|

Cost Sharing

In health care, cost sharing occurs when patients pay for a portion of health care costs not covered by health insurance. The "out-of-pocket" payment varies among healthcare plans and depends on whether or not the patient chooses to use a healthcare provider who is contracted with the healthcare plan's network. Examples of out-of-pocket payments involved in cost sharing include copays, deductibles, and coinsurance. In accounting, cost sharing or matching means that portion of project or program costs not borne by the funding agency. It includes all contributions, including cash and in-kind, that a recipient makes to an award. If the award is federal, only acceptable non-federal costs qualify as cost sharing and must conform to other necessary and reasonable provisions to accomplish the program objectives. Cost sharing effort is included in the calculation of total committed effort. Effort is defined as the portion of time spent on a particular activity expressed as a percentage of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Care

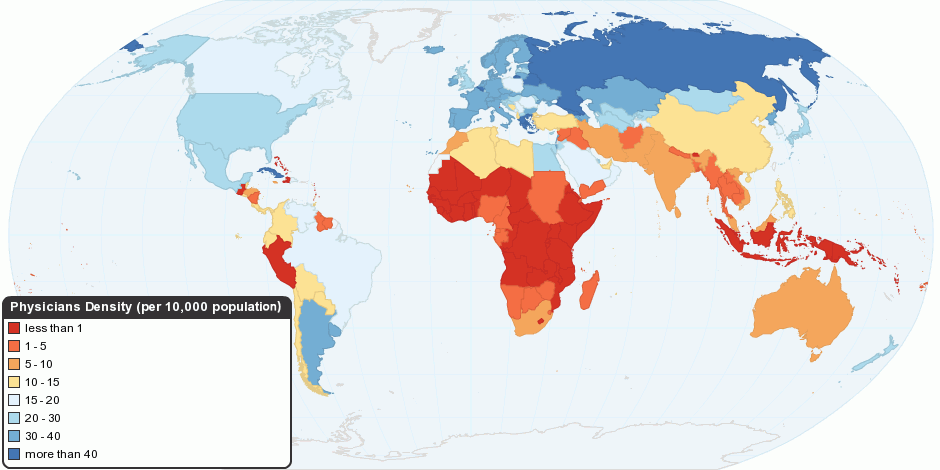

Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration or cure of disease, illness, injury, and other physical and mental impairments in people. Health care is delivered by health professionals and allied health fields. Medicine, dentistry, pharmacy, midwifery, nursing, optometry, audiology, psychology, occupational therapy, physical therapy, athletic training, and other health professions all constitute health care. It includes work done in providing primary care, secondary care, and tertiary care, as well as in public health. Access to health care may vary across countries, communities, and individuals, influenced by social and economic conditions as well as health policies. Providing health care services means "the timely use of personal health services to achieve the best possible health outcomes". Factors to consider in terms of health care access include financial limitations (such as insurance coverage), geo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Care Costs

Health, according to the World Health Organization, is "a state of complete physical, mental and social well-being and not merely the absence of disease and infirmity".World Health Organization. (2006)''Constitution of the World Health Organization''– ''Basic Documents'', Forty-fifth edition, Supplement, October 2006. A variety of definitions have been used for different purposes over time. Health can be promoted by encouraging healthful activities, such as regular physical exercise and adequate sleep, and by reducing or avoiding unhealthful activities or situations, such as smoking or excessive stress. Some factors affecting health are due to individual choices, such as whether to engage in a high-risk behavior, while others are due to structural causes, such as whether the society is arranged in a way that makes it easier or harder for people to get necessary healthcare services. Still, other factors are beyond both individual and group choices, such as genetic disorders. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance

Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity. According to the Health Insurance Association of America, health insurance is defined as "coverage that provides for the payments of benefits as a result of sickness or injury. It includes insurance for losses from accident, medical expense, disability, or accidental death and dismemberment". Background A health i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PLoS Med

''PLOS Medicine'' (formerly styled ''PLoS Medicine'') is a peer-reviewed weekly medical journal covering the full spectrum of the medical sciences. It began operation on October 19, 2004, as the second journal of the Public Library of Science (PLOS), a non-profit open access publisher. All content in ''PLOS Medicine'' is published under the Creative Commons "by-attribution" license. To fund the journal, the publication's business model requires in most cases that authors pay publication fees. The journal was published online and in a printed format until 2005 and is now only published online. The journal's acting chief editor is Clare Stone, who replaced the previous chief editor, Larry Peiperl, in 2018. Aims and scope The journal's initial aim was to provide an open-access alternative to existing top tier journals such as ''The New England Journal of Medicine'' and ''The Lancet'' and has concentrated on publishing papers on diseases that take the greatest toll on health globa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copay

A copayment or copay (called a gap in Australian English) is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after the deductible up to a certain limit. It must be paid before any policy benefit is payable by an insurance company. Copayments do not usually contribute towards any policy out-of-pocket maximum, whereas coinsurance payments do. Insurance companies use copayments to share health care costs to prevent moral hazard. It may be a small portion of the actual cost of the medical service but is meant to deter people from seeking medical care that may not be necessary, e.g., an infection by the common cold. In health systems with prices below the market clearing level in wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deductible

In an insurance policy, the deductible (in British English, the excess) is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term ''deductible'' may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments. Deductibles are typically used to deter the large number of claims that a consumer can be reasonably expected to bear the cost of. By restricting its coverage to events that are significant enough to incur large costs, the insurance firm expects to pay out slightly smaller amounts much less frequently, incurring much higher savings. As a result, insurance premiums are typically cheaper when they involve higher deductibles. For example, health insurance companies offer plans with high premiums and low deductibles, or plans with low premiums and high deductibles. One plan may have a premium of $1,087 a month with a $6,000 deductible, while ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coinsurance

In insurance, co-insurance or coinsurance is the splitting or spreading of risk among multiple parties. In the United States In the U.S. insurance market, co-insurance is the joint assumption of risk between the insurer and the insured. In title insurance, it also means the sharing of risks between two or more title insurance companies. In health insurance In health insurance, copayment is fixed while co-insurance is the percentage that the insured pays after the insurance policy's deductible is exceeded, up to the policy's stop loss. It can be expressed as a pair of percentages with the insurer's portion stated first, or just a single percentage showing what the insured pays. Once the insured's out-of-pocket expenses equal the stop loss the insurer will assume responsibility for 100% of any additional costs. 70–30, 80–20, and 90–10 insurer-insured co-insurance schemes are common, with stop loss limits of $1,000 to $3,000 after which the insurer covers all expenses. In prop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost-sharing Mechanism

In economics and mechanism design, a cost-sharing mechanism is a process by which several agents decide on the scope of a public product or service, and how much each agent should pay for it. Cost-sharing is easy when the marginal cost is constant: in this case, each agent who wants the service just pays its marginal cost. Cost-sharing becomes more interesting when the marginal cost is not constant. With increasing marginal costs, the agents impose a negative externality on each other; with decreasing marginal costs, the agents impose a positive externality on each other (see example below). The goal of a cost-sharing mechanism is to divide this externality among the agents. There are various cost-sharing mechanisms, depending on the type of product/service and the type of cost-function. Divisible product, increasing marginal costs In this setting, several agents share a production technology. They have to decide how much to produce and how to share the cost of production. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Truthful Mechanism

In game theory, an asymmetric game where players have private information is said to be strategy-proof or strategyproof (SP) if it is a weakly-dominant strategy for every player to reveal his/her private information, i.e. given no information about what the others do, you fare best or at least not worse by being truthful. SP is also called truthful or dominant-strategy-incentive-compatible (DSIC), to distinguish it from other kinds of incentive compatibility. An SP game is not always immune to collusion, but its robust variants are; with group strategyproofness no group of people can collude to misreport their preferences in a way that makes every member better off, and with strong group strategyproofness no group of people can collude to misreport their preferences in a way that makes at least one member of the group better off without making any of the remaining members worse off. Examples Typical examples of SP mechanisms are majority voting between two alternatives, second- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Economics

Health economics is a branch of economics concerned with issues related to efficiency, effectiveness, value and behavior in the production and consumption of health and healthcare. Health economics is important in determining how to improve health outcomes and lifestyle patterns through interactions between individuals, healthcare providers and clinical settings. In broad terms, health economists study the functioning of healthcare systems and health-affecting behaviors such as smoking, diabetes, and obesity. One of the biggest difficulties regarding healthcare economics is that it does not follow normal rules for economics. Price and Quality are often hidden by the third-party payer system of insurance companies and employers. Additionally, QALY (Quality Adjusted Life Years), one of the most commonly used measurements for treatments, is very difficult to measure and relies upon assumptions that are often unreasonable. A seminal 1963 article by Kenneth Arrow is often cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |