|

Market-based Environmental Policy Instruments

In environmental law and policy, market-based instruments (MBIs) are policy instruments that use markets, price, and other economic variables to provide incentives for polluters to reduce or eliminate negative environmental externalities. MBIs seek to address the market failure of externalities (such as pollution) by incorporating the external cost of production or consumption activities through taxes or charges on processes or products, or by creating property rights and facilitating the establishment of a proxy market for the use of environmental services. Market-based instruments are also referred to as economic instruments, price-based instruments, new environmental policy instruments (NEPIs) or new instruments of environmental policy. Examples include environmentally related taxes, charges and subsidies, emissions trading and other tradeable permit systems, deposit-refund systems, environmental labeling laws, licenses, and economic property rights. For instance, the European ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Law

Environmental law is a collective term encompassing aspects of the law that provide protection to the environment. A related but distinct set of regulatory regimes, now strongly influenced by environmental legal principles, focus on the management of specific natural resources, such as forests, minerals, or fisheries. Other areas, such as environmental impact assessment, may not fit neatly into either category, but are nonetheless important components of environmental law. History Early examples of legal enactments designed to consciously preserve the environment, for its own sake or human enjoyment, are found throughout history. In the common law, the primary protection was found in the law of nuisance, but this only allowed for private actions for damages or injunctions if there was harm to land. Thus, smells emanating from pigsties, strict liability against dumping rubbish, or damage from exploding dams. Private enforcement, however, was limited and found to be woefully in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Pricing Reform

Environmental pricing reform (EPR) or Ecological fiscal reform (EFR) is a fiscal policy of adjusting market prices to account for environmental costs and benefits; this is accomplished by the utilization of any forms of taxation or subsidy to incentivize or disincentivize practices with environmental impacts. An externality (a type of market failure) exists where a market price omits environmental costs and/or benefits. In such a situation, rational (self-interested) economic decisions can lead to environmental harm, as well as to economic distortions and inefficiencies. Environmental pricing reform can be economy-wide, or more focused (e.g. specific to a sector (such as electric power generation or mining) or a particular environmental issue (such as climate change). A " market-based instrument" or "economic instrument for environmental protection" is an individual instance of Environmental Pricing Reform. Examples include green tax-shifting (ecotaxation), tradeable pollution per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thin Market

Thin may refer to: * a lean body shape. ''(See also: emaciation, underweight)'' * ''Thin'' (film), a 2006 HBO documentary about eating disorders * Paper Thin (other), referring to multiple songs * Thin (web server), a Ruby web-server based on Mongrel * Thin (name) See also * * * Thin client, a computer in a client-server architecture network. * Thin film, a material layer of about 1 μm thickness. * Thin-film deposition, any technique for depositing a thin film of material onto a substrate or onto previously deposited layers * Thin film memory, high-speed variation of core memory developed by Sperry Rand in a government-funded research project * Thin-film optics, the branch of optics that deals with very thin structured layers of different materials * Thin layer chromatography (TLC), a chromatography technique used in chemistry to separate chemical compounds * Thin layers (oceanography), congregations of phytoplankton and zooplankton in the water column * Thin le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Induced Innovation

Induced innovation is a microeconomic hypothesis first proposed in 1932 by John Hicks in his work ''The Theory of Wages''. He proposed that "a change in the relative prices of the factors of production is itself a spur to invention, and to invention of a particular kind—directed to economizing the use of a factor which has become relatively expensive." Considerable literature has been produced on this hypothesis, which is often presented in terms of the effects of wage increases as an encouragement to labor-saving innovation. The hypothesis has also been applied to viewing increases in energy costs as a motivation for a more rapid improvement in energy efficiency of goods than would normally occur. Induced innovation in climate change A significant application of Hicks's theory can be found in the field of climate change. The exponential population growth occurred in the last century has drastically increased pressure on natural resources. In order to have a sustainable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Command And Control Regulation

Command and Control (CAC) regulation finds common usage in academic literature and beyond. The relationship between CAC and environmental policy is considered in this article, an area that demonstrates the application of this type of regulation. However, CAC is not limited to the environmental sector and encompasses a variety of different fields. Definition Command and Control (CAC) Regulation can be defined as “the direct regulation of an industry or activity by legislation that states what is permitted and what is illegal”.McManus, P. (2009) Environmental Regulation. Australia: Elsevier Ltd. This approach differs from other regulatory techniques, e.g. the use of economic incentives, which frequently includes the use of taxes and subsidies as incentives for compliance.Baldwin, R., Cave, M., Lodge, M. (2011) Understanding Regulation: Theory, Strategy and Practice. 2nd ed. Oxford: Oxford University Press The ‘command’ is the presentation of quality standards/targets by a gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Recycling

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of income by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Dividend

A double is a look-alike or doppelgänger; one person or being that resembles another. Double, The Double or Dubble may also refer to: Film and television * Double (filmmaking), someone who substitutes for the credited actor of a character * ''The Double'' (1934 film), a German crime comedy film * ''The Double'' (1971 film), an Italian film * ''The Double'' (2011 film), a spy thriller film * ''The Double'' (2013 film), a film based on the Dostoevsky novella * '' Kamen Rider Double'', a 2009–10 Japanese television series ** Kamen Rider Double (character), the protagonist in a Japanese television series of the same name Food and drink * Doppio, a double shot of espresso * Dubbel, a strong Belgian Trappist beer or, more generally, a strong brown ale * A drink order of two shots of hard liquor in one glass * A "double decker", a hamburger with two patties in a single bun Games * Double, action in games whereby a competitor raises the stakes ** , in contract bridge ** Doub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Compliance Costs

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. * Let t be the total tax liability. * Let i be the total tax base. ::= \frac. In a proportional tax, the tax rate is fixed and the average tax rate equals this tax rate. In case of tax brackets, commonly used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grandfathering

A grandfather clause, also known as grandfather policy, grandfathering, or grandfathered in, is a provision in which an old rule continues to apply to some existing situations while a new rule will apply to all future cases. Those exempt from the new rule are said to have grandfather rights or acquired rights, or to have been grandfathered in. Frequently, the exemption is limited, as it may extend for a set time, or it may be lost under certain circumstances; for example, a grandfathered power plant might be exempt from new, more restrictive pollution laws, but the exception may be revoked and the new rules would apply if the plant were expanded. Often, such a provision is used as a compromise or out of practicality, to allow new rules to be enacted without upsetting a well-established logistical or political situation. This extends the idea of a rule not being retroactively applied. Origin Southern United States The term originated in late nineteenth-century legislation and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

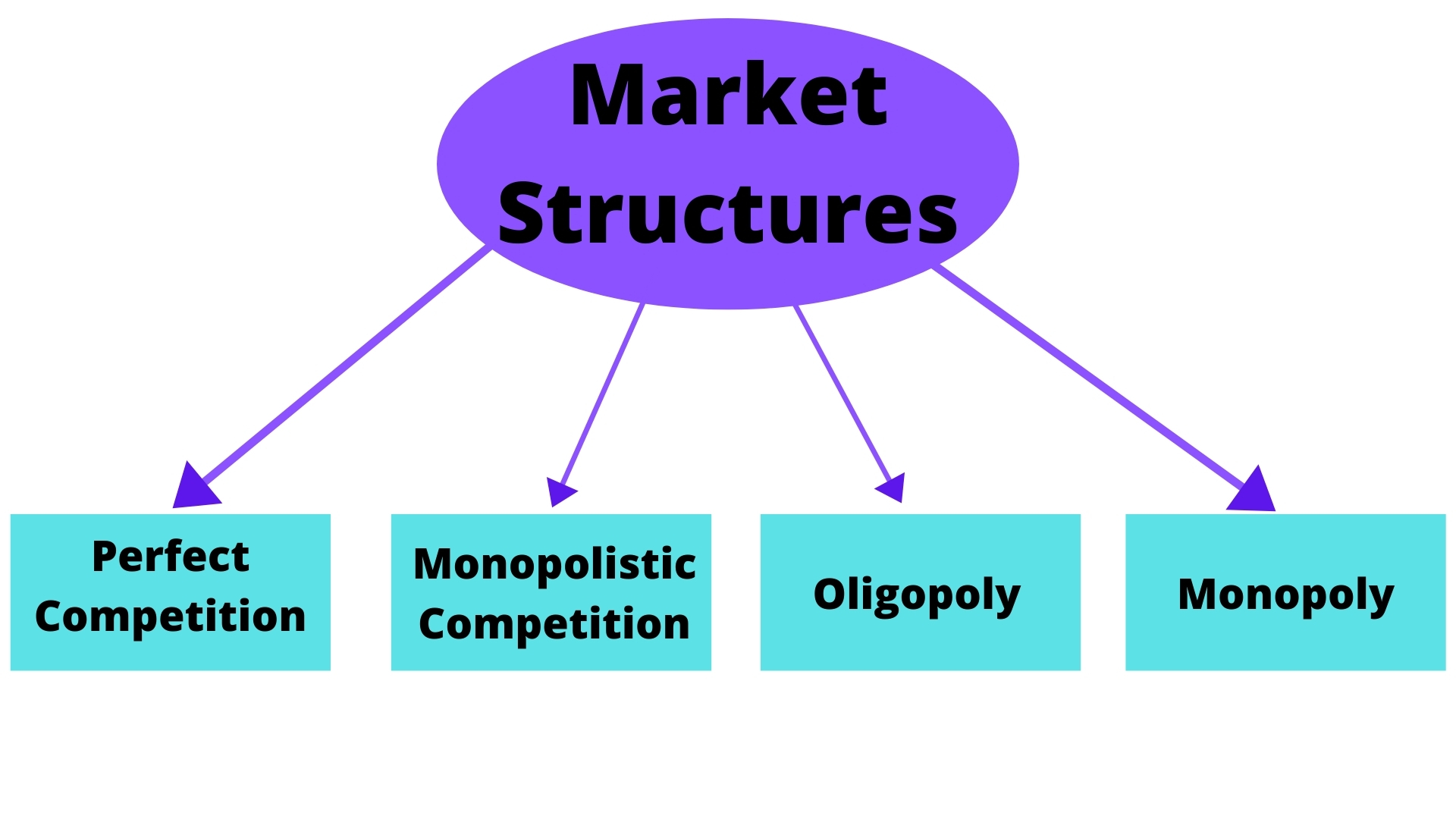

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity

{{SIA ...

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity, the ease with which an asset can be sold * Accounting liquidity, the ability to meet cash obligations when due * Liquid capital, the amount of money that a firm holds * Liquidity risk, the risk that an asset will have impaired market liquidity See also *Liquid (other) *Liquidation (other) Liquidation is the conversion of a business's assets to money in order to pay off debt. Liquidation may also refer to: * Murder * Fragmentation (music), a compositional technique * ''Liquidation'' (miniseries), a Russian television series See a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |