|

Comorian Franc

The franc (french: link=no, franc comorien; ar, فرنك قمري; sign: FC; ISO 4217 code: KMF) is the official currency of Comoros. It is nominally subdivided into 100 ''centimes'', although no centime denominations have ever been issued. History The French franc became the currency of Comoros after the islands became a French protectorate in 1886. In 1891, Sultan Said Ali bin Said Omar of Grande Comore ( Ngazidja) issued coins denominated in centimes and francs which circulated alongside French currency. In 1912, the Comoros became a province of Madagascar, which was also a French possession. French banknotes and coins circulated in the colony. Apart from an emergency issue of small change notes in 1920, the French currency circulated alone until 1925. On 1 July 1925, the French government formed an agreement with the '' Banque de Paris et des Pays-Bas'' to create the Banque de Madagascar, headquartered in Paris, and granted it a private monopoly to issue currency for th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euro

The euro (symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . The euro is divided into 100 cents. The currency is also used officially by the institutions of the European Union, by four European microstates that are not EU members, the British Overseas Territory of Akrotiri and Dhekelia, as well as unilaterally by Montenegro and Kosovo. Outside Europe, a number of special territories of EU members also use the euro as their currency. Additionally, over 200 million people worldwide use currencies pegged to the euro. As of 2013, the euro is the second-largest reserve currency as well as the second-most traded currency in the world after the United States dollar. , with more than €1.3 trillion in circulation, the euro has one of the highest combined values of banknotes and coins in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banque De Madagascar Et Des Comores

The Banque de Madagascar, from 1946 the Banque de Madagascar et des Comores, was a bank established by the French government in 1925 to issue currency and provide credit in French Madagascar. As such, it fulfilled many of the functions of a central bank for the colony. Background Following the establishment of the Malagasy Protectorate, France took over direct administration of Madagascar as a colony in 1897. The Comptoir national d'escompte de Paris established a presence on the island in the late 19th century, and had advocated the creation of a local issuance bank as early as 1895. Until World War I, its only form of currency was coins of French francs. Franc banknotes were introduced during the war in substitution to the coin money, but did not satisfy the needs of Madagascar's colonial economy that would be better served by local money issuance. Parliamentary debates lingered in France for several years, as different models were considered including direct issuance by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

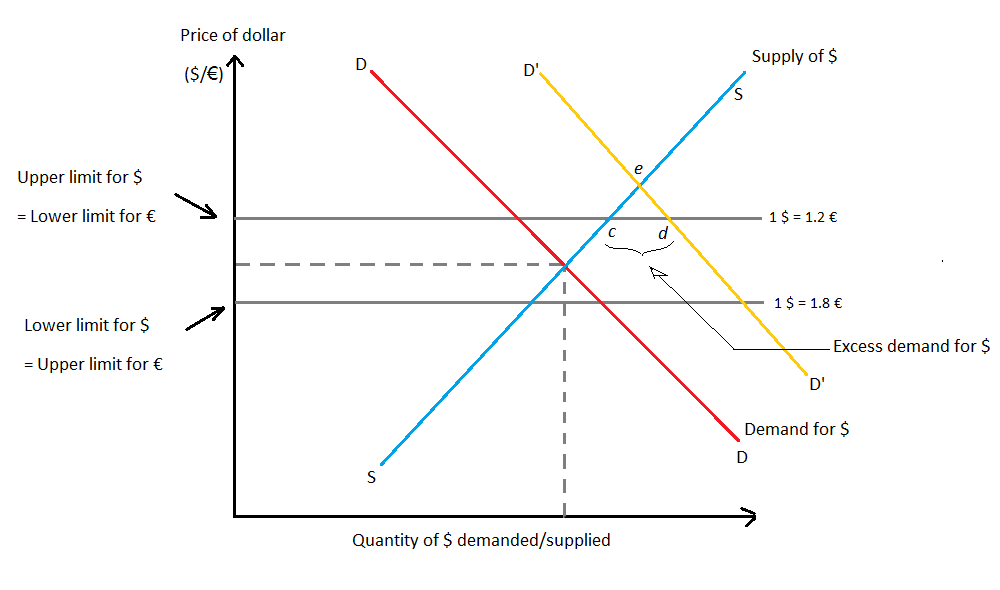

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for or that will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can also have a strong or weak currency. There is no agreement in the ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Currency

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a '' revaluation''. A monetary authority (e.g., a central bank) maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate. However, under a floating exchange rate system (in which exchange rates are determined by market forces acting on the foreign exchange market, and not by government or central bank policy actions), a decrease in a currency's value relative to other major cur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Minister

A finance minister is an executive or cabinet position in charge of one or more of government finances, economic policy and financial regulation. A finance minister's portfolio has a large variety of names around the world, such as "treasury", "finance", "financial affairs", "economy" or "economic affairs". The position of the finance minister might be named for this portfolio, but it may also have some other name, like "Treasurer" or, in the United Kingdom, "Chancellor of the Exchequer". The duties of a finance minister differ between countries. Typically, they encompass one or more of government finance, fiscal policy, and financial regulation, but there are significant differences between countries: * in some countries the finance minister might also have oversight of monetary policy (while in other countries that is the responsibility of an independent central bank); * in some countries the finance minister might be assisted by one or more other ministers (some suppo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro. Foreign exchange reserves assets can comprise banknotes, bank deposits, and government securities of the reserve currency, such as bonds and treasury bills. Some countries hold a part of their reserves in gold, and special drawing rights are also considered reserve assets. Often, for convenience, the cash or securities are retained by the central bank of the reserve or other currency and the "holdings" of the foreign country are tagged or otherwise identified as belonging to the other country without them actually leavi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trésor Public

The Trésor public ( en, Public treasury) is the national administration of the Treasury in France. It is headed by the general directorate of public finances (''Direction générale des finances publiques'') in the Ministry of the Economy, Finance and Industry. The ''Trésor Public'' is responsible for: * the accountancy of the state; * the control and help in the accountancy of public administrations and local governments; * the perception of direct taxes such as the income tax (the computation of those taxes is vested in a separate administration); Until the 2012 reform, the Treasury was headed in each department by the Treasurer-Paymaster General (''Trésorier-Payeur Général''), a high-ranking official. In Paris, the function used to be divided into the Paymaster General of the Treasury (''Payeur Général du Trésor''), and the Receiver General of the Finances (''Receveur Général des Finances''). Each region had its own Treasurer-Paymaster General, the one for the ''dé ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank (" lender of last resort"); * Reserve management: managing a cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies must be exchanged. Currency trading Freely convertible currencies have immediate value on the foreign exchange market, and few restrictions on the manner and amount that can be traded for another currency. Free convertibility is a major feature of a hard currency. Some countries pass laws restricting the legal exchange rates of their currencies or requiring permits to exchange more than a certain amount. Some currencies, such as the North Korean won, the Transnistrian ruble, and the Cuban national peso, are officially nonconvertible and can only be exchanged on the black market. If an official exchange rate is set, its value on the black market is often lower. Convertibility controls may be introduced as part of an overall monetary polic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)