|

Deficit Reduction In The United States

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the Federal budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt. CBO reported in July 2014 that the continuation of present tax and spending policies for the long-run (into the 2030s) results in a budget trajectory that causes debt to grow faster than GDP, which is "unsustainable." Further, CBO reported that high levels of debt relative to GDP may pose significant risks to economic growth and the ability of lawmakers to respond to crises. These risks can be addressed by higher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

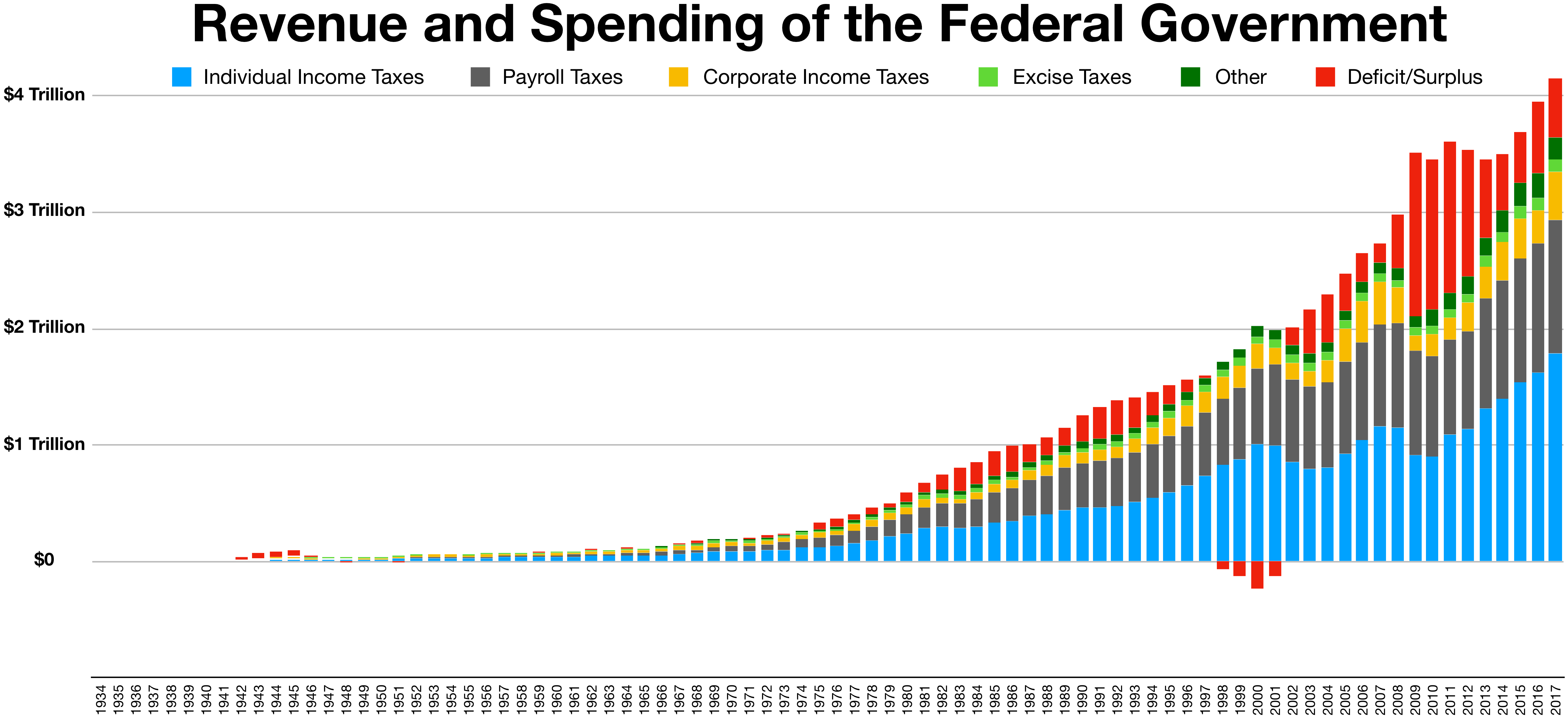

Revenue And Spending Of The Federal Government

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of income b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

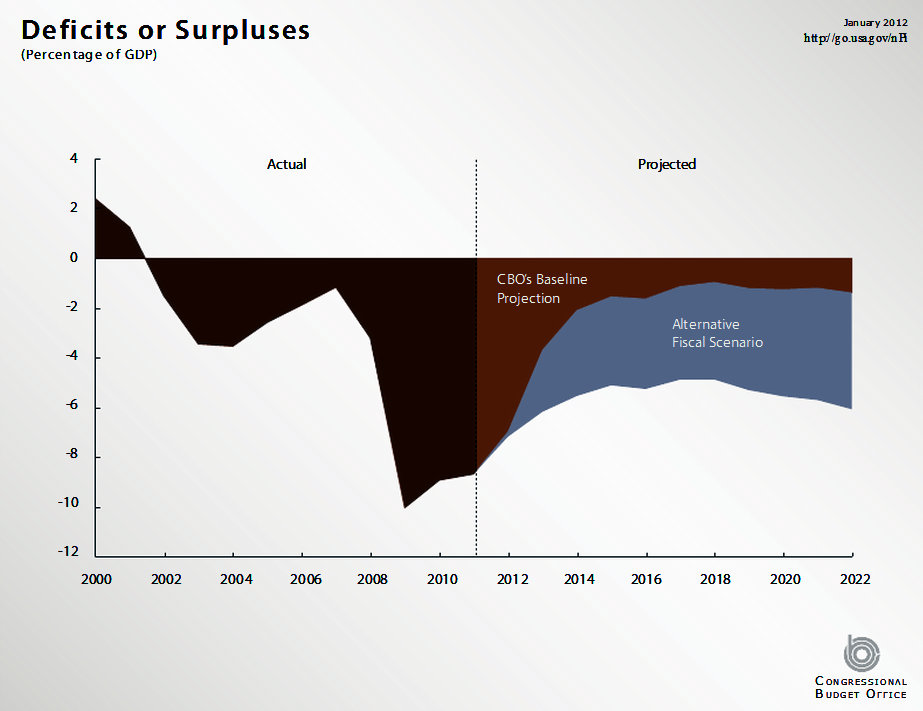

CBO Deficit - Baseline Comparison - April 2018

CBO may stand for: * Chief business officer, the top operating strategy executive of a commercial company, or academic/research institution * Chief brand officer, another title for the Chief marketing officer * CBO-FM, a CBC Radio One station in Ottawa, Ontario, Canada * Central Bank of Oman, established in December 1974 and began operations on 1 April 1975 * Combined Bomber Offensive, an Anglo-American offensive of strategic bombing during World War II in Europe * Community-based organization * Congressional Budget Office, United States federal agency responsible for government budget calculations and analyses * Criminal behaviour order, a court order issued in England and Wales designed to change the behaviour of convicts * Central Boycott Office, an agency facilitating the Arab League boycott of Israel * City of Birmingham Orchestra, the original name of the City of Birmingham Symphony Orchestra * Collateralized bond obligation, a type of collateralized debt obligation * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

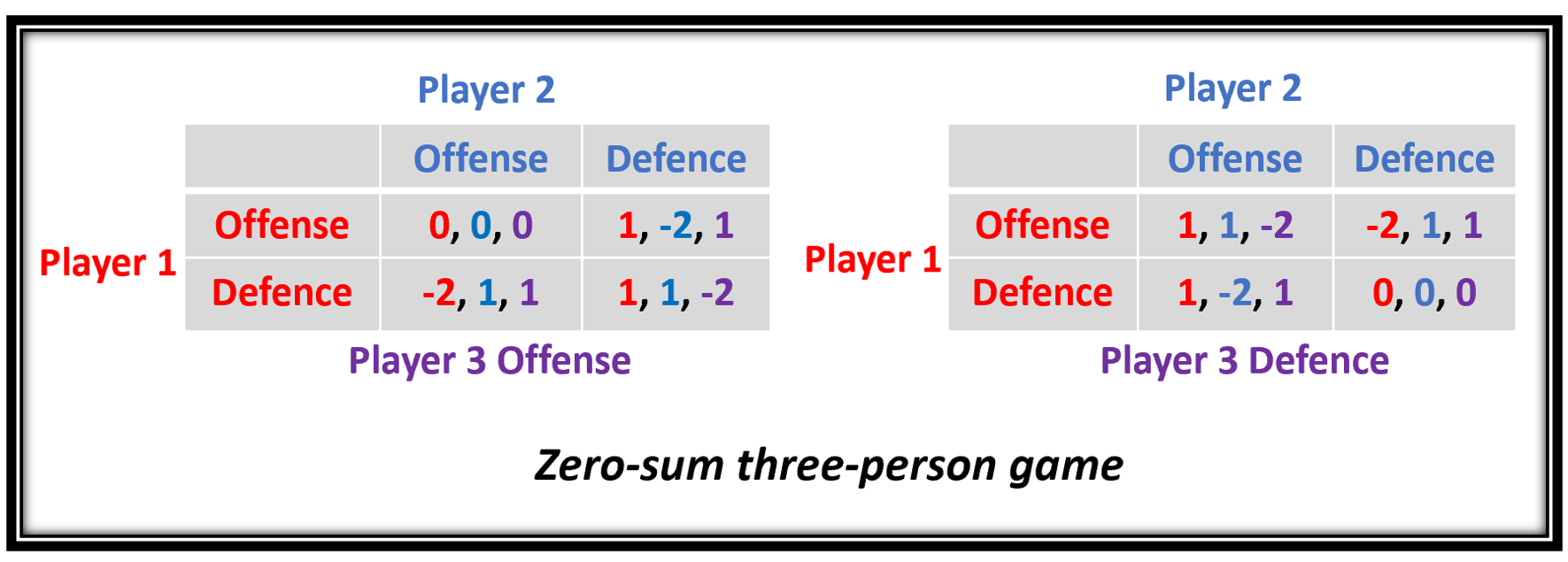

Zero Sum Game

Zero-sum game is a mathematical representation in game theory and economic theory of a situation which involves two sides, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, therefore the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, and bridge where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are zero-sum games as well. In c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comparative Revenue And Spending Increases

In general linguistics, the comparative is a syntactic construction that serves to express a comparison between two (or more) entities or groups of entities in quality or degree - see also comparison (grammar) for an overview of comparison, as well as positive and superlative degrees of comparison. The syntax of comparative constructions is poorly understood due to the complexity of the data. In particular, the comparative frequently occurs with independent mechanisms of syntax such as coordination (linguistics), coordination and forms of Ellipsis (linguistics), ellipsis (gapping, pseudogapping, null complement anaphora, Stripping (linguistics), stripping, verb phrase ellipsis). The interaction of the various mechanisms complicates the analysis. Absolute and null forms A number of fixed expressions use a comparative form where no comparison is being asserted, such as ''higher education'' or ''younger generation''. These comparatives can be called ''absolute''. Similarly, a null ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt ( financial instrument) which yields so low a rate of interest." Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity Origin and definition of the term John Maynard Keynes, in his 1936 ''Gener ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Taxpayer Relief Act

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts". The Act centers on a partial resolution to the US fiscal cliff by addressing the expiration of certain provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (known together as the "Bush tax cuts"), which had been temporarily extended by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The Act also addressed the activation of the Budget Control Act of 2011's budget sequestration provisions. A compromise measure, the Act gives permanence to the lower rate of much of the Bush tax cuts, while retaining the higher tax rate at upper income levels that became effective on January 1 due to the expiration of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Control Act Of 2011

The Budget Control Act of 2011 () is a federal statute enacted by the 112th United States Congress and signed into law by US President Barack Obama on August 2, 2011. The Act brought conclusion to the 2011 US debt-ceiling crisis. The law involves the introduction of several complex mechanisms, such as creation of the Congressional Joint Select Committee on Deficit Reduction (sometimes called the "super committee"), options for a balanced budget amendment, and automatic budget sequestration. Provisions Debt ceiling: * The debt ceiling was increased by $400 billion immediately. * The President could request a further increase of $500 billion, which is subject to a congressional motion of disapproval which the President may veto, in which case a two-thirds majority in Congress would be needed to override the veto. This has been called the 'McConnell mechanism' after the Senate Minority Leader Mitch McConnell, who first suggested it as part of another scheme. * The Pres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

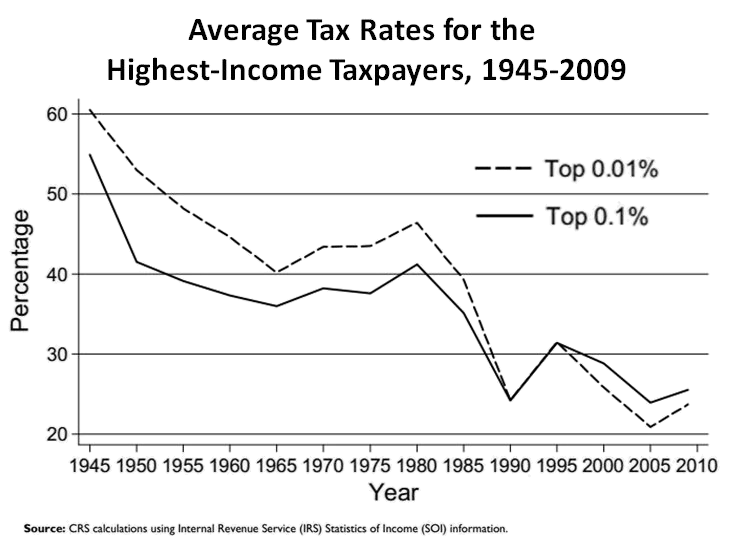

Bush Tax Cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through: * Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) * Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) * Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 * American Taxpayer Relief Act of 2012 (partial extension) While each act has its own legislative history and effect on the tax code, the JGTRRA amplified and accelerated aspects of the EGTRRA. Since 2003, the two acts have often been spoken of together, especially in terms of analyzing their effect on the U.S. economy and population and in discussing their political ramifications. Both laws were passed using controversial Congressional reconciliation (United States Congress), reconciliation procedures. The Bush tax cuts had sunset provisions that made them expire at the end o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Fiscal Cliff

The United States fiscal cliff refers to the combined effect of several previously-enacted laws that came into effect simultaneously in January 2013, increasing taxes and decreasing spending. The Bush tax cuts of 2001 and 2003, which had been extended for two years by the 2010 Tax Relief Act, were scheduled to expire on December 31, 2012. Planned spending cuts under the Budget Control Act of 2011 also came into play. That Act was passed as a compromise to resolve a dispute concerning the US debt ceiling and address the failure of the 111th Congress to pass a federal budget. Discretionary spending for federal agencies and cabinet departments would have been reduced through broad cuts referred to as budget sequestration. Mandatory programs, such as Social Security, Medicaid, federal pay (including military pay and pensions) and veterans' benefits would have been exempted from the spending cuts. The fiscal cliff would have increased tax rates and decreased government spending thr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Austerity

Austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditors and credit rating agencies and make borrowing easier and cheaper as a result. In most macroeconomic models, austerity policies which reduce government spending lead to increased unemployment in the short term. These reductions in employment usually occur di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

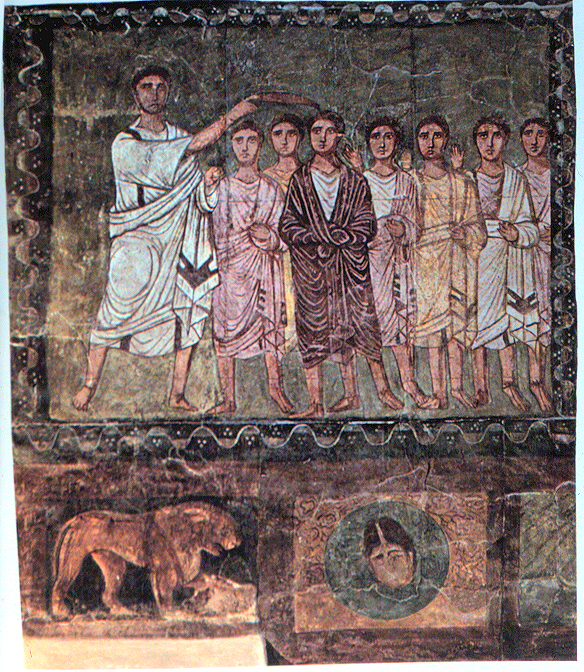

David M

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, David ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |