|

Commodity Trading Advisor

A commodity trading advisor (CTA) is US financial regulatory term for an individual or organization who is retained by a fund or individual client to provide advice and services related to trading in futures contracts, commodity options and/or swaps. They are responsible for the trading within managed futures accounts. The definition of CTA may also apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. CTAs are generally regulated by the United States federal government through registration with the Commodity Futures Trading Commission (CFTC) and membership of the National Futures Association (NFA). Characteristics Trading activities A CTA generally acts as an asset manager, following a set of investment strategies utilizing futures contracts and options on futures contracts on a wide variety of physical goods such as agricultural products, forest products, metals, and energy, plus derivative cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the stability and integrity of the financial system. This may be handled by either a government or non-government organization. Financial regulation has also influenced the structure of banking sectors by increasing the variety of financial products available. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in financial regulation. The first recorded ban (regulation) on short selling was enacted by the Dutch authorities as early as 1610. Aims of regulation The objectives of financial regulators are usually: * market confidence – to maintain confidence in the financial system * financial stability – contributing to the protection a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Exchange Act

Commodity Exchange Act (ch. 545, , enacted June 15, 1936) is a federal act enacted in 1936 by the U.S. Government, with some of its provisions amending the Grain Futures Act of 1922. The Act provides federal regulation of all commodities and futures trading activities and requires all futures and commodity options to be traded on organized exchanges. In 1974, the Commodity Futures Trading Commission (CFTC) was created as a result of the Commodity Exchange Act, and in 1982 the National Futures Association (NFA) was created by CFTC. See also * Grain Futures Act * National Futures Association * Commodity Futures Trading Commission *Futures exchange A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity o ... * Futures contract * Commodity Futures Modernization Act of 2000 External links 7 U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grain Futures Act

The Grain Futures Act (ch. 369, , ) is a United States federal law enacted September 21, 1922 involving the regulation of trading in certain commodity futures, and causing the establishment of the Grain Futures Administration, a predecessor organization to the Commodity Futures Trading Commission. The bill that became the Grain Futures Act was introduced in the United States Congress two weeks after the US Supreme Court declared the Futures Trading Act of 1921 unconstitutional in Hill v. Wallace 259 U.S. 44 (1922).Markham, Jerry The history of Commodity futures Trading and its Regulation, 13 The Grain Futures Act was held to be constitutional by the US Supreme Court in Board of Trade of City of Chicago v. Olsen 262 US 1 (1923). In 1936 it was revised into the Commodity Exchange Act (CEA). The act was further superseded in 1974 by establishing the Commodity Futures Trading Commission. In 1982 the Commodity Futures Trading Commission created the National Futures Association (NF ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Acceptable Rate Of Return

In business and for engineering economics in both industrial engineering and civil engineering practice, the minimum acceptable rate of return, often abbreviated MARR, or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other projects. A synonym seen in many contexts is minimum attractive rate of return. The hurdle rate is frequently used as a synonym of cutoff rate, benchmark and cost of capital. It is used to conduct preliminary analysis of proposed projects and generally increases with increased risk. Hurdle rate determination The hurdle rate is usually determined by evaluating existing opportunities in operations expansion, rate of return for investments, and other factors deemed relevant by management. As an example, suppose a manager knows that investing in a conservative project, such as a bond investment or another project with no risk, yields a k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Engineering

Engineering is the use of scientific principles to design and build machines, structures, and other items, including bridges, tunnels, roads, vehicles, and buildings. The discipline of engineering encompasses a broad range of more specialized fields of engineering, each with a more specific emphasis on particular areas of applied mathematics, applied science, and types of application. See glossary of engineering. The term ''engineering'' is derived from the Latin ''ingenium'', meaning "cleverness" and ''ingeniare'', meaning "to contrive, devise". Definition The American Engineers' Council for Professional Development (ECPD, the predecessor of ABET) has defined "engineering" as: The creative application of scientific principles to design or develop structures, machines, apparatus, or manufacturing processes, or works utilizing them singly or in combination; or to construct or operate the same with full cognizance of their design; or to forecast their behavior under speci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistics

Statistics (from German: '' Statistik'', "description of a state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a scientific, industrial, or social problem, it is conventional to begin with a statistical population or a statistical model to be studied. Populations can be diverse groups of people or objects such as "all people living in a country" or "every atom composing a crystal". Statistics deals with every aspect of data, including the planning of data collection in terms of the design of surveys and experiments.Dodge, Y. (2006) ''The Oxford Dictionary of Statistical Terms'', Oxford University Press. When census data cannot be collected, statisticians collect data by developing specific experiment designs and survey samples. Representative sampling assures that inferences and conclusions can reasonably extend from the sample to the population as a whole. An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematics

Mathematics is an area of knowledge that includes the topics of numbers, formulas and related structures, shapes and the spaces in which they are contained, and quantities and their changes. These topics are represented in modern mathematics with the major subdisciplines of number theory, algebra, geometry, and analysis, respectively. There is no general consensus among mathematicians about a common definition for their academic discipline. Most mathematical activity involves the discovery of properties of abstract objects and the use of pure reason to prove them. These objects consist of either abstractions from nature orin modern mathematicsentities that are stipulated to have certain properties, called axioms. A ''proof'' consists of a succession of applications of deductive rules to already established results. These results include previously proved theorems, axioms, andin case of abstraction from naturesome basic properties that are considered true starting points of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Science

Science is a systematic endeavor that Scientific method, builds and organizes knowledge in the form of Testability, testable explanations and predictions about the universe. Science may be as old as the human species, and some of the earliest archeological evidence for scientific reasoning is tens of thousands of years old. The earliest written records in the history of science come from Ancient Egypt and Mesopotamia in around 3000 to 1200 Common Era, BCE. Their contributions to mathematics, astronomy, and medicine entered and shaped Greek natural philosophy of classical antiquity, whereby formal attempts were made to provide explanations of events in the Universe, physical world based on natural causes. After the fall of the Western Roman Empire, knowledge of History of science in classical antiquity, Greek conceptions of the world deteriorated in Western Europe during the early centuries (400 to 1000 CE) of the Middle Ages, but was preserved in the Muslim world during the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Analysis (finance)

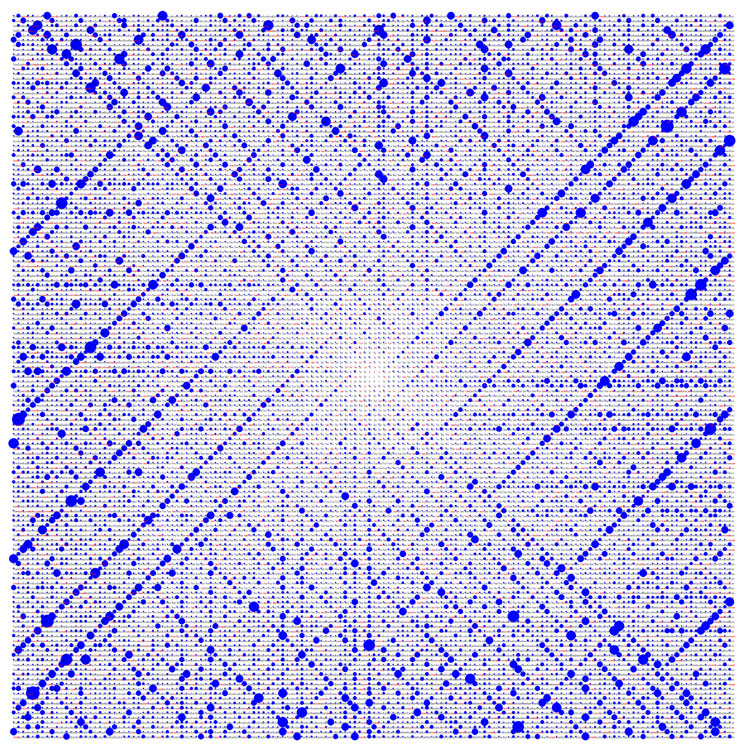

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, investment management and other related finance occupations. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns ( trend following or mean reversion). Although the original quantitative analysts were " sell side quants" from market maker firms, concerned with derivatives pricing and risk management, the meaning of the term has expanded over time to include those individuals involved in almost any application of mathematical finance, including the buy side. Applied quantitative analysis is commonly associated with quantitative i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Spread

Options spreads are the basic building blocks of many options trading strategies. A spread position is entered by buying and selling options of the same class on the same underlying security but with different strike prices or expiration dates. An option spread shouldn't be confused with a spread option. The three main classes of spreads are the horizontal spread, the vertical spread and the diagonal spread. They are grouped by the relationships between the strike price and expiration dates of the options involved - *Vertical spreads, or money spreads, are spreads involving options of the same underlying security, same expiration month, but at different strike prices. *Horizontal, calendar spreads, or time spreads are created using options of the same underlying security, same strike prices but with different expiration dates. *Diagonal spreads are constructed using options of the same underlying security but different strike prices and expiration dates. They are called diago ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short-term Trading

Short-term trading refers to those trading strategies in stock market or futures market in which the time duration between entry and exit is within a range of few days to few weeks. There are two main school of thoughts: swing trading and trend following. Day trading is an extremely short-term style of trading in which all positions entered during a trading day are exited the same day. Short term trading can be risky and unpredictable due to the volatile nature of the stock market at times. Within the time frame of a day and a week many factors can have a major effect on a stock's price. Company news, reports, and consumer’s attitudes can all have a positive or negative effect on the stock going up or down. According to Zweig (2006), “In an article in a women’s magazine many years ago we advised the readers to buy their stocks as they bought their groceries, not as they bought their perfume” (p. 8). This means doing the research to spot the best opportunities and l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |