|

Central Bank Of Indonesia

Bank Indonesia (BI) is the central bank of the Republic of Indonesia. It replaced in 1953 the Bank of Java ( nl, De Javasche Bank, DJB), which had been created in 1828 to serve the financial needs of the Dutch East Indies. History Bank of Java King William I of the Netherlands granted the right to create a private bank in the Indies in 1826, which was named . It was founded on 24 January 1828 and later became the bank of issue of the Dutch East Indies. The bank regulated and issued the Netherlands Indies gulden. In 1881, an office of the Bank of Java was opened in Amsterdam. Later followed the opening of an office in New York. By 1930 the bank owned sixteen office branches in the Dutch East Indies: Bandung, Cirebon, Semarang, Yogyakarta, Surakarta, Surabaya, Malang, Kediri, Banda Aceh, Medan, Padang, Palembang, Banjarmasin, Pontianak, Makassar, and Manado. The Bank of Java was operated as a private bank and individuals as well as industries etc. could get help in the ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Negara Indonesia

Bank Negara Indonesia ( 'State Bank of Indonesia'), is an Indonesian state-owned bank. It has branches primarily in Indonesia, but it can also found in Seoul, Singapore, Hong Kong, Tokyo, London and New York. It had 1000 branches and over 9 million customers in 2006. It is listed on the Indonesia Stock Exchange as "BBNI". Its market capitalization as of 12 March 2007 was 23.8 trillion rupiah (approximately US$2.6 billion). It is the fourth-largest bank of Indonesia in terms of assets. History Early years Bank Negara Indonesia was established on 5 July 1946. It was prepared to be the Central Bank of Indonesia with the task of issuing and handling Indonesian currency. A few months after its establishment, Bank Negara Indonesia officially distributed the first official currency of Indonesia – ORI or ''Oeang Republik Indonesia''. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

People's Representative Council

The People's Representative Council of the Republic of Indonesia ( id, Dewan Perwakilan Rakyat Republik Indonesia, DPR-RI), also known as the House of Representatives, is one of two elected chambers of the People's Consultative Assembly (MPR), the national legislature of Indonesia. It is considered the lower house, while the Regional Representative Council (DPD) serve as the upper house; while the Constitution of Indonesia, Indonesian constitution does not explicitly mention the divide, the DPR enjoys more power, privilege, and prestige compared to the DPD. Members of the DPR are elected through a elections in Indonesia, general election every five years. Currently, there are 575 members; an increase compared to 560 prior to the 2019 Indonesian legislative election, 2019 elections. The DPR has been the subject of frequent public criticism due to perceived high levels of fraud and Corruption in Indonesia, corruption. History ''Volksraad'' In 1915, members of the Indonesian n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Indonesia

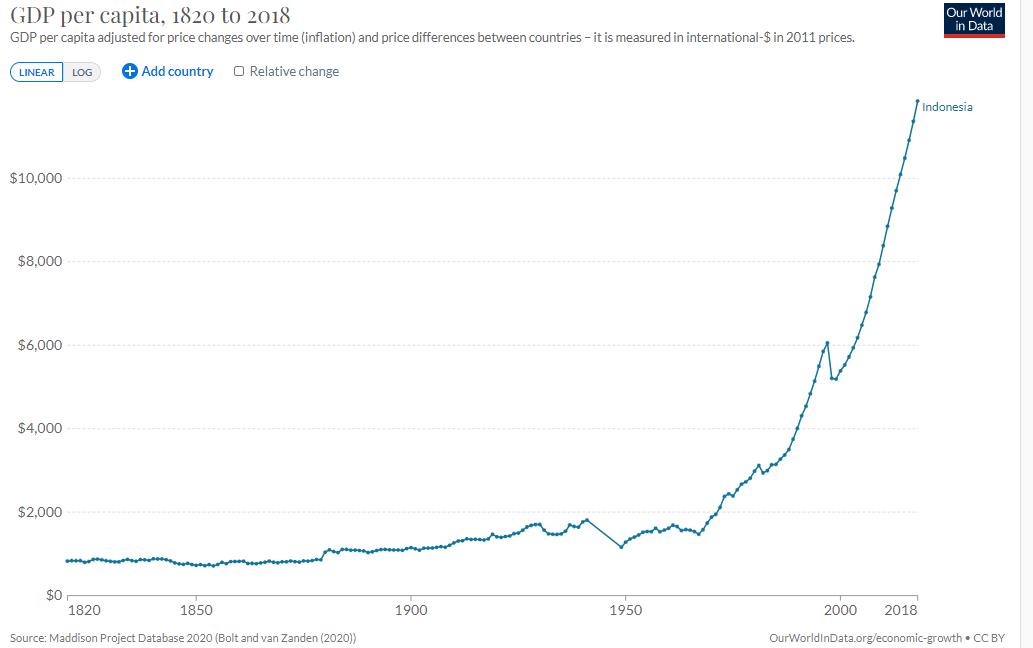

The economy of Indonesia is the largest in Southeast Asia and is one of the emerging market economies. As a middle-income country and member of the G20, Indonesia is classified as a newly industrialized country. It is the 17th largest economy in the world by nominal GDP and the 7th largest in terms of GDP (PPP). Estimated at US$40 billion in 2019, Indonesia's Internet economy is expected to cross the US$130 billion mark by 2025. Indonesia depends on the domestic market and government budget spending and its ownership of state-owned enterprises (the central government owns 141 enterprises). The administration of prices of a range of basic goods (including rice and electricity) also plays a significant role in Indonesia's market economy. However, since the 1990s, the majority of the economy has been controlled by individual Indonesians and foreign companies. In the aftermath of the 1997 Asian financial crisis, the government took custody of a significant portion of private sect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking System

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment. Money was historically an emergent market phenomenon that possess intrinsic value as a commodity; nearly all contemporary money systems are based on unbacked fiat money without use value. Its value is consequently derived by social convention, having been declared by a government or regulatory entity to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private", in the case of the United States dollar. Contexts which erode public confidence, such as the circulation of counterfeit money or domestic hyperinflation, can cause good money to lose its value. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Indonesia

The term Government of Indonesia ( id, Pemerintah Indonesia) can have a number of different meanings. At its widest, it can refer collectively to the three traditional branches of government – the executive branch, legislative branch and judicial branch. The term is also used colloquially to mean the executive and legislature together, as these are the branches of government responsible for day-to-day governance of the nation and lawmaking. At its narrowest, the term is used to refer to the executive branch in form of the Cabinet of Indonesia as this is the branch of government responsible for day-to-day governance. History Liberal democracy era An era of Liberal Democracy ( id, Demokrasi Liberal) in Indonesia began on August 17, 1950 following the dissolution of the federal United States of Indonesia less than a year after its formation, and ended with the imposition of martial law and President Sukarno's 1959 Decree, President Sukarno's decree regarding the introduction ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PRIMA (Indonesia)

PRIMA is one of the interbank networks in Indonesia. PRIMA is owned by PT Rintis Sejahtera. PT Rintis Sejahtera is a Satellite Communication services provider that transmitting digital information within the region and around the world. Before the creation of ATM PRIMA, this network was known as ATM BCA network that worked as the ATM network for Bank Central Asia. Services * PRIMAMESH * PRIMALINK * PRIMASTAR * PRIMANET * EFT SWITCHING, the Interbank network * BROADBAND Members * Bank Central AsiaRintis.co.id * * Bank Jabar Banten * |

Bank Central Asia

PT Bank Central Asia Tbk, commonly known as Bank Central Asia (BCA) is an Indonesian bank founded on 21 February 1957. It is considered as the largest privately owned bank in Indonesia. The Asian financial crisis in 1997 had a tremendous impact on Indonesia's entire banking system. In particular, it affected BCA's cash flow and even threatened its survival. A bank rush forced BCA to seek assistance and subsequent nationalization from the Indonesian government. The Indonesian Bank Restructuring Agency took over control of the bank in 1998. Full recovery was accomplished later in the same year. In December 1998, third-party funds were back at the pre-crisis level. BCA's assets stood at Rp 67.93 trillion, as opposed to Rp 53.36 trillion in December 1997. Public confidence in BCA was fully restored, and BCA was released by IBRA to BI in 2001. Subsequently, BCA took a major step by going public. The IPO took place in 2000, selling 22.55% of BCA's shares that were being div ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Mandiri

PT Bank Mandiri (Persero) Tbk or Bank Mandiri, headquartered in Jakarta, is the largest bank in Indonesia in terms of assets, loans and deposits. Total assets as of March 2021, were IDR 1.58 quadrillion (around US$110.56 billion). As of March 2021, Bank Mandiri was the largest bank in Indonesia by total assets. As of December 2020, the bank had 2,511 branches spread across three different time zones in Indonesia and 7 branches abroad, about 13,217 Automatic Teller Machines (ATMs), and five principal subsidiaries: Mandiri Sekuritas, Mandiri Tunas Finance, AXA Mandiri Financial Services, Bank Mandiri Taspen, and Mandiri AXA General Insurance. History Pre-merger Bank Mandiri is the result of the merger made by Indonesian government from four older government-owned banks that failed in 1998. Those four banks were Bank Bumi Daya, Bank Dagang Negara, Bank Ekspor Impor Indonesia, and Bank Pembangunan Indonesia. During the amalgamation and reorganisation, the government r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ASEAN

ASEAN ( , ), officially the Association of Southeast Asian Nations, is a political and economic union of 10 member states in Southeast Asia, which promotes intergovernmental cooperation and facilitates economic, political, security, military, educational, and sociocultural integration between its members and countries in the Asia-Pacific. The union has a total area of and an estimated total population of about 668million. ASEAN's primary objective was to accelerate economic growth and through that social progress and cultural development. A secondary objective was to promote regional peace and stability based on the rule of law and the principles of the UN Charter. With some of the fastest growing economies in the world, ASEAN has broadened its objective beyond the economic and social spheres. In 2003, ASEAN moved along the path similar to the European Union (EU) by agreeing to establish an ASEAN community that consists of three pillars: the ASEAN Security Community, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Teller Machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of names, including automatic teller machine (ATM) in the United States (sometimes redundantly as "ATM machine"). In Canada, the term ''automated banking machine'' (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM over ABM. In British English, the terms ''cashpoint'', ''cash machine'' and ''hole in the wall'' are most widely used. Other terms include ''any time money'', ''cashline'', ''tyme machine'', ''cash dispenser'', ''cash corner'', ''bankomat'', or ''bancomat''. ATMs that are not operated by a financial i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Receivership

In law, receivership is a situation in which an institution or enterprise is held by a receiver—a person "placed in the custodial responsibility for the property of others, including tangible and intangible assets and rights"—especially in cases where a company cannot meet its financial obligations and is said to be insolvent.Philip, Ken, and Kerin Kaminski''Secured Lender'', January/February 2007, Vol. 63 Issue 1, pages 30-34,36. The receivership remedy is an equitable remedy that emerged in the English chancery courts, where receivers were appointed to protect real property. Receiverships are also a remedy of last resort in litigation involving the conduct of executive agencies that fail to comply with constitutional or statutory obligations to populations that rely on those agencies for their basic human rights. Receiverships can be broadly divided into two types: *Those related to insolvency or enforcement of a security interest. *Those where either **One is Incapable of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |