|

Credit Enhancement

Credit enhancement is the improvement of the credit profile of a structured financial transaction or the methods used to improve the credit profiles of such products or transactions. It is a key part of the securitization transaction in structured finance, and is important for credit rating agencies when rating a securitization. Types There are two primary types of credit enhancement: internal and external. Internal credit enhancement Subordination or credit tranching Establishing a senior/subordinated structure is one of the most popular techniques to create internal credit enhancement. Cash flows generated by assets are allocated with different priorities to classes of varying seniorities. The senior/subordinated structure thus consists of several tranches, from the most senior to the most subordinated (or junior). The subordinated tranches function as protective layers of the more senior tranches. The tranche with the highest seniority has the first right on cash flow. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Borrowing Under A Securitization Structure

Borrow or borrowing can mean: to receive (something) from somebody temporarily, expecting to return it. *In finance, monetary debt *In language, the use of loanwords * In arithmetic, when a digit becomes less than zero and the deficiency is taken from the next digit to the left *You cannot borrow an item that will be replaced. This is commonly referred to as loaning or replacing. Borrowing is retuning the same item that was used. *In music, the use of borrowed chords *In construction, borrow pit *In golf, the tendency of a putted ball to deviate from the straight line; see Glossary of golf#B People * David Borrow (born 1952), British politician * George Borrow (1803–1881), English author * Nik Borrow, bird artist and ornithologist See also * Borough * Borro (other) * Borrowes, a surname * Borrows, a surname * Bureau (other) * Burrow An Eastern chipmunk at the entrance of its burrow A burrow is a hole or tunnel excavated into the ground by an animal to co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

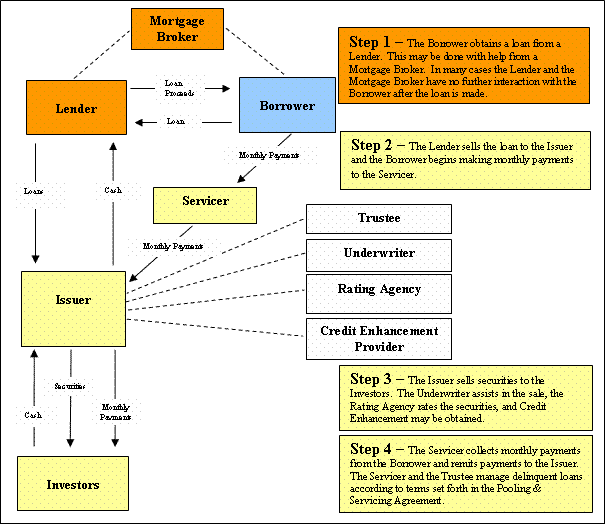

Securitization Transaction

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time- and st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Finance

Structured finance is a sector of finance - specifically financial law - that manages leverage and risk. Strategies may involve legal and corporate restructuring, off balance sheet accounting, or the use of financial instruments. Securitization provides $15.6 trillion in financing and funded more than 50% of U.S. household debt last year. At the end of the day, through securitization and structured finance, more families, individuals, and businesses have access to essential credit, seamlessly and at a lower price. With more than 370 member institutions, the Structured Finance Association (SFA) is the leading trade association for the structured finance industry. SFA’s purpose is to help its members and public policymakers grow credit availability and the real economy in a responsible manner. ISDA conducted market surveys of its Primary Membership to provide a summary of the notional amount outstanding of interest rate, credit, and equity derivatives, until 2010. The ISDMarg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating Agency

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of Default (finance), default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers. Other forms of a rating agency include environmental, social and corporate governance (ESG) rating agencies and the Chinese Social Credit System. The debt instruments rated by CRAs include government bonds, corporate bonds, certificate of deposit, CDs, municipal bonds, preferred stock, and collateralized securities, such as Mortgage-backed security, mortgage-backed securities and collateralized debt obligations. The issuers of the obligations or Security (finance), securities may be companies, special purpose entity, special purpose entities, state or l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time- an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset-backed Security

An asset-backed security (ABS) is a security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues. Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Surety Bond

In finance, a surety , surety bond or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party (the ''obligee'') a certain amount if a second party (the ''principal'') fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. The person or company providing the promise is also known as a "surety" or as a "guarantor". Overview A surety bond is defined as a contract among at least three parties: * the ''obligee'': the party who is the recipient of an obligation * the ''principal'': the primary party who will perform the contractual obligation * the ''surety'': who assures the obligee that the principal can perform the task European surety bonds can be issued by banks and surety companies. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monoline Insurance

Bond insurance, also known as "financial guaranty insurance", is a type of insurance whereby an insurance company guarantees scheduled payments of interest and principal on a bond or other security in the event of a payment default by the issuer of the bond or security. It is a form of "credit enhancement" that generally results in the rating of the insured security being the higher of (i) the claims-paying rating of the insurer or (ii) the rating the bond would have without insurance (also known as the "underlying" or "shadow" rating). The insurer is paid a premium by the issuer or owner of the security to be insured. The premium may be paid as a lump sum or in installments. The premium charged for insurance on a bond is a measure of the perceived risk of failure of the issuer. It can also be a function of the interest savings realized by an issuer from employing bond insurance or the increased value of the security realized by an owner who purchased bond insurance. Bond insurers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Letter Of Credit

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods. History The letter of credit has been used in Europe since ancient times. Letters of credit were traditionally governed by internationally recognized rules and procedures rather than by national law. The International Chamber of Commerce oversaw the preparation of the first Uniform Customs and Practice for Documentary Credits (UCP) in 1933, creating a voluntary framework for commercial banks to apply to transactions worl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pooled Investment

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable securities, or short collective invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Senior Stretch Loan

A senior stretch loan, or overadvance loan, is a hybrid debt instrument consisting of both asset-based loan and cash flow loan. Borrowers Such loans are suitable for two types of companies: *Companies that have substantial asset base but do not have stable or predictable cash flows. For example, troubled or turnaround companies. Cash flow loans would be much smaller and more expensive for these companies. *Companies with healthy cash flows but lower assets. In this case, a pure asset-based loan would be insufficient. For both types, the senior stretch debt structure takes advantage of the combination of the company's assets and cash flow to make significantly more debt available than would have been otherwise. See also *Seniority (finance) *Term loan {{Unreferenced, date=March 2018 A term loan is a monetary loan that is usually repaid in regular payments over a set period of time. Term loans usually last between one and ten years, but may last as long as 30 years in some cases. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Finance

Structured finance is a sector of finance - specifically financial law - that manages leverage and risk. Strategies may involve legal and corporate restructuring, off balance sheet accounting, or the use of financial instruments. Securitization provides $15.6 trillion in financing and funded more than 50% of U.S. household debt last year. At the end of the day, through securitization and structured finance, more families, individuals, and businesses have access to essential credit, seamlessly and at a lower price. With more than 370 member institutions, the Structured Finance Association (SFA) is the leading trade association for the structured finance industry. SFA’s purpose is to help its members and public policymakers grow credit availability and the real economy in a responsible manner. ISDA conducted market surveys of its Primary Membership to provide a summary of the notional amount outstanding of interest rate, credit, and equity derivatives, until 2010. The ISDMarg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |