|

Electronic Municipal Market Access

The Electronic Municipal Market Access (EMMA) system, operated by the Municipal Securities Rulemaking Board (MSRB), serves as the official source for municipal securities A municipality is usually a single administrative division having corporate status and powers of self-government or jurisdiction as granted by national and regional laws to which it is subordinate. The term ''municipality'' may also mean the g ... disclosures and related financial data in the United States. EMMA provides free on-line access to centralized new issue municipal securities disclosure documents (known as official statements), on-going continuing disclosures for all municipal securities, escrow deposit agreements for advance refundings (i.e., refinancings) of outstanding bonds, real-time municipal bond trade price information, interest rates and auction results for municipal auction rate securities (the first free source for this kind of information on the auction rate securities market) and inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Municipal Securities Rulemaking Board

The Municipal Securities Rulemaking Board (MSRB) writes investor protection rules and other rules regulating broker-dealers and banks in the United States municipal securities market, including tax-exempt and taxable municipal bonds, municipal notes, and other securities issued by states, cities, and counties or their agencies to help finance public projects or for other public policy purposes. Operations Like the Financial Industry Regulatory Authority (FINRA), the MSRB is a self-regulatory organization that is subject to oversight by the Securities and Exchange Commission (SEC). The MSRB is authorized to create rules designed "to prevent fraudulent and manipulative acts and practices, to promote just and equitable principles of trade, to foster cooperation and coordination with persons engaged in regulating, clearing, settling, and processing information with respect to, and facilitating transactions in municipal securities, to remove impediments to and perfect the mechanism ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Municipal Securities

A municipality is usually a single administrative division having corporate status and powers of self-government or jurisdiction as granted by national and regional laws to which it is subordinate. The term ''municipality'' may also mean the governing body of a given municipality. A municipality is a general-purpose administrative subdivision, as opposed to a special-purpose district. The term is derived from French and Latin . The English word ''municipality'' derives from the Latin social contract (derived from a word meaning "duty holders"), referring to the Latin communities that supplied Rome with troops in exchange for their own incorporation into the Roman state (granting Roman citizenship to the inhabitants) while permitting the communities to retain their own local governments (a limited autonomy). A municipality can be any political jurisdiction, from a sovereign state such as the Principality of Monaco, to a small village such as West Hampton Dunes, New York. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auction Rate Securities

An auction rate security (ARS) typically refers to a debt instrument (corporate or municipal bonds) with a long-term nominal maturity for which the interest rate is regularly reset through a Dutch auction. Since February 2008, most such auctions have failed, and the auction market has been largely frozen. In late 2008, investment banks that had marketed and distributed auction rate securities agreed to repurchase most of them at par. Background The first auction rate security for the tax-exempt market was introduced by Goldman Sachs in 1988, a $121.4 million financing for Tucson Electric Company by the Industrial Development Authority of Pima County, Arizona. However, the security was invented by Ronald Gallatin at Lehman Brothers in 1984. Auctions are typically held every 7, 28, or 35 days; interest on these securities is paid at the end of each auction period. Certain types of daily auctioned ARSs have coupons paid on the first of every month. There are also other, more unus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EDGAR

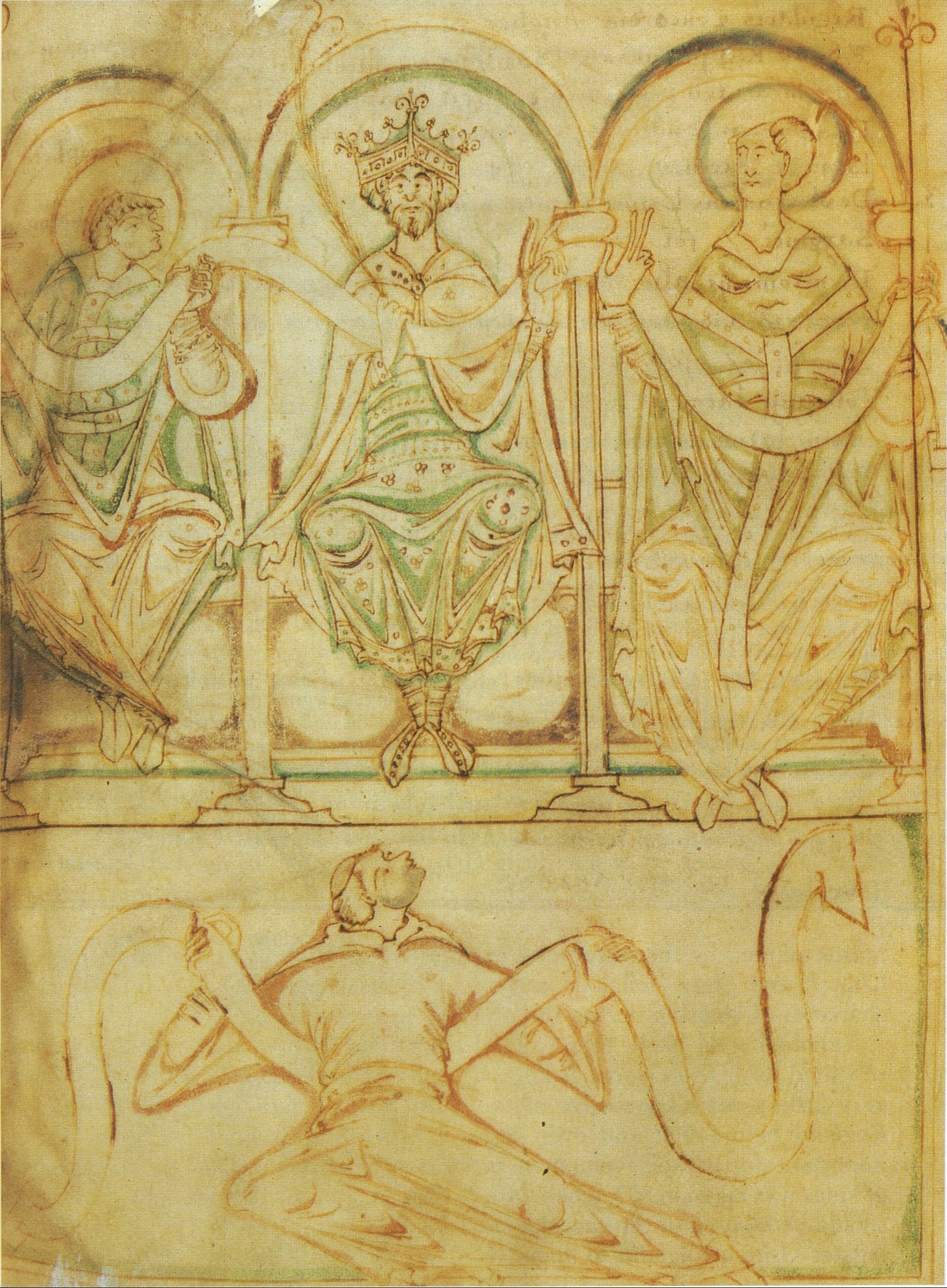

Edgar is a commonly used English given name, from an Anglo-Saxon name ''Eadgar'' (composed of '' ead'' "rich, prosperous" and ''gar'' "spear"). Like most Anglo-Saxon names, it fell out of use by the later medieval period; it was, however, revived in the 18th century, and was popularised by its use for a character in Sir Walter Scott's ''The Bride of Lammermoor'' (1819). People with the given name * Edgar the Peaceful (942–975), king of England * Edgar the Ætheling (c. 1051 – c. 1126), last member of the Anglo-Saxon royal house of England * Edgar of Scotland (1074–1107), king of Scotland * Edgar Angara, Filipino lawyer * Edgar Barrier, American actor * Edgar Baumann, Paraguayan javelin thrower * Edgar Bergen, American actor, radio performer, ventriloquist * Edgar Berlanga, American boxer * Edgar H. Brown, American mathematician * Edgar Buchanan, American actor * Edgar Rice Burroughs, American author, creator of ''Tarzan'' * Edgar Cantero, Spanish author in Catalan, Sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Act Of 1933

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution. It requires every offer or sale of securities that uses the means and instrumentalities of interstate commerce to be registered with the SEC pursuant to the 1933 Act, unless an exemption from registration exists under the law. The term "means and instrumentalities of interstate commerce" is extremely broad and it is virtually impossible to avoid the operation of the statute by attempting to offer or sell a security without using an "instrumentality" of interstate commerce. Any use of a telephone, for example, or the mails would probably be enough to subject the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Exchange Act Of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law. Companies raise billions of dollars by issuing securities in what is known as the primary market. Contrasted with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer, frequently through brokers or dealers. Trillions of dollars are made and lost each year through t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Company Act Of 1940

The Investment Company Act of 1940 (commonly referred to as the '40 Act) is an act of Congress which regulates investment funds. It was passed as a United States Public Law () on August 22, 1940, and is codified at . Along with the Securities Exchange Act of 1934, the Investment Advisers Act of 1940, and extensive rules issued by the U.S. Securities and Exchange Commission; it is central to financial regulation in the United States. It has been updated by the Dodd-Frank Act of 2010. It is the primary source of regulation for mutual funds and closed-end funds, now a multi-trillion dollar investment industry. The 1940 Act also impacts the operations of hedge funds, private equity funds and even holding companies. History Following the founding of the mutual fund in 1924, investors invested in this new investment vehicle heavily. Five and a half years later, the Wall Street Crash of 1929 occurred in the stock market, followed shortly thereafter by the United States entry into the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation In The United States

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |