|

Exotic Derivative

An exotic derivative, in finance, is a derivative which is more complex than commonly traded "vanilla" products. This complexity usually relates to determination of payoff; see option style. The category may also include derivatives with a non-standard subject matter - i.e., underlying - developed for a particular client or a particular market.Understanding derivative contracts: types of derivatives The term "exotic derivative" has no precisely defined meaning, being a colloquialism that reflects how common a particular derivative is in the marketplace. As such, certain derivative instruments have been considered exotic when conceived of and sold, but lost this status when they were traded with significant enough volume. Examples of this phenomenon include [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Energy Derivative

An energy derivative is a derivative contract based on (derived from) an underlying energy asset, such as natural gas, crude oil, or electricity. Energy derivatives are exotic derivatives and include exchange-traded contracts such as futures and options, and over-the-counter (i.e., privately negotiated) derivatives such as forwards, swaps and options. Major players in the energy derivative markets include major trading houses, oil companies, utilities, and financial institutions. Energy derivatives were criticized after the 2008 financial crisis, with critics pointing out that the market artificially inflates the price of oil and other energy providers. Definition The basic building blocks for all derivative contracts are futures contracts and swaps contracts. In energy markets, these are traded on the New York Mercantile Exchange NYMEX, in Tokyo TOCOM and online through the IntercontinentalExchange. Futures contracts A futures contract is an agreement to buy or sel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monte Carlo Methods In Finance

Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by simulating the various sources of uncertainty affecting their value, and then determining the distribution of their value over the range of resultant outcomes. This is usually done by help of stochastic asset models. The advantage of Monte Carlo methods over other techniques increases as the dimensions (sources of uncertainty) of the problem increase. Monte Carlo methods were first introduced to finance in 1964 by David B. Hertz through his ''Harvard Business Review'' article, discussing their application in Corporate Finance. In 1977, Phelim Boyle pioneered the use of simulation in derivative valuation in his seminal '' Journal of Financial Economics'' paper. This article discusses typical financial problems in which Monte Carlo methods are used. It also touches on the use of so-called "quasi-random" methods such as the use of S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Salomon Smith Barney

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street". Salomon Brothers served many of the largest corporations in America. At one time, it was the leading underwriter of corporate bonds and the largest dealer of Treasury Securities in the United States. It was also one of the top firms in futures and options (known as "derivatives") and in securitization in a range of asset classes including commercial real estate securities. The bank was famed for its "cutthroat corporate culture that rewarded risk-taking with massive bonuses, punishing poor results with a swift boot." In Michael Lewis' 1989 book ''Liar's Poker'', the insider descriptions of life at Salomon gave way to the pop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

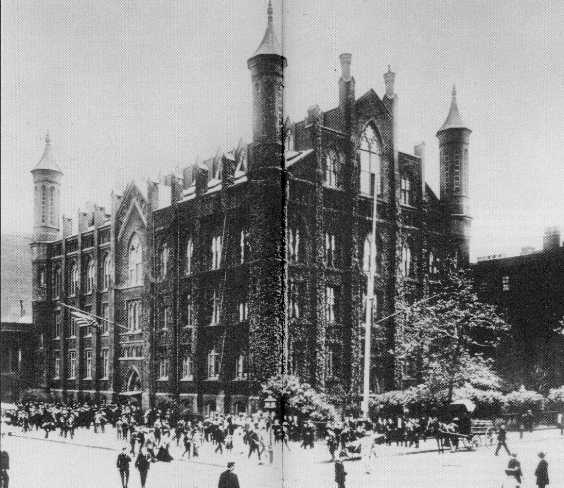

Baruch College

Baruch College (officially the Bernard M. Baruch College) is a public college in New York City. It is a constituent college of the City University of New York system. Named for financier and statesman Bernard M. Baruch, the college operates undergraduate and postgraduate programs through the Zicklin School of Business, the Weissman School of Arts and Sciences, and the Marxe School of Public and International Affairs. History Baruch College is one of the senior colleges in the CUNY system. It traces its roots back to the 1847 founding of the Free Academy, the first institution of free public higher education in the United States. The New York State Literature Fund was created to serve students who could not afford to enroll in New York City's private colleges. The Fund led to the creation of the Committee of the Board of Education of the City of New York, led by Townsend Harris, J.S. Bosworth, and John L. Mason, which brought about the establishment of what would become the F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jim Gatheral

Jim Gatheral is a researcher in the field of mathematical finance, who has contributed to the study of volatility as applied to the pricing and risk management of derivatives. A recurrent subject in his books and papers is the volatility smile, and he published in 2006 a book ''The Volatility Surface'' based on a course he taught for six years at New York University, along with Nassim Taleb. More recently his work has moved in the direction of market microstructure, especially as applied to algorithmic trading. He is the author of ''The Volatility Surface: A Practitioner's Guide.'' (2006, New Jersey: Wiley. ) In March 2010, Jim Gatheral left his position at Merrill Lynch to assume a tenured full professor position at the Financial Engineering Masters Program at Baruch College, where he is teaching volatility surface modeling and market microstructure. Prior to this, he worked at Bank of America and Bankers Trust before heading the Equity Quantitative Analytics group at M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Chicago

The University of Chicago (UChicago, Chicago, U of C, or UChi) is a private university, private research university in Chicago, Illinois. Its main campus is located in Chicago's Hyde Park, Chicago, Hyde Park neighborhood. The University of Chicago is consistently ranked among the best universities in the world and it is among the most selective in the United States. The university is composed of College of the University of Chicago, an undergraduate college and five graduate research divisions, which contain all of the university's graduate programs and interdisciplinary committees. Chicago has eight professional schools: the University of Chicago Law School, Law School, the Booth School of Business, the Pritzker School of Medicine, the Crown Family School of Social Work, Policy, and Practice, the Harris School of Public Policy, the University of Chicago Divinity School, Divinity School, the Graham School of Continuing Liberal and Professional Studies, and the Pritzker School of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue & Customs

, patch = , patchcaption = , logo = HM Revenue & Customs.svg , logocaption = , badge = , badgecaption = , flag = , flagcaption = , image_size = , commonname = , abbreviation = , motto = , formed = , preceding1 = Inland Revenue , preceding2 = HM Customs and Excise , dissolved = , superseding = , employees = 63,042 FTE , volunteers = , budget = (2018–2019) , country = United Kingdom , constitution1 = Commissioners for Revenue and Customs Act 2005 , speciality1 = customs , speciality2 = tax , headquarters = 100 Parliament Street, London, SW1A 2BQ , sworntype = , sworn = , unsworntype = , unsworn = , minister1name = Andrew Griffith MP , minister1pfo = Economic Secretary to the Treasury a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized "structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor's investment return and the issuer's payment obligations are contingent on, or highly sensitive to, changes in the value of underlying a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Innovation

Financial innovation is the act of creating new financial instruments as well as new financial technologies, institutions, and markets. Recent financial innovations include hedge funds, private equity, weather derivatives, retail-structured products, exchange-traded funds, multi-family offices, and Islamic bonds (Sukuk). The shadow banking system has spawned an array of financial innovations including mortgage-backed securities products and collateralized debt obligations (CDOs). There are 3 categories of innovation: institutional, product, and process. Institutional innovations relate to the creation of new types of financial firms such as specialist credit card firms like Capital One, electronic trading platforms such as Charles Schwab Corporation, and direct banks. Product innovation relates to new products such as derivatives, securitization, and foreign currency mortgages. Process innovations relate to new ways of doing financial business, including online banking and t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Engineering

Financial engineering is a multidisciplinary field involving financial theory, methods of engineering, tools of mathematics and the practice of programming. It has also been defined as the application of technical methods, especially from mathematical finance and computational finance, in the practice of finance.Tanya S. Beder and Cara M. Marshall, ''Financial Engineering: The Evolution of a Profession'', Wiley (June 7, 2011) 978-0470455814 Financial engineering plays a key role in the customer-driven derivatives business — delivering bespoke OTC-contracts and "exotics", and implementing various structured products — which encompasses quantitative modelling, quantitative programming and risk managing financial products in compliance with the regulations and Basel capital/liquidity requirements. An older use of the term "financial engineering" that is less common today is aggressive restructuring of corporate balance sheets. Mathematical finance is the application o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exotic Option

In finance, an exotic option is an option which has features making it more complex than commonly traded vanilla options. Like the more general exotic derivatives they may have several triggers relating to determination of payoff. An exotic option may also include a non-standard underlying instrument, developed for a particular client or for a particular market. Exotic options are more complex than options that trade on an exchange, and are generally traded over-the-counter. Etymology The term "exotic option" was popularized by Mark Rubinstein's 1990 working paper (published 1992, with Eric Reiner) "Exotic Options", with the term based either on exotic wagers in horse racing, or due to the use of international terms such as "Asian option", suggesting the "exotic Orient". Journalist Brian Palmer used the "successful $1 bet on the superfecta" in the 2010 Kentucky Derby that "paid a whopping $101,284.60" as an example of the controversial high-risk, high-payout exotic bets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barrier Option

A barrier option is an option whose payoff is conditional upon the underlying asset's price breaching a barrier level during the option's lifetime. Types Barrier options are path-dependent exotics that are similar in some ways to ordinary options. You can call or put in American, Bermudan, or European exercise style. But they become activated (or extinguished) only if the underlying breaches a predetermined level (the barrier). "In" options only become active in the event that a predetermined knock-in barrier price is breached: # If the barrier price is far from being breached, the knock-in option will be worth slightly more than zero. # If the barrier price is close to being breached, the knock-in option will be worth slightly less than the corresponding vanilla option. # If the barrier price has been breached, the knock-in option will trade at the exact same value as the corresponding vanilla option. "Out" options start their lives active and become null and void in the even ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |