|

Deposit Creation Multiplier

Money creation, or money issuance, is the process by which the money supply of a country, or an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money is created by both central banks and commercial banks. Money issued by central banks is a liability, typically called reserve deposits, and is only available for use by central bank account holders, which are generally large commercial banks and foreign central banks. Central banks can increase the quantity of reserve deposits directly, by making loans to account holders, purchasing assets from account holders, or by recording an asset, such as a deferred asset, and directly increasing liabilities. However, the majority of the money supply used by the public for conducting transactions is created by the commercial banking system in the form of commercial bank deposits. Bank loans issued by commercial banks expand the quantity of bank deposits. Money creation occurs when the am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions. Even for narrow aggregates like M1, by far the largest part of the money supply consists of deposits in commercial banks, whereas currency (banknotes and coins) issued by central banks only makes up a small part of the total money supply in modern economies. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate System

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold or silver. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

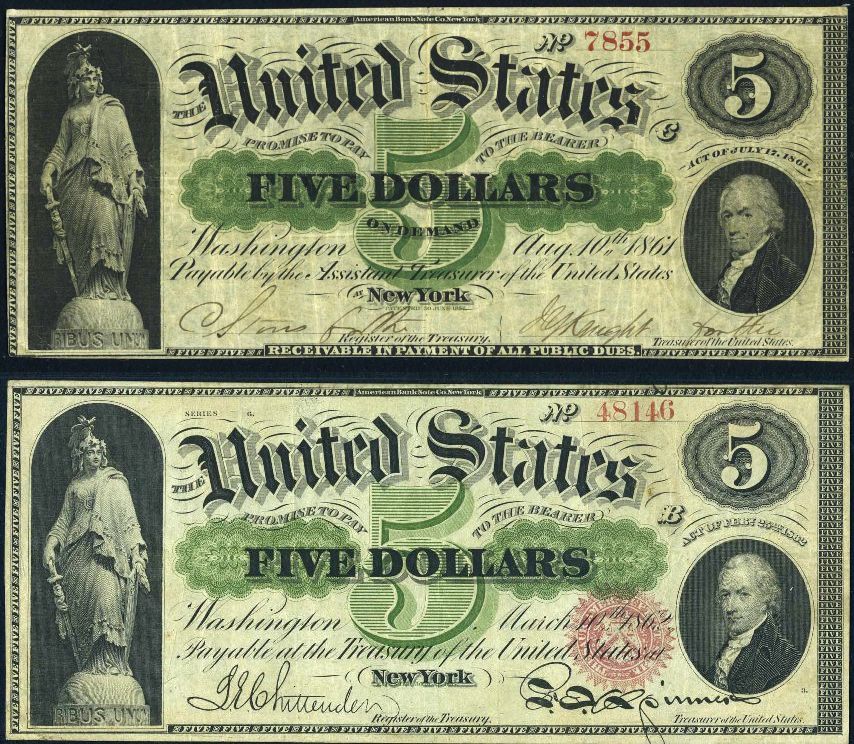

United States Note

A United States Note, also known as a Legal Tender Note, is a type of Banknote, paper money that was issued from 1862 to 1971 in the United States. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money other than the currently issued Federal Reserve Note. They were known popularly as "greenbacks", a name inherited from the earlier Greenback (1860s money), greenbacks, the Demand Notes, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the early 1860s the so-called ''second obligation'' on the reverse of the notes stated: By the 1930s, this obligation would eventually be shortened to: They were originally issued directly into circulation by the United States Department of the Treasury, U.S. Treasury to pay expenses incurred by the Union (American Civil War), Union during the American Civil War. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Note

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Federal Reserve Board of Governors, Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States. Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly United States Treasury security, Treasury securities and agency security, mortgage agency securities that they purchase on the open market by fiat money, fiat payment. History Following the enactment of the Cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the ..., the ease with which an asset can be sold * Accounting liquidity, the ability to meet cash obligations when due * Funding liquidity, the availability of credit to finance the purchase of financial asset * Liquid capital, the amount of money that a firm holds * Liquidity risk, the risk that an asset will have impaired market liquidity See also * Liquid (other) * Liquidation (other) {{SIA ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Aggregates

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions. Even for narrow aggregates like M1, by far the largest part of the money supply consists of deposits in commercial banks, whereas currency (banknotes and coins) issued by central banks only makes up a small part of the total money supply in modern economies. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the president or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms." Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Asset

A financial asset is a non-physical asset whose value is derived from a contractual claim, such as deposit (finance), bank deposits, bond (finance), bonds, and participations in companies' share capital. Financial assets are usually more market liquidity, liquid than tangible property, tangible assets, such as commodities or real estate. The opposite of financial assets is Non-financial asset, non-financial assets, which include both tangible property (sometimes also called real assets) such as land, real estate or commodities, and Intangible asset, intangible assets such as intellectual property, including copyrights, patents, trademarks and data. Types According to the International Financial Reporting Standards (IFRS), a financial asset can be: * Cash or cash equivalent, * Equity (finance), Equity instruments of another entity, * Contractual right to receive cash or another financial asset from another entity or to exchange financial assets or financial liabilities with anot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Mechanics 4 Mechanical Interrelationships Governing The Credit Volume (Table 1 By F

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), but promises either to repay or return those resources (or other materials of equal value) at a later date. The resources provided by the first party can be either property, fulfillment of promises, or performances. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower. Etymology The term "credit" was first used in English in the 1520s. The term came "from Middle French crédit (15c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Easing

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application following the 2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets. Similar to conventional Open market operation, open-market operations used to implement monetary policy, a central bank implements quantitative easing by buying financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their Yield (finance), yield, while simultaneously increasing the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Contraction

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Easing

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application following the 2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets. Similar to conventional open-market operations used to implement monetary policy, a central bank implements quantitative easing by buying financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their yield, while simultaneously increasing the money supply. However, in contrast to n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |