|

Capitated Reimbursement

Capitation is a payment arrangement for health care service providers. It pays a set amount for each enrolled person assigned to them, per period of time, whether or not that person seeks care. The amount of remuneration is based on the average expected health care utilization of that patient, with payment for patients generally varying by age and health status. Types There are differing arrangements in different healthcare systems. Capitation in the USA Primary capitation is a relationship between a managed care organization and primary care physician, in which the physician is paid directly by the organization for those who have selected the physician as their provider. Secondary capitation is a relationship arranged by a managed care organization between a physician and a secondary or specialist provider, such as an X-ray facility or ancillary facility such as a durable medical equipment supplier whose secondary provider is also paid capitation based on that PCP's enrolled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Care

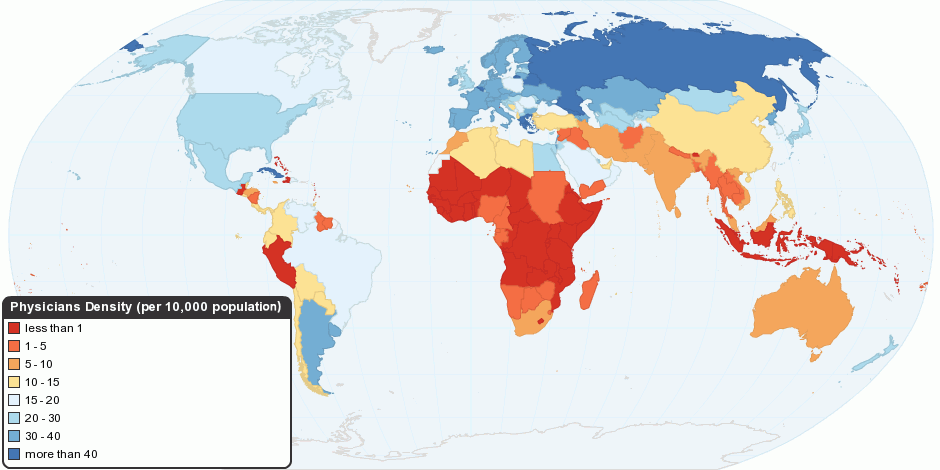

Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration or cure of disease, illness, injury, and other physical and mental impairments in people. Health care is delivered by health professionals and allied health fields. Medicine, dentistry, pharmacy, midwifery, nursing, optometry, audiology, psychology, occupational therapy, physical therapy, athletic training, and other health professions all constitute health care. It includes work done in providing primary care, secondary care, and tertiary care, as well as in public health. Access to health care may vary across countries, communities, and individuals, influenced by social and economic conditions as well as health policies. Providing health care services means "the timely use of personal health services to achieve the best possible health outcomes". Factors to consider in terms of health care access include financial limitations (such as insurance coverage), geo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Economics

Health economics is a branch of economics concerned with issues related to efficiency, effectiveness, value and behavior in the production and consumption of health and healthcare. Health economics is important in determining how to improve health outcomes and lifestyle patterns through interactions between individuals, healthcare providers and clinical settings. In broad terms, health economists study the functioning of healthcare systems and health-affecting behaviors such as smoking, diabetes, and obesity. One of the biggest difficulties regarding healthcare economics is that it does not follow normal rules for economics. Price and Quality are often hidden by the third-party payer system of insurance companies and employers. Additionally, QALY (Quality Adjusted Life Years), one of the most commonly used measurements for treatments, is very difficult to measure and relies upon assumptions that are often unreasonable. A seminal 1963 article by Kenneth Arrow is often cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pay For Performance (healthcare)

In the healthcare industry, pay for performance (P4P), also known as "value-based purchasing", is a payment model that offers financial incentives to physicians, hospitals, medical groups, and other healthcare providers for meeting certain performance measures. Clinical outcomes, such as longer survival, are difficult to measure, so pay for performance systems usually evaluate process quality and efficiency, such as measuring blood pressure, lowering blood pressure, or counseling patients to stop smoking. This model also penalizes health care providers for poor outcomes, medical errors, or increased costs. Integrated delivery systems where insurers and providers share in the cost are intended to help align incentives for value-based care. Professional societies in the United States have given qualified approval to incentive programs, but express concern with the validity of quality indicators, patient and physician autonomy and privacy, and increased administrative burdens. Studie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Managed Care

The term managed care or managed healthcare is used in the United States to describe a group of activities intended to reduce the cost of providing health care and providing American health insurance while improving the quality of that care ("managed care techniques"). It has become the predominant system of delivering and receiving American health care since its implementation in the early 1980s, and has been largely unaffected by the Affordable Care Act of 2010. ...intended to reduce unnecessary health care costs through a variety of mechanisms, including: economic incentives for physicians and patients to select less costly forms of care; programs for reviewing the medical necessity of specific services; increased beneficiary cost sharing; controls on inpatient admissions and lengths of stay; the establishment of cost-sharing incentives for outpatient surgery; selective contracting with health care providers; and the intensive management of high-cost health care cases. The p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fee-for-service

Fee-for-service (FFS) is a payment model where services are unbundled and paid for separately. In health care, it gives an incentive for physicians to provide more treatments because payment is dependent on the quantity of care, rather than quality of care. However evidence of the effectiveness of FFS in improving health care quality is mixed, without conclusive proof that these programs either succeed or fail. Similarly, when patients are shielded from paying (cost-sharing) by health insurance coverage, they are incentivized to welcome any medical service that might do some good. Fee-for-services raises costs, and discourages the efficiencies of integrated care. A variety of reform efforts have been attempted, recommended, or initiated to reduce its influence (such as moving towards bundled payments and capitation). In capitation, physicians are not incentivized to perform procedures, including necessary ones, because they are not paid anything extra for performing them. FFS is t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bundled Payment

Bundled payment is the reimbursement of health care providers (such as hospitals and physicians) "on the basis of expected costs for defined episodes of care." It has been described as "a middle ground" between fee-for-service reimbursement (in which providers are paid for each service rendered to a patient) and capitation (in which providers are paid a "lump sum" per patient regardless of how many services the patient receives), given that risk is shared between payer and provider. Bundled payments have been proposed in the health care reform debate in the United States as a strategy for reducing health care costs, especially during the Obama administration (2009–2016). Commercial payers have shown interest in bundled payments in order to reduce costs. In 2012, it was estimated that approximately one-third of the United States healthcare reimbursement used bundled methodology. Terminology Also known as episode-based payment, episode payment, episode-of-care payment, case rate, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities underwriting In the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Care Physician

A primary care physician (PCP) is a physician who provides both the first contact for a person with an undiagnosed health concern as well as continuing care of varied medical conditions, not limited by cause, organ system, or diagnosis. The term is primarily used in the United States. In the past, the equivalent term was 'general practitioner' in the US; however in the United Kingdom and other countries the term general practitioner is still used. A core element in general practice is continuity that bridges episodes of various illnesses. Greater continuity with a general practitioner has been shown to reduce the need for out-of-hours services and acute hospital admittance. Furthermore, continuity by a general practitioner reduces mortality. All physicians first complete medical school ( MD, MBBS, or DO). To become primary care physicians, medical school graduates then undertake postgraduate training in primary care programs, such as family medicine (also called family practi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |