|

Chapter 13 Bankruptcy

Title 11 of the United States Code sets forth the statutes governing the various types of relief for bankruptcy in the United States. Chapter 13 of the United States Bankruptcy Code provides an individual with the opportunity to propose a plan of reorganization to reorganize their financial affairs while under the bankruptcy court's protection. The purpose of chapter 13 is to enable an individual with a regular source of income to propose a chapter 13 plan that provides for their various classes of creditors. Under chapter 13, the Bankruptcy Court has the power to approve a chapter 13 plan without the approval of creditors as long as it meets the statutory requirements under chapter 13. Chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is in contrast to the purpose of Chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt and the liquidation of non-exempt property. A Chapte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Title 11 Of The United States Code

Title 11 of the United States Code, also known as the United States Bankruptcy Code, is the source of bankruptcy law in the United States Code. Chapters Title 11 is subdivided into nine chapters. It used to include more chapters, but some of them have since been repealed in their entirety. The nine chapters are: *Chapter 1: General Provisions *Chapter 3: Case Administration *Chapter 5: Creditors, the Debtor and the Estate * Chapter 7: Liquidation * Chapter 9 : Adjustment of Debts of a Municipality *Chapter 11: Reorganization *Chapter 12: Adjustment of Debts of a Family Farmer or Fisherman with Regular Annual Income *Chapter 13: Adjustment of Debts of an Individual with Regular Income * Chapter 15: Ancillary and Other Cross-Border Cases References Further reading External linksUnited States Bankruptcy Codevia usbankruptcycode.orgU.S. Code Title 11 via United States Government Publishing OfficeU.S. Code Title 11 via Cornell University Cornell University is a private stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

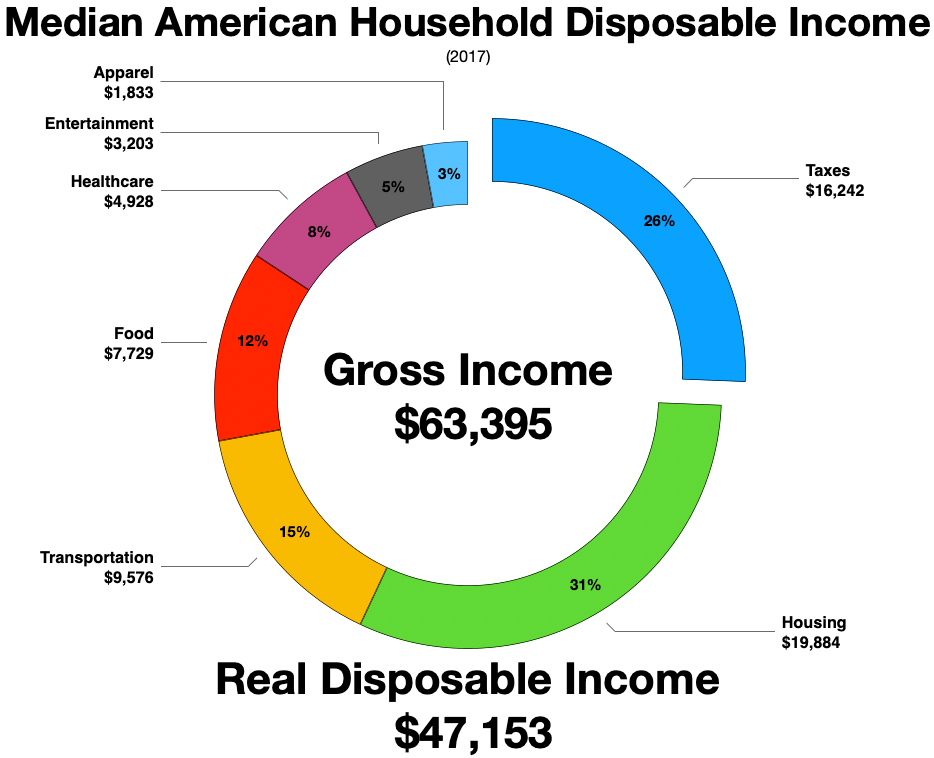

Disposable Income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cram Down

A cram down or cramdown is the involuntary imposition by a court of a reorganization plan over the objection of some classes of creditors. Home mortgage loans While typically used in a corporate context, the phrase has gained popularity in the context of personal bankruptcies as a result of the financial crisis of 2007–2009. In the mortgage context, the term "cramdown" has a distinct meaning than in a chapter 11 corporate bankruptcy. Instead of referring to the confirmation of a plan over the objection of an impaired class of creditors, a mortgage cram-down refers to reducing the creditor's allowed secured claim to the value of the collateral property. This procedure, which is sometimes known as lien stripping or strip-down, has nothing to do with the plan confirmation process per se. Under current United States law, bankruptcy courts are not allowed to perform cramdowns (i.e., reduce the principal amount or change the interest rate or other terms) on creditors who hold lo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy Abuse Prevention And Consumer Protection Act

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) () is a legislative act that made several significant changes to the United States Bankruptcy Code. Referred to colloquially as the "New Bankruptcy Law", the Act of Congress attempts to, among other things, make it more difficult for some consumers to file bankruptcy under Chapter 7; some of these consumers may instead utilize Chapter 13. It was passed by the 109th United States Congress on April 14, 2005 and signed into law by President George W. Bush on April 20, 2005. Provisions of the act apply to cases filed on or after October 17, 2005. Provisions The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) made changes to American bankruptcy laws, affecting both consumer and business bankruptcies. Many of the bill's provisions were explicitly designed by the bill's Congressional sponsors to make it "more difficult for people to file for bankruptcy." The BAPCPA was intended to make it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.Tysons Corner CDP, Virginia ". . Retrieved on May 7, 2009. The FHLMC was created in 1970 to expand the secondary market for in the US. Along with the Fe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or "thrifts"). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2022, Fannie Mae was ranked number 33 on the ''Fortune'' 500 rankings of the largest United States corporations by total revenue. __TOC__ History Background and early decades Historically, most housing loans in the early 1900s in the United States were s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA), 15 U.S.C. § 1681 ''et seq'', is U.S. Federal Government legislation enacted to promote the accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies. It was intended to shield consumers from the willful and/or negligent inclusion of erroneous data in their credit reports. To that end, the FCRA regulates the collection, dissemination, and use of consumer information, including consumer credit information. Together with the Fair Debt Collection Practices Act (FDCPA), the FCRA forms the foundation of consumer rights law in the United States. It was originally passed in 1970, and is enforced by the U.S. Federal Trade Commission, the Consumer Financial Protection Bureau and private litigants. History Before standardization of credit scoring, statements of character were integral to credit reports well into the 1960s. With credit reports containing probing details about personality, habits, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Bankruptcy

Personal bankruptcy law allows, in certain jurisdictions, an individual to be declared bankrupt. Virtually every country with a modern legal system features some form of debt relief for individuals. Personal bankruptcy is distinguished from corporate bankruptcy. By country The DICE report 2006 of Munich's ifo Economic Research compared international personal bankruptcy in selected OECD-countries. United States In the United States, the same chapters of the Bankruptcy Code are applied in both personal and corporate bankruptcies. Most individuals who enter bankruptcy do so under Chapter 13 (a "reorganization" plan) or Chapter 7 (a "liquidation" of debtor's assets). More rarely, personal bankruptcy proceedings are carried out under Chapter 11. The ultimate goal of personal bankruptcy, from the viewpoint of the debtor, is receiving a discharge. Canada The concept behind bankruptcy in Canada is that an individual assigns (surrender) everything they own to a trustee in bankruptcy in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chapter 13

Title 11 of the United States Code sets forth the statutes governing the various types of relief for bankruptcy in the United States. Chapter 13 of the United States Bankruptcy Code provides an individual with the opportunity to propose a plan of reorganization to reorganize their financial affairs while under the bankruptcy court's protection. The purpose of chapter 13 is to enable an individual with a regular source of income to propose a chapter 13 plan that provides for their various classes of creditors. Under chapter 13, the Bankruptcy Court has the power to approve a chapter 13 plan without the approval of creditors as long as it meets the statutory requirements under chapter 13. Chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is in contrast to the purpose of Chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt and the liquidation of non-exempt property. A Chapter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Involuntary Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy In The United States

In the United States, bankruptcy is largely governed by federal law, commonly referred to as the "Bankruptcy Code" ("Code"). The United States Constitution (Article 1, Section 8, Clause 4) authorizes Congress to enact "uniform Laws on the subject of Bankruptcies throughout the United States". Congress has exercised this authority several times since 1801, including through adoption of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA). Some laws relevant to bankruptcy are found in other parts of the United States Code. For example, bankruptcy crimes are found in Title 18 of the United States Code (Crimes). Tax implications of bankruptcy are found in Title 26 of the United States Code ( Internal Revenue Code), and the creation and jurisdiction of bankruptcy courts are found in Title 28 of the United States Code (Judiciary and Judicial procedure). Bankrupt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)