|

Catastrophe Bond

Catastrophe bonds (also known as cat bonds) are risk-linked securities that transfer a specified set of risks from a sponsor to investors. They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew and the Northridge earthquake. Catastrophe bonds emerged from a need by insurance companies to alleviate some of the risks they would face if a major catastrophe occurred, which would incur damages that they could not cover by the invested premiums. An insurance company issues bonds through an investment bank, which are then sold to investors. These bonds are inherently risky, generally BB, and usually have maturities less than 3 years. If no catastrophe occurred, the insurance company would pay a coupon to the investors. But if a catastrophe did occur, then the principal would be forgiven and the insurance company would use this money to pay their claim-holders. Investors include hedge funds, catastrophe-oriented funds, and asset managers. They are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Destruction Following Hurricane Andrew

Destruction may refer to: Concepts * Destruktion, a term from the philosophy of Martin Heidegger * Destructive narcissism, a pathological form of narcissism * Self-destructive behaviour, a widely used phrase that ''conceptualises'' certain kinds of destructive acts as belonging to the self * Slighting, the deliberate destruction of a building * Final destruction ( End of the World) Comics and gaming * Destruction (DC Comics), one of the Endless in Neil Gaiman's comic book series ''The Sandman'' * Destructoid, a video-game blog Music * Destruction (band), a German thrash metal band * '' ''Destruction'' (EP)'', a 1994 EP by Destruction * "Destruction" (song), a 2015 song by Joywave * "Destruction", a 1984 song by Loverboy featured in Giorgio Moroder’s restoration of the film ''Metropolis'' * "The Destruction", a song from the 1988 musical '' Carrie'' Television and film * "Destruction" (UFO), a 1970 episode of ''UFO'' * ''Destruction'' (film), a 1915 film starring Theda Ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special Purpose Entity

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership) created to fulfill narrow, specific or temporary objectives. SPEs are typically used by companies to isolate the firm from financial risk. A formal definition is "The Special Purpose Entity is a fenced organization having limited predefined purposes and a legal personality". Normally a company will transfer assets to the SPE for management or use the SPE to finance a large project thereby achieving a narrow set of goals without putting the entire firm at risk. SPEs are also commonly used in complex financings to separate different layers of equity infusion. Commonly created and registered in tax havens, SPEs allow tax avoidance strategies unavailable in the home district. Round-tripping is one such strategy. In addition, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

USAA

The United Services Automobile Association (USAA) is a San Antonio-based Fortune 500 diversified financial services group of companies including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve, or served, in the United States Armed Forces. At the end of 2020, it had more than 13 million members. USAA was founded in 1922 in San Antonio by a group of 25 U.S. Army officers as a mechanism for mutual self-insurance when they were unable to secure auto insurance because of the perception that they, as military officers, were a high-risk group. USAA has since expanded to offer banking and insurance services to past and present members of the Armed Forces, officers and enlisted, and their families. The company ranked No. 96th in the 2020 Fortune 500 list of the largest United States corporations by total revenue and appeared on Fortune's 2021 Blue Ribbon list of compa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hannover Re

Hannover Re (in German ''Hannover Rück'') is a reinsurance company based in Hannover, Germany. It is the third-largest reinsurance group in the world, with a gross premium of around € The euro sign () is the currency sign used for the euro, the official currency of the eurozone and unilaterally adopted by Kosovo and Montenegro. The design was presented to the public by the European Commission on 12 December 1996. It consists ...27 billion. Founded in 1966, Hannover Re transacts all lines of property & casualty and life & health reinsurance and has a network of over 170 subsidiaries, branches and representative offices on all five continents with a total staff of more than 3,000. The Group's German business is written by the subsidiary E+S Rück. History Hannover Re was founded on 6 June 1966. In the 1970s, the company entered the US and Japanese markets. In 1981, the company made its first acquisition of a foreign insurance group – the Hollandia Group (now Hannover Re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/america-canada/us/documents/investor-relations/2019/aig-2018-annual-report.pdf page 7 The company operates through three core businesses: General Insurance, Life & Retirement, and a standalone technology-enabled subsidiary. General Insurance includes Commercial, Personal Insurance, U.S. and International field operations. Life & Retirement includes Group Retirement, Individual Retirement, Life, and Institutional Markets. AIG is a sponsor of the AIG Women's Open golf tournament. AIG's corporate headquarters are in New York City and the company also has offices around the world. AIG serves 87% of the Fortune Global 500 and 83% of the Forbes 2000. AIG was ranked 60th on the 2018 Fortune 500 list. According to the 2016 Forbes Global 2000 list, AIG ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wharton School

The Wharton School of the University of Pennsylvania ( ; also known as Wharton Business School, the Wharton School, Penn Wharton, and Wharton) is the business school of the University of Pennsylvania, a private Ivy League research university in Philadelphia. Generally considered to be one of the most prestigious business schools in the world, the Wharton School is the world's oldest collegiate business school, having been established in 1881 through a donation from Joseph Wharton. The Wharton School awards the Bachelor of Science with a school-specific economics major, with concentrations in over 18 disciplines in Wharton's academic departments. The degree is a general business degree focused on core business skills. At the graduate level, the Master of Business Administration (MBA) program can be pursued standalone or offers dual studies leading to a joint degree from other schools (e.g., law, engineering, government). Similarly, in addition to its tracks in accounting, finance, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Sandor

Richard L. Sandor is an American businessman, economist, and entrepreneur. He is chairman and CEO of the American Financial Exchange (AFX) established in 2015, which is an electronic exchange for direct interbank/financial institution lending and borrowing. The AFX flagship product, the AMERIBOR benchmark index, reflects the actual borrowing costs of thousands of regional and community banks across the U.S. and is one of the short-term borrowing rates, along with the Secured Overnight Financing Rate, vying to replace U.S. dollar Libor as a benchmark in the U.S. Sandor is chairman and CEO of Environmental Financial Products LLC, which specializes in inventing, designing and developing new financial markets with a special emphasis on investment advisory services. He is widely recognized as the "father of financial futures" for his pioneering work in developing the first interest rate futures contract in the 1970s, when he served as chief economist and vice president of the Chicago ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times Magazine

''The New York Times Magazine'' is an American Sunday magazine Supplement (publishing), supplement included with the Sunday edition of ''The New York Times''. It features articles longer than those typically in the newspaper and has attracted many notable contributors. The magazine is noted for its photography, especially relating to fashion and style. Its puzzles have been popular since their introduction. History Its first issue was published on September 6, 1896, and contained the first photographs ever printed in the newspaper.The New York Times CompanyNew York Times Timeline 1881-1910. Retrieved on 2009-03-13. In the early decades, it was a section of the broadsheet paper and not an insert as it is today. The creation of a "serious" Sunday magazine was part of a massive overhaul of the newspaper instigated that year by its new owner, Adolph Ochs, who also banned fiction, comic strips and gossip columns from the paper, and is generally credited with saving ''The New York Times ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

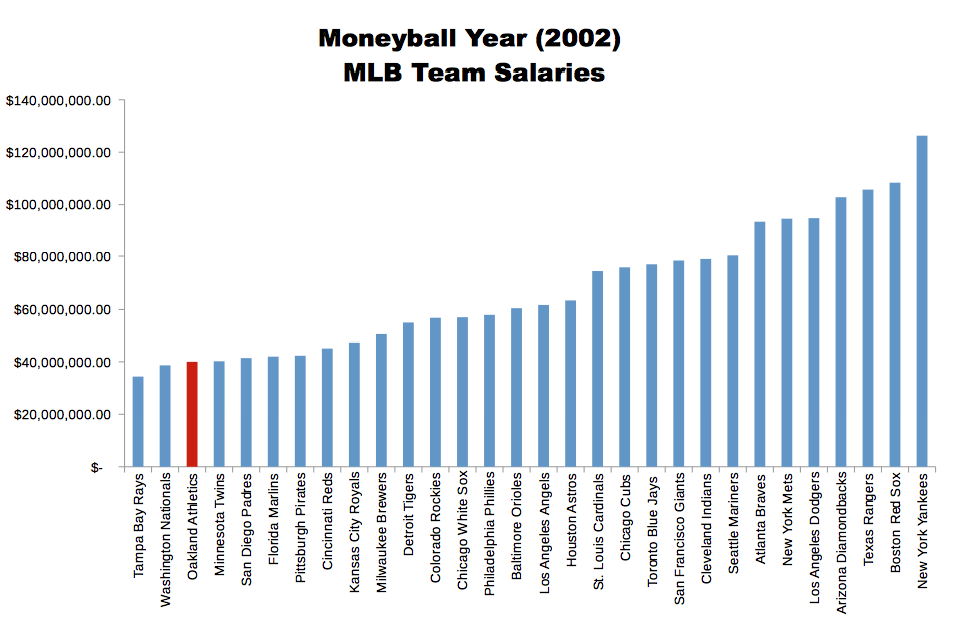

Moneyball

''Moneyball: The Art of Winning an Unfair Game'' is a book by Michael Lewis, published in 2003, about the Oakland Athletics baseball team and its general manager Billy Beane. Its focus is the team's analytical, evidence-based, sabermetric approach to assembling a competitive baseball team despite Oakland's small budget. A film based on Lewis' book, starring Brad Pitt and Jonah Hill, was released in 2011. Synopsis The central premise of ''Moneyball'' is that the collective wisdom of baseball insiders (including players, managers, coaches, scouts, and the front office) over the past century is outdated, subjective, and often flawed. Statistics such as stolen bases, runs batted in, and batting average, typically used to gauge players, are relics of a 19th-century view of the game and the statistics available at that time. Before sabermetrics was introduced to baseball, teams were dependent on the skills of their scouts to find and evaluate players. Scouts are experienced in the spo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liar's Poker

''Liar's Poker'' is a non-fiction, semi-autobiographical book by Michael Lewis describing the author's experiences as a bond salesman on Wall Street during the late 1980s. First published in 1989, it is considered one of the books that defined Wall Street during the 1980s, along with Bryan Burrough and John Helyar's '' Barbarians at the Gate: The Fall of RJR Nabisco'', and the fictional ''The Bonfire of the Vanities'' by Tom Wolfe. The book captures an important period in the history of Wall Street. Two important figures in that history feature prominently in the text, the head of Salomon Brothers' mortgage department Lewis Ranieri and the firm's CEO John Gutfreund. The book's name is taken from liar's poker, a gambling game popular with the bond traders in the book. Overview The narrative of ''Liar's Poker'' jumps back and forth between two different threads. One thread is autobiographical: it follows Lewis through his college education, his hiring by Salomon Brothers (now a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Lewis (author)

Michael Monroe Lewis (born October 15, 1960) Gale Biography In Context. is an American author and financial journalist. He has also been a contributing editor to '' Vanity Fair'' since 2009, writing mostly on business, finance, and economics. He is known for his nonfiction work, particularly his coverage of financial crises and behavioral finance. Lewis was born in New Orleans and attended Princeton University, from which he graduated with a degree in art history. After attending the London School of Economics, he began a career on Wall Street during the 1980s as a bond salesman at Salomon Brothers. The experience prompted him to write his first book, ''Liar's Poker'' (1989). Fourteen years later, Lewis wrote '' Moneyball: The Art of Winning an Unfair Game'' (2003), in which he investigated the success of Billy Beane and the Oakland Athletics. His 2006 book '' The Blind Side: Evolution of a Game'' was his first to be adapted into a film, '' The Blind Side'' (2009). In 2010, he r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time- and stru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |