|

Economics Of The Arts And Literature

Economics of the arts and literature or cultural economics (used below for convenience) is a branch of economics that studies the economics of creation, distribution, and the consumption of work of art, works of art, literature and similar creative and/or cultural products. For a long time, the concept of the "arts" were confined to visual arts (e.g., painting) and performing arts (music, theatre, dance) in the Anglo-Saxon tradition. Usage has widened since the beginning of the 1980s with the study of cultural industry (cinema, television programs, book and periodical publishing and music publishing) and the economy of cultural institutions (museums, libraries, historic buildings). The field is coded as JEL classification codes#Other special topics (economics) JEL: Z Subcategories, JEL: Z11 in the ''Journal of Economic Literature'' JEL classification codes, classification system used for article searches. Introduction Cultural economics is concerned with the arts in a broa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

100th 2

1 (one, unit, unity) is a number representing a single or the only entity. 1 is also a numerical digit and represents a single unit (measurement), unit of counting or measurement. For example, a line segment of ''unit length'' is a line segment of length 1. In conventions of sign where zero is considered neither positive nor negative, 1 is the first and smallest Positive number, positive integer. It is also sometimes considered the first of the sequence (mathematics), infinite sequence of natural numbers, followed by 2, although by other definitions 1 is the second natural number, following 0. The fundamental mathematical property of 1 is to be a multiplicative identity, meaning that any number multiplied by 1 equals the same number. Most if not all properties of 1 can be deduced from this. In advanced mathematics, a multiplicative identity is often denoted 1, even if it is not a number. 1 is by convention not considered a prime number; this was not universally ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William G

William is a male given name of Germanic origin.Hanks, Hardcastle and Hodges, ''Oxford Dictionary of First Names'', Oxford University Press, 2nd edition, , p. 276. It became very popular in the English language after the Norman conquest of England in 1066,All Things William"Meaning & Origin of the Name"/ref> and remained so throughout the Middle Ages and into the modern era. It is sometimes abbreviated "Wm." Shortened familiar versions in English include Will, Wills, Willy, Willie, Bill, and Billy. A common Irish form is Liam. Scottish diminutives include Wull, Willie or Wullie (as in Oor Wullie or the play ''Douglas''). Female forms are Willa, Willemina, Wilma and Wilhelmina. Etymology William is related to the given name ''Wilhelm'' (cf. Proto-Germanic ᚹᛁᛚᛃᚨᚺᛖᛚᛗᚨᛉ, ''*Wiljahelmaz'' > German ''Wilhelm'' and Old Norse ᚢᛁᛚᛋᛅᚼᛅᛚᛘᛅᛋ, ''Vilhjálmr''). By regular sound changes, the native, inherited English form of the name shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diversification (finance)

In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. A common path towards diversification is to reduce risk or volatility by investing in a variety of assets. If asset prices do not change in perfect synchrony, a diversified portfolio will have less variance than the weighted average variance of its constituent assets, and often less volatility than the least volatile of its constituents. Diversification is one of two general techniques for reducing investment risk. The other is hedging. Examples The simplest example of diversification is provided by the proverb "Don't put all your eggs in one basket". Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them. On the other hand, having a lot of baskets may increase costs. In finance, an example of an undiversified portfoli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform. To be able to trade a security on a certain stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as modern markets use electronic communic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment, such as interest payments, coupons, cash dividends, stock dividends or the payoff from a derivative or structured product. It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. The latter is also called the holding period return. A loss instead of a profit is described as a '' negative return'', assuming the amount invested is greater than zero. To compare returns over time periods of different lengths on an equal basis, it is useful to convert each return into a return over a period of time of a standard length. The result of the conversion is called the rate of return. Typically, the period of time is a year, in which case the rate of return is also called the annualized return, and the conversion process, described below ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopsony

An oligopsony (from Greek ὀλίγοι (''oligoi'') "few" and ὀψωνία (''opsōnia'') "purchase") is a market form in which the number of buyers is small while the number of sellers in theory could be large. This typically happens in a market for inputs where numerous suppliers are competing to sell their product to a small number of (often large and powerful) buyers. It contrasts with an oligopoly, where there are many buyers but few sellers. An oligopsony is a form of imperfect competition. The terms monopoly (one seller), monopsony (one buyer), and bilateral monopoly have a similar relationship. Industry examples In each of these cases, the buyers have a major advantage over the sellers. They can play off one supplier against another, thus lowering their costs. They can also dictate exact specifications to suppliers, for delivery schedules, quality, and (in the case of agricultural products) crop varieties. They also pass off much of the risks of overproduction, natural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result from the desire to maximize profits, which can lead to collusion between companies. This reduces competition, increases prices for consumers, and lowers wages for employees. Many industries have been cited as oligopolistic, including civil aviation, electricity providers, the telecommunications sector, Rail freight markets, food processing, funeral services, sugar refining, beer making, pulp and paper making, and automobile manufacturing. Most countries have laws outlawing anti-competitive behavior. EU competition law prohibits anti-competitive practices such as price-fixing and manipulating market supply and trade among competitors. In the US, the United States Department of Justice Antitrust Division and the Federal Trade Commission are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

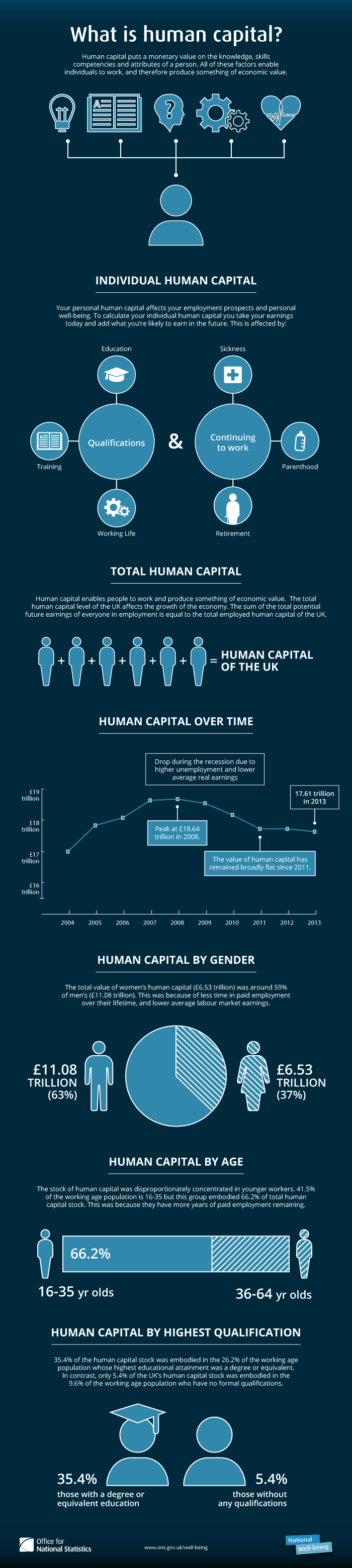

Human Capital

Human capital is a concept used by social scientists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a substantial impact on individual earnings. Research indicates that human capital investments have high economic returns throughout childhood and young adulthood. Companies can invest in human capital, for example, through education and training, enabling improved levels of quality and production. As a result of his conceptualization and modeling work using Human Capital as a key factor, the 2018 Nobel Prize for Economics was jointly awarded to Paul Romer, who founded the modern innovation-driven approach to understanding economic growth. In the recent literature, the new concept of task-specific human capital was coined in 2004 by Robert Gibbons, an economist at MIT, and Michael Waldman, an economist at Cornell University. The concept emphasizes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tartuffe

''Tartuffe, or The Impostor, or The Hypocrite'' (; french: Tartuffe, ou l'Imposteur, ), first performed in 1664, is a theatrical comedy by Molière. The characters of Tartuffe, Elmire, and Orgon are considered among the greatest classical theatre roles. History Molière performed his first version of ''Tartuffe'' in 1664. Almost immediately following its performance that same year at Versailles' grand fêtes (The Party of the Delights of the Enchanted Island/''Les fêtes des plaisirs de l'ile enchantée''), King Louis XIV suppressed it, probably due to the influence of the archbishop of Paris, Paul Philippe Hardouin de Beaumont de Péréfixe, who was the King's confessor and had been his tutor. While the king had little personal interest in suppressing the play, he did so because, as stated in the official account of the fête: although it was found to be extremely diverting, the king recognized so much conformity between those that a true devotion leads on the path to heave ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Molière

Jean-Baptiste Poquelin (, ; 15 January 1622 (baptised) – 17 February 1673), known by his stage name Molière (, , ), was a French playwright, actor, and poet, widely regarded as one of the greatest writers in the French language and world literature. His extant works include comedies, farces, tragicomedies, comédie-ballets, and more. His plays have been translated into every major living language and are performed at the Comédie-Française more often than those of any other playwright today. His influence is such that the French language is often referred to as the "language of Molière". Born into a prosperous family and having studied at the Collège de Clermont (now Lycée Louis-le-Grand), Molière was well suited to begin a life in the theatre. Thirteen years as an itinerant actor helped him polish his comedic abilities while he began writing, combining Commedia dell'arte elements with the more refined French comedy. Through the patronage of aristocrats including ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

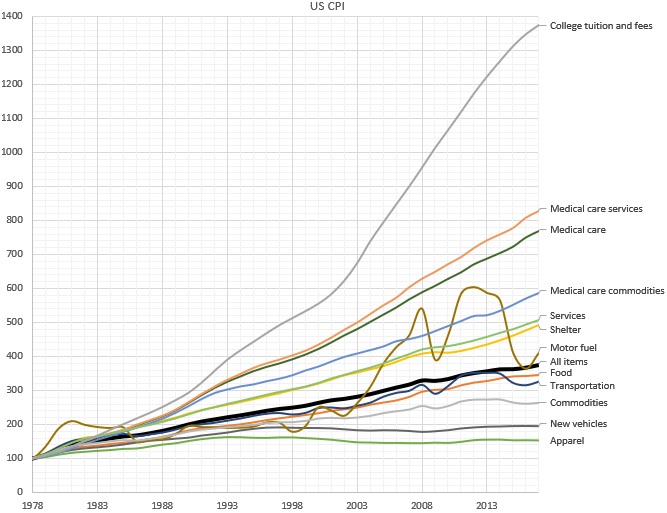

Baumol's Cost Disease

Baumol's cost disease, also known as the Baumol effect, is the rise of wages in jobs that have experienced little or no increase in labor productivity, in response to rising salaries in other jobs that have experienced higher productivity growth. The phenomenon was described by William J. Baumol and William G. Bowen in the 1960s and is an example of cross elasticity of demand. The rise of wages in jobs without productivity gains derives from the requirement to compete for workers with jobs that have experienced productivity gains and so can naturally pay higher salaries, just as classical economics predicts. For instance, if the retail sector pays its managers 19th-century-style wages, retail managers may decide to quit to get jobs in the automobile sector, where wages are higher because of higher labor productivity. Thus, retail managers' salaries increase not due to labor productivity increases in the retail sector but due to productivity and corresponding wage increases in oth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)