|

Economic Stimulus Act Of 2008

The Economic Stimulus Act of 2008 () was an Act of Congress providing for several kinds of economic stimuli intended to boost the United States economy in 2008 and to avert a recession, or ameliorate economic conditions. The stimulus package was passed by the U.S. House of Representatives on January 29, 2008, and in a slightly different version by the U.S. Senate on February 7, 2008. The Senate version was then approved in the House the same day. It was signed into law on February 13, 2008, by President George W. Bush with the support of both Democratic and Republican lawmakers. The law provides for tax rebates to low- and middle-income U.S. taxpayers, tax incentives to stimulate business investment, and an increase in the limits imposed on mortgages eligible for purchase by government-sponsored enterprises (e.g. Fannie Mae and Freddie Mac). The total cost of this bill was projected at $152 billion for 2008. Tax rebates Tax rebates that were created by the law were paid to in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Congress

An Act of Congress is a statute enacted by the United States Congress. Acts may apply only to individual entities (called private laws), or to the general public ( public laws). For a bill to become an act, the text must pass through both houses with a majority, then be either signed into law by the president of the United States, be left unsigned for ten days (excluding Sundays) while Congress remains in session, or, if vetoed by the president, receive a congressional override from of both houses. Public law, private law, designation In the United States, Acts of Congress are designated as either public laws, relating to the general public, or private laws, relating to specific institutions or individuals. Since 1957, all Acts of Congress have been designated as "Public Law X–Y" or "Private Law X–Y", where X is the number of the Congress and Y refers to the sequential order of the bill (when it was enacted). For example, P. L. 111–5 (American Recovery and Reinvest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certified Public Accountant

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, all states except Hawaii have passed mobility laws to allow CPAs from other states to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting-related experience. Continuing professional education (CPE) is also required to maintain licensure. Individuals who have been awarded the CPA but have lapsed in the fulfillment of the required CPE or who have requested conversion to inactive status are in many states permit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resident Aliens

In law, an alien is any person (including an organization) who is not a citizen or a national of a specific country, although definitions and terminology differ to some degree depending upon the continent or region. More generally, however, the term "alien" is perceived as synonymous with foreign national. (explaining that "the term 'foreign national' means.... (2) an individual who is not a citizen of the United States or a national of the United States (as defined in section 1101(a)(22) of title 8) and who is not lawfully admitted for permanent residence, as defined by section 1101(a)(20) of title 8."). Lexicology The term "alien" is derived from the Latin ''alienus'', which in turn is derived from the Oscan ''mancupatis'', (a proto-Etruscan tribe), meaning a slave. The Latin later came to mean a stranger, a foreigner, or someone not related by blood. Similar terms to "alien" in this context include ''foreigner'' and ''lander''. Categories Different countries around ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Ensign

John Eric Ensign (born March 25, 1958) is an American veterinarian and former politician from Nevada. A member of the Republican Party, Ensign was a Congressman and United States Senator from Nevada; he served in the latter seat from January 2001 until May 2011, when he resigned amid a Senate Ethics Committee investigation into his attempts to hide an extramarital affair. Following his resignation from the Senate, Ensign returned to Nevada and resumed his career as a veterinarian. Early life, education, and veterinary career Ensign was born in 1958 in Roseville, California, to Sharon Lee Cipriani (whose father was Italian) and a father whose surname was Mueller. Ensign's father abandoned the family when Ensign was four years of age; Ensign then moved with Cipriani to Nevada. Cipriani later married Michael S. Ensign, a gaming industry executive; he formally adopted young John, who considers him his "real father." The senior Ensign later became chairman of the board of direct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

White Nationalism

White nationalism is a type of racial nationalism or pan-nationalism which espouses the belief that white people are a Race (human categorization), raceHeidi Beirich and Kevin Hicks. "Chapter 7: White nationalism in America". In Perry, Barbara. ''Hate Crimes''. Greenwood Publishing, 2009. pp.114–115 and seeks to develop and maintain a white racial and national identity."White Nationalism, Explained" The New York Times. 21 November 2016. "White nationalism, he said, is the belief that national identity should be built around white ethnicity, and that white people should therefore maintain both a demographic majority and dominance of the nation’s culture and public life.... white nationalism is about maintaining political and economic dominance, not just a numerical majority or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federation For American Immigration Reform

The Federation for American Immigration Reform (FAIR) is a non profit, anti-immigration organization in the United States. The group publishes position papers, organizes events, and runs campaigns in order to advocate for changes in U.S. immigration policy. The Southern Poverty Law Center classifies FAIR as a hate group with ties to white supremacist groups. FAIR was founded in 1979 by Michigan surgeon and white nationalist John Tanton. Other co-founders include Otis Graham and former Gulf Oil CEO, Sydney Swensrud. It is currently headquartered in Washington, D.C. History The "founder of the modern immigration reform movement"—John Tanton, an ophthalmologist in Petoskey, Michigan—"saw a threat coming in the soaring rates of immigration" and that the "environment was threatened by overpopulation". Frustrated by the lack of interest of his "liberal colleagues in groups such as Planned Parenthood and the Sierra Club where he was actively engaged, he helped establish "three ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Number

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as . The number is issued to an individual by the Social Security Administration, an independent agency of the United States government. Although the original purpose for the number was for the Social Security Administration to track individuals, the Social Security number has become a ''de facto'' national identification number for taxation and other purposes. A Social Security number may be obtained by applying on Form SS-5, Application for a Social Security Number Card. History Social Security numbers were first issued by the Social Security Administration in November 1936 as part of the New Deal Social Security program. Within three months, 25 million numbers were issued. On November 24, 1936, 1,074 of the nation's 45,000 post offices were designated "typ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Taxpayer Identification Number

An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service (IRS). It is a nine-digit number beginning with the number “9”, has a range of numbers from "50" to "65", "70" to "88", “90” to “92” and “94” to “99” for the fourth and fifth digits, and is formatted like a SSN (i.e., 9XX-XX-XXXX). ITIN numbers are issued by the IRS to individuals who do not have and are not eligible to obtain a valid U.S. Social Security Number, but who are required by law to file a U.S. Individual Income Tax Return. Regardless of immigration status, both resident and nonresident immigrants may have Federal tax return and payment responsibilities under the Internal Revenue Code. Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN, unless they meet an exception. An ITIN application cannot be filed electronically (efile). The application must be attached to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Income Hypothesis

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his ''A Theory of Consumption Function'', published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption. The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Keynesian orthodoxy. Friedman's predictions of consumption smoothing, where people spread out transitory changes in income over time, depar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

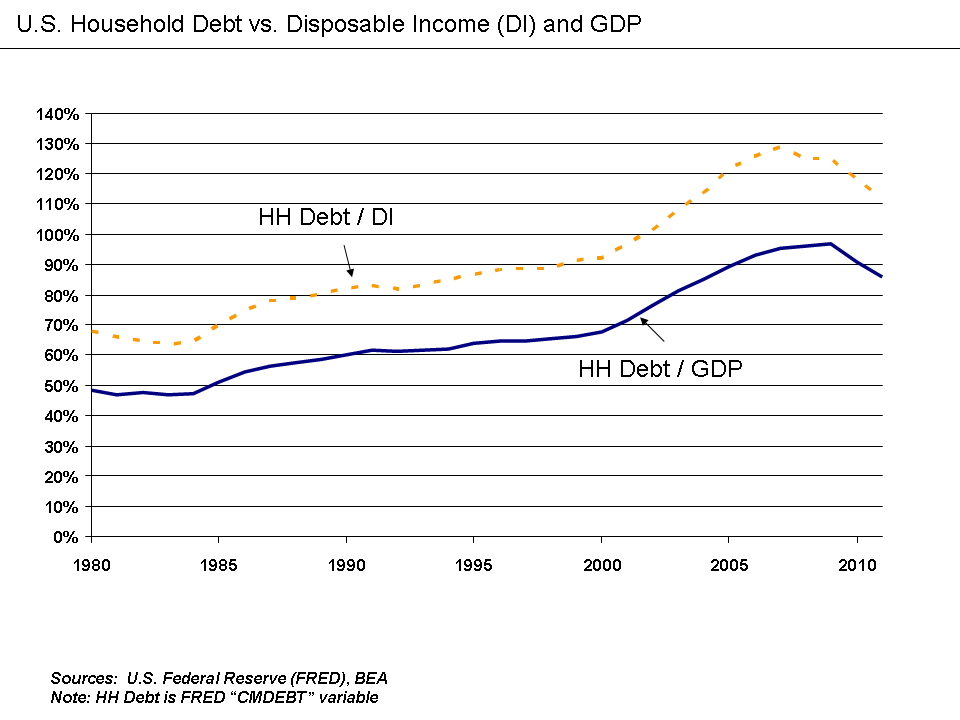

United States Housing Bubble

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States. Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, Henry Paulson, the U.S. Secretary of the Treasury, called the bursting housing bubble "the most significant risk to our economy". Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but mortgage markets, home ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jumbo Mortgages

In the United States, a jumbo mortgage is a mortgage loan that may have high credit quality, but is in an amount above conventional conforming loan limits.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). This standard is set by the two government-sponsored enterprises, Fannie Mae and Freddie Mac, and sets the limit on the maximum value of any individual mortgage they will purchase from a lender. Fannie Mae (FNMA) and Freddie Mac (FHLMC) are large agencies that purchase the bulk of U.S. residential mortgages from banks and other lenders, allowing them to free up liquidity to lend more mortgages. When FNMA and FHLMC limits don't cover the full loan amount, the loan is referred to as a "jumbo mortgage". Traditionally, the interest rates on jumbo mortgages are higher than for conforming mortgages, however with GSE fees increasing, Jumbo loans have recently seen lower interest rates than conforming loans. History On February 13, 2008, President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |