|

Caracas Stock Exchange

The Caracas Stock Exchange or Bolsa de Valores de Caracas (BVC) is a stock exchange located in Caracas, Venezuela. Established in 1947, BVC merged with a competitor in 1974. Operational and Legal Structure BVC is a private exchange, providing operations for the purchase and authorized sale of securities according to the Capital Marketing Laws of Venezuela. It is member of the Executive Committee of the Latin American Federation of Stock markets. At the exchange, companies emit by procedures authorized by the regulating authorities, instruments of fixed income and securities (''renta fija y de renta variable'') with the purpose of securing capital from public investors. BVC is also used as a location for trading in Bonds and other debt instruments. The legal structure prevailing in the Venezuelan capital market are the Securities Marketing Law (''la Ley de Mercado de Capitales'', enacted in 1975 and amended in 1998), Transaction Law (''Ley de Caja de Valores''), the Statutory La ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bolsa De Valores De Caracas (emblem)

The Caracas Stock Exchange or Bolsa de Valores de Caracas (BVC) is a stock exchange located in Caracas, Venezuela. Established in 1947, BVC merged with a competitor in 1974. Operational and Legal Structure BVC is a private exchange, providing operations for the purchase and authorized sale of securities according to the Capital Marketing Laws of Venezuela. It is member of the Executive Committee of the Latin American Federation of Stock markets. At the exchange, companies emit by procedures authorized by the regulating authorities, instruments of fixed income and securities (''renta fija y de renta variable'') with the purpose of securing capital from public investors. BVC is also used as a location for trading in Bonds and other debt instruments. The legal structure prevailing in the Venezuelan capital market are the Securities Marketing Law (''la Ley de Mercado de Capitales'', enacted in 1975 and amended in 1998), Transaction Law (''Ley de Caja de Valores''), the Statutory ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ministry Of Economy And Finance (Venezuela)

The Ministry of Economy and Finance (''Ministerio del Poder Popular de Economía y Finanzas'', in Spanish, literally, "Ministry of People's Power for the Economy and Finance") is a ministry of the government of Venezuela with similar portfolios dating back to 1810 with the creation of a tax office. When Gran Colombia was dissolved and Venezuela assumed its independence, the Ministry of Finance was created in 1830 when General José Antonio Páez commissioned the establishment of the public business office to three Secretariats of State: Interior, Justice and Police, War and Navy, Finance, and Foreign Relations. The current minister has been Delcy Rodríguez since September 2020. Ministers of Finance when part Gran Colombia * Manuel Palacios Fajardo, 1819 *Pedro Gual Escandón, 1819-1821 * Luis Eduardo Azuela, 1821 *José María del Castillo y Rada, 1821-1828 * Nicolas M. Tanco, 1828-1829 *José Ignacio de Márquez, 1830 * Gerónimo Mendoza, 1830 Ministers of Finance of Venezuela ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1947

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into Personal finance, personal, Corporate finance, corporate, and public finance. In a financial system, assets are bought, sold, or traded as Financial instrument, financial instruments, such as Currency, currencies, Loan, loans, Bond (finance), bonds, Share (finance), shares, Stock, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be Bank, banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. A broad range of subfields within finance ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Of Venezuela

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Venezuela

The economy of Venezuela is based primarily on petroleum, making the country the 25th largest producer of oil in the world and the 8th largest member of OPEC. Venezuela also manufactures and exports heavy industry products such as steel, aluminum, and cement. Other notable manufacturing includes electronics and automobiles as well as beverages and foodstuffs. Agriculture in Venezuela accounts for approximately 4.7% of GDP, 7.3% of the labor force and at least one-fourth of Venezuela's land area. Venezuela exports rice, corn, fish, tropical fruit, coffee, pork and beef. Venezuela has an estimated United States dollar, USD$14.3 trillion worth of natural resources and is not self-sufficient in most areas of agriculture. Exports accounted for 16.7% of GDP and petroleum products accounted for about 95% of those exports. Since the 1920s, Venezuela has been a rentier state, offering oil as its main export. From the 1950s to the early 1980s, the Venezuelan economy experienced a steady ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchanges In South America

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

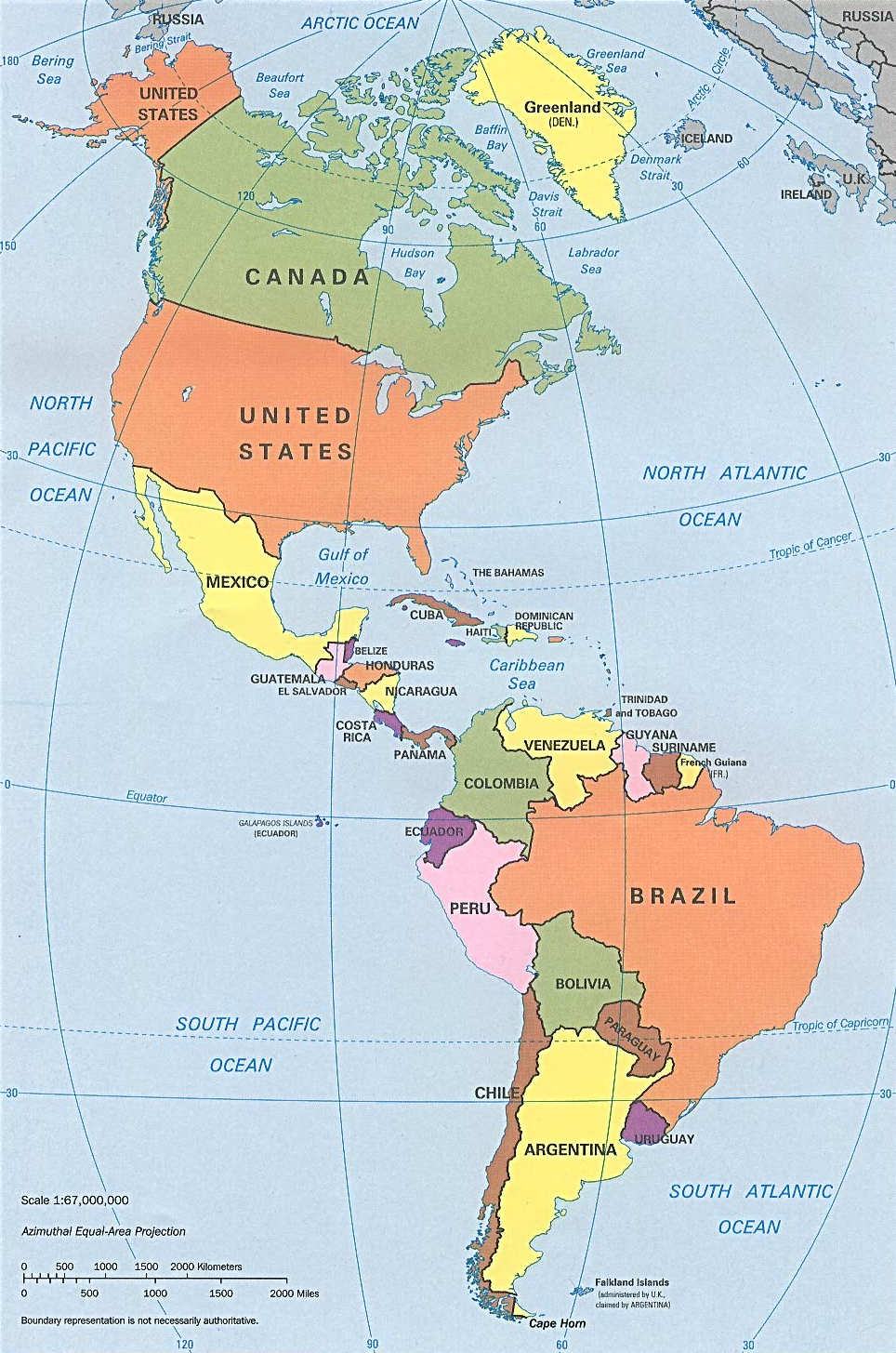

List Of Stock Exchanges In The Americas

This is a list of active stock exchanges in the Americas. Stock exchanges in Latin America (where Spanish and Portuguese prevail) use the term ''Bolsa de Valores'', meaning "bag" or "purse" of "values". (compare Börse in German or bourse in French). The Caribbean has one major regional stock exchange: the Eastern Caribbean Securities Exchange (ECSE), which serves Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines. The service area of the ECSE corresponds to the service area of the Eastern Caribbean Central Bank, with which it is associated. Stock exchanges in the Americas Former exchanges Major exchange mergers See also * List of futures exchanges * List of stock exchanges External linksWorld-Stock-Exchange.net list of Stock Markets in South America References {{DEFAULTSORT:Stock Exchanges In The Americas, List Of * * * * Americas-related lists Americas The Americas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vancouver Stock Exchange

The Vancouver Stock Exchange (VSE) was a stock exchange based in Vancouver, British Columbia. It was incorporated 1906. On November 29, 1999 the VSE was merged into the Canadian Venture Exchange (CDNX). History It was incorporated 1906 and was the third major stock exchange in Canada, after the Toronto Stock Exchange (TSX) and Montreal Stock Exchange (MSE), and featured many small-capitalization, mining, oil and gas-exploration stocks. In 1989, ''Forbes'' magazine labelled the VSE the "scam capital of the world." In 1991, it listed some 2,300 stocks. Some local figures stated that the majority of these stocks were either total failures or frauds. A 1994 report by James Matkin (Vancouver Stock Exchange & Securities Regulation Commission) made reference to "shams, swindles and market manipulations" within the VSE. Regardless, it had roughly C$4 billion in annual trading in 1991. On November 29, 1999 the VSE was merged into the Canadian Venture Exchange (CDNX) (now known as the TSX ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Finance Corporation

The International Finance Corporation (IFC) is an international financial institution that offers investment, advisory, and asset-management services to encourage private-sector development in less developed countries. The IFC is a member of the World Bank Group and is headquartered in Washington, D.C. in the United States. It was established in 1956, as the private-sector arm of the World Bank Group, to advance economic development by investing in for-profit and commercial projects for poverty reduction and promoting development. The IFC's stated aim is to create opportunities for people to escape poverty and achieve better living standards by mobilizing financial resources for private enterprise, promoting accessible and competitive markets, supporting businesses and other private-sector entities, and creating jobs and delivering necessary services to those who are poverty stricken or otherwise vulnerable. Since 2009, the IFC has focused on a set of development goals that it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Depositary Receipt

An American depositary receipt (ADR, and sometimes spelled ''depository'') is a negotiable security that represents securities of a foreign company and allows that company's shares to trade in the U.S. financial markets. Shares of many non-U.S. companies trade on U.S. stock exchanges through ADRs, which are denominated and pay dividends in U.S. dollars, and may be traded like regular shares of stock. ADRs are also traded during U.S. trading hours, through U.S. broker-dealers. ADRs simplify investing in foreign securities because the depositary bank "manage all custody, currency and local taxes issues". The first ADR was introduced by J.P. Morgan in 1927 for the British retailer Selfridges on the New York Curb Exchange, the American Stock Exchange's precursor. They are the U.S. equivalent of a global depository receipt (GDR). Securities of a foreign company that are represented by an ADR are called American depositary shares (ADSs). Depositary receipts ADRs are one type of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. Ho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shareholders

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself. The influence of a shareholder on the business is determined by the shareholding percentage owned. Shareholders of a corporation are legally separate from the corporation itself. They are generally not liable for the corporation's debts, and the shareholders' liability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_per_capita_in_2020.png)