|

Crown Trust

The Crown Trust Company was an Ontario-based firm that operated in most of Canada prior to its bankruptcy, along with several other trusts, in 1983. The bankruptcies occurred when a major Canadian recession drove down speculative real estate values into which the trusts had made increasingly bad loans during a period of rising inflation and interest rates. Crown Trust, and many other Canadian financial institutions, were left with an overwhelming volume of defaulted mortgages. History In January 1946, the Trust and Guarantee Company Limited acquired Crown Trust. For one year it operated under the name the Crown Trust and Guarantee Company. In December 1947 it was renamed the Crown Trust Company. It eventually came to be controlled by Argus Corporation. References Trust companies of Canada Defunct financial services companies of Canada {{finance-company-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Company

A trust company is a corporation that acts as a fiduciary, trustee or agent of trusts and agencies. A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being a trustee of various kinds of trusts. The "trust" name refers to the ability to act as a trustee – someone who administers financial assets on behalf of another. The assets are typically held in the form of a trust, a legal instrument that spells out who the beneficiaries are and what the money can be spent for. A trustee will manage investments, keep records, manage assets, prepare court accounting, pay bills (depending on the nature of the trust), medical expenses, charitable gifts, inheritances or other distributions of income and principal. Estate administration A trust company can be named as an executor or personal representative in a last will and testament. The responsibilities of an executor in settling the estate of a deceased perso ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Deposit Insurance Corporation

The Canada Deposit Insurance Corporation (CDIC; french: Société d'assurance-dépôts du Canada) is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks (and other member institutions) up to C$100,000 in case of a bank failure. CDIC automatically insures many types of savings against the failure of a financial institution. However, the bank must be a CDIC member and not all savings are insured. CDIC is also Canada's resolution authority for banks, federally regulated credit unions, trust and loan companies as well as associations governed by the ''Cooperative Credit Associations Act'' that take deposits. History The Canada Deposit Insurance Corporation was created 4 March 1967 (under Schedule III, Part 1 of the '' Financial Administration Act'' and ''Canada Deposit Insurance Corporation Act''). It is simila ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Early 1980s Recession

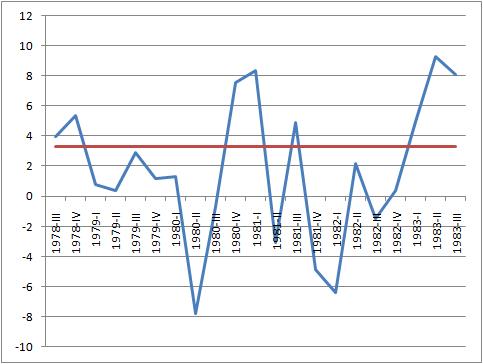

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to the recession was the 1979 energy crisis, mostly caused by the Iranian Revolution which caused a disruption to the global oil supply, which saw oil prices rising sharply in 1979 and early 1980. The sharp rise in oil prices pushed the already high rates of inflation in several major advanced countries to new double-digit highs, with countries such as the United States, Canada, West Germany, Italy, the United Kingdom and Japan tightening their monetary policies by increasing interest rates in order to control the inflation. These G7 countries each, in fact, had " double-dip" recessions involving short declines in economic output in parts of 1980 followed by a short period of expansion, in turn, followed by a steeper, longer period of econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008. The biggest sovereign default is Greece, with $138 billion in March 2012. Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms "insolvency", illiquidity and " bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meaning debtors are unable to pay their debts. * Bankruptcy: A legal finding tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argus Corporation

The Argus Corporation was an investment holding company based in Toronto, Ontario. During the 1960s and 1970s, it was the most powerful and best known conglomerate in Canada, at one time controlling the companies making up 10 percent of all shares traded daily on the Toronto Stock Exchange. At its height in the 1970s, it was a true conglomerate with many unrelated businesses. Among these were Dominion grocery stores, Orange Crush soft drinks, Massey Ferguson farm machinery, Domtar wood products and Carling O'Keefe breweries. The company was purchased by Conrad Black in 1978. Black and his associates sold off most of the Argus assets by 1985, and by 2005 Argus contained only one asset and was itself wholly owned by Black's Ravelston Corporation. Due to the fallout of ongoing lawsuits, Ravelston went bankrupt in 2008, and Argus disappeared. History Argus was founded as an investment holding company in 1945 by E. P. Taylor with minority partners Colonel W. Eric Phillips, Wall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Companies Of Canada

Trust often refers to: * Trust (social science), confidence in or dependence on a person or quality It may also refer to: Business and law * Trust law, a body of law under which one person holds property for the benefit of another * Trust (business), the combination of several businesses under the same management to prevent competition Arts, entertainment, and media * The Trust, a fictional entity in the ''Stargate'' franchise Books * ''Trust'' (novel), 2022 novel by Hernan Diaz Films * ''The Trust'' (1915 film), a lost silent drama film * ''Trust'' (1976 film), a Finnish-Soviet historical drama * ''Trust'' (1990 film), a dark romantic comedy * ''The Trust'' (1993 film), an American drama about a murder in 1900 * ''Trust'' (1999 film), a British television crime drama * ''Trust'', a 2009 film starring Jamie Luner and Nels Lennarson * ''Trust'' (2010 film), a drama film directed by David Schwimmer * ''The Trust'' (2016 film), a film starring Nicolas Cage and Elijah Wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |