|

CBZ Bank

CBZ Bank Limited, also CBZ Bank, is a commercial bank in Zimbabwe. It is one of the financial services institutions licensed by the Reserve Bank of Zimbabwe, the central bank and national banking regulator. Location The headquarters and main branch of the bank are located on the 3rd Floor of Union House, at 60 Kwame Nkrumah Avenue, in downtown Harare, the capital and largest city in Zimbabwe. The geographical coordinates of the bank's headquarters are: 17°49'40.0"S, 31°02'55.0"E (Latitude:-17.827778; Longitude:31.048611). Overview , the bank was the largest financial services provider in Zimbabwe, ahead of FBC Bank, Barclays Bank Zimbabwe, Stanbic Bank Zimbabwe and Standard Chartered Zimbabwe. At that time, CBZ Bank's total assets were valued in excess of US$1.992 billion with shareholders' equity of US$188.11 million. History The bank was founded in 1980 as the Bank of Credit and Commerce Zimbabwe Limited (BCCZL). In 1991, BCCZL ran into financial difficulty and faced liq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harare

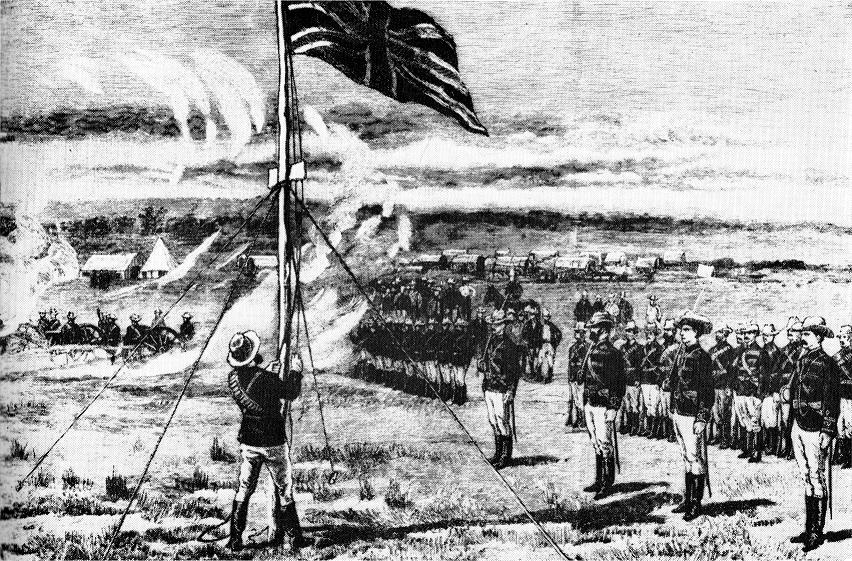

Harare (; formerly Salisbury ) is the capital and most populous city of Zimbabwe. The city proper has an area of 940 km2 (371 mi2) and a population of 2.12 million in the 2012 census and an estimated 3.12 million in its metropolitan area in 2019. Situated in north-eastern Zimbabwe in the country's Mashonaland region, Harare is a metropolitan province, which also incorporates the municipalities of Chitungwiza and Epworth. The city sits on a plateau at an elevation of above sea level and its climate falls into the subtropical highland category. The city was founded in 1890 by the Pioneer Column, a small military force of the British South Africa Company, and named Fort Salisbury after the UK Prime Minister Lord Salisbury. Company administrators demarcated the city and ran it until Southern Rhodesia achieved responsible government in 1923. Salisbury was thereafter the seat of the Southern Rhodesian (later Rhodesian) government and, between 1953 and 1963, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Zimbabwe

The politics of Zimbabwe takes place in a framework of a full presidential republic, whereby the President is the head of state and government as organized by the 2013 Constitution. Executive power is exercised by the government. Legislative power is vested in both the government and parliament. The status of Zimbabwean politics has been thrown into question by a 2017 coup. Political developments since the Lancaster House Agreement The Zimbabwean Constitution, initially from the Lancaster House Agreement a few months before the 1980 elections, chaired by Lord Carrington, institutionalises majority rule and protection of minority rights. Since independence, the Constitution has been amended by the government to provide for: *The abolition of seats reserved for whites in the country's parliament in 1987; [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1980

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Zimbabwe

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Harare

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Zimbabwe

The economy of Zimbabwe mainly relies on the tertiary sector of the economy, also known as the service sector of the economy, which makes up to 60% of total GDP as of 2017. Zimbabwe has the second biggest Informal economy in the world as a percentage of its economy, with a score of 60.6%.https://www.herald.co.zw/zim-has-worlds-second-largest-informal-economy-imf/ /ref> Agriculture and mining largely contribute to exports. After continuous negative growth between 1999 and 2008, the economy of Zimbabwe grew at a meteoric annual rate of 34% from 2008 to 2013, rendering it the fastest-growing economy in the world. Its economy then stagnated again through 2020, before seeing another extremely sharp increase (45%) in the most recent year. The country has reserves of metallurgical-grade Chromite. Other commercial mineral deposits include Coal, asbestos, copper, nickel, gold, platinum and Iron ore. Current economic conditions In 2000, Zimbabwe planned a land redistribution act to co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks In Zimbabwe

This is a list of "Operating Banking Institutions" in Zimbabwe. # Agricultural Development Bank of Zimbabwe # BancABC Zimbabwe # CABS # CBZ Bank Limited # First Capital Bank Limited # Ecobank Zimbabwe Limited # FBC Bank Limited # Nedbank Zimbabwe Limited # Metbank # NMB Bank Limited # Stanbic Bank Zimbabwe Limited # Standard Chartered Bank Zimbabwe Limited # Steward Bank # ZB Bank Limited # Tetrad Investment Bank Limited # FBC Building Society # National Building Society # ZB Building Society # People's Own Savings Bank # Infrastructure Development Bank of Zimbabwe # Small and Medium Enterprises Development Corporation. # Time Bank See also *Economy of Zimbabwe *List of banks in Africa *Reserve Bank of Zimbabwe References External linksZimbabwe Banking Banking Sector Profits Double {{Economy of Zimbabw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Mutual

Old Mutual Limited is a pan-African investment, savings, insurance, and banking group. It is listed on the Johannesburg Stock Exchange, the Zimbabwe Stock Exchange, the Namibian Stock Exchange and the Botswana Stock Exchange. It was founded in South Africa by John Fairbairn in 1845 and was demutualised and listed on the London Stock Exchange and other stock exchanges in 1999. It introduced a new strategy, called 'managed separation', that entailed the separation of its four businesses – Old Mutual Emerging Markets, Nedbank, UK-based Old Mutual Wealth and Boston-based Old Mutual Asset Management (OMAM) – into standalone entities in 2018. This led to the demerger of Quilter plc (formerly 'Old Mutual Wealth') and the unbundling of its shareholding in Nedbank. The business, which is now largely based in South Africa, provides sponsorship and supports bursaries at South African universities. History The company was founded in 1845 as a mutual insurance company by John Fairbai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Libyan Foreign Bank

Libyan Foreign Bank (LFB) was established in 1972 in Tripoli, Libya as Libyan Arab Foreign Bank; it was renamed Libyan Foreign Bank in 2005. It was Libya's first offshore banking institution licensed to operate internationally. The Central Bank of Libya owns 100% of LFB. The head office is located in Libya's capital Tripoli. Since 2010, the bank owns 84% of British Arab Commercial Bank, and 68% of Banca UBAE (Est. 1972) in Rome.On 12 March 2011, the Bank of Italy placed Banca UBAE under special administration following the European Council's decision to freeze Libyan banking assets. The intent was to ensure that the bank could continue to operate normally, and in conformity with international policies. Operations LFB provides services and operations to facilitate international trade, money flows for investment and payment, and loans to government and official institutions as well as to the private sectors. Its international services comprise insurance and confirmation of letters ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zimbabwe Stock Exchange

The Zimbabwe Stock Exchange, or ZSE, is the official stock exchange of Zimbabwe. Its history dates back to 1896 but has only been open to foreign investment since 1993. The exchange has about a dozen members, and currently lists 63 equities. There are two primary indices, the ZSE All Share and the ZSE Top 10. History The first stock exchange in Zimbabwe opened shortly after the arrival of the Pioneer Column in Bulawayo in 1896. However, it only operated for about six years. Other stock exchanges were established in Gwelo (Gweru) and Umtali (Mutare). The Mutare Exchange, also opened in 1896, thrived on the success of local mining, but with the realization that deposits in the area were not extensive, activity declined and it closed in 1924. After World War II, a new exchange was founded in Bulawayo by Alfred Mulock Bentley and dealing started in January 1946. A second floor was opened in Salisbury (Harare) in December 1951 and trading between the two centers took place by tele ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CBZ Holdings

CBZ Holdings, whose full name is CBZ Holdings Limited, is a financial services conglomerate in Zimbabwe. It owns subsidiaries in banking, insurance, investments, wealth management, mortgages and retail finance. Location The headquarters of the financial services conglomerate are located on the 3rd Floor of Union House, at 60 Kwame Nkrumah Avenue, in downtown Harare, the capital and largest city in Zimbabwe. The geographical coordinates of the bank's headquarters are: 17°49'40.0"S, 31°02'55.0"E (Latitude:-17.827778; Longitude:31.048611). Overview , CBZ Holdings Limited is a large financial services conglomerate in Zimbabwe, with an asset base in excess of US$2.192 billion, and shareholders' equity in excess of US$309.69 million. History The flagship business of the Group, CBZ Bank Limited, was founded in 1980. It was taken over by the Government of Zimbabwe in 1991, to avert looming liquidation and was renamed Commercial Bank of Zimbabwe Limited. The company was listed on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |