|

Controlled Payment Number

A controlled payment number, disposable credit card or virtual credit card is an alias for a credit card number, with a limited number of transactions, and an expiration date between two and twelve months from the issue date. This "alias" number is indistinguishable from an ordinary credit card number, and the user's actual credit card number is never revealed to the merchant. The technology was introduced primarily as an anti-fraud measure, so that a virtual unique credit card number may be generated to settle a specific transaction, on an exact date by an authorized individual. The possibility of a fraud occurring is significantly less than a traditional physical card, which can be lost, stolen or indeed cloned. The number is generated through the use of either a Web application or a specialized client program, interacting with the card issuer's computer, and is linked to the actual credit card number. While it could usually be set up to allow multiple transactions, it could only ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Number

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and may not directly identify the bank account number/s to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is typically embossed on the front of a payment card, and is encoded ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Cards

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Terminology

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), but promises either to repay or return those resources (or other materials of equal value) at a later date. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower. Etymology The term "credit" was first used in English in the 1520s. The term came "from Middle French crédit (15c.) "belief, trust," from Italian credito, from Latin creditum "a loan, thing entrusted to another," from pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Card Security Code

The card security code is located on the back of Discover, Diners Club, and JCB credit or debit cards and is typically a separate group of three digits to the right of the signature strip file:CIDSampleAmex.png, On American Express cards, the card security code is a printed, not embossed, group of four digits on the front towards the right A card security code (CSC; also known as CVC, CVV, or #Naming, several other names) is a series of numbers that, in addition to the bank card number, is printed (not embossed) on a card. The CSC is used as a security feature for card not present transactions, where a personal identification number (PIN) cannot be manually entered by the cardholder (as they would during point-of-sale or card present transactions). It was instituted to reduce the incidence of credit card fraud. These codes are in slightly different places for different card issuers. The CSC for Visa, Mastercard, and Discover credit cards is a three-digit number on the ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neteller

Neteller is an e-money transfer service used to transfer money to and from merchants, such as forex trading firms, social networks firms. Users in some locations can withdraw funds directly using the Net+ card or transfer the balance to their own bank accounts, others are restricted. Neteller is owned and operated by British global payments company Paysafe Group, alongside former competitor Skrill and prepaid payment method paysafecard. History Neteller was created in 1999 in Canada and moved to the Isle of Man in 2004. Paysafe Group is listed as an "Authorised Electronic Money Institution". In 2015, Optimal Payments Plc (now Paysafe Group) finalized a transformational transaction for the global payments industry – the acquisition of Skrill Group, one of Europe’s largest online payments systems and among the world’s largest independent digital wallet providers. Neteller is not a bank and does not lend customers' funds. It is required under FCA e-money regulations to mai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PayPal

PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders. The company operates as a payment processor for online vendors, auction sites and many other commercial users, for which it charges a fee. Established in 1998 as Confinity, PayPal went public through an IPO in 2002. It became a wholly owned subsidiary of eBay later that year, valued at $1.5 billion. In 2015 eBay spun off PayPal to its shareholders, and PayPal became an independent company again. The company was ranked 143rd on the 2022 Fortune 500 of the largest United States corporations by revenue. History Early history PayPal was originally established by Max Levchin, Peter Thiel, and Luke Nosek in December 1998 as Confinity, a company that developed security software for hand-hel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

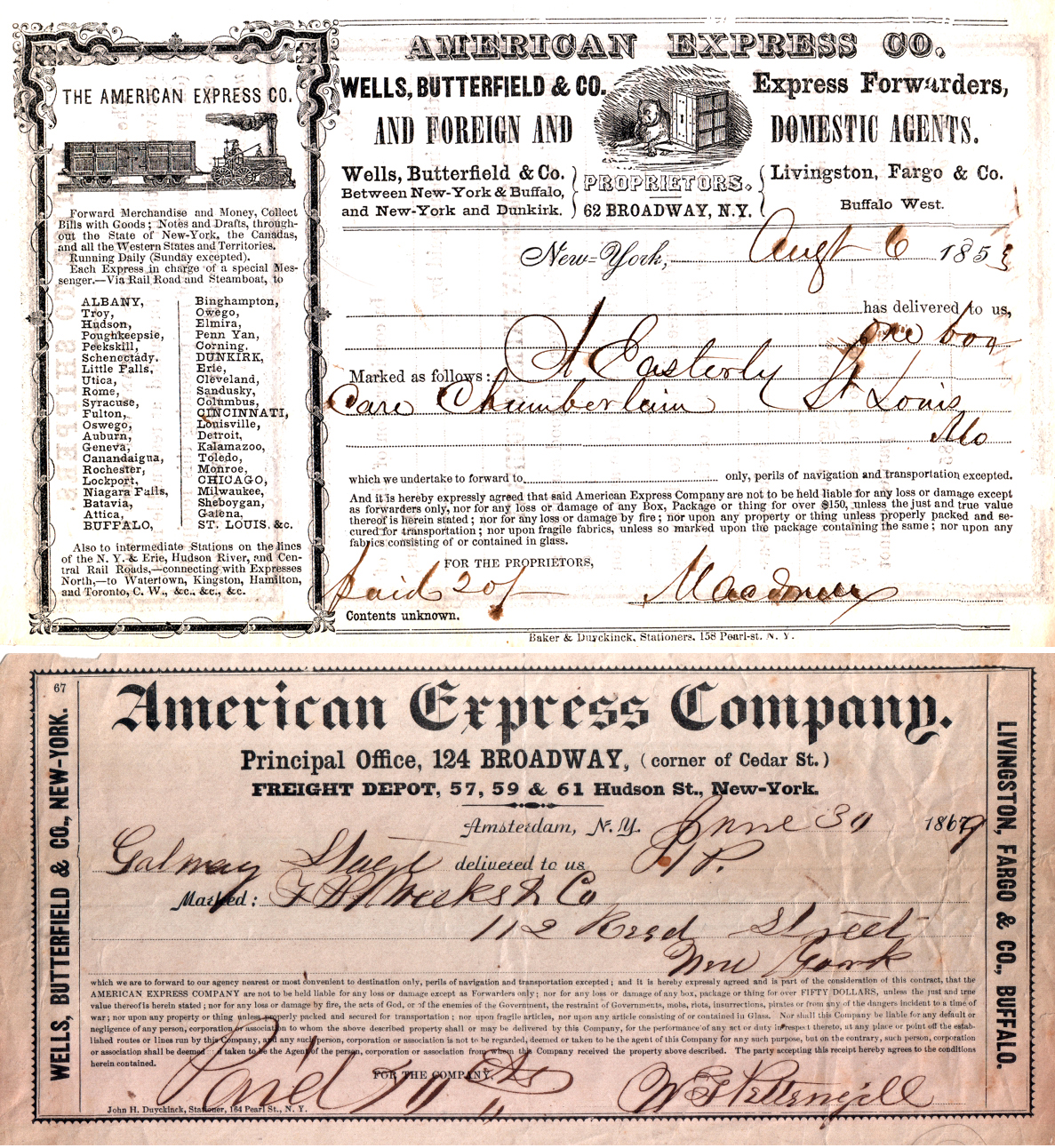

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cahoot

cahoot is an internet-only division of Santander UK plc, the British subsidiary of the Santander Group. Cahoot was launched in June 2000, as the internet based banking brand of Abbey National plc. Cahoot is based in Belfast, Northern Ireland. History There have been several instances of security or operational failures with the website. The initial launch of the bank in 2000 resulted in the website crashing. One case in November 2004 was a security scare, in which it was revealed that customers' accounts could be accessed without going through security procedures, after an update to the online banking system. From 15 to 16 October 2008, the secure section of the Cahoot website became unavailable, due, according to Cahoot, to a power outage in Spain. Although the main page of the website operated normally, it proved impossible for customers to log in to access their savings, leaving them unable to access their accounts and carry out transactions. Call centre staff were also u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discover Card

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit, features that were disruptive to the existing credit card industry. A subsequent innovation was "Cashback Bonus" on purchases. Most cards with the Discover brand are issued by Discover Bank, formerly the Greenwood Trust Company. Discover transactions are processed through the Discover Network payment network. In 2005, Discover Financial Services acquired Pulse, an electronic funds transfer network, allowing it to market and issue debit and ATM cards. In February 2006, Discover Financial Services announced that it would begin offering Discover debit cards to other financial institutions, made possible by the acquisition of Pulse. Discover is the third largest credit card brand in the U.S. based on the number of cards in circulation, behind Visa and Mastercard, with 57 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Etisalat Egypt

Etisalat Egypt S.A.E. is the third mobile operator to enter the Egyptian market and the first integrated operator for telecom services in Egypt. It officially started its business in 2007 and managed to attract one million subscribers in the first fifty days of the launch of its operations. Etisalat was the first company to provide 3.5G services, and was also the first to provide 4G services without the need for its customers to change their SIM cards, in addition to constantly developing its network. Etisalat Egypt is one of the companies operating under Emirates Telecommunication Group Company, which was established in 1976 and later expanded to operate in 16 countries across the Middle East, Africa and Asia, serving more than 148 million subscribers with its services. Etisalat provides mobile, fixed line, mobile Internet and fixed Internet services. Etisalat's Share in the Egyptian Market Within two years of operation, the company was able to attract more than 15 million s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Payments can be effected in a number of ways, for example: * the use of money, cheque, or debit, credit, or bank transfers, whether through mobile payment or otherwise * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly effected in the local currency of the payee unless the parties agree otherwise. Payment in another currency involves an additional foreign exchange trans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |