|

Cup And Handle

In the domain of technical analysis of market prices, a cup and handle or cup with handle formation is a chart pattern consisting of a drop in the price and a rise back up to the original value, followed first by a smaller drop and then a rise past the previous peak. It is interpreted as an indication of bullish sentiment in the market and possible further price increases. The cup part of the pattern should be fairly shallow, with a rounded or flat "bottom" (not a V-shaped one), and ideally reach to the same price at the upper end of both sides. The drop of the handle part should retrace about 30% to 50% of the rise at the end of the cup. For stock prices, the pattern may span from a few weeks to a few years; but commonly the cup lasts from 1 to 6 months, while the handle should only last for 1 to 4 weeks. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

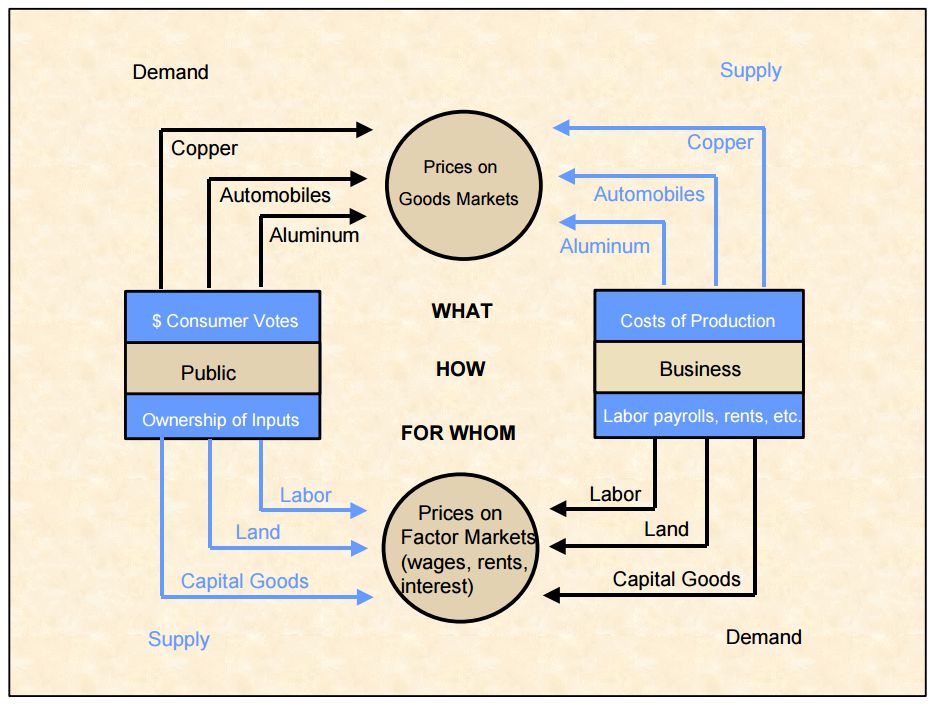

Market Price

A price is the (usually not negative) quantity of payment or Financial compensation, compensation given by one Party (law), party to another in return for Good (economics), goods or Service (economics), services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply (economics), supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted to currency, quantities of goods or vouchers. * In modern Economy, economies, prices are generally expressed in units of some form of currency. (More specifically, for Raw material, raw m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chart Pattern

A chart pattern or price pattern is a pattern within a chart when prices are graphed. In stock and commodity markets trading, chart pattern studies play a large role during technical analysis. When data is plotted there is usually a pattern which naturally occurs and repeats over a period. Chart patterns are used as either reversal or continuation signals. There are three main types of chart patterns which are used by technical analysts: traditional chart patternHarmonic Patterns* candlestick pattern Traditional Chart Pattern Included in this type are the most common patterns which have been introduced to chartists for more than a hundred years. Below is a list of the most commonly used traditional chart patterns: Reversal Patterns: # Double Top Reversal # Double Bottom Reversal # Triple Top Reversal # Triple Bottom Reversal # Head and Shoulders # Key Reversal Bar Continuation Patterns: # Triangle # Flag and Pennant # Channel # Cup with Handle Harmonic Pattern Harmonic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Sentiment

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be ''bullish''. On the contrary, if the market sentiment is ''bearish'', most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as ''permabulls'' and ''permabears'' respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William O'Neil

William J. O'Neil (born March 25, 1933) is an American entrepreneur, stockbroker and writer, who founded the stock brokerage firm William O'Neil & Co. Inc in 1963 and the business newspaper ''Investor's Business Daily'' in 1984. He is the author of the books ''How to Make Money in Stocks'', ''24 Essential Lessons for Investment Success'' and ''The Successful Investor'' among others, and is the creator of the CAN SLIM investment strategy. Early life and education O'Neil was born March 25, 1933, in Oklahoma City and raised in Texas. In 1951, he graduated from Woodrow Wilson High School in Dallas, Texas. He studied business at Southern Methodist University, received a bachelor's degree in 1955 and served in the United States Air Force. Career Early career In 1958, O'Neil started his career as a stockbroker at Hayden, Stone & Company, and developed an investment strategy which made early use of computers. In 1960, he was accepted to Harvard Business School's first Program fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Trend

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A market trend can only be determined in hindsight, since at any time prices in the future are not known. Market terminology The terms "bull market" and "bear market" describe upward and downward market trends, respectively, and can be used to describe either the market as a whole or specific sectors and securities. The terms come from London's Exchange Alley in the early 18th century, where traders who engaged in naked short selling were called "bear-skin jobbers" because they sold a bear's skin (the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volume (finance)

In capital markets, volume, or trading volume, is the amount (total number) of a security (or a given set of securities, or an entire market) that was traded during a given period of time. In the context of a single stock trading on a stock exchange, the volume is commonly reported as the number of shares that changed hands during a given day. The transactions are measured on stocks, bonds, options contracts, futures contracts and commodities. The average volume of a security over a longer period of time is the total amount traded in that period, divided by the length of the period. Therefore, the unit of measurement for average volume is shares per unit of time, typically per trading day. Significance Trading volume is usually higher when the price of a security is changing. News about a company's financial status, products, or plans, whether positive or negative, will usually result in a temporary increase in the trade volume of its stock. Shifts in trade volume can make obse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |