|

Cooperative Loans In Malaysia

Cooperative loans in Malaysia (commonly known in the Malay language as Pinjaman Koperasi) are credit services offered by cooperatives registered under the Cooperative Commission of Malaysia (SKM) to their members who work as civil servants. It is part of the shadow banking system in Malaysia. The borrowers are restricted to employees in government departments, statutory bodies, government-linked companies or municipal councils. The Congress of Unions of Employees in the Public and Civil Services (CUEPACS) supports these loans because they aid civil servants in overcoming financial problems and reducing borrowing from loan sharks. All matters relating to the administration of these loans are regulated under the Cooperative Society Act of 1993. Loan features Cooperative loans in Malaysia share some common features such as: Repayment by salary deduction Payment of monthly installment is via an automatic salary deduction by a government-related body called the National Cooperative Move ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shadow Banking System

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that provide services similar to traditional commercial banks but outside normal banking regulations. Examples of NBFIs include hedge funds, insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. The phrase "shadow banking" is regarded by some as pejorative, and the term "market-based finance" has been proposed as an alternative. Former US Federal Reserve Chair Ben Bernanke provided the following definition in November 2013: Shadow banking has grown in importance to rival traditional depository banking, and was a factor in the subprime mortgage crisis of 2007–2008 and the global recession that followed. Overview Paul McCulley of investment management firm PIMCO coined the term "shadow banking". Shadow banking is sometimes said to include entities such as hedge funds, money market fund ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congress Of Unions Of Employees In The Public And Civil Services

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of adversaries) during battle, from the Latin '' congressus''. Political congresses International relations The following congresses were formal meetings of representatives of different nations: *The Congress of Aix-la-Chapelle (1668), which ended the War of Devolution *The Congress of Aix-la-Chapelle (1748), which ended the War of the Austrian Succession *The Congress of Aix-la-Chapelle (1818) *The Congress of Berlin (1878), which settled the Eastern Question after the Russo-Turkish War (1877–1878) *The Congress of Gniezno (1000) *The Congress of Laibach (1821) *The Congress of Panama, an 1826 meeting organized by Simón Bolívar *The Congress of Paris (1856), which ended the Crimean War *The Congress of Troppau (1820) *The Congress of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

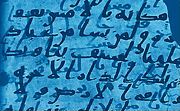

Sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the Hadith. In Arabic, the term ''sharīʿah'' refers to God's immutable divine law and is contrasted with ''fiqh'', which refers to its human scholarly interpretations. In the historical course, fiqh sects have emerged that reflect the preferences of certain societies and state administrations on behalf of people who are interested in the theoretical (method) and practical application (Ahkam / fatwa) studies of laws and rules, but sharia has never been a valid legal system on its own. It has been used together with " customary (Urf) law" since Omar or the Umayyads. It may also be wrong to think that the Sharia, as a religious argument or belief, is entirely within or related to Allah's commands and prohibitions. Several non-graded crimes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supplemental charters and a new charter granted in 1971. Founded as the Institute of British Architects in London in 1834, the RIBA retains a central London headquarters at 66 Portland Place as well as a network of regional offices. Its members played a leading part in promotion of architectural education in the United Kingdom; the RIBA Library, also established in 1834, is one of the three largest architectural libraries in the world and the largest in Europe. The RIBA also played a prominent role in the development of UK architects' registration bodies. The institute administers some of the oldest architectural awards in the world, including RIBA President's Medals Students Award, the Royal Gold Medal, and the Stirling Prize. It also manages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Haram

''Haram'' (; ar, حَرَام, , ) is an Arabic term meaning 'Forbidden'. This may refer to either something sacred to which access is not allowed to the people who are not in a state of purity or who are not initiated into the sacred knowledge; or, in direct contrast, to an evil and thus "sinful action that is forbidden to be done". The term also denotes something "set aside", thus being the Arabic equivalent of the Hebrew concept he, , ḥērem, label=none and the concept of (cf. sacred) in Roman law and religion. In Islamic jurisprudence, ''haram'' is used to refer to any act that is forbidden by God and is one of the five Islamic commandments ( ar, الأحكام الخمسة, al-ʾAḥkām al-Ḵamsa) that define the morality of human action. Acts that are haram are typically prohibited in the religious texts of the Quran, and the category of haram is the highest status of prohibition. If something is considered haram, it remains prohibited no matter how good the i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Takaful

Takaful ( ar, التكافل, sometimes translated as "solidarity" or mutual guarantee) Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.403 is a co-operative system of reimbursement or repayment in case of loss, organized as an Islamic or ''sharia'' compliant alternative to conventional insurance, which contains ''riba'' (usury) and ''gharar'' (excessive uncertainty). Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.402 Under takaful, people and companies concerned about hazards make regular contributions ("donations") to be reimbursed or repaid to members in the event of loss, and managed on their behalf by a takaful operator. Like other Islamic finance products, Takaful is grounded in Islamic ''Muamalat'' (commercial and civil acts or dealings branch of Islamic law). In 2018, the takaful industry had grown to a size of $27.7 billion of "contributions" (from a 2011 figure of $12 billion). The movement has been praised as providing "superior alternatives" to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maybank

Malayan Banking Berhad (doing business as Maybank) is a Malaysian universal bank, with key operating "home markets" of Malaysia, Singapore, and Indonesia. According to the 2020 Brand Finance report, Maybank is Malaysia's most valuable bank brand, the fourth top brand in amongst the Asean countries, and ranked 70th in the world’s most valuable bank brands. Background Maybank is Malaysia's largest bank by market capitalisation and total assets and one of the largest banks in Southeast Asia, with total assets exceeding US$203 billion and having a net profit of US$1.98 billion for 2019. Maybank is also ranked 106th in The Banker's 2020 Top 1000 World Banks (as at July 2020) and is ranked 349th in the Forbes Global 2000 Leading Companies (as at May 2020). Maybank is the largest public listed company on Bursa Malaysia, the Malaysian stock exchange, with a market capitalisation of US$23.7 billion as of 31 December 2019. Maybank's Islamic banking arm, Maybank Islamic, is the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RHB Bank

RHB Bank Berhad (), formerly known as RHB Sakura Merchant Bank Berhad, is a Malaysian bank based in Kuala Lumpur and founded in 1994. It is a subsidiary of RHB Capital Berhad, which is one of the largest banks in Malaysia. RHB Bank has over 180 branches in Malaysia and provides a range of banking products and services for individuals, small businesses and corporates. RHB Bank is one of the few banks in Malaysia that offers Islamic banking products and services. These products are offered through its subsidiary, RHB Islamic Bank Berhad. RHB Islamic Bank has a wide network of branches and ATMs in Malaysia and provides a range of banking products and services that are compliant with Shariah principles. RHB Bank is listed on the Bursa Malaysia and has a market capitalisation of RM24.77 billion as of August 2022. History A wholly owned subsidiary of RHB Capital, RHB Bank Berhad is a result of three mergers –with Kwong Yik Bank Berhad, Sime Bank Berhad and Bank Utama (Malaysia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kuwait Finance House

Kuwait Finance House ( ar, بيت التمويل الكويتي) (KFH) was established in the Kuwait, State of Kuwait, in 1977, as the first bank operating in accordance with the Islamic Sharia, Shari'a rulings. KFH is listed in Kuwait Stock Exchange (KSE), with a market capitalization of $8.2 billion (Kuwaiti Dinar, KWD 2.49 billion) as of May 2016. Assets total $55.52 billion (Kuwaiti Dinar, KWD 16.83 billion) and deposits amount to $34.97 billion (Kuwaiti Dinar, KWD 10.66 billion.) History Kuwait Finance House was established in 1977 as Kuwait's first Islamic bank. It received 170 applications to open new accounts on its first day of operation on 31 August 1978. KFH opened in temporary headquarters on Ahmad Al-Jaber Street, before moving to the Emad Commercial Center in 1983 and then its present-day location on Abdullah Al-Mubarek Street in 1986. By 1983, KFH was the only Islamic Bank listed on the Banker's list of the top 100 Arab Banks. In 1984, KFH was listed on the Kuwait ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Rakyat

{{Infobox company , name = Bank Kerjasama Rakyat Malaysia Berhad (Bank Rakyat) , logo = , type = {{unbulleted list, Islamic banking, Cooperative banking , foundation = 28 September 1954 , location = Menara Kembar Bank Rakyat, Jalan Rakyat, Kuala Lumpur, Malaysia , key_people = (Chairman) , products = Banking and finance , industry = Islamic banking Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economic ... , homepage = {{URL, https://www.bankrakyat.com.my Bank Kerjasama Rakyat Malaysia Berhad (Jawi: بڠک کرجاسام رعيت مليسيا برحد) or Bank Rakyat (Jawi: بڠک رعيت) was established on 28 September 1954 under Ordinance Cooperation’s Act 1948, regulated by Bank Negara Malaysia (BNM) under Development Financial Institutions Act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |