|

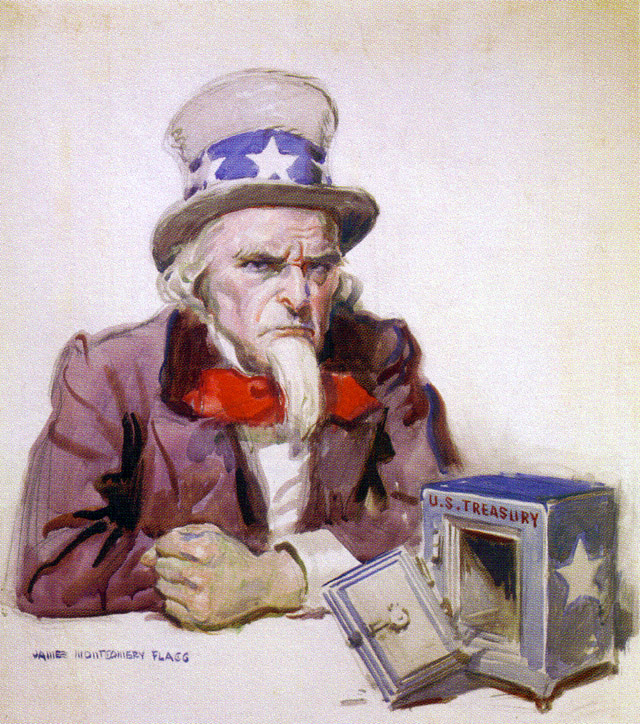

Excess Profits Tax

In the United States, an excess profits tax is a tax on any profit above a certain amount. A predominantly wartime fiscal instrument, the tax was designed primarily to capture wartime profits that exceeded normal peacetime profits to prevent perverse incentives for manufacturers to engage in war profiteering and warmongering. History United Kingdom In Great Britain in World War I, the Treasury rejected proposals for a stiff capital levy, which the Labour Party wanted to use to weaken the capitalists. Instead, there was an excess profits tax, of 50 percent of profits above the normal prewar level; the rate was raised to 80 percent in 1917.Mark Billings and Lynne Oats, "Innovation and pragmatism in tax design: Excess Profits Duty in the UK during the First World War." ''Accounting History Review'' 24#2-3 (2014): 83-101. Excise taxes were added on luxury imports such as automobiles, clocks and watches. There was no sales tax or value added tax at this time in Britain. United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (accounting)

Profit, in accounting, is an income distributed to the ownership , owner in a Profit (economics) , profitable market production process (business). Profit is a measure of profitability which is the owner's major interest in the income-formation process of market production. There are several profit measures in common use. Income formation in market production is always a balance between income generation and income distribution. The income generated is always distributed to the Stakeholder (corporate), stakeholders of production as economic value within the review period. The profit is the share of income formation the owner is able to keep to themselves in the income distribution process. Profit is one of the major sources of economics , economic well-being because it means incomes and opportunities to develop production. The words "income", "profit" and "earnings" are synonyms in this context. Measurement of profit There are several important profit measures in common use. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perverse Incentive

A perverse incentive is an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers. The cobra effect is the most direct kind of perverse incentive, typically because the incentive unintentionally rewards people for making the issue worse. The term is used to illustrate how incorrect stimulation in economics and politics can cause unintended consequences. Examples of perverse incentives The original cobra effect The term ''cobra effect'' was coined by economist Horst Siebert based on an anecdote of an occurrence in India during British rule. The British government, concerned about the number of venomous cobras in Delhi, offered a bounty for every dead cobra. Initially, this was a successful strategy; large numbers of snakes were killed for the reward. Eventually, however, enterprising people began to breed cobras for the income. When the government became aware of this, the reward program was scrapped. When cobra breeders s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

War Profiteering

A war profiteer is any person or organization that derives profit (economics), profit from warfare or by selling weapons and other goods to parties at war. The term typically carries strong negative connotations. General profiteering (business), profiteering, making a profit criticized as excessive or unreasonable, also occurs in peacetime. An example of war profiteers were the shoddy millionaires, "shoddy" millionaires who allegedly sold recycled wool and cardboard shoes to soldiers during the American Civil War. Some have argued that major modern defense conglomerates like Lockheed Martin, Boeing, BAE Systems, General Dynamics, and Raytheon fit the description in the post-9/11 era. This argument is based in the military-industrial complex, political influence of the arms industry, defense industry, for example in 2010 the defense industry spent $144 million on lobbying and donated over $22.6 million to congressional candidates, as well as large profits for defense company shareh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing military alliances: the Allies and the Axis powers. World War II was a total war that directly involved more than 100 million personnel from more than 30 countries. The major participants in the war threw their entire economic, industrial, and scientific capabilities behind the war effort, blurring the distinction between civilian and military resources. Aircraft played a major role in the conflict, enabling the strategic bombing of population centres and deploying the only two nuclear weapons ever used in war. World War II was by far the deadliest conflict in human history; it resulted in 70 to 85 million fatalities, mostly among civilians. Tens of millions died due to genocides (including the Holocaust), starvation, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Windfall Profits Tax

A windfall tax is a higher tax rate on profits that ensue from a sudden windfall gain to a particular company or industry. There have been windfall taxes in various countries across the world, including Mongolia, Australia, and on wind power in Turkey. Australia In Australia, windfall taxes include: * Commonwealth places windfall tax, imposed under the ''Commonwealth Places Windfall Tax (Collection) Act 1998'' (1998 No 25) and the ''Commonwealth Places Windfall Tax (Imposition) Act 1998'' (1998 No 26) * Franchise fees windfall tax, imposed under the ''Franchise Fees Windfall Tax (Collection) Act 1997'' (1997 No 132), ''Franchise Fees Windfall Tax (Imposition) Act 1997'' (1997 No 133), and ''Franchise Fees Windfall Tax (Consequential Amendments) Act 1997'' (1997 No 134) In both cases, windfall tax originates in High Court decisions that certain state taxes were unconstitutional. Thus, the States were required to repay to the taxpayers the amounts previously collected under th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)