|

Deposit Account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below. Transactions on deposit accounts are recorded in a bank's books, and the resulting balance is recorded as a liability of the bank and represents an amount owed by the bank to the customer. In other words, the banker-customer (depositor) relationship is one of debtor-creditor. Some banks charge fees for transactions on a customer's account. Additionally, some banks pay customers interest on their account balances. Types of accounts * How banking works In banking, the verbs "deposit" and "withdraw" mean a customer paying money into, and taking money out of, an account, respectively. From a legal and financial accounting standpoint, the noun "deposit" is used by the banking industry in financial statements to describe the liability o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current accounts, loan accounts or many other types of account. A customer may have more than one account. Once an account is opened, funds entrusted by the customer to the financial institution on deposit are recorded in the account designated by the customer. Funds can be withdrawn from loan loaders. The financial transactions which have occurred on a bank account within a given period of time are reported to the customer on a bank statement, and the balance of the accounts of a customer at any point in time is their financial position with the institution. Nature of a bank account In most legal systems, a deposit of f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certificate Of Deposit

A certificate of deposit (CD) is a time deposit, a financial product commonly sold by banks, thrift institutions, and credit unions in the United States. CDs differ from savings accounts in that the CD has a specific, fixed term (often one, three, or six months, or one to five years) and usually, a fixed interest rate. The bank expects the CD to be held until maturity, at which time they can be withdrawn and interest paid. Like savings accounts, CDs are insured "money in the bank" (in the US up to $250,000) and thus, up to the local insured deposit limit, virtually risk free. In the US, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for banks and by the National Credit Union Administration (NCUA) for credit unions. In exchange for the customer depositing the money for an agreed term, institutions usually offer higher interest rates than they do on accounts that customers can withdraw from on demand—though this may not be the case in an inverted yie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Guarantee

A loan guarantee, in finance, is a promise by one party (the guarantor) to assume the debt obligation of a borrower if that borrower defaults. A guarantee can be limited or unlimited, making the guarantor liable for only a portion or all of the debt. Private loan guarantees There are two main types: # Guarantor mortgages # Unsecured guarantor loan Guarantor mortgages Popular with young borrowers who do not have a large deposit saved and need to borrow up to 100% of the property value to purchase a property. Generally, their parents will provide a guarantee to the lender to cover any shortfall in the event of default. There are three main types # Guarantor Mortgage – generally, a parent or close family member will guarantee the mortgage debt and will cover the repayment obligations should the borrower default. # Family offset mortgage – typically, a parent or grandparent will put their savings into an account linked to the borrower’s mortgage. They do not get any intere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Insurance

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability. Overview Banks are allowed (and usually encouraged) to lend or invest most of the money deposited with them instead of safe-keeping the full amounts (see fractional-reserve banking). If many of a bank's borrowers fail to repay their loans when due, the bank's creditors, including its depositors, risk loss. Because they rely on customer deposits that can be withdrawn on little or no notice, banks in financial trouble are prone to bank runs, where depositors seek to withdraw funds quickly ahead of a possible bank insolvency. Because banking institution failures have the potential to trigger a broad spectrum of harmful events, including economic recessions, policy makers mai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as '' excess reserves''. The reserve ratio is sometimes used by a country’s monetary authority as a tool in monetary policy, to influence the country's money supply by limiting or expanding the amount of lending by the banks. Monetary authorities increase the reserve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. Some jurisdictions allow contract law to overrule the status of legal tender, allowing (for example) merchants to specify that they will not accept cash payments. Coins and banknotes are usually defined as legal tender in many countries, but personal cheques, credit cards, and similar non-cash methods of payment are usually not. Some jurisdictions may include a specific foreign currency as legal tender, at times as its exclusive legal tender or concurrently with its domestic currency. Some jurisdictions may forbid or restrict payment made by other than ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). The central bank of a country may use a definition of what constitutes legal tender for its purposes. Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of securities, inflation, the exchange rates, and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a direct relationship between the growth of the money su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fractional-reserve Banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, and are at liberty to lend the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. The country's central bank determines the minimum amount that banks must hold in liquid assets, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves. Bank deposits are usually of a relatively short-term duration, and may be "at call", while loans made by banks tend to be longer-term, resulting in a risk that customers may at any time collectively wish to withdraw cash out of their accounts in excess of the bank reserves. The reserves only provide liquidity to cover withdrawals within the normal pattern. Banks a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency. Monetary policy is a modification of the supply of money, i.e. "printing" more money, or decreasing the money supply by changing interest rates or removing excess reserves. This is in contrast to fiscal policy, which relies on taxation, government spending, and government borrowing as methods for a government to manage business cycle phenomena such as recessions. Further purposes of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Monetary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

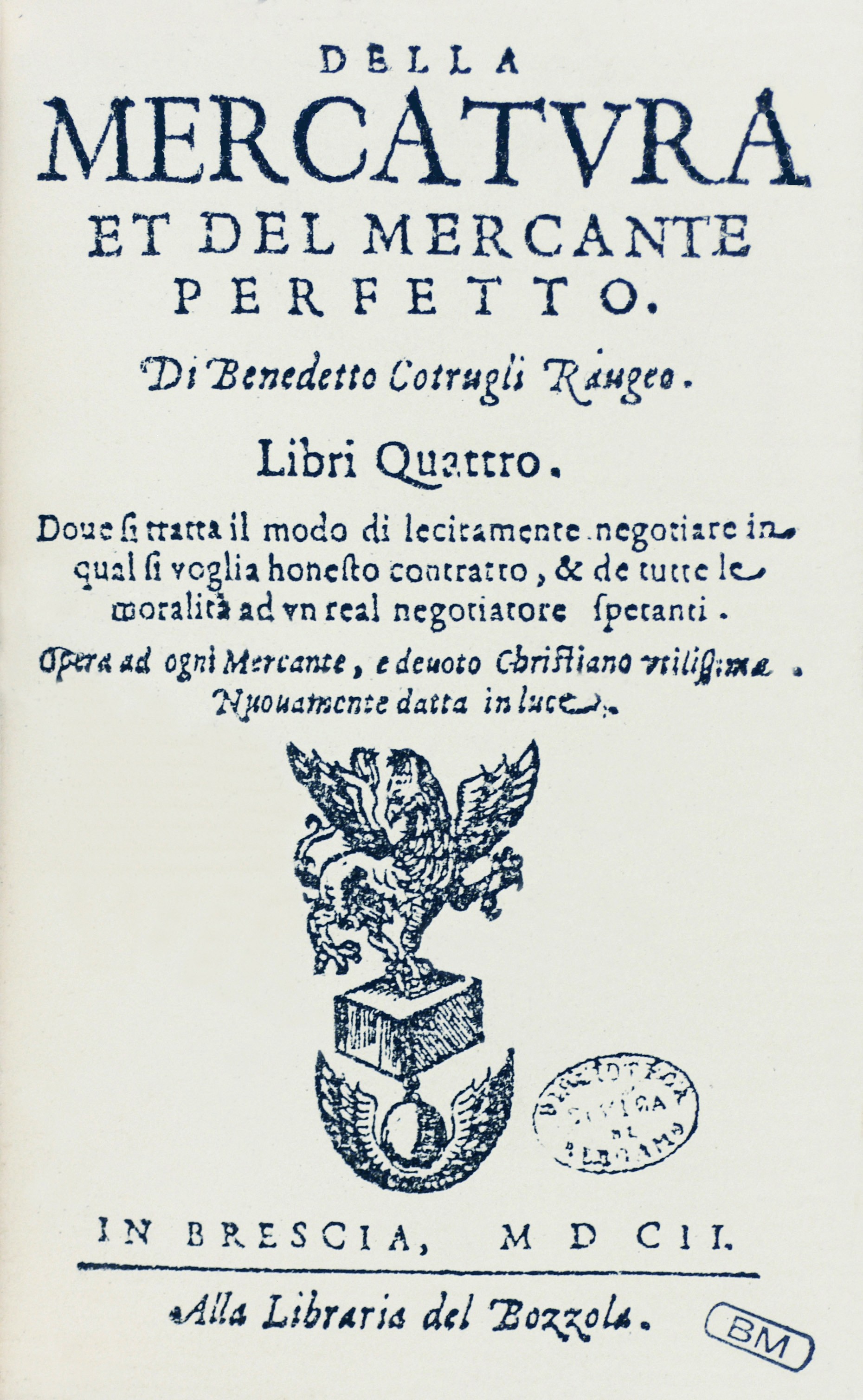

Double-entry Bookkeeping System

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EFTPOS

Electronic funds transfer at point of sale (EFTPOS; ) is an electronic payment system involving electronic funds transfers based on the use of payment cards, such as debit or credit cards, at payment terminals located at points of sale. EFTPOS technology was developed during the 1980s. In Australia and New Zealand, it is also the brand name of a specific system used for such payments; these systems are mainly country-specific and do not interconnect. In Singapore, it is known as NETS. Debit and credit cards are embossed plastic cards complying with ISO/IEC 7810 ID-1 standard. The cards have an embossed bank card number conforming with the ISO/IEC 7812 numbering standard. History EFTPOS technology originated in the United States in 1981 and was rolled out in 1982. Initially, a number of nationwide systems were set up, such as ''Interlink'', which were limited to participating correspondent banking relationships, not being linked to each other. Consumers and merchants we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the '' drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes pea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)