|

Entrepreneur In Residence

An Entrepreneur in residence, or Executive in residence (EIR), is a position most often held by successful entrepreneurs in venture capital firms, private equity firms, startup accelerators, law firms or business schools. The EIR typically leads, or has led, a small, early-stage, emerging company deemed to have high-growth potential, or which has demonstrated high-growth in its number of employees, annual revenue, or both. An institutional fund may provide an entrepreneur in residence, or executive in residence, with the working capital to nurture expansion, new-product development, or restructuring of a company's operations, management, or ownership. Venture capital, private equity, startup accelerators In a venture capital fund, a private equity fund or a startup accelerator; the entrepreneur in residence works with the general partners and assists the firm's portfolio companies by leveraging their industry knowledge, expertise and network. In addition he/she is expected to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Entrepreneurship

Entrepreneurship is the creation or extraction of economic value. With this definition, entrepreneurship is viewed as change, generally entailing risk beyond what is normally encountered in starting a business, which may include other values than simply economic ones. An entrepreneur is an individual who creates and/or invests in one or more businesses, bearing most of the risks and enjoying most of the rewards.The process of setting up a business is known as entrepreneurship. The entrepreneur is commonly seen as an innovator, a source of new ideas, goods, services, and business/or procedures. More narrow definitions have described entrepreneurship as the process of designing, launching and running a new business, which is often similar to a small business, or as the "capacity and willingness to develop, organize and manage a business venture along with any of its risks to make a profit." The people who create these businesses are often referred to as entrepreneurs. While de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture capital investment occurs after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructuring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Accelerator

Startup accelerators, also known as seed accelerators, are fixed-term, cohort-based programs, that include mentorship and educational components and culminate in a public pitch event or demo day. While traditional business incubators are often government-funded, generally take no equity, and rarely provide funding, accelerators can be either privately or publicly funded and cover a wide range of industries. Unlike business incubators, the application process for seed accelerators is open to anyone but highly competitive. There are specific accelerators, such as corporate accelerators, which are often subsidiaries or programs of larger corporations that act like seed accelerators. Distinctive qualities The main differences between business incubators, startup studios, and accelerators are: # The application process is open to anyone but highly competitive. Y Combinator and TechStars have application acceptance rates between 1% and 3%. # Seed investment in startups is usually ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Firm

A law firm is a business entity formed by one or more lawyers to engage in the practice of law. The primary service rendered by a law firm is to advise clients (individuals or corporations) about their legal rights and responsibilities, and to represent clients in civil or criminal cases, business transactions, and other matters in which legal advice and other assistance are sought. Arrangements Law firms are organized in a variety of ways, depending on the jurisdiction in which the firm practices. Common arrangements include: * Sole proprietorship, in which the attorney ''is'' the law firm and is responsible for all profit, loss and liability; * General partnership, in which all the attorneys who are members of the firm share ownership, profits and liabilities; * Professional corporations, which issue stock to the attorneys in a fashion similar to that of a business corporation; * Limited liability company, in which the attorney-owners are called "members" but are not direct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business School

A business school is a university-level institution that confers degrees in business administration or management. A business school may also be referred to as school of management, management school, school of business administration, or colloquially b-school or biz school. A business school teaches topics such as accounting, administration, business analytics, strategy, economics, entrepreneurship, finance, human resource management, management science, management information systems, international business, logistics, marketing, sales, operations management, organizational psychology, organizational behavior, public relations, research methods, real estate, and supply chain management among others. Types There are several forms of business schools, including a school of business, business administration, and management. # Most of the university business schools consist of faculties, colleges, or departments within the university, and predominantly teach busines ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Start-up Company

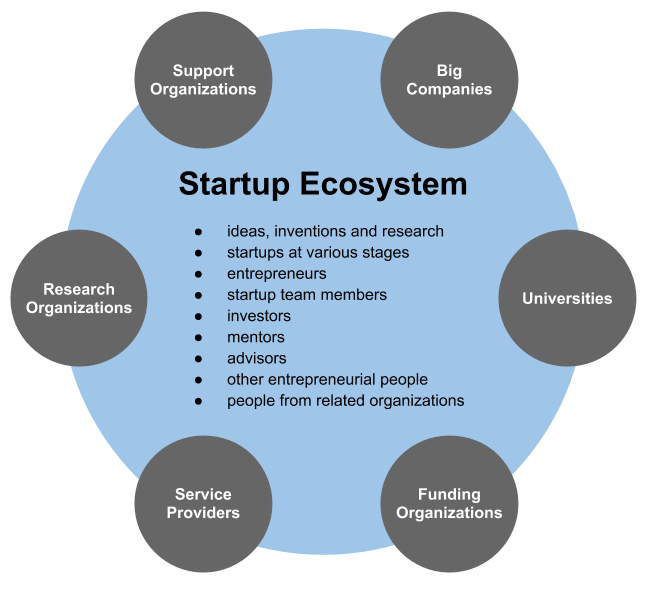

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Capital

Working capital (WC) is a financial metric which represents operating liquidity available to a business, organisation, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. Gross working capital is equal to current assets. Working capital is calculated as current assets minus current liabilities. If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit and negative working capital. A company can be endowed with assets and profitability but may fall short of liquidity if its assets cannot be readily converted into cash. Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts receiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture capital investment occurs after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Partnership

A general partnership, the basic form of partnership under common law, is in most countries an association of persons or an unincorporated company with the following major features: *Must be created by agreement, proof of existence and estoppel. *Formed by two or more persons *The owners are jointly and severally liable for any legal actions and debts the company may face, unless otherwise provided by law or in the agreement. It is a partnership in which partners share equally in both responsibility and liability. Characteristics Partnerships have certain default characteristics relating to both (a) the relationship between the individual partners and (b) the relationship between the partnership and the outside world. The former can generally be overridden by express agreement between the partners. Whilst the latter is in general hardly varied, a careful draft would oust certain kinds of third party liability. A clause can contain that only the negligent partners can be sued ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio (finance)

In finance, a portfolio is a collection of investments. Definition The term “portfolio” refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial professionals, hedge funds, banks and other financial institutions. It is a generally accepted principle that a portfolio is designed according to the investor's risk tolerance, time frame and investment objectives. The monetary value of each asset may influence the risk/reward ratio of the portfolio. When determining asset allocation, the aim is to maximise the expected return and minimise the risk. This is an example of a multi-objective optimization problem: many efficient solutions are available and the preferred solution must be selected by considering a tradeoff between risk and return. In particular, a portfolio A is dominated by another portfolio A' if A' has a greater expected gain and a lesser risk than A. If no portfolio dominate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |