|

Capital Rule

The capital rule is a British rule for determining eligibility for social security benefits. The means tested social security system in the United Kingdom has always operated an eligibility test for savings. The Poor law required claimants to be destitute but there does not appear to be any documentation about how the test of destitution was applied. The great increase in home-ownership during the twentieth century in the UK necessitated detailed rules about how a claimant's capital should be treated. Since at least 1948 the value of a claimant's home has been disregarded in assessing their resources. Capital has always been assessed on a household basis, that is jointly for a couple, whether or not married. The capital of any dependent children is normally disregarded. The National Assistance Act 1948 ( 11 & 12 Geo. 6. c. 29) established that the value of the claimant's home should be disregarded, as were war savings and up to £375 in savings. Capital in excess of £50 but be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Social Security In The UK

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system. History Before the official establishment of the modern welfare state, clear examples of social welfare existed to help the poor and vulnerable within British society. A key date in the welfare state's history is 1563; when Queen Elizabeth I's government encouraged the wealthier members of society to give to the poor, by passing the Poor Act 1562. The welfare state in the modern sense was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the Poor Relief Act 1601 (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Poor Law

In English and British history, poor relief refers to government and ecclesiastical action to relieve poverty. Over the centuries, various authorities have needed to decide whose poverty deserves relief and also who should bear the cost of helping the poor. Alongside ever-changing attitudes towards poverty, many methods have been attempted to answer these questions. Since the early 16th century legislation on poverty enacted by the Parliament of England, poor relief has developed from being little more than a systematic means of punishment into a complex system of government-funded support and protection, especially following the creation in the 1940s of the welfare state. Tudor era In the late 15th century, Parliament took action on the growing problem of poverty, focusing on punishing people for being " vagabonds" and for begging. In 1495, during the reign of King Henry VII, Parliament enacted the Vagabonds and Beggars Act 1494. This provided for officers of the law to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Home-ownership

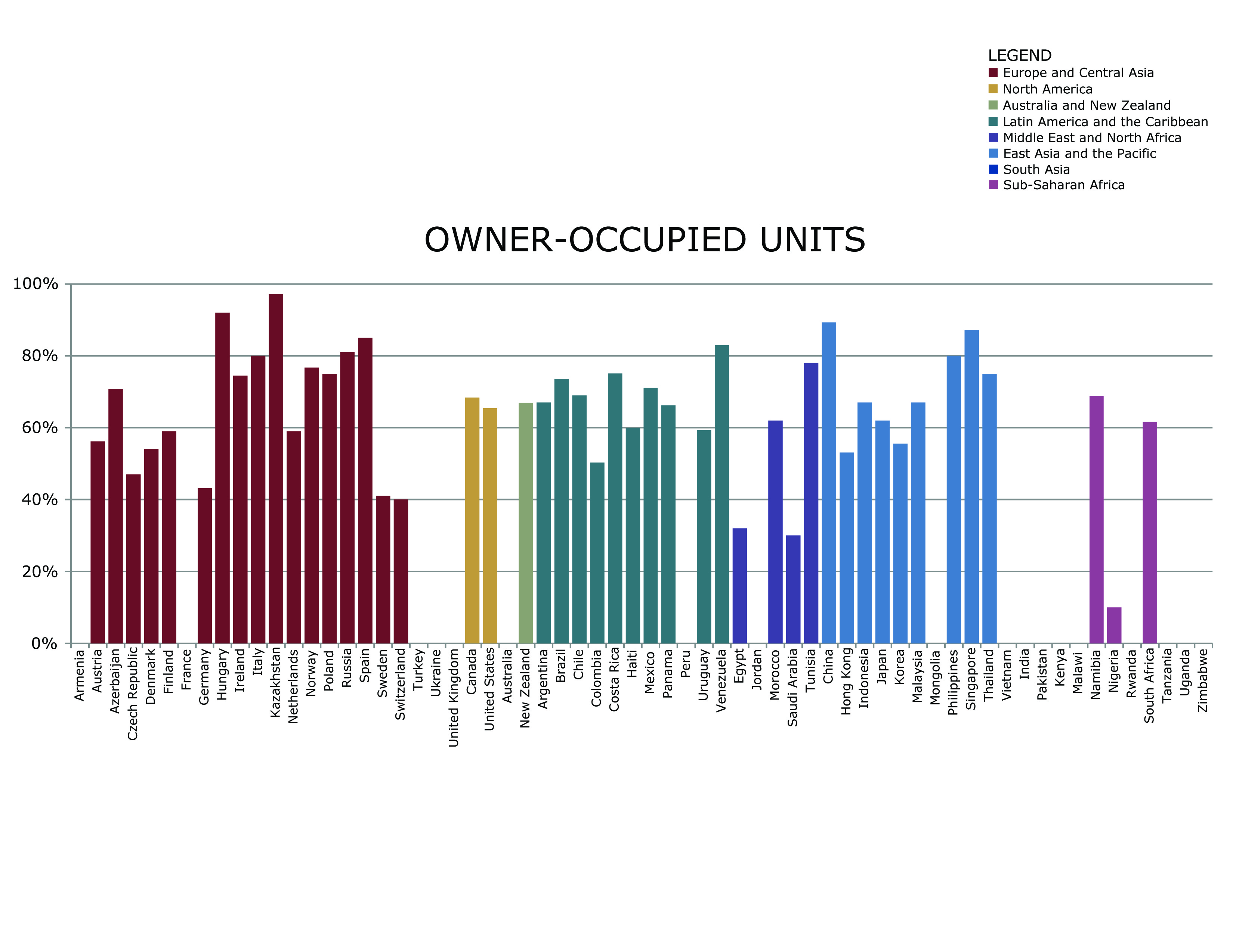

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the homeowner fail ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

National Assistance Act 1948

The National Assistance Act 1948 ( 11 & 12 Geo. 6. c. 29) is an act of Parliament passed in the United Kingdom by the Labour government of Clement Attlee. It formally abolished the Poor Law system that had existed since the reign of Elizabeth I, and established a social safety net for those who did not pay national insurance contributions (such as the homeless, the physically disabled, and unmarried mothers) and were therefore left uncovered by the National Insurance Act 1946 and the National Insurance (Industrial Injuries) Act 1946. It also provided help to elderly people who required supplementary benefits to make a subsistence living, and obliged local authorities to provide suitable accommodation for those who through infirmity, age, or any other reason were "in need of care and attention not otherwise available to them". The legislation also empowered local authorities to grant financial aid to organizations of volunteers concerned with the provision of recreational facilit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

11 & 12 Geo

Eleven or 11 may refer to: *11 (number) * One of the years 11 BC, AD 11, 1911, 2011 Literature * ''Eleven'' (novel), a 2006 novel by British author David Llewellyn *''Eleven'', a 1970 collection of short stories by Patricia Highsmith *''Eleven'', a 2004 children's novel in The Winnie Years by Lauren Myracle *''Eleven'', a 2008 children's novel by Patricia Reilly Giff *''Eleven'', a short story by Sandra Cisneros Music * Eleven (band), an American rock band * Eleven: A Music Company, an Australian record label *Up to eleven, an idiom from popular culture, coined in the movie ''This Is Spinal Tap'' Albums * ''11'' (The Smithereens album), 1989 * ''11'' (Ua album), 1996 * ''11'' (Bryan Adams album), 2008 * ''11'' (Sault album), 2022 * ''Eleven'' (Harry Connick, Jr. album), 1992 * ''Eleven'' (22-Pistepirkko album), 1998 * ''Eleven'' (Sugarcult album), 1999 * ''Eleven'' (B'z album), 2000 * ''Eleven'' (Reamonn album), 2010 * ''Eleven'' (Martina McBride album), 2011 * ''Eleven'' (Mr F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Supplementary Benefit

Supplementary Benefit was a means-tested benefit in the United Kingdom, paid to people on low incomes, whether or not they were classed as unemployed, such as pensioners, the sick and single parents. Introduced in November 1966, it replaced the earlier system of discretionary National Assistance payments and was intended to 'top up' other benefits, hence its name. To qualify a claimant had to demonstrate that their capital was below the limit, £6,000, and that their weekly income was less than their requirements, as calculated in accordance with the benefits regulations. The Supplementary Benefits Commission was established alongside the Ministry of Social Security by the Ministry of Social Security Act 1966 to work to administer the new benefits. Richard Titmuss was appointed vice-chair of the Commission. In 1968 the Ministry of Social Security was incorporated into the new Department of Health and Social Security (DHSS). The benefit was paid weekly, through giro cheque ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Income Support

Income Support is an income-related benefit in the United Kingdom for some people who are on a low income, but have a reason for not actively seeking work. Claimants of Income Support may be entitled to certain other benefits, for example, Housing Benefit, Council Tax Reduction, Child Benefit, Carer's Allowance, Child Tax Credit and help with health costs. A person with capital over £16,000 cannot get Income Support, and savings over £6,000 affect how much Income Support can be received. Claimants must be between 16 and Pension Credit age, work fewer than 16 hours a week, and have a reason why they are not actively seeking work (caring for a child under 5 years old or someone who receives a specified disability benefit). Lone parents Claimants can receive income support if they are a lone parent and responsible for a child under five who is a member of their household. A claimant is considered responsible for a child in any week if receiving child benefit for the child. How ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Housing Benefit

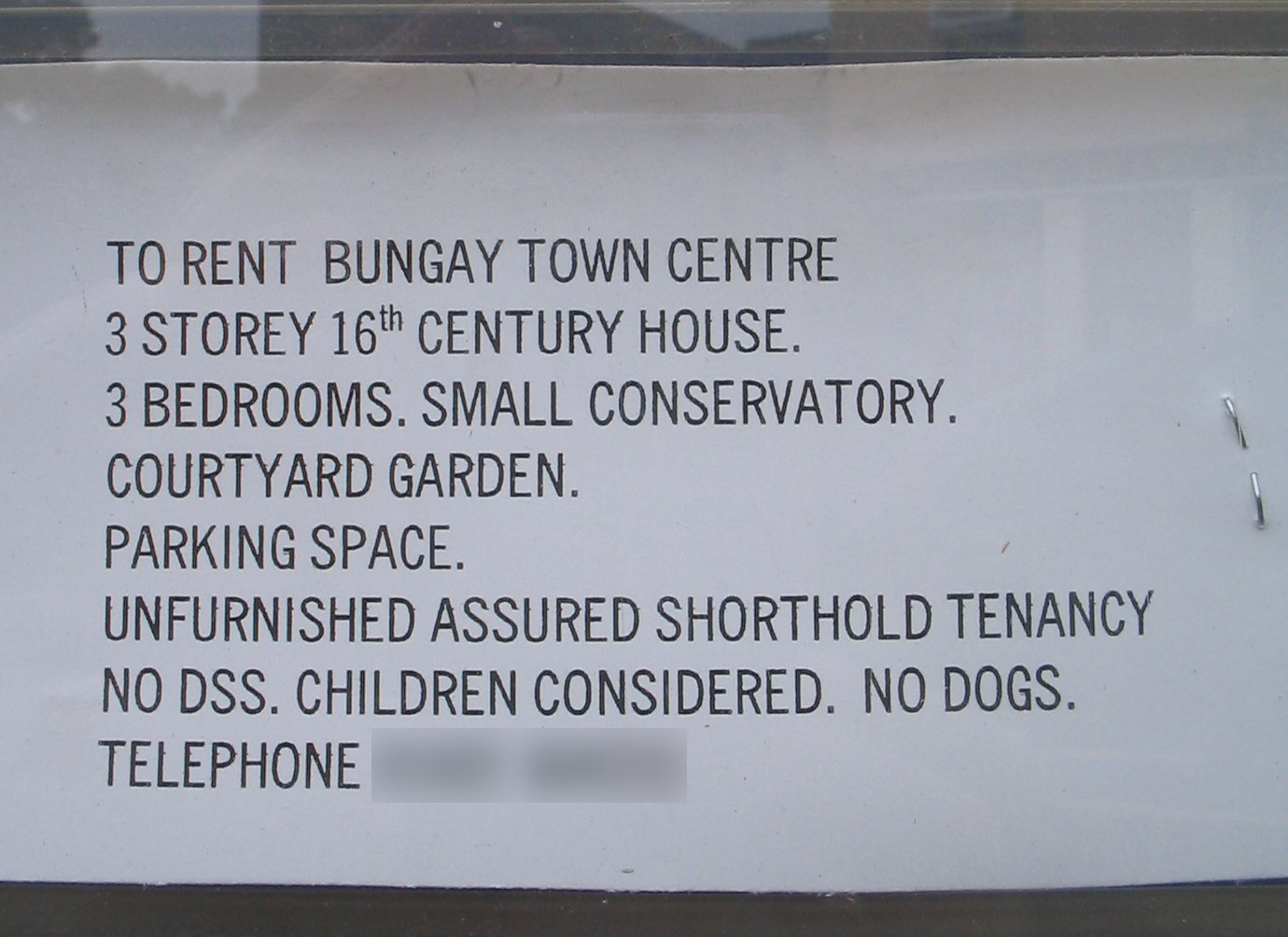

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state pension, totalling £23.8 billion in 2013–14. The primary legislation governing Housing Benefit is the Social Security Contributions and Benefits Act 1992. Operationally, the governing regulations are statutory instruments arising from that Act. It is governed by one of two sets of regulations. For working age claimants it is governed by the "Housing Benefit Regulations 2006", but for those who have reached the qualifying age for Pension Credit (regardless of whether it has been claimed) it is governed by the "Housing Benefit (Persons who have attained the qualifying age for state pension credit) Regulations 2006". It is normally administered by the local authority in whose area the property being rented lies. In some circumstance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Universal Credit

Universal Credit is a United Kingdom based Welfare state in the United Kingdom, social security payment. It is Means test, means-tested and is replacing and combining six benefits, for working-age households with a low income: income-related Employment and Support Allowance (ESA), income-based Jobseeker's Allowance (JSA), and Income Support; Child Tax Credit (CTC) and Working Tax Credit (WTC); and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or for having limited capability to work-related activities, due to illness or disability. The new policy was announced in 2010 at the Conservative Party (UK), Conservative Party annual party conference, conference by the Work and Pensions Secretary, Iain Du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |