|

Online Banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website. The online banking system will typically connect to or be part of the core banking system operated by a bank to provide customers access to banking services in addition to or in place of traditional branch banking. Online banking significantly reduces the banks' operating cost by reducing reliance on a branch network and offers greater convenience to some customers by lessening the need to visit a branch bank as well as the convenience of being able to perform banking transactions even when branches are closed. Internet banking provides personal and corporate banking services offering features such as viewing account balances, obtaining statements, checking recent transactions, transferring money between accounts, and mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Payment System

An e-commerce payment system (or an electronic payment system) facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking. Credit cards remain the most common forms of payment for e-commerce transactions. As of 2008, in North America, almost 90% of online retail transactions were made with this payment type.Turban, E. King, D. McKay, J. Marshall, P. Lee, J & Vielhand, D. (2008). Electronic Commerce 2008: A Managerial Perspective. London: Pearson Education Ltd. p.550 It is difficult for an online retailer to operate without supporting credit and debit cards due to their widespread use. Online merchants must comply with stringent rules stipulated by the credit and debit card issuers (e.g. Visa Inc., Visa and Mastercard) in accordance with a bank regulation, bank and financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Videotex

Videotex (or interactive videotex) was one of the earliest implementations of an end-user information system. From the late 1970s to early 2010s, it was used to deliver information (usually pages of text) to a user in computer-like format, typically to be displayed on a television or a dumb terminal. In a strict definition, videotex is any system that provides interactive content and displays it on a video monitor such as a television, typically using modems to send data in both directions. A close relative is teletext, which sends data in one direction only, typically encoded in a television signal. All such systems are occasionally referred to as ''viewdata''. Unlike the modern Internet, traditional videotex services were highly centralized. Videotex in its broader definition can be used to refer to any such service, including teletext, the Internet, bulletin board systems, online service providers, and even the arrival/departure displays at an airport. This usage is no longe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neobanks

A neobank (also known as an online bank, internet-only bank, virtual bank or digital bank) is a type of direct bank that operates exclusively online without traditional physical branch networks. The term "challenger bank" is used in the UK to refer to a number of fintech banking startups that emerged in the wake of the 2007–2009 financial crisis. Their services may be accessed by clients through their respective computers or mobile devices. The range of services provided by neobanks is not as broad as that of their traditional counterparts. Unlike incumbent banks, a large portion of the income of neobanks is mainly made up of transaction fees received when customers pay with their debit card. History The term ''neobank'' has been in use since at least 2016 to describe fintech-based financial providers that were challenging traditional banks. There were two main types of company that provided services digitally: companies that applied for their own banking license and compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gartner

Gartner, Inc is a technological research and consulting firm based in Stamford, Connecticut that conducts research on technology and shares this research both through private consulting as well as executive programs and conferences. Its clients include large corporations, government agencies, technology companies, and investment firms. In 2018, the company reported that its client base consisted of over 12,000 organizations in over 100 countries. As of 2022, Gartner has over 15,000 employees located in over 100 offices worldwide. It is a member of the S&P 500. History Gideon Gartner founded Gartner, Inc in 1979. Originally private, the company launched publicly as Gartner Group in 1986 before Saatchi & Saatchi acquired it in 1988. In 1990, Gartner Group was acquired by some of its executives, including Gartner himself, with funding from Bain Capital and Dun & Bradstreet. The company went public again in 1993. In 2000, the name was simplified from ''Gartner Group'' to Gartn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Year 2000 Problem

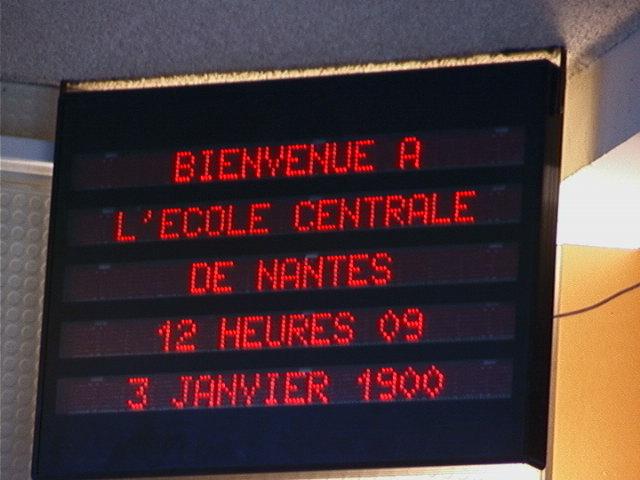

The year 2000 problem, also known as the Y2K problem, Y2K scare, millennium bug, Y2K bug, Y2K glitch, Y2K error, or simply Y2K refers to potential computer errors related to the Time formatting and storage bugs, formatting and storage of calendar data for dates in and after the year 2000. Many Computer program, programs represented four-digit years with only the final two digits, making the year 2000 indistinguishable from 1900. Computer systems' inability to distinguish dates correctly had the potential to bring down worldwide infrastructures for industries ranging from banking to air travel. In the years leading up to the turn of the century (millennium), the public gradually became aware of the "Y2K scare", and individual companies predicted the global damage caused by the bug would require anything between $400 million and $600 billion to rectify. A lack of clarity regarding the potential dangers of the bug led some to stock up on food, water, and firearms, purchase backup ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

McKinsey And Company

McKinsey & Company is a global management consulting firm founded in 1926 by University of Chicago professor James O. McKinsey, that offers professional services to corporations, governments, and other organizations. McKinsey is the oldest and largest of the " Big Three" management consultancies (MBB), the world's three largest strategy consulting firms by revenue. The firm mainly focuses on the finances and operations of their clients. Under the leadership of Marvin Bower, McKinsey expanded into Europe during the 1940s and 1950s. In the 1960s, McKinsey's Fred Gluck—along with Boston Consulting Group's Bruce Henderson, Bill Bain at Bain & Company, and Harvard Business School's Michael Porter—transformed corporate culture. A 1975 publication by McKinsey's John L. Neuman introduced the business practice of "overhead value analysis" that contributed to a downsizing trend that eliminated many jobs in middle management. McKinsey has a notoriously competitive hiring process, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Banking

Digital banking is part of the broader context for the move to online banking, where banking services are delivered over the internet. The shift from traditional to digital banking has been gradual and remains ongoing, and is constituted by differing degrees of banking service digitization. Digital banking involves high levels of process automation and web-based services and may include APIs enabling cross-institutional service composition to deliver banking products and provide transactions. It provides the ability for users to access financial data through desktop, mobile and ATM services. Description A digital bank represents a virtual process that includes online banking and beyond. As an end-to-end platform, digital banking must encompass the front end that consumers see, back end that bankers see through their servers and admin control panels and the middleware that connects these nodes. Ultimately, a digital bank should facilitate all functional levels of banking on all s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)