|

Count Me In (charity)

Count Me In (full name: Count Me In for Women's Economic Independence) is a charitable organization that provides financial assistance, business coaching and consulting services to woman- owned businesses. The assistance is provided through three basic programs: an online community for women business owners supplemented by live events; the "Make Mine a Million $ Business" award, providing up to US$50,000 to businesses with a minimum of two years in business and $250,000 in annual revenue; and the "Micro to Millions" award, offering up to $10,000 for businesses not meeting the time or revenue requirements for the larger award. History Count Me In is a leading national not-for-profit provider of resources, business education and community support for women entrepreneurs seeking to grow micro businesses to million dollar enterprises. Founded in 1999 by Iris Burnett and Nell Merlino, Count Me In began as the first online microlender, and in the following years discontinued the microl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charitable Organization

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, Religion, religious or other activities serving the public interest or common good). The legal definition of a charitable organization (and of charity) varies between countries and in some instances regions of the country. The Charity regulators, regulation, the tax treatment, and the way in which charity law affects charitable organizations also vary. Charitable organizations may not use any of their funds to profit individual persons or entities. (However, some charitable organizations have come under scrutiny for spending a disproportionate amount of their income to pay the salaries of their leadership). Financial figures (e.g. tax refund, revenue from fundraising, revenue from sale of goods and services or revenue from investment) are indicators to assess the financial sustainability of a charity, especially to charity evaluators. This ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microgrant

A microgrant is a small sum of money distributed to an individual or organization, typically for hundreds or thousands of dollars, with the intent of enabling the recipient to develop or sustain an income-generating enterprise. Often they target individuals living on less than $1/day, extreme poverty, for the purpose of creating a sustainable livelihood or microenterprise. Recipients of microgrants can also be organizations or grassroots groups that are engaged in charitable activities. se to seek out a loan, or do not qualify for a microloan or other form of microcredit. There are three primary types of microgrants; one is a small sum of money (~US$50-500) granted to an individual to start an income-generating project, another is a small grant (~$2,000-$10,000) to a community for an impact-oriented projects and a third is a small grant to an individual for any cause they see fit. The term microgrant can also refer to a grant that is low in value. Microgrants for income-generati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Micro Credit For Water Supply And Sanitation

Microcredit for water supply and sanitation is the application of microcredit to provide loans to small enterprises and households in order to increase access to an improved water source and sanitation in developing countries. While most investments in water supply and sanitation infrastructure are financed by the public sector, investment levels have been insufficient to achieve universal access. Commercial credit to public utilities was limited by low tariffs and insufficient cost-recovery. Microcredits are a complementary or alternative approach to allow the poor to gain access to water supply and sanitation.Loughborough University - Well Factsheet on Microfinance for Sanitation Originally compiled by Darren Saywell and updated by Catarina Fonseca, 2006< ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grameen America

Grameen America is a 501(c)(3) nonprofit microfinance organization based in New York City. It was founded by Nobel Peace Prize recipient Muhammad Yunus in 2008. Grameen America is run by former Avon Chairman and CEO Andrea Jung. The organization provides loans, savings programs, financial education, and credit establishment to women who live in poverty in the United States. All loans must be used to build small businesses. Services Grameen America offers four key products. #Microloans. The maximum first-time loan is $1,500, though borrowers can return for larger loans once they have repaid their initial loan. #Savings program. Grameen America provides no-fee, no minimum balance savings accounts through commercial partner banks. #Credit Establishment. Grameen America helps members build credit by reporting loan repayments directly to Experian. #Financial Education. Grameen encourages group mentoring during a five-day initial training and weekly meetings with members. Lending proce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grama Vidiyal

IDFC Bharat Ltd is a microfinance bank (Formerly known as Grama Vidiyal), operating in the Tamil Nadu area of South India. Since 1993, it has provided small loans to women without access to formal credit and who typically have daily incomes of less than INR 80 (US$2) per day. History In 2007, Grama Vidiyal transformed from a charitable trust to a regulated Non-Bank Financial Company (NBFC). Its status as an NBFC brings Grama Vidiyal under the purview of government regulation but will permit the firm to take on larger amounts of equity capital. Grama Vidiyal expects continued rapid growth, reaching more than two million clients by expanding to other states of India with an excess of Rs.15 billion (US$400,000,000) in loans outstanding by 2012. Loan products Grama Vidiyal offers a variety of loans to its members. Other services Grama Vidiyal is among the largest microinsurance providers in India, and was studied by the ILO for a 2005 case study on microinsurance Investors ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flat Rate (finance)

Flat interest rate mortgages and loans calculate interest based on the amount of money a borrower receives at the beginning of a loan. However, if repayment is scheduled to occur at regular intervals throughout the term, the average amount to which the borrower has access is lower and so the effective or true rate of interest is higher. Only if the principal is available in full throughout the loan term does the flat rate equate to the true rate. This is the case in the example to the right, where the loan contract is for 400,000 Cambodian riels over 4 months. Interest is set at 16,000 riels (4%) a month while principal is due in a single payment ''at the end''. Flat rate calculations Loans with interest quoted using a flat rate originated before currency was invented and continued to feature regularly up to and beyond the 20th century within developed countries. More recently, they have also come to be used in the informal economy of developing countries, frequently adopt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

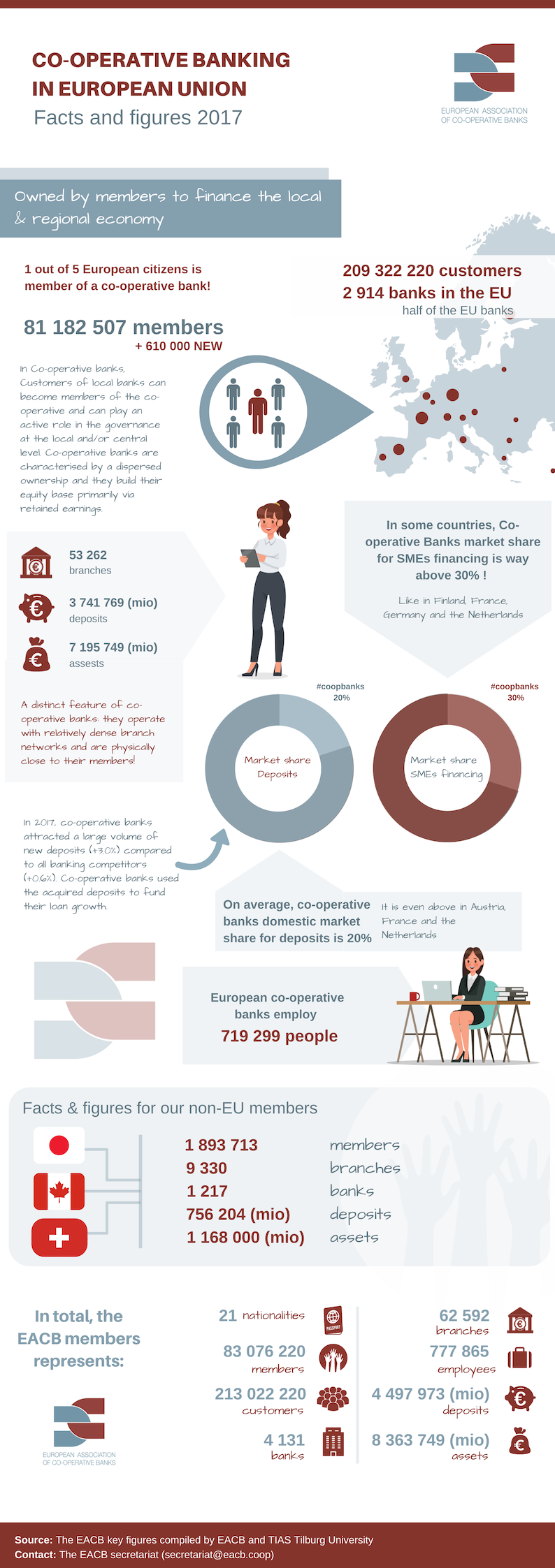

Cooperative Banking

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times lower failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accion USA

The Accion U.S. Network is an American nonprofit microfinance organization headquartered in New York, NY. It is the largest and only nationwide nonprofit microfinance network in the U.S. About The Accion U.S. Network is part of Accion International, a U.S.-based nonprofit organization operating globally, with the mission of giving people the financial tools they need to create or grow healthy businesses. The domestic Accion programs started in Brooklyn, NY, and grew from there to become the first nationwide network microlender. Member Offices In addition to having lending offices in nearly 30 cities, Accion also offers online lending. Its four member offices are: * Accion East * Accion Chicago * Accion New Mexico · Arizona · Colorado * Accion San Diego (now re-named Accessity and serving all of Southern California) Accion offers micro loans and other financial services to low- and moderate-income entrepreneurs in the United States who are typically unable to access bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acción Emprendedora

Acción Emprendedora (AE) is a non-profit organization founded in 2002 in Chile. The organization claims to seek the eradication of poverty by training and assisting poor small business owners and helping microentrepreneurs grow their businesses through education and mediating loan negotiations. Based in Santiago de Chile, it is present in seven major cities throughout Chile. In Chile, 98% of businesses are small businesses and micro-enterprises, and 62% of national employment is linked to micro-enterprises, half of whose employees have not completed their basic education. Development model AE uses a three-step development model: # AE offers basic and advanced business classes in entrepreneurial communities. # AE provides access to low-rate microcredit that would be otherwise unavailable to impoverished communities. # AE provides free consulting services during the initial development or growth of the micro-enterprise, as well as free access to technology. History Since 2003, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |