|

Income In The United States

__NOTOC__ Income in the United States is measured by the various federal agencies including the Internal Revenue Service, Bureau of Labor Statistics, US Department of Commerce, and the US Census Bureau. Additionally, various agencies, including the Congressional Budget Office compile reports on income statistics. The primary classifications are by household or individual. The top quintile in personal income in 2019 was $103,012 (included in the chart below). The differences between household and personal income are considerable, since 61% of households now have two or more income earners. Median personal income in 2020 was $56,287 for full time workers. This difference becomes very apparent when comparing the percentage of households with six figure incomes to that of individuals. Overall, including all households/individuals regardless of employment status, the median household income was $67,521 in 2020 while the median personal income (including individuals aged 15 and ov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five major unincorporated territories, nine United States Minor Outlying Islands, Minor Outlying Islands, and 326 Indian reservations. The United States is also in Compact of Free Association, free association with three Oceania, Pacific Island Sovereign state, sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Palau, Republic of Palau. It is the world's List of countries and dependencies by area, third-largest country by both land and total area. It shares land borders Canada–United States border, with Canada to its north and Mexico–United States border, with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the List of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Median Household Income

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways of understanding income distribution. Median income can be calculated by household income, by personal income, or for specific demographic groups. Median equivalent adult income The following table represents data from OECD's "median disposable income per person" metric; disposable income deducts from gross income the value of taxes on income and wealth paid and of contributions paid by households to public social security schemes. The figures are equivalised by dividing income by the square root of household size. As OECD displays median disposable incomes in each country's respective currency, the values were converted here using PPP conversion factors for private consumption from the same source, accounting for each country's cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income In The United States

__NOTOC__ Income in the United States is measured by the various federal agencies including the Internal Revenue Service, Bureau of Labor Statistics, US Department of Commerce, and the US Census Bureau. Additionally, various agencies, including the Congressional Budget Office compile reports on income statistics. The primary classifications are by household or individual. The top quintile in personal income in 2019 was $103,012 (included in the chart below). The differences between household and personal income are considerable, since 61% of households now have two or more income earners. Median personal income in 2020 was $56,287 for full time workers. This difference becomes very apparent when comparing the percentage of households with six figure incomes to that of individuals. Overall, including all households/individuals regardless of employment status, the median household income was $67,521 in 2020 while the median personal income (including individuals aged 15 and ov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

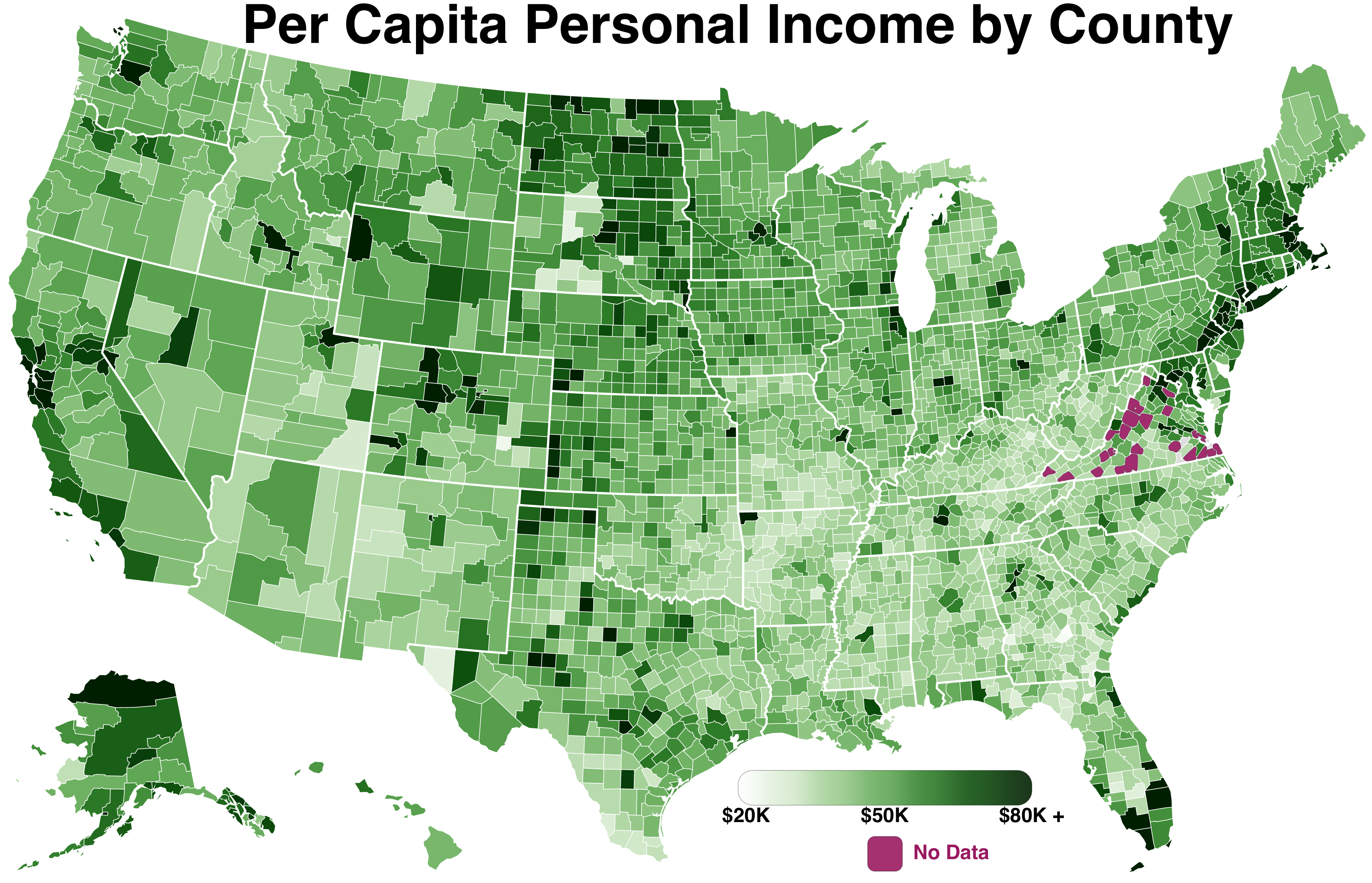

List Of United States Counties By Per Capita Income

This is a list of United States counties by per capita income. Data for the 50 states and the District of Columbia is from the 2009–2013 American Community Survey 5-Year Estimates; data for Puerto Rico is from the 2013–2017 American Community Survey 5-Year estimates, and data for the other U.S. territories is from the 2010 U.S. Census. State income levels and income data for the United States as a whole are included for comparison. Note that county-equivalents in Louisiana are called "parishes" and in Alaska are called in "boroughs," and also that in Alaska census areas in the Unorganized Borough are county-equivalents. For states where independent cities are county-equivalents, the word "city" is included to identify the independent cities and to differentiate them from counties with identical names; the counties with the identical names have the word "county" following them. The word "county" is included in the names of counties that have names identical to the names of U. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment In The United States

Unemployment in the United States discusses the causes and measures of U.S. unemployment and strategies for reducing it. Job creation and unemployment are affected by factors such as economic conditions, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage levels. Overview Unemployment generally falls during periods of economic prosperity and rises during recessions, creating significant pressure on public finances as tax revenue falls and social safety net costs increase. Government spending and taxation decisions ( fiscal policy) and U.S. Federal Reserve interest rate adjustments ( monetary policy) are important tools for managing the unemployment rate. There may be an economic trade-off between unemployment and inflation, as policies designed to reduce unemployment can create inflationary pressure, and vice versa. The U.S. Federal Reserve (the Fed) has a dual mandate to achiev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Socio-economic Mobility In The United States

Socioeconomics (also known as social economics) is the social science that studies how economic activity affects and is shaped by social processes. In general it analyzes how modern societies progress, stagnate, or regress because of their local or regional economy, or the global economy. Overview “Socioeconomics” is sometimes used as an umbrella term for various areas of inquiry. The term “social economics” may refer broadly to the "use of economics in the study of society". More narrowly, contemporary practice considers behavioral interactions of individuals and groups through social capital and social "markets" (not excluding, for example, sorting by marriage) and the formation of social norms. In the relation of economics to social values. A distinct supplemental usage describes social economics as "a discipline studying the reciprocal relationship between economic science on the one hand and social philosophy, ethics, and human dignity on the other" towa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

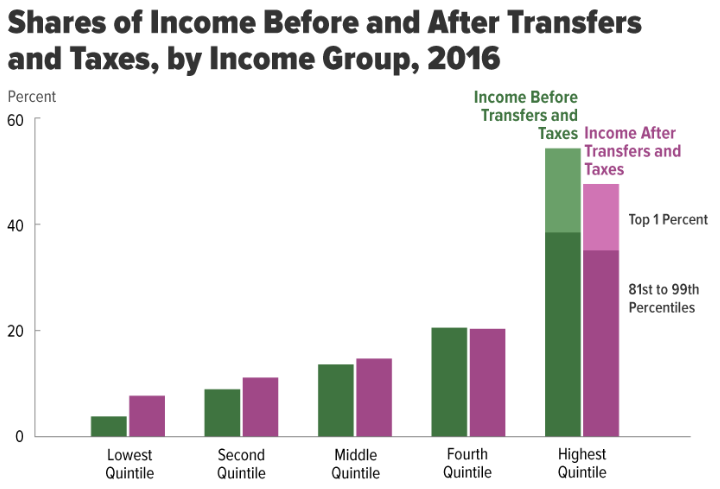

Income Inequality In The United States

Income inequality in the United States is the extent to which income is distributed in differing amounts among the American population. It has fluctuated considerably since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980. The U.S. has the highest level of income inequality among its (post-)industrialized peers.United Press International (UPI), June 22, 2018"U.N. Report: With 40M in Poverty, U.S. Most Unequal Developed Nation"/ref> When measured for all households, U.S. income inequality is comparable to other developed countries before taxes and transfers, but is among the highest after taxes and transfers, meaning the U.S. shifts relatively less income from higher income households to lower income households. In 2016, average market income was $15,600 for the lowest quintile and $280,300 for the highest quintile. The degree of inequality accelerated within the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of The United States

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GDP (nominal) and the eighth-highest per capita GDP (PPP) as of 2022. US share of Global economy is 15.78% in PPP terms in 2022. The United States has the most technologically powerful and innovative economy in the world. Its firms are at or near the forefront in technological advances, especially in artificial intelligence, computers, pharmaceuticals, and medical, aerospace, and military equipment. The U.S. dollar is the currency of record most used in international transactions and is the world's foremost reserve currency, backed by the nation’s massive economy, stable government, extensive natural resources, highly advanced military, its role as the reference standard for the petrodollar system, and its linked eurodollar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |