|

Carr–Madan Formula

In financial mathematics, the Carr–Madan formula of Peter Carr and Dilip B. Madan shows that the analytical solution of the European option price can be obtained once the explicit form of the characteristic function of \log S_t, where S_t is the price of the underlying asset at time t, is available. This analytical solution is in the form of the Fourier transform, which then allows for the fast Fourier transform to be employed to numerically compute option values and Greeks The Greeks or Hellenes (; el, Έλληνες, ''Éllines'' ) are an ethnic group and nation indigenous to the Eastern Mediterranean and the Black Sea regions, namely Greece, Cyprus, Albania, Italy, Turkey, Egypt, and, to a lesser extent, oth ... in an efficient manner. References Further reading * . * {{DEFAULTSORT:Carr-Madan formula Mathematical finance Special functions Financial models Options_(finance) Fourier analysis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Analytical Solution

Generally speaking, analytic (from el, ἀναλυτικός, ''analytikos'') refers to the "having the ability to analyze" or "division into elements or principles". Analytic or analytical can also have the following meanings: Chemistry * Analytical chemistry, the analysis of material samples to learn their chemical composition and structure * Analytical technique, a method that is used to determine the concentration of a chemical compound or chemical element * Analytical concentration Mathematics * Abstract analytic number theory, the application of ideas and techniques from analytic number theory to other mathematical fields * Analytic combinatorics, a branch of combinatorics that describes combinatorial classes using generating functions * Analytic element method, a numerical method used to solve partial differential equations * Analytic expression or analytic solution, a mathematical expression using well-known operations that lend themselves readily to calculation * A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Option

In finance, the style or family of an option is the class into which the option falls, usually defined by the dates on which the option may be exercised. The vast majority of options are either European or American (style) options. These options—as well as others where the payoff is calculated similarly—are referred to as "vanilla options". Options where the payoff is calculated differently are categorized as "exotic options". Exotic options can pose challenging problems in valuation and hedging. American and European options The key difference between American and European options relates to when the options can be exercised: * A European option may be exercised only at the expiration date of the option, i.e. at a single pre-defined point in time. * An American option on the other hand may be exercised at any time before the expiration date. For both, the payoff—when it occurs—is given by * \max\, for a call option * \max\, for a put option where K is the strike pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option Price

In finance, a price (premium) is paid or received for purchasing or selling options. This article discusses the calculation of this premium in general. For further detail, see: for discussion of the mathematics; Financial engineering for the implementation; as well as generally. Premium components This price can be split into two components: intrinsic value, and time value. Intrinsic value The ''intrinsic value'' is the difference between the underlying spot price and the strike price, to the extent that this is in favor of the option holder. For a call option, the option is in-the-money if the underlying spot price is higher than the strike price; then the intrinsic value is the underlying price minus the strike price. For a put option, the option is in-the-money if the ''strike'' price is higher than the underlying spot price; then the intrinsic value is the strike price minus the underlying spot price. Otherwise the intrinsic value is zero. For example, when a DJI call (bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Characteristic Function (probability Theory)

In probability theory and statistics, the characteristic function of any real-valued random variable completely defines its probability distribution. If a random variable admits a probability density function, then the characteristic function is the Fourier transform of the probability density function. Thus it provides an alternative route to analytical results compared with working directly with probability density functions or cumulative distribution functions. There are particularly simple results for the characteristic functions of distributions defined by the weighted sums of random variables. In addition to univariate distributions, characteristic functions can be defined for vector- or matrix-valued random variables, and can also be extended to more generic cases. The characteristic function always exists when treated as a function of a real-valued argument, unlike the moment-generating function. There are relations between the behavior of the characteristic function of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fourier Transform

A Fourier transform (FT) is a mathematical transform that decomposes functions into frequency components, which are represented by the output of the transform as a function of frequency. Most commonly functions of time or space are transformed, which will output a function depending on temporal frequency or spatial frequency respectively. That process is also called ''analysis''. An example application would be decomposing the waveform of a musical chord into terms of the intensity of its constituent pitches. The term ''Fourier transform'' refers to both the frequency domain representation and the mathematical operation that associates the frequency domain representation to a function of space or time. The Fourier transform of a function is a complex-valued function representing the complex sinusoids that comprise the original function. For each frequency, the magnitude (absolute value) of the complex value represents the amplitude of a constituent complex sinusoid with that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fast Fourier Transform

A fast Fourier transform (FFT) is an algorithm that computes the discrete Fourier transform (DFT) of a sequence, or its inverse (IDFT). Fourier analysis converts a signal from its original domain (often time or space) to a representation in the frequency domain and vice versa. The DFT is obtained by decomposing a sequence of values into components of different frequencies. This operation is useful in many fields, but computing it directly from the definition is often too slow to be practical. An FFT rapidly computes such transformations by factorizing the DFT matrix into a product of sparse (mostly zero) factors. As a result, it manages to reduce the complexity of computing the DFT from O\left(N^2\right), which arises if one simply applies the definition of DFT, to O(N \log N), where N is the data size. The difference in speed can be enormous, especially for long data sets where ''N'' may be in the thousands or millions. In the presence of round-off error, many FFT algorithm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

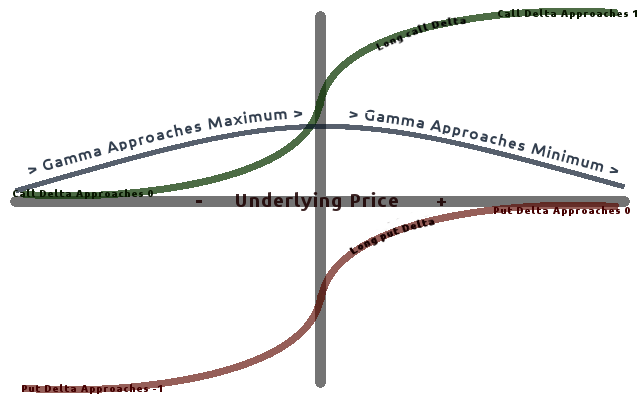

Greeks (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special Functions

Special functions are particular mathematical functions that have more or less established names and notations due to their importance in mathematical analysis, functional analysis, geometry, physics, or other applications. The term is defined by consensus, and thus lacks a general formal definition, but the List of mathematical functions contains functions that are commonly accepted as special. Tables of special functions Many special functions appear as solutions of differential equations or integrals of elementary functions. Therefore, tables of integrals usually include descriptions of special functions, and tables of special functions include most important integrals; at least, the integral representation of special functions. Because symmetries of differential equations are essential to both physics and mathematics, the theory of special functions is closely related to the theory of Lie groups and Lie algebras, as well as certain topics in mathematical physics. Symbolic c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Models

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of Production (economics), production, Distribution (economics), distribution, and Consumption (economics), consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in Financial system, financial systems at various scopes, thus the field can be roughly divided into Personal finance, personal, Corporate finance, corporate, and public finance. In a financial system, assets are bought, sold, or traded as Financial instrument, financial instruments, such as Currency, currencies, Loan, loans, Bond (finance), bonds, Share (finance), shares, Stock, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be Bank, banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are alway ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |