|

Cherry-picking Tax Avoidance

Cherry picking tax avoidance was a form of tax avoidance used in Australia in the 1970s and early 1980s. Company contributions to a superannuation fund were claimed as tax deductions, but the money immediately went back to the company. In the taxonomy of tax schemes, this one was an obvious abuse of an intended system. The Australian Taxation Office was able to attack the scheme, at least in some instances, on the basis that the funds were not in fact ones that benefited employees (a legislative requirement for tax deductibility). Operation A company would create a superannuation fund, with an associate as the trustee. The company paid money into the fund, ostensibly for the benefit of particular employees. Under section 82AAE (now repealed) of the Income Tax Assessment Act 1936 such contributions were tax deductible (to a limit of 5% of initial salary or $400, whichever was greater). But the trustee of the fund would immediately lend the money back to the company on fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

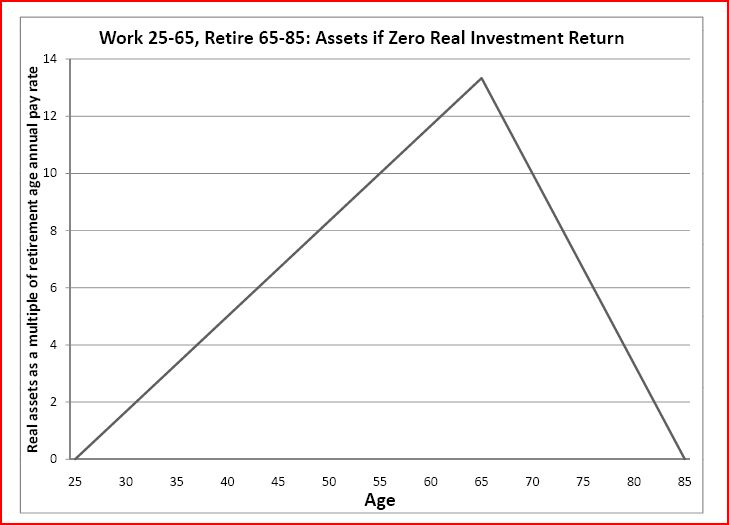

Retirement

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Australia

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission. Australia maintains a relatively low tax burden in comparison with other wealthy, developed nations, at 27.8% of GDP in 2018. History When the first Governor, Governor Phillip, arrived in New South Wales in 1788, he had a Royal Instruction that gave him power to impose taxation if the colony needed it. The first taxes in Australia were raised to help pay for the completion of Sydney's first gaol and provide for the orphans of the colony. Import duties were put on spirits, wine and beer and later on luxury goods. After 1824 the Government of New South Wales raised extra revenue from customs and excise duties. These were the most important sources of revenue for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AustLII

The Australasian Legal Information Institute (AustLII) is an institution operated jointly by the Faculties of Law of the University of Technology Sydney and the University of New South Wales. Its public policy purpose is to improve access to justice through access to legal information. Inception and aims AustLII was established in 1995. Founded as joint program of the University of Technology Sydney and the University of New South Wales law schools, its initial funding was provided by the Australian Research Council. Its public policy purpose is to improve access to justice through access to legal information. Content AustLII content is publicly available legal information. Its primary source information includes legislation, treaties and decisions of courts and tribunals. It also hosts secondary legal materials, including law reform and royal commission reports, as well as legal journals. The AustLII databases include the complete text of all of the decisions of the Hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Court Of Australia

The Federal Court of Australia is an Australian superior court of record which has jurisdiction to deal with most civil disputes governed by federal law (with the exception of family law matters), along with some summary (less serious) and indictable (more serious) criminal matters. Cases are heard at first instance by single judges. The court includes an appeal division referred to as the Full Court comprising three judges, the only avenue of appeal from which lies to the High Court of Australia. In the Australian court hierarchy, the Federal Court occupies a position equivalent to the supreme courts of each of the states and territories. In relation to the other courts in the federal stream, it is superior to the Federal Circuit and Family Court of Australia for all jurisdictions except family law. It was established in 1976 by the Federal Court of Australia Act. The Chief Justice of the Federal Court is James Allsop. Jurisdiction The Federal Court has no inherent jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Department Of Attorney General And Justice (New South Wales)

The New South Wales Department of Justice was a state government agency in New South Wales, Australia, that operated under various names between 2009 and 2019. In 2019, most of its functions were absorbed by a new Department of Communities and Justice. The department was responsible for the state's justice system – courts, prosecutions, prisons, sheriffs – and most emergency service agencies. The department was known as the Department of Justice and Attorney General (2009–2011), the Department of Attorney General and Justice (2011–2014), the Department of Police and Justice (2014) and finally the Department of Justice (2014–2019). History The re-organisation of the legal system of Colonial New South Wales led to the creation of the Attorney-General, an appointed law officer. Following the creation of self-government in 1856, the position of Attorney-General became an officer appointed by the Government of the day from within the membership of the Parliament of New Sout ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hal Wootten

John Halden Wootten QC (19 December 1922 – 27 July 2021) was an Australian lawyer and legal academic and the founder of the University of New South Wales Faculty of Law, of which he was the Foundation Chair and its inaugural Dean. Wootten served in multiple capacities and offices, including as a Judge of the Supreme Court of New South Wales, a Chairman of the Law Reform Commission of New South Wales, and a Deputy President of the Native Title Tribunal. Early life and education John Halden Wootten was born to a lower-middle-classFaine J. (1992.''Taken on Oath: A Generation of Lawyers'' Federation Press, Leichhardt, p. 174. family of dairy farmers from the North Coast region of New South Wales and is of English descent. Wootten's father grew up at Hal's paternal grandparents' farm in Alstonville, alongside Hal's uncles, in a Methodist upbringing. Wootten's father died when Hal was 11 months old; he was raised by his mother and, primarily, her parents, with whom Wootten lived ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supreme Court Of New South Wales

The Supreme Court of New South Wales is the highest state court of the Australian State of New South Wales. It has unlimited jurisdiction within the state in civil matters, and hears the most serious criminal matters. Whilst the Supreme Court is the highest New South Wales court in the Australian court hierarchy, an appeal by special leave can be made to the High Court of Australia. Matters of appeal can be submitted to the New South Wales Court of Appeal and Court of Criminal Appeal, both of which are constituted by members of the Supreme Court, in the case of the Court of Appeal from those who have been commissioned as judges of appeal. The Supreme Court consists of 52 permanent judges, including the Chief Justice of New South Wales, presently Andrew Bell, the President of the Court of Appeal, 10 Judges of Appeal, the Chief Judge at Common Law, and the Chief Judge in Equity. The Supreme Court's central location is the Law Courts Building in Queen's Square, Sydney, New So ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Termination Of Employment

Termination of employment or separation of employment is an employee's departure from a job and the end of an employee's duration with an employer. Termination may be voluntary on the employee's part, or it may be at the hands of the employer, often in the form of dismissal (firing) or a layoff. Dismissal or firing is usually thought to be the employee's fault, whereas a layoff is generally done for business reasons (for instance, a business slowdown or an economic downturn) outside the employee's performance. Firing carries a stigma in many cultures and may hinder the jobseeker's chances of finding new employment, particularly if they have been terminated from a previous job. Jobseekers sometimes do not mention jobs from which they were fired on their resumes; accordingly, unexplained gaps in employment, and refusal or failure to contact previous employers are often regarded as "red flags". Dismissal Dismissal is when the employer chooses to require the employee to leave, us ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unsecured Debt

In finance, unsecured debt refers to any type of debt or general obligation that is not protected by a guarantor, or collateralized by a lien on specific assets of the borrower in the case of a bankruptcy or liquidation or failure to meet the terms for repayment. Unsecured debts are sometimes called signature debt or personal loans. These differ from secured debt such as a mortgage, which is backed by a piece of real estate. In the event of the bankruptcy of the borrower, the unsecured creditors have a general claim on the assets of the borrower after the specific pledged assets have been assigned to the secured creditors. The unsecured creditors usually realize a smaller proportion of their claims than the secured creditors. In some legal systems, unsecured creditors who are ''also'' indebted to the insolvent debtor are able (and, in some jurisdictions, required) to set off the debts, so actually putting the unsecured creditor with a matured liability to the debtor in a pre-p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, smaller islands. With an area of , Australia is the largest country by area in Oceania and the world's List of countries and dependencies by area, sixth-largest country. Australia is the oldest, flattest, and driest inhabited continent, with the least fertile soils. It is a Megadiverse countries, megadiverse country, and its size gives it a wide variety of landscapes and climates, with Deserts of Australia, deserts in the centre, tropical Forests of Australia, rainforests in the north-east, and List of mountains in Australia, mountain ranges in the south-east. The ancestors of Aboriginal Australians began arriving from south east Asia approximately Early human migrations#Nearby Oceania, 65,000 years ago, during the Last Glacial Period, last i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)