|

Corporate Governance

Corporate governance is defined, described or delineated in diverse ways, depending on the writer's purpose. Writers focused on a disciplinary interest or context (such as accounting, finance, law, or management) often adopt narrow definitions that appear purpose-specific. Writers concerned with regulatory policy in relation to corporate governance practices often use broader structural descriptions. A broad (meta) definition that encompasses many adopted definitions is "Corporate governance” describes the processes, structures, and mechanisms that influence the control and direction of corporations." This meta definition accommodates both the narrow definitions used in specific contexts and the broader descriptions that are often presented as authoritative. The latter include: the structural definition from the Cadbury Report, which identifies corporate governance as "the system by which companies are directed and controlled" (Cadbury 1992, p. 15); and the relational-structura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Stock

A treasury stock or reacquired stock is stock which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings). Stock repurchases are used as a tax efficient method to put cash into shareholders' hands, rather than paying dividends, in jurisdictions that treat capital gains more favorably. Sometimes, companies repurchase their stock when they feel that it is undervalued on the open market. Other times, companies repurchase their stock to reduce dilution from incentive compensation plans for employees. Another reason for stock repurchase is to protect the company against a takeover threat.Robert T. Sprouse, "Accounting for treasury stock transactions: Prevailing practices and new statutory provisions." ''Columbia Law Review'' 59.6 (1959): 882-900online/ref> The United Kingdom equivalent of treasury stock as used in the United States is treasury share. Treasury stocks in the UK refers to governm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sytse Douma

Sytse Wybren Douma (born 1942) is a Dutch organizational theorist, consultant and Emeritus Professor at the Tilburg School of Economics and Management of the Tilburg University, known for his work with Hein Schreuder on "Economic approaches to organizations". Biography Born and raised in Leeuwarden, Douma attended the Gymnasium of Leeuwarden, and in 1967 received his MA in applied mathematics from the University of Groningen. Douma started his career in 1969 as management consultant at the Dutch consultancy firm Berenschot. From 1974 to 1979 he headed the department of financial services of the private bank MeesPierson. In 1977 he return to the academic world as Associate Professor at the Interfaculteit Bedrijfskunde, where he received his PhD. From 1974 to 1977 he was Professor of Business economics at the Open University, and from 1987 to 2007 Professor Organization of the Enterprise at the Tilburg University. From 2003 to 2007 he was Dean of the Faculty of Technology Manag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multistakeholder Model

Multistakeholder governance is a practice of governance that employs bringing multiple stakeholders together to participate in dialogue, decision making, and implementation of responses to jointly perceived problems. The stakeholder theory, principle behind such a structure is that if enough input is provided by multiple types of actors involved in a question, the eventual consensual decision gains more legitimacy, and can be more effectively implemented than a traditional state-based response. While the evolution of multistakeholder governance is occurring principally at the international level, Public–private partnership, public-private partnerships (PPPs) are domestic analogues. Stakeholders refer to a collection of actors from different social, political, economic spheres working intentionally together to govern a physical, social, economic, or policy area. The range of actors can include multinational corporations, national enterprises, governments, civil society bodies, aca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of The Firm

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market. Firms are key drivers in economics, providing goods and services in return for monetary payments and rewards. Organisational structure, incentives, employee productivity, and information all influence the successful operation of a firm in the economy and within itself. As such major economic theories such as Transaction cost theory, Managerial economics and Behavioural theory of the firm will allow for an in-depth analysis on various firm and management types. Overview In simplified terms, the theory of the firm aims to answer these questions: # Existence. Why do firms emerge? Why are not all transactions in the economy mediated over the market? # Boundaries. Why is the boundary between firms and the market located exactly there in relation to size and output variety? ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oliver Hart (economist)

Oliver Simon D'Arcy Hart (born October 9, 1948) is a British-born American economist, currently the Lewis P. and Linda L. Geyser University Professor at Harvard University. Together with Bengt R. Holmström, he received the Nobel Memorial Prize in Economic Sciences in 2016. Biography Oliver Hart was born in Britain to Philip D'Arcy Hart, a medical researcher, and Ruth Meyer, a gynecologist. Both his parents were Jewish; his father was a member of the Montagu family; Oliver's great-grandfather was Samuel Montagu, 1st Baron Swaythling. Hart earned his B.A. in mathematics at King's College, Cambridge, in 1969 (where his contemporaries included the former Bank of England Governor Mervyn King), his M.A. in economics at the University of Warwick in 1972, and his Ph.D. in economics at Princeton University in 1974. He completed his doctoral dissertation, titled "Essays in the economics of uncertainty", under the supervision of Michael Rothschild. He was a Lecturer in Economics at Un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert W

The name Robert is an ancient Germanic given name, from Proto-Germanic "fame" and "bright" (''Hrōþiberhtaz''). Compare Old Dutch ''Robrecht'' and Old High German ''Hrodebert'' (a compound of '' Hruod'' ( non, Hróðr) "fame, glory, honour, praise, renown" and ''berht'' "bright, light, shining"). It is the second most frequently used given name of ancient Germanic origin. It is also in use as a surname. Another commonly used form of the name is Rupert. After becoming widely used in Continental Europe it entered England in its Old French form ''Robert'', where an Old English cognate form (''Hrēodbēorht'', ''Hrodberht'', ''Hrēodbēorð'', ''Hrœdbœrð'', ''Hrœdberð'', ''Hrōðberχtŕ'') had existed before the Norman Conquest. The feminine version is Roberta. The Italian, Portuguese, and Spanish form is Roberto. Robert is also a common name in many Germanic languages, including English, German, Dutch, Norwegian, Swedish, Scots, Danish, and Icelandic. It can be use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andrei Shleifer

Andrei Shleifer ( ; born February 20, 1961) is a Russian-American economist and Professor of Economics at Harvard University, where he has taught since 1991. Shleifer was awarded the biennial John Bates Clark Medal in 1999 for his seminal works in three fields: corporate finance (corporate governance, law and finance), the economics of financial markets (deviations from efficient markets), and the economics of transition. IDEAS/RePEc has ranked him as the second top economist in the world, and he is also listed as #1 on the list of "Most-Cited Scientists in Economics & Business". He served as project director of the Harvard Institute for International Development's Russian aid project from its inauguration in 1992 until 1997,Wedel, Janine. Shadow Elite: How the World's New Power Brokers Undermine Democracy, Government, and the Free Market. New York: Basic, 2009. where he and his associates made Russian investments, and settled a lawsuit from the U.S. government for such a violatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Klausner

Michael Klausner (born 1954) is the Nancy and Charles Munger Professor of Business and Professor of Law at Stanford Law School. He has been a member of the Stanford Law School faculty since 1997. He works in the areas of corporate law, corporate governance, and financial regulation. Education Klausner graduated summa cum laude from the University of Pennsylvania with a Bachelor of Arts in Political Science and Urban Studies. He went on to study law at Yale Law School, earning a Juris Doctor with a joint Master of Arts in Economics. At Yale, Klausner was the Notes and Topics editor for the Yale Law Journal.http://www.law.stanford.edu/display/images/dynamic/people_cv/klausner_cv.pdf Academic and professional career After finishing law school in 1981, Klausner clerked for Justice William J. Brennan Jr. of the U.S. Supreme Court and Judge David L. Bazelon of the U.S. Court of Appeals for the District of Columbia Circuit. He then worked as an associate with Paul, Weiss, Rifkind, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Efficiency

In microeconomics, economic efficiency, depending on the context, is usually one of the following two related concepts: * Allocative or Pareto efficiency: any changes made to assist one person would harm another. * Productive efficiency: no additional output of one good can be obtained without decreasing the output of another good, and production proceeds at the lowest possible average total cost. These definitions are not equivalent: a market or other economic system may be allocatively but not productively efficient, or productively but not allocatively efficient. There are also other definitions and measures. All characterizations of economic efficiency are encompassed by the more general engineering concept that a system is efficient or optimal when it maximizes desired outputs (such as utility) given available inputs. Standards of thought There are two main standards of thought on economic efficiency, which respectively emphasize the distortions created by ''governments'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Accountability

Corporate accountability is the acknowledgement and assumption of responsibility for the consequences of a company's actions. It can be defined in narrowly financial terms, e.g. for a business to meet certain standards or address the regulatory requirements of its business activities. Corporate accountability may also be applied more broadly, such as expectations for a publicly-traded company to be accountable to its employees and local community rather than focusing exclusively on earning profits in the short-term for the benefit of its shareholders. See also * Environmental, social and corporate governance * Corporate social responsibility * Corporate crime In criminology, corporate crime refers to crimes committed either by a corporation (i.e., a business entity having a separate legal personality from the natural persons that manage its activities), or by individuals acting on behalf of a corpo ... References {{DEFAULTSORT:Corporate accountability Problems in bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

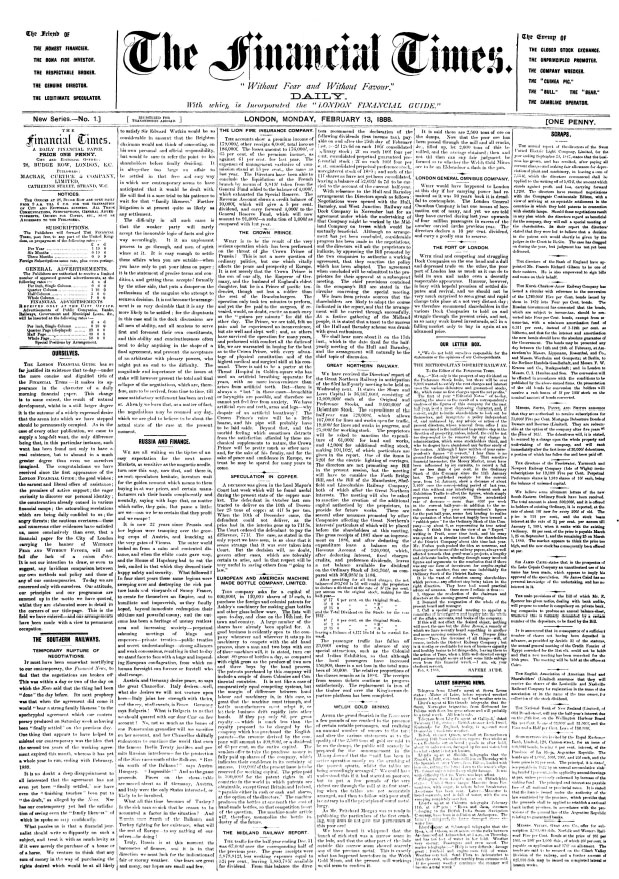

The Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherida ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |