|

Earnings Call

An earnings call is a teleconference, or webcast, in which a public company discusses the financial results of a reporting period ("earnings guidance"). The name comes from earnings per share (EPS), the bottom line number in the income statement divided by the number of shares outstanding. The US-based National Investor Relations Institute (NIRI) says that 92% of companies represented by their members conduct earnings calls and that virtually all of these are webcast. Transcripts of calls may be made available either by the company or a third party. The calls are usually preceded or accompanied by a press release containing a summary of the financial results, and possibly by a more detailed filing under securities law. Earnings calls usually happen, or at least begin, while the stock market on which the company's shares are traded is closed to trading, so that all investors will have had a chance to hear management's presentation before trading in the stock resumes. Generally, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

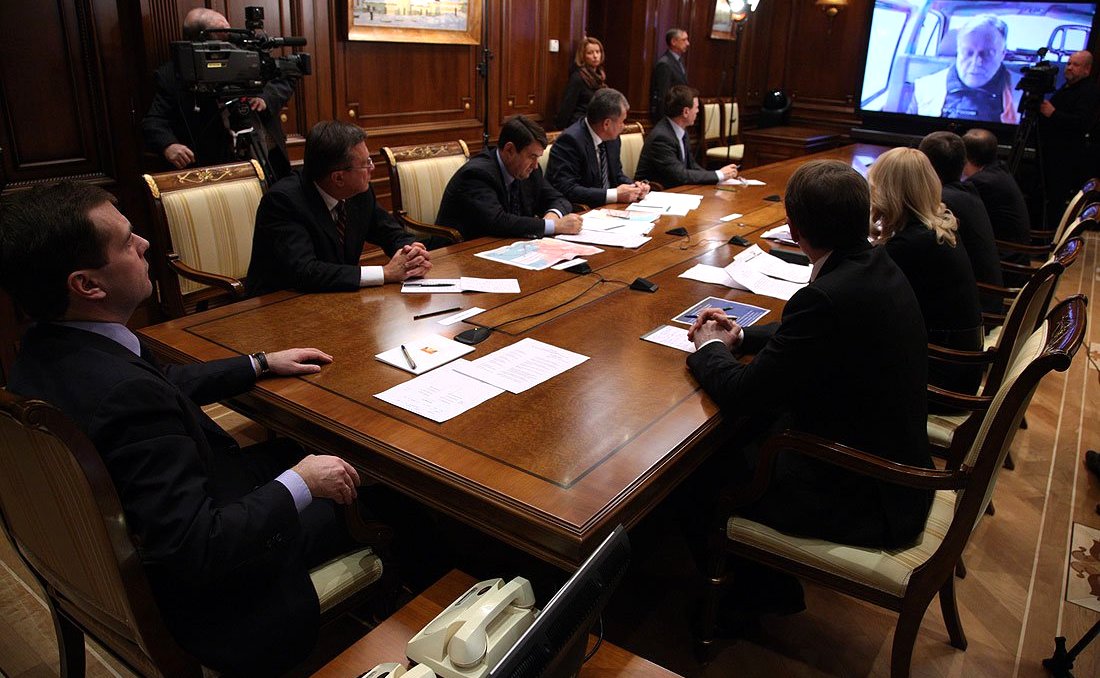

Teleconference

A teleconference is the live exchange of information among several people remote from one another but linked by a telecommunications system. Terms such as audio conferencing, telephone conferencing and phone conferencing are also sometimes used to refer to teleconferencing. The telecommunications system may support the teleconference by providing one or more of the following: audio, video, and/or data services by one or more means, such as telephone, computer, telegraph, teletypewriter, radio, and television. Telcon is used as an abbreviation for both "telephone conference" and "telephone conversation". Internet teleconferencing Internet teleconferencing includes internet telephone conferencing, videotelephony Videotelephony, also known as videoconferencing and video teleconferencing, is the two-way or multipoint reception and transmission of audio and video signals by people in different locations for real time communication.McGraw-Hill Concise Ency ..., web conferencing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Securities And Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual repo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, the capital structure of corporations, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value. Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term business operations, operating balance of current assets and Current liability, current liabilities; the focus here is on managing cash, inventory, inventories, and short-term borrowing an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Teleconferencing

A teleconference is the live exchange of information among several people remote from one another but linked by a telecommunications system. Terms such as audio conferencing, telephone conferencing and phone conferencing are also sometimes used to refer to teleconferencing. The telecommunications system may support the teleconference by providing one or more of the following: audio, video, and/or data services by one or more means, such as telephone, computer, telegraph, teletypewriter, radio, and television. Telcon is used as an abbreviation for both "telephone conference" and "telephone conversation". Internet teleconferencing Internet teleconferencing includes internet telephone conferencing, videotelephony, web conferencing, and augmented reality conferencing. Internet telephony involves conducting a teleconference over the Internet or a wide area network. One key technology in this area is Voice over Internet Protocol Voice over Internet Protocol (VoIP), also called ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Terms

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 6K

Form 6K is an SEC filing submitted to the U.S. Securities and Exchange Commission used by certain foreign private issuers to provide information that is: * Required to be made public in the country of its domicile * Filed with and made public by a foreign stock exchange on which its securities are traded * Distributed to security holders. The report must be furnished promptly after such material is made public. The form is not considered "filed" because of Section 18 (for liability purposes). This is the only information furnished by foreign private issuers between annual reports, since such issuers are not required to file on Forms 10-Q or 8-K Form 8-K is a very broad form used to notify investors in United States public companies of specified events that may be important to shareholders or the United States Securities and Exchange Commission. This is one of the most common types of for .... External links SEC HomepageLatest 6-K SEC Filings (EDGAR) SEC filings {{Finance- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 20-F

Form 20-F is an SEC filing submitted to the US Securities and Exchange Commission used by certain foreign private issuers to provide information. The form is used by companies where 50% or less of the total amount of voting shares are held by American Citizens, but its shares can be traded on an American Exchange. The purpose of the form is to standardize the reports of foreign businesses for the American Markets. 20-F, 20-F/A Annual and transition report of foreign private issuers pursuant to sections 13 or 15(d) 20FR12B, 20FR12B/A Form for initial registration of a class of securities of foreign private issuers pursuant to section 12(b) 20FR12G, 20FR12G/A Form for initial registration of a class of securities of foreign private issuers pursuant to section 12(g) The postfix /A stands for 'Amendment' The report must be filed within four months after the end of the fiscal year. A 40-F is used for Canadian filers. It is similar to the Form 10-K A Form 10-K is an annual report req ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Depositary Receipt

An American depositary receipt (ADR, and sometimes spelled ''depository'') is a negotiable security that represents securities of a foreign company and allows that company's shares to trade in the U.S. financial markets. Shares of many non-U.S. companies trade on U.S. stock exchanges through ADRs, which are denominated and pay dividends in U.S. dollars, and may be traded like regular shares of stock. ADRs are also traded during U.S. trading hours, through U.S. broker-dealers. ADRs simplify investing in foreign securities because the depositary bank "manage all custody, currency and local taxes issues". The first ADR was introduced by J.P. Morgan in 1927 for the British retailer Selfridges on the New York Curb Exchange, the American Stock Exchange's precursor. They are the U.S. equivalent of a global depository receipt (GDR). Securities of a foreign company that are represented by an ADR are called American depositary shares (ADSs). Depositary receipts ADRs are one type of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchanges

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform. To be able to trade a security on a certain stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as modern markets use electronic communicatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 10-Q

Form 10-Q, (also known as a 10-Q or 10Q) is a quarterly report mandated by the United States federal Securities and Exchange Commission, to be filed by publicly traded corporations. Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, the 10-Q is an SEC filing that must be filed quarterly with the US Securities and Exchange Commission. It contains similar information to the annual form 10-K, however the information is generally less detailed, and the financial statements are generally unaudited. Information for the final quarter of a firm's fiscal year is included in the 10-K, so only three 10-Q filings are made each year. These reports generally compare last quarter to the current quarter and last year's quarter to this year's quarter. The SEC put this form in place to facilitate better informed investors. The form 10-Q must be filed within 40 days for large accelerated filers and accelerated filers or 45 days after the end of the fiscal quarter for al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Year

A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally not the reporting period to align with the calendar year (1 January to 31 December). Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees, are also levied on a fiscal year basis, but others are charged on an anniversary basis. Some companies, such as Cisco Systems, end their fiscal year on the same day of the week each year: the day ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 10-K

A Form 10-K is an annual report required by the U.S. Securities and Exchange Commission (SEC), that gives a comprehensive summary of a company's financial performance. Although similarly named, the annual report on Form 10-K is distinct from the often glossy "annual report to shareholders," which a company must send to its shareholders when it holds an annual meeting to elect directors (though some companies combine the annual report and the 10-K into one document). The 10-K includes information such as company history, organizational structure, executive compensation, equity, subsidiaries, and audited financial statements, among other information. Companies with more than $10 million in assets and a class of equity securities that is held by more than 2000 owners must file annual and other periodic reports, regardless of whether the securities are publicly or privately traded. Up until March 16, 2009, smaller companies could use Form 10-KSB. If a shareholder requests a company's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)