|

Coherent Risk Measure

In the fields of actuarial science and financial economics there are a number of ways that risk can be defined; to clarify the concept theoreticians have described a number of properties that a risk measure might or might not have. A coherent risk measure is a function that satisfies properties of monotonicity, sub-additivity, homogeneity, and translational invariance. Properties Consider a random outcome X viewed as an element of a linear space \mathcal of measurable functions, defined on an appropriate probability space. A functional \varrho : \mathcal → \R \cup \ is said to be coherent risk measure for \mathcal if it satisfies the following properties: Normalized : \varrho(0) = 0 That is, the risk when holding no assets is zero. Monotonicity : \mathrm\; Z_1,Z_2 \in \mathcal \;\mathrm\; Z_1 \leq Z_2 \; \mathrm ,\; \mathrm \; \varrho(Z_1) \geq \varrho(Z_2) That is, if portfolio Z_2 always has better values than portfolio Z_1 under almost all scenarios then the risk of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Actuarial Science

Actuarial science is the discipline that applies mathematics, mathematical and statistics, statistical methods to Risk assessment, assess risk in insurance, pension, finance, investment and other industries and professions. Actuary, Actuaries are professionals trained in this discipline. In many countries, actuaries must demonstrate their competence by passing a series of rigorous professional examinations focused in fields such as probability and predictive analysis. Actuarial science includes a number of interrelated subjects, including mathematics, probability theory, statistics, finance, economics, financial accounting and computer science. Historically, actuarial science used deterministic models in the construction of tables and premiums. The science has gone through revolutionary changes since the 1980s due to the proliferation of high speed computers and the union of stochastic actuarial models with modern financial theory. Many universities have undergraduate and gradu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Of Default

Probability of default (PD) is a financial term describing the likelihood of a default over a particular time horizon. It provides an estimate of the likelihood that a borrower will be unable to meet its debt obligations. PD is used in a variety of credit analyses and risk management frameworks. Under Basel II, it is a key parameter used in the calculation of economic capital or regulatory capital for a banking institution. PD is closely linked to the expected loss, which is defined as the product of the PD, the loss given default (LGD) and the exposure at default (EAD). Overview The probability of default is an estimate of the likelihood that the default event will occur. It applies to a particular assessment horizon, usually one year. Credit scores, such as FICO for consumers or bond ratings from S&P, Fitch or Moodys for corporations or governments, typically imply a certain probability of default. For group of obligors sharing similar credit risk characteristics su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Space

In probability theory, a probability space or a probability triple (\Omega, \mathcal, P) is a mathematical construct that provides a formal model of a random process or "experiment". For example, one can define a probability space which models the throwing of a . A probability space consists of three elements:Stroock, D. W. (1999). Probability theory: an analytic view. Cambridge University Press. # A '' sample space'', \Omega, which is the set of all possible outcomes of a random process under consideration. # An event space, \mathcal, which is a set of events, where an event is a subset of outcomes in the sample space. # A '' probability function'', P, which assigns, to each event in the event space, a probability, which is a number between 0 and 1 (inclusive). In order to provide a model of probability, these elements must satisfy probability axioms. In the example of the throw of a standard die, # The sample space \Omega is typically the set \ where each element in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

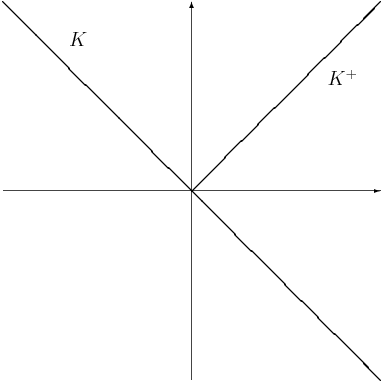

Solvency Cone

The solvency cone is a concept used in financial mathematics which models the possible trades in the financial market. This is of particular interest to markets with transaction costs. Specifically, it is the convex cone of portfolios that can be exchanged to portfolios of non-negative components (including paying of any transaction costs). Mathematical basis If given a bid-ask matrix \Pi for d assets such that \Pi = \left(\pi^\right)_ and m \leq d is the number of assets which with any non-negative quantity of them can be "discarded" (traditionally m = d), then the solvency cone K(\Pi) \subset \mathbb^d is the convex cone spanned by the unit vectors e^i, 1 \leq i \leq m and the vectors \pi^e^i-e^j, 1 \leq i,j \leq d. Definition A solvency cone K is any closed convex cone such that K \subseteq \mathbb^d and K \supseteq \mathbb^d_+. Uses A process of (random) solvency cones \left\_^T is a model of a financial market. This is sometimes called a market process. The negative of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Cost

In economics, a transaction cost is a cost incurred when making an economic trade when participating in a market. The idea that transactions form the basis of economic thinking was introduced by the institutional economist John R. Commons in 1931. Oliver E. Williamson's ''Transaction Cost Economics'' article, published in 2008, popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs can boost economic growth.North, Douglass C. 1992. "Transaction costs, institutions, and economic performance", San Francisco, CA: ICS Press. Alongside production costs, transaction costs are one of the most significant factors in business operation and management. Definition Williamson defines transaction costs as a cost innate in running an economic system of companies, comprising the total costs of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Superhedging Price

The superhedging price is a coherent risk measure. The superhedging price of a portfolio (A) is equivalent to the smallest amount necessary to be paid for an admissible portfolio (B) at the current time so that at some specified future time the value of B is at least as great as A. In a complete market the superhedging price is equivalent to the price for hedging the initial portfolio. Mathematical definition If the set of equivalent martingale measures is denoted by EMM then the superhedging price of a portfolio ''X'' is \rho(-X) where \rho is defined by : \rho(X) = \sup_ \mathbb^Q X/math>. \rho defined as above is a coherent risk measure. Acceptance set The acceptance set for the superhedging price is the negative of the set of values of a self-financing portfolio at the terminal time. That is : A = \. Subhedging price The subhedging price is the greatest value that can be paid so that in any possible situation at the specified future time you have a second portfolio worth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exponential Utility

In economics and finance, exponential utility is a specific form of the utility function, used in some contexts because of its convenience when risk (sometimes referred to as uncertainty) is present, in which case expected utility is maximized. Formally, exponential utility is given by: :u(c) = \begin (1-e^)/a & a \neq 0 \\ c & a = 0 \\ \end c is a variable that the economic decision-maker prefers more of, such as consumption, and a is a constant that represents the degree of risk preference (a>0 for risk aversion, a=0 for risk-neutrality, or a of final wealth ''W'' subject to :W = x'r + (W_0 - x'k) \cdot r_f where the prime sign indicates a vector transpose and where W_0 is initial wealth, ''x'' is a column vector of quantities placed in the ''n'' risky assets, ''r'' is a random vector of stochastic returns on the ''n'' assets, ''k'' is a vector of ones (so W_0 - x'k is the quantity placed in the risk-free asset), and ''r''''f'' is the known scalar return on the risk-free asset ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Entropic Risk Measure

In financial mathematics (concerned with mathematical modeling of financial markets), the entropic risk measure is a risk measure which depends on the risk aversion of the user through the exponential utility function. It is a possible alternative to other risk measures as value-at-risk or expected shortfall. It is a theoretically interesting measure because it provides different risk values for different individuals whose attitudes toward risk may differ. However, in practice it would be difficult to use since quantifying the risk aversion for an individual is difficult to do. The entropic risk measure is the prime example of a convex risk measure which is not coherent. Given the connection to utility functions, it can be used in utility maximization problems. Mathematical definition The entropic risk measure with the risk aversion parameter \theta > 0 is defined as : \rho^(X) = \frac\log\left(\mathbb ^right) = \sup_ \left\ \, where H(Q, P) = E\left frac\log\frac\right/math> ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sample Of Wang Transform Function Or Distortion Function

Sample or samples may refer to: * Sample (graphics), an intersection of a color channel and a pixel * Sample (material), a specimen or small quantity of something * Sample (signal), a digital discrete sample of a continuous analog signal * Sample (statistics), a subset of a population – complete data set People * Sample (surname) * Samples (surname) Places * Sample, Kentucky, unincorporated community, United States * Sampleville, Ohio, unincorporated community, United States * Hugh W. and Sarah Sample House, listed on the National Register of Historic Places in Iowa, United States Music * Sample (music), to reuse a portion of a sound recording in another recording, or the portion reused * "Sample" (Sakanaction song) * "Sample", a song by No-Man from ''Flowermix'' * The Samples, a band from Boulder, Colorado Other uses * USS ''Sample'' (FF-1048), a frigate in the U.S. Navy * The Sample, a defunct department store in Buffalo, New York, U.S. * SAMPLE history, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

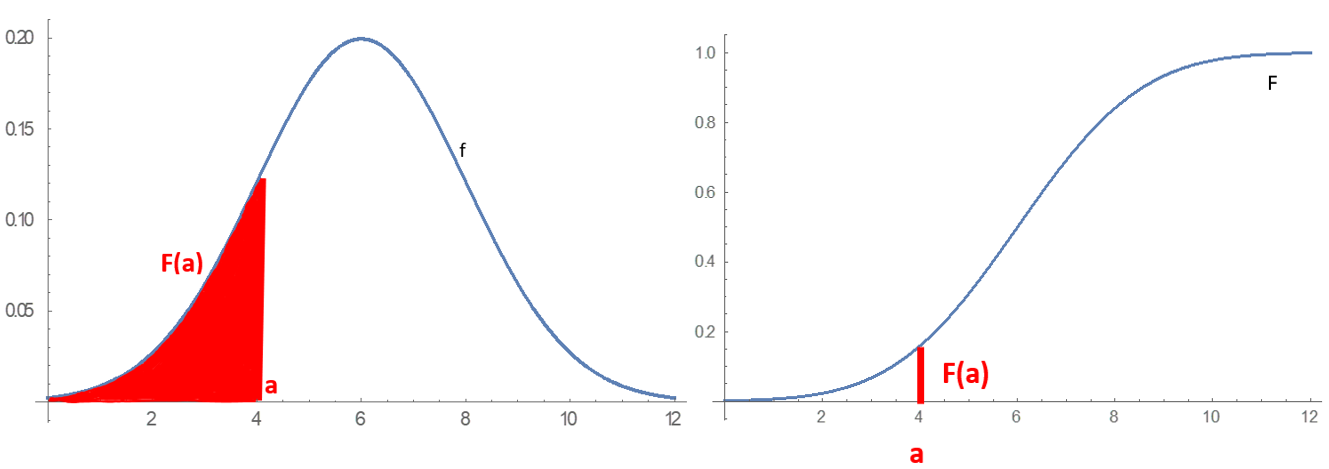

Continuous Distribution

In probability theory and statistics, a probability distribution is a function that gives the probabilities of occurrence of possible events for an experiment. It is a mathematical description of a random phenomenon in terms of its sample space and the probabilities of events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A probability distribution is a mathematical description of the probabilities of events, subsets of the sample space. The sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tail Value At Risk

In financial mathematics, tail value at risk (TVaR), also known as tail conditional expectation (TCE) or conditional tail expectation (CTE), is a risk measure associated with the more general value at risk. It quantifies the expected value of the loss given that an event outside a given probability level has occurred. Background There are a number of related, but subtly different, formulations for TVaR in the literature. A common case in literature is to define TVaR and average value at risk as the same measure. Under some formulations, it is only equivalent to expected shortfall when the underlying distribution function is continuous at \operatorname_(X), the value at risk of level \alpha. Under some other settings, TVaR is the conditional expectation of loss above a given value, whereas the expected shortfall is the product of this value with the probability of it occurring. The former definition may not be a coherent risk measure in general, however it is coherent if the und ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |