|

Dubai Banking Group

Dubai Banking Group is the global shari'a compliant financial investor of Dubai Group with assets valued at over USD 10 billion ( AED 36.7 billion). The group was established in 2007 when Dubai Islamic Investment Group, founded in 2004, and Dubai Bank, founded in 2002, consolidated their activities to form Dubai Banking Group. Dubai Banking Group's major investments include: * 100% ownership of Dubai Bank * 100% ownership of Dubai Tadawul, a Dubai-based private brokerage company * 51% stake in Al Fajer Re-Takaful, a closed Kuwaiti shareholding company * 40% stake in Bank Islam, Malaysia's oldest and largest Islamic bank * 40% stake in ACR Re-Takaful Holdings Limited, the world's largest reinsurance company * 33.33% stake in National Bonds UAE, the national Shari'ah-compliant saving scheme * 18.75% stake in BankIslami Pakistan, the first bank to receive an Islamic Banking License in Pakistan [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Arab Emirates

The United Arab Emirates (UAE; ar, اَلْإِمَارَات الْعَرَبِيَة الْمُتَحِدَة ), or simply the Emirates ( ar, الِْإمَارَات ), is a country in Western Asia (The Middle East). It is located at the eastern end of the Arabian Peninsula and shares borders with Oman and Saudi Arabia, while having maritime borders in the Persian Gulf with Qatar and Iran. Abu Dhabi is the nation's capital, while Dubai, the most populous city, is an international hub. The United Arab Emirates is an elective monarchy formed from a federation of seven emirates, consisting of Abu Dhabi (the capital), Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain. Each emirate is governed by an emir and together the emirs form the Federal Supreme Council. The members of the Federal Supreme Council elect a president and vice president from among their members. In practice, the emir of Abu Dhabi serves as president while the ruler of Dubai is vice pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Salaam Al-Shaksy

Salaam Said Al Shaksy (born 1961) is chairman of Oman Housing Bank. Al Shaksy was also a member of the board of directors of Oman Oil Company and ORPIC Group. His other appointments included: member of the board of Al Raffd Fund (Oman's Government-funded SME fund); a member of Oman's 2040 Vision Economic Committee; board member of Oman Banks Association; chairman of Oman Growth Fund; a member of Oman Business Forum; and chairman of The Shaksy Group. Prior to this he was chief integration officer at Oman Arab Bank SAOG after its merger with Alizz Islamic Bank, where he served as chief executive officer from 2014 to 2020. Before this he was CEO of National Bank of Oman SAOG between 2010 and 2014, leading its turnaround and transformation during this period. Al Shaksy has held a number of senior executive positions including CEO of Dubai Banking Group, CEO of Dubai Islamic Investment Group and deputy chief executive officer of Bank Dhofar (where he led its merger with Majan Int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investments

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effect o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dubai Group

Dubai Group is an Emirati investment company based in the United Arab Emirates, and a subsidiary of Dubai Holding. The company was founded in 2000 as the Investment Office, and was renamed Dubai Group in 2005. Through its companies, the group focuses on banking, investments and insurance in the United Arab Emirates and globally. The group consists of three companies, each with its respective focal point: * Dubai Investment Group * Dubai Banking Group * Noor Investment Group Noor or Nour may refer to: People *Noor (name) *Queen Noor of Jordan Fiction * ''Noor'' (film), a 2017 Bollywood film * ''Noor'' (play), a 2009 play by Akbar Ahmed *''Noor'', a 2020 Pakistani television series with Usama Khan * ''Noor'' (novel), .... References External linksOfficial website Companies based in Dubai Investment companies of the United Arab Emirates {{UnitedArabEmirates-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

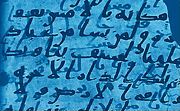

Shari'a

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the Hadith. In Arabic, the term ''sharīʿah'' refers to God's immutable divine law and is contrasted with ''fiqh'', which refers to its human scholarly interpretations. In the historical course, fiqh sects have emerged that reflect the preferences of certain societies and state administrations on behalf of people who are interested in the theoretical (method) and practical application (Ahkam / fatwa) studies of laws and rules, but sharia has never been a valid legal system on its own. It has been used together with " customary (Urf) law" since Omar or the Umayyads. It may also be wrong to think that the Sharia, as a religious argument or belief, is entirely within or related to Allah's commands and prohibitions. Several non-graded crimes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Arab Emirates Dirham

The dirham (; ar, درهم إماراتي, abbreviation: د.إ in Arabic, Dh (singular) and Dhs (plural) or DH in Latin; ISO code: AED) is the official currency of the United Arab Emirates. The dirham is subdivided into 100 . History The name ''dirham'' is a loan from greek δραχμή (drakhmé). Due to centuries of trade and usage of the currency, ''dirham'' survived through the Ottoman Empire. Before 1966, all the emirates that now form the UAE used the Gulf rupee, which was pegged at parity to the Indian rupee. On 6 June 1966, India decided to devalue the Gulf rupee against the Indian rupee. Not accepting the devaluation, several of the states still using the Gulf rupee adopted their own or other currencies. All the Trucial States except Abu Dhabi adopted the Qatar and Dubai riyal, which was equal to the Gulf rupee prior to the devaluation. These emirates briefly adopted the Saudi riyal during the transition from the Gulf rupee to the Qatar and Dubai riyal. Abu Dhabi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dubai Bank

Dubai Bank was an Islamic bank based in Dubai, UAE. The bank was launched in September 2002 and transformed into Shari’a-compliant financial institution with on 1 January 2007. Dubai Bank was part of the Dubai Group, a Dubai Holdings company. On 1 December 2012 the bank was acquired by Emirates NDB. History The bank increased its capital to AED 1.50 Billion in 2007 and was on an expansion spree, and had total assets of AED 14.4 billion. The bank as of the end of 2007 had 15 branches spread across UAE and had more aggressive plans in 2008 including opening another 10 branches. As per the pre orders from the Ruler of Dubai on 11 October 2011, Emirates NBD Emirates NBD Bank PJSC is Dubai's government-owned bank and is one of the largest banking groups in the Middle East in terms of assets. History and profile Emirates NBD was initially formed as National Bank of Dubai (NBD) on 19 June 1963 by the ... was set to take over Dubai Bank. There were no financial details avai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Islam

Bank Islam Malaysia Berhad ( Jawi: بڠك اسلام مليسيا برحد) is an Islamic bank based in Malaysia that has been in operation since July 1983. Bank Islam was established primarily to assist the financial needs of the country's Muslim population, and extended its services to the broader population. The bank currently provides Sharia Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the H ...-compliant card services and mobile banking. Subsidiaries * BIMB Investment Management Bhd * BIMB Securities Sdn Bhd * Al-Wakalah Nominees (Tempatan) Sdn Bhd * Bank Islam Trust Company (Labuan) Ltd * Farihan Corporation Sdn Bhd References External links * {{official, http://www.bankislam.com/ 1983 establishments in Malaysia Banks established in 1983 Malaysian companies establis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BankIslami Pakistan

BankIslami Pakistan LTD. () is a Pakistani Islamic bank based in Karachi, Pakistan. It has 340 branches in 114 cities in Pakistan. It is the first Islamic commercial bank to receive the Islamic banking license under the Islamic banking policy of 2003 from the State Bank of Pakistan on March 31, 2005. The bank started its operations on 7 April 2006 and offers shariah-compliant retail banking, investment banking, consumer banking, and trade finance products. The bank intends to focus on wealth management as the core area of business and plans to soon launch proprietary products and integrated financial planning services. The bank has a nationwide presence. Its branch network consists of 343 branches and sub-branches spread over 125 cities in Pakistan. With the amalgamation of KASB on May 7, 2015, all 104 branches of KASB have become part of BankIslami’s branch network. BankIslami is now the 11th largest banking network in the country with 317 branches in 93 cities nationwide. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Companies Of The United Arab Emirates

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effect o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)