education may also refer, not to the process, but to the product of this process: the mental states and dispositions possessed by educated people. Education originated as the transmission of cultural heritage from one generation to the next. Today, educational goals increasingly encompass new ideas such as the liberation of learners, skills needed for modern society, empathy, and complex vocational skills. Types of education are commonly divided into ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Transfer Payments

Transfer payments are a collection of payments made by the Government of Canada to Canadian provinces and territories under the Federal–Provincial Arrangements Act. Chief among these are the Canada Social Transfer, the Canada Health Transfer and equalization payments. The last of these can be spent however the receiving provinces see fit, while the first two are intended to support social and health services respectively. The health transfer is the largest of the three, with a combined cash and tax point value of $36.1 billion in the 2017-2018 budget. The social transfer has a cash and tax point value of $13.3 billion while the general equalization payments distributed $17.6 billion to six "have-not" provinces. While the territories do not participate in the equalization payment program (the Territorial Formula Financing program taking its place), they do participate in the health and social transfers. Total federal transfers The Canadian federal government announced in 2023 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australia

Australia, officially the Commonwealth of Australia, is a sovereign ''Sovereign'' is a title which can be applied to the highest leader in various categories. The word is borrowed from Old French , which is ultimately derived from the Latin , meaning 'above'. The roles of a sovereign vary from monarch, ruler or ... country comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands. With an area of , Australia is the largest country by area in Oceania and the world's sixth-largest country. Australia is the oldest, flattest, and driest inhabited continent, with the least fertile soils. It is a megadiverse country, and its size gives it a wide variety of landscapes and climates, with deserts in the centre, tropical Forests of Australia, rainforests in the north-east, and List of mountains in Australia, mountain ranges in the south-east. The ancestors of Aboriginal Australians began arriving from south east Asia approx ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Territorial Formula Financing

Territorial Formula Financing (TFF) is an annual unconditional transfer payment from Canada's federal government to the three territorial governments of Yukon, the Northwest Territories, and Nunavut to support the provision of public services. A significant portion of the financial resources of the territorial governments comes from the Canadian federal government through the TFF grant. For instance, during the 2005–06 fiscal year, TFF was approximately 61 per cent of Yukon's, 66 per cent of the Northwest Territories' and 81 per cent of Nunavut's total financial resources. In the 2023-24 fiscal year A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many ..., Yukon will receive $1.252 billion ($28,208 per capita), the Northwest Territories $1,611 billion ($37,073 per capita) and Nunavu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |