|

BPCE

Groupe BPCE (for Banque Populaire Caisse d'Epargne) is a major French banking group formed by the 2009 merger of two major retail banking groups, Groupe Caisse d'Épargne and Groupe Banque Populaire. As of 2021, it was France's fourth largest bank, the seventh largest in Europe, and the nineteenth in the world by total assets. It has more than 8,200 branches nationwide under their respective brand names serving nearly 150 million customers. It is Europe's largest bank by revenue, ahead of BNP Paribas and HSBC. It is considered a global systemically important bank (G-SIB) by the Financial Stability Board. Background Caisses d'Épargne, Eulia and Ixis Groupe Caisse d'Épargne ("Savings Bank Group") was born in 1818 with the foundation of the Paris savings bank, . It long grew from the bottom up as an expanding set of local savings banks, until a 1983 legislation created a central financial entity or "national center", the (CENCEP). In 1992, CENCEP was replaced by the (CNCE), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BPCE Avenue De France

Groupe BPCE (for Banque Populaire Caisse d'Epargne) is a major French banking group formed by the 2009 merger of two major retail banking groups, Groupe Caisse d'Épargne and Groupe Banque Populaire. As of 2021, it was France's fourth largest bank, the seventh largest in Europe, and the nineteenth in the world by total assets. It has more than 8,200 branches nationwide under their respective brand names serving nearly 150 million customers. It is Europe's largest bank by revenue, ahead of BNP Paribas and HSBC. It is considered a global systemically important bank (G-SIB) by the Financial Stability Board. Background Caisses d'Épargne, Eulia and Ixis Groupe Caisse d'Épargne ("Savings Bank Group") was born in 1818 with the foundation of the Paris savings bank, . It long grew from the bottom up as an expanding set of local savings banks, until a 1983 legislation created a central financial entity or "national center", the (CENCEP). In 1992, CENCEP was replaced by the (CNCE), w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Groupe Caisse D'Épargne

Groupe Caisse d'épargne was a French cooperative banking group, with around, 4700 branches in the country. Its origins go back to the founding in 1818 of the , France's first savings bank. The group was active in retail and private banking, as well as holding a significant stake in the publicly traded investment bank Natixis. In 2009, it merged with Groupe Banque Populaire to form Groupe BPCE. History The first French savings bank (french: Caisse d'Épargne) was created in Paris in 1818 by a group of financiers, social reformers and philanthropists that included Benjamin Delessert, Jean-Conrad Hottinguer, Joseph Marie de Gérando, Jacques Laffitte, the Duke of La Rochefoucauld-Liancourt, James Mayer de Rothschild, and Vital Roux. The Caisses d'Épargne were not banks, since they were not allowed to lend. The deposits they collected were invested in government bonds, from 1895 via centralized management by the Caisse des Dépôts et Consignations, a financial arm of the Fre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédit Foncier De France

Crédit Foncier de France (CFF) was a major French bank, active from 1852 to 2019 when its activities were entirely subsumed into Groupe BPCE, although the brand name appears to remain active. History The Crédit Foncier (English: landed credit) initially made loans to commune in France, communes. The movement was initiated by Louis Wolowski and Count Xavier Branicki, and sanctioned by Emperor Napoleon III of France, Napoléon III in 1852 in an attempt to modernize the medieval French banking system and expand French investment outside Europe. Its name became the “Banque Foncière of Paris.” Similar institutions at Nevers and Marseilles were amalgamated into one under the title of “Crédit Foncier de France.” The amount of the loan could not exceed half of the value of the property pledged or hypothecated, and that the repayment of the loan was by an Annuity (finance theory), annuity, which included the interest and part of the principal, terminable at a certain date. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Groupe Banque Populaire

Groupe Banque Populaire ("People's Bank") was a French group of cooperative banks. The central entity was controlled by 15 independent regional banks and also operated under the CASDEN and the Crédit Coopératif subsidiaries. In 2006, Groupe Banque Populaire created Natixis with another French cooperative banking group, Groupe Caisse d'Epargne, to which they brought Banque Populaire's Natexis and Caisse d'Epargne's IXIS Corporate and Investment Bank. In 2009, Banque Populaire and Caisse d'Epargne merged to form Groupe BPCE. Merger In October 2008 the group announced plans, since approved by the French government, to merge with Groupe Caisse d'Epargne. The companies merged in 2009 to form the Groupe BPCEJolly, DavidParent of French Bank Agrees to Guarantee Troubled Assets.''New York Times.'' 26 August 2009. and retain their separate retail banking brands and branch networks. Banque Populaire's chief executive officer Philippe Dupont has been nominated to head the enlarged com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banque Palatine

Banque Palatine is a French bank founded in 1780 in Lyon, and is therefore one of the oldest French banks still being run. It is today a full branch subsidiary of the mutual group BPCE. Its core businesses are retail banking with small and medium-sized enterprises, private banking and asset management. Its headquarters is in Paris downtown, in the la Madeleine neighbourhood. Its long-term debt rating is Aa3 (Moody's). Activities Wealth management bank The Palatine Bank provides services in three domains: wealth management, investment advice and management of current accounts. Its customers are composed of business executives, members of the liberal professions, middle management, non-residents and pensioners. Within the Palatine Bank the management of the private customer market is devoted to asset management. Bank of firms Banque Palatine offers financial and banking expertise to midcap companies (ETI) whose turnover exceeds 15 million euro: funding projects abroad, corporate f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tours Duo

Tours Duo are two skyscrapers designed by Jean Nouvel and located in the 13th arrondissement of Paris, on the edge of the ring road and Ivry-sur-Seine. As of 2022, most of their surface is occupied by the group headquarters of banking group BPCE. The mixed-use project covers more than 108,000 m2. It mainly houses offices but also a hotel, a restaurant, a bar with a panoramic terrace overlooking Paris, an auditorium, shops and green terraces. The ''Tour Duo n°1'', with 180 m, is the third tallest building in Paris after the Eiffel Tower (324 m) and the Tour Montparnasse (209 m), at par with the forthcoming Tour Triangle. The whole is intended to complete the "belt" formed by several towers and high-rise buildings at the gates of Paris. Work began at the end of March 2017, and the two completed towers were delivered in 2021. See also * List of tallest buildings and structures in the Paris region * List of tallest buildings in France For non-building structures like towers, m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natexis Banques Populaires

Natixis is a French corporate and investment bank created in November 2006 from the merger of the asset management and investment banking operations of ''Natexis Banques Populaires'' (Banque Populaire group) and ''IXIS'' (Groupe Caisse d'Epargne). Natixis provides financial data for the 'Markets' section on the news channel, Euronews. On October 26, 2010, Natixis Investment Managers (NIM) has acquired a majority stake in asset management start-up ‘Ossiam’. In February 2021, Groupe BPCE made a tender offer for all Natixis shares it did not own. The offer completed in June 2021 and Natixis stock was delisted. Operations * Corporate & Investment Banking Includes Capital Markets, Debt & Finance and Corporate & Institutional Banking. Capital Markets encompass equities, commodities, fixed-income, forex, derivatives and structured products. * Asset Management Natixis Investment Managers is the 14th largest asset management firm in the world with $734 billion in assets under ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natexis

Natixis is a French corporate and investment bank created in November 2006 from the merger of the asset management and investment banking operations of ''Natexis Banques Populaires'' (Banque Populaire group) and ''IXIS'' (Groupe Caisse d'Epargne). Natixis provides financial data for the 'Markets' section on the news channel, Euronews. On October 26, 2010, Natixis Investment Managers (NIM) has acquired a majority stake in asset management start-up ‘Ossiam’. In February 2021, Groupe BPCE made a tender offer for all Natixis shares it did not own. The offer completed in June 2021 and Natixis stock was delisted. Operations * Corporate & Investment Banking Includes Capital Markets, Debt & Finance and Corporate & Institutional Banking. Capital Markets encompass equities, commodities, fixed-income, forex, derivatives and structured products. * Asset Management Natixis Investment Managers is the 14th largest asset management firm in the world with $734 billion in assets under ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cooperative Banking

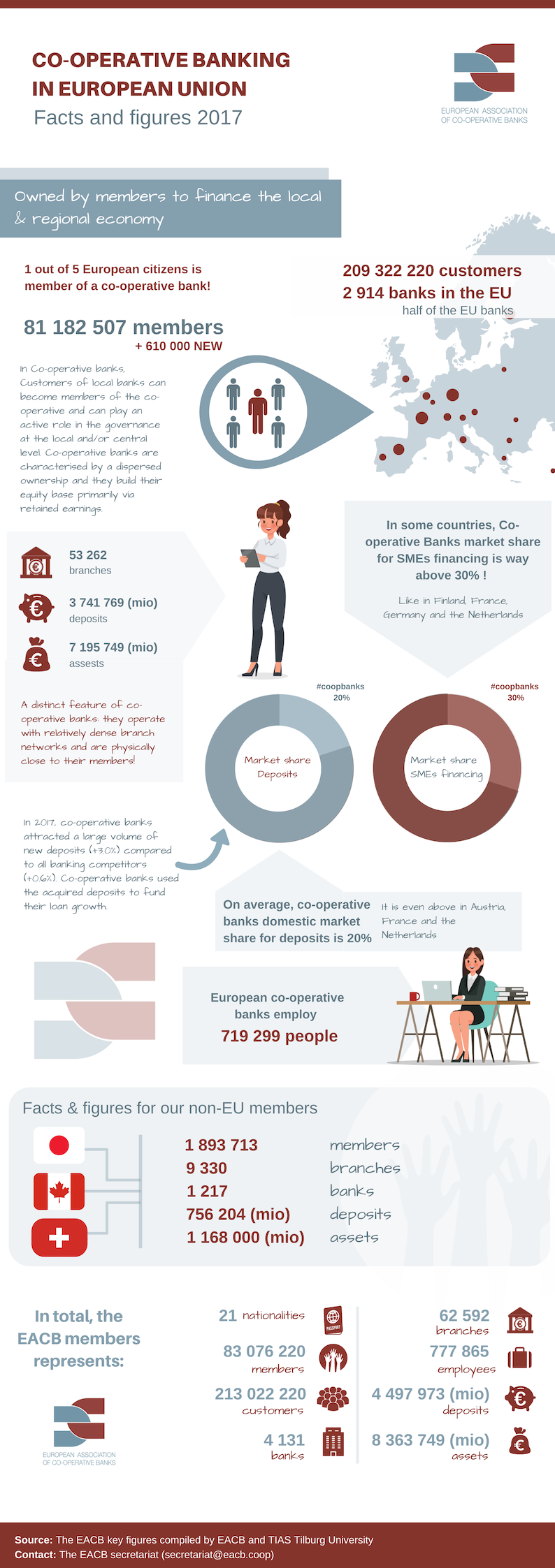

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times lower failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédit National

The Crédit national was a former French banking institution created under the impetus of Charles François Laurent, an expert in international financing, by a special law on , located on the border between the private domain and the sphere of influence of the French State. The G.I.E. Crédit National Syndication was struck off the commercial register on August 2, 1995. Leaders Presidents * Charles Lawrence: 1919 * Louis Martin: 1920 — 1936 * Wilfrid Baumgartner: 1936 — 1949 * Jacques Brunet: 1949 — 1960 * John Saltes: 1960-1972 * Bernard Clappier: 1973 — 1974 * André de Lattre: 1974 — 1982 * Jean Saint-Geours: 1982 — 1987 * Paul Mentré: 1987 — 1990 * Yves Lyon-Caen: 1990 — 1993 * Jean-Yves Haberer: 1993 — 1994 * Emmanuel Rodocanachi: 1994 — 1998 Directors * Marcel Frachon: 1919 — 1929 * Jean du Buit: 1929 — 1942 See also * Crédit Foncier de France * Bank of France The Bank of France ( French: ''Banque de France''), headquar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Systemically Important Financial Institution

A systemically important financial institution (SIFI) is a bank, insurance company, or other financial institution whose failure might trigger a financial crisis. They are colloquially referred to as "too big to fail". As the financial crisis of 2007–2008 unfolded, the international community moved to protect the global financial system through preventing the failure of SIFIs, or, if one does fail, limiting the adverse effects of its failure. In November 2011, the Financial Stability Board (FSB) published a list of global systemically important financial institutions (G-SIFIs). Also in November 2010, the Basel Committee on Banking Supervision (BCBS) introduced new guidance (known as Basel III) that also specifically target SIFIs. The main focus of the Basel III guidance is to increase bank capital requirements and to introduce capital surcharges for G-SIFIs. However, some economists warned in 2012 that the tighter Basel III capital regulation, which is primarily based on risk ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portmanteau

A portmanteau word, or portmanteau (, ) is a blend of wordsGarner's Modern American Usage , p. 644. in which parts of multiple words are combined into a new word, as in ''smog'', coined by blending ''smoke'' and ''fog'', or ''motel'', from ''motor'' and ''hotel''. In , a portmanteau is a single morph that is analyzed as representing two (or more) underlying s. When portmanteaus shorten es ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |