|

Collateral Management

Collateral has been used for hundreds of years to provide security against the possibility of payment default by the opposing party in a trade. Collateral management began in the 1980s, with Bankers Trust and Salomon Brothers taking collateral against credit exposure. There were no legal standards, and most calculations were performed manually on spreadsheets. Collateralisation of derivatives exposures became widespread in the early 1990s. Standardisation began in 1994 via the first ISDA documentation. In the modern banking industry collateral is mostly used in over the counter (OTC) trades. However, collateral management has evolved rapidly in the last 15–20 years with increasing use of new technologies, competitive pressures in the institutional finance industry, and heightened counterparty risk from the wide use of derivatives, securitization of asset pools, and leverage. As a result, collateral management is now a very complex process with interrelated functions involving ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003. History In 1903 a group of New York national banks formed trust company Bankers Trust to provide trust services to customers of state and national banks throughout the country on the premise that it would not lure commercial bank customers away. In addition to offering the usual trust and commercial banking functions, it also acted as a "bankers' bank" by holding the reserves of other banks and trust companies and loaning them money when they needed additional reserves due to unexpected withdrawals. Bankers Trust Company was incorporated on March 24, 1903, with an initial capital of $1.5 million. Despite technically having numerous stockholders, the voting power was held by three associates of J.P. Morgan. Thus, it was wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Group Of Ten (economic)

The Group of Ten (G-10 or G10) refers to the group of countries that agreed to participate in the General Arrangements to Borrow (GAB), an agreement to provide the International Monetary Fund (IMF) with additional funds to increase its lending ability. History The GAB was established in 1962, when the governments of eight International Monetary Fund (IMF) members—Belgium, Canada, France, Italy, Japan, the Netherlands, the United Kingdom, and the United States—and the central banks of two others, Germany and Sweden, agreed to make resources available to the IMF with an additional $6 billion of their resources. The additional money was intended to allow the IMF to have increased lending resources. In 1964, the funds were used by the IMF to rescue the pound sterling. The G-10 grew in 1964 by the association of the eleventh member, Switzerland, then not a member of the IMF, but the name of the group remained the same. Activities The GAB enables the IMF to borrow specified a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Adequacy

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital adequacy ratio of equity as a percentage of risk-weighted assets. These requirements are put into place to ensure that these institutions do not take on excess leverage and risk becoming insolvent. Capital requirements govern the ratio of equity to debt, recorded on the liabilities and equity side of a firm's balance sheet. They should not be confused with reserve requirements, which govern the assets side of a bank's balance sheet—in particular, the proportion of its assets it must hold in cash or highly-liquid assets. Capital is a source of funds not a use of funds. Regulations A key part of bank regulation is to make sure that firms operating in the industry are prudently managed. The aim is to protect the firms themselves, their custom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

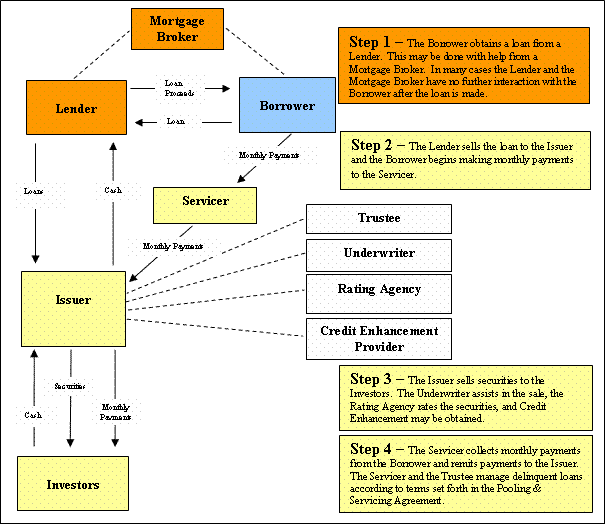

Credit Enhancement

Credit enhancement is the improvement of the credit profile of a structured financial transaction or the methods used to improve the credit profiles of such products or transactions. It is a key part of the securitization transaction in structured finance, and is important for credit rating agencies when rating a securitization. Types There are two primary types of credit enhancement: internal and external. Internal credit enhancement Subordination or credit tranching Establishing a senior/subordinated structure is one of the most popular techniques to create internal credit enhancement. Cash flows generated by assets are allocated with different priorities to classes of varying seniorities. The senior/subordinated structure thus consists of several tranches, from the most senior to the most subordinated (or junior). The subordinated tranches function as protective layers of the more senior tranches. The tranche with the highest seniority has the first right on cash flow. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark-to-market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s, and is now regarded as the "gold standard" in some circles. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen. Mark-to-market accounting can change values on the balance sheet as market conditions change. In contrast, historical cost accounting, based on the past transactions, is simpler, more stable, and easier to perform, but does not represent current market value. It summarizes past tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark-to-market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s, and is now regarded as the "gold standard" in some circles. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen. Mark-to-market accounting can change values on the balance sheet as market conditions change. In contrast, historical cost accounting, based on the past transactions, is simpler, more stable, and easier to perform, but does not represent current market value. It summarizes past tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swap (finance)

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.Financial Industry Business Ontology Version 2 Annex D: Derivatives, EDM Council, Inc., Object Management Group, Inc., 2019 The general swap can also be seen as a series of forward contracts through which two parties exchange financial instruments, resulting in a common series of exchange dates and two streams of instruments, the ''legs'' of the swap. The legs can be almost anything but usually one leg involves cash flows based on a |

Commodities

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them. The price of a commodity good is typically determined as a function of its market as a whole: well-established physical commodities have actively traded spot and derivative markets. The wide availability of commodities typically leads to smaller profit margins and diminishes the importance of factors (such as brand name) other than price. Most commodities are raw materials, basic resources, agricultural, or mining products, such as iron ore, sugar, or grains like rice and wheat. Commodities can also be mass-produced unspecialized products such as chemicals and computer memory. Popular commodities include crude oil, corn, and gold. Other definitions of commodity include something useful or valued and an alternative term for an economic good or service avail ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more generally) buildings or housing in general."Real estate": Oxford English Dictionary online: Retrieved September 18, 2011 In terms of law, ''real'' is in relation to land property and is different from personal property while ''estate'' means the "interest" a person has in that land property. Real estate is different from personal property, which is not permanently attached to the land, such as vehicles, boats, jewelry, furniture, tools and the rolling stock of a farm. In the United States, the transfer, owning, or acquisition of real estate can be through business corporations, individuals, nonprofit corporations, fiduciaries, or any legal entity as seen within the law of each U.S. state. History of real estate The natural right of a person t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covered Bonds

Covered bonds are debt securities issued by a bank or mortgage institution and collateralised against a pool of assets that, in case of failure of the issuer, can cover claims at any point of time. They are subject to specific legislation to protect bond holders. Unlike asset-backed securities created in securitization, the covered bonds continue as obligations of the issuer; in essence, the investor has recourse against the issuer and the collateral, sometimes known as "dual recourse". Typically, covered bond assets remain on the issuer's consolidated balance sheet (usually with an appropriate capital charge). As of beginning of 2019 volume of outstanding covered bonds worldwide was euro 2,577 billion, while largest markets were Denmark (€406 bil.), Germany (€370 bil.), France (€321 bil.) and Spain (€232 bil.). History Covered bonds were created in Prussia in 1769 by Frederick The Great and in Denmark in 1795. Danish covered bond lending emerged after the Great Fire of Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is ownership of assets that may have debts or other liabilities attached to them. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that developed in England during the Late Middle Ages to meet the growing demands of commercial activity. While the older common law courts dealt with questions of property title, equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |