|

Debt Capital Markets

A capital market is a financial market in which long-term debt (over a year) or Equity (finance), equity-backed security (finance), securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the prima ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange (organized Market)

An exchange, bourse (), trading exchange or trading venue is an organized market where (especially) tradable securities, commodities, foreign exchange, futures, and options contracts are bought and sold. History 12th century: Brokers on the Grand Bridge, France In the twelfth century, foreign exchange dealers in France were responsible for controlling and regulating the debts of agricultural communities on behalf of banks. These were actually the first brokers. They met on the Grand Bridge in Paris, the current Pont au Change. It takes its name from the forex brokers. 13th century: ''Huis ter Beurze'', Belgium The term ''bourse'') which was later used as bursa in Medieval Latin to refer to the "purse". is related to the 13th-century inn named "''Huis ter Beurze''" owned by family in Bruges, Belgium, where traders and foreign merchants from across Europe, especially the Italian Republics of Genoa, Florence and Venice, conducted business in the late medieval period. The build ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

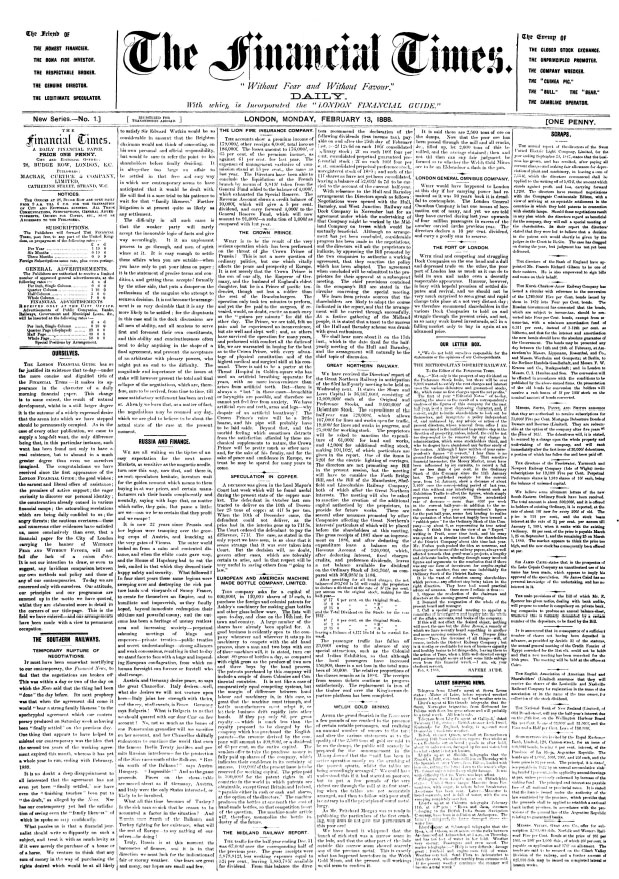

The Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherida ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2007–2012 Global Financial Crisis

7 (seven) is the natural number following 6 and preceding 8. It is the only prime number preceding a cube. As an early prime number in the series of positive integers, the number seven has greatly symbolic associations in religion, mythology, superstition and philosophy. The seven Classical planets resulted in seven being the number of days in a week. It is often considered lucky in Western culture and is often seen as highly symbolic. Unlike Western culture, in Vietnamese culture, the number seven is sometimes considered unlucky. It is the first natural number whose pronunciation contains more than one syllable. Evolution of the Arabic digit In the beginning, Indians wrote 7 more or less in one stroke as a curve that looks like an uppercase vertically inverted. The western Ghubar Arabs' main contribution was to make the longer line diagonal rather than straight, though they showed some tendencies to making the digit more rectilinear. The eastern Arabs developed the digit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disintermediation

Disintermediation is the removal of intermediaries in economics from a supply chain, or "cutting out the middlemen" in connection with a transaction or a series of transactions. Instead of going through traditional distribution channels, which had some type of intermediary (such as a distributor, wholesaler, broker, or agent), companies may now deal with customers directly, for example via the Internet. Disintermediation may decrease the total cost of servicing customers and may allow the manufacturer to increase profit margins and/or reduce prices. Disintermediation initiated by consumers is often the result of high market transparency, in that buyers are aware of supply prices direct from the manufacturer. Buyers may choose to bypass the middlemen (wholesalers and retailers) to buy directly from the manufacturer, and pay less. Buyers can alternatively elect to purchase from wholesalers. Often, a business-to-consumer electronic commerce (B2C) company functions as the bridge bet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank. Central banks monitor the amount of money in the economy by measuring monetary aggregates (termed broad money), consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.For example, in the United States, money supply measured as M2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time- and stru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Lending

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forex

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Market

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Good

The economic concept of a capital good (also called complex product systems (CoPS),H. Rush, "Managing innovation in complex product systems (CoPS)," IEE Colloquium on EPSRC Technology Management Initiative (Engineering & Physical Sciences Research Council), London, UK, 1997, pp. 4/1-4/4, doi: 10.1049/ic:19971215. and means of production) is as a "...series of heterogeneous commodities, each having specific technical characteristics ..." in the form of a durable good that is used in the production of goods or services. Capital goods are a particular form of economic good and are tangible property. A society acquires capital goods by saving wealth that can be invested in the means of production. People use them to produce other goods or services within a certain period. Machinery, tools, buildings, computers, or other kinds of equipment that are involved in the production of other things for sale are capital goods. The owners of the capital good can be individuals, households, corpo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |