|

Convertible Arbitrage

Convertible arbitrage is a market-neutral investment strategy often employed by hedge funds. It involves the simultaneous purchase of convertible securities and the short sale of the same issuer's common stock. The premise of the strategy is that the convertible is sometimes priced inefficiently relative to the underlying stock, for reasons that range from illiquidity to market psychology. In particular, the equity option embedded in the convertible bond may be a source of cheap volatility, which convertible arbitrageurs can then exploit. The number of shares sold short usually reflects a delta-neutral or market-neutral ratio. As a result, under normal market conditions, the arbitrageur expects the combined position to be insensitive to small fluctuations in the price of the underlying stock. However, maintaining a market-neutral position may require rebalancing transactions, a process called dynamic delta hedging. This rebalancing adds to the return of convertible arbitrag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market-neutral

An investment strategy or portfolio is considered market-neutral if it seeks to avoid some form of market risk entirely, typically by hedging. To evaluate market-neutrality requires specifying the risk to avoid. For example, convertible arbitrage attempts to fully hedge fluctuations in the price of the underlying common stock. A portfolio is truly market-neutral if it exhibits zero correlation with the unwanted source of risk. Market neutrality is an ideal, which is seldom possible in practice. A portfolio that appears market-neutral may exhibit unexpected correlations as market conditions change. The risk of this occurring is called |

Greeks (finance)

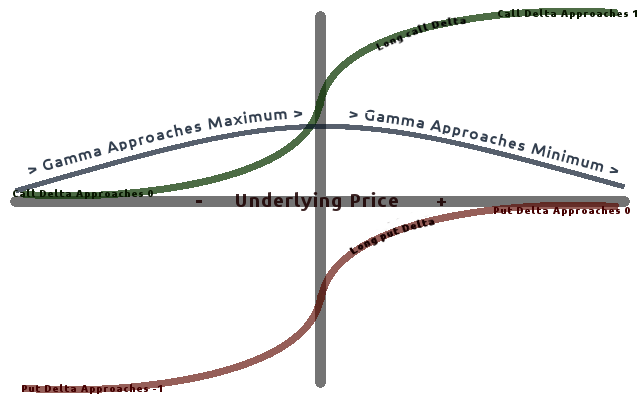

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convertible Security

A convertible security is a financial instrument whose holder has the right to convert it into another security of the same issuer. Most convertible securities are convertible bonds or preferred stocks that pay regular interest and can be converted into shares of the issuer's common stock. Convertible securities typically include other embedded options, such as call or put options. Consequently, determining the value of convertible securities can be a complex exercise. The complex valuation issue may attract specialized professional investors, including arbitrageurs and hedge funds who try to exploit disparities in the relationship between the price of the convertible security and the underlying common stock. Types Types of convertible securities include: * Convertible bond *Reverse convertible bond *Convertible preferred stock * Asset-linked bond: Although a bond with an asset warrant is a type of convertible security, regular warrants are not. A regular warrant provides an eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convertible Bond

In finance, a convertible bond or convertible note or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering. Convertible bonds are most often issued by companies with a low credit rating and high growth potential. Convertible bonds are also considered debt security because the companies agree to give fixed or floating interest rate as they do in common bonds for the funds of investor. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. The investor receives the potenti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Monday (1987)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as ''Black Tuesday'' because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression. The degree to which the stock market crashe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kirk Kerkorian

Kerkor Kerkorian ( hy, Գրիգոր Գրիգորեան; June 6, 1917 – June 15, 2015) was an American businessman, investor, and philanthropist. He was the president and CEO of Tracinda Corporation, his private holding company based in Beverly Hills, California. Kerkorian was one of the important figures in the shaping of Las Vegas and, with architect Martin Stern Jr., is described as the "father of the mega-resort". He built the world's largest hotel in Las Vegas three times: the International Hotel (opened in 1969), the MGM Grand Hotel (1973) and the MGM Grand (1993). He purchased the Metro-Goldwyn-Mayer movie studio in 1969. Of Armenian descent, Kerkorian provided over $1 billion for charity in Armenia through his Lincy Foundation, which was established in 1989 and particularly focused on helping to rebuild northern Armenia after the 1988 earthquake. Kerkorian also provided money to ensure that a film based on the history of the Armenian genocide would be made. The resu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Motors Corporation

The General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. It is the largest automaker in the United States and was the largest in the world for 77 years before losing the top spot to Toyota in 2008. General Motors operates manufacturing plants in eight countries. Its four core automobile brands are Chevrolet, Buick, GMC (automobile), GMC, and Cadillac. It also holds interests in Chinese brands Wuling Motors and Baojun as well as DMAX (engines), DMAX via joint ventures. Additionally, GM also owns the BrightDrop delivery vehicle manufacturer, GM Defense, a namesake Defense vehicles division which produces military vehicles for the United States government and military; the vehicle safety, security, and information services provider OnStar; the auto parts company ACDelco, a GM Financial, namesake financial lending service; and majority ownership in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

In economics and finance, arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalise on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practice, there are always risks in arbitrage, some minor (such as fluctuation of prices decreasing profit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delta Hedging

In finance, delta neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged when small changes occur in the value of the underlying security. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. A related term, delta hedging is the process of setting or keeping the delta of a portfolio as close to zero as possible. In practice, maintaining a zero delta is very complex because there are risks associated with re-hedging on large movements in the underlying stock's price, and research indicates portfolios tend to have lower cash flows if re-hedged too frequently.De Weert F. pp. 74-81 Nomenclature \Delta The sensitivity of an option's value to a change in the underlying stock's price. V_0 The initial value of the optio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrageur

In economics and finance, arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalise on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practice, there are always risks in arbitrage, some minor (such as fluctuation of prices decreasing profit m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Strategy

In finance, an investment strategy is a set of rules, behaviors or procedures, designed to guide an investor's selection of an investment portfolio. Individuals have different profit objectives, and their individual skills make different tactics and strategies appropriate. Some choices involve a tradeoff between risk and return. Most investors fall somewhere in between, accepting some risk for the expectation of higher returns. Investors frequently pick investments to hedge themselves against inflation. During periods of high inflation investments such as shares tend to perform less well in real terms. Time horizon of investments. Investments such as shares should be invested into with the time frame of a minimum of 5 years in mind. It is recommended in finance a minimum of 6 months to 12 months expenses in a rainy-day current account, giving instant access before investing in riskier investments than an instant access account. It is also recommended no more than 90% of your money i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |