|

Angel Investors

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or ownership equity. Angel investors usually give support to start-ups at the initial moments (where risks of the start-ups failing are relatively high) and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital, as well as to provide advice to their portfolio companies. Over the last 50 years, the number of angel investors has greatly increased. Etymology and origin T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Company

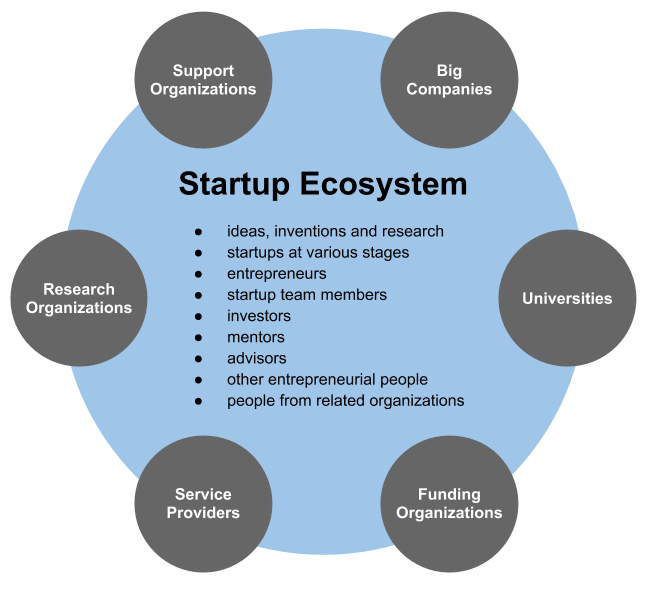

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Company

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states (for example, Texas), businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC). An LLC is a hybrid le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Development Bank Of Canada

The Business Development Bank of Canada (BDC; french: Banque de développement du Canada) is a Crown corporation and national development bank wholly owned by the Government of Canada, mandated to help create and develop Canadian businesses through financing, growth and transition capital, venture capital and advisory services, with a focus on small and medium-sized enterprises. Founded in 1944, its corporate headquarters is located in Montreal and it has more than 123 business centres working with 60,000 clients.BDC Annual Report, 2017 Retrieved 2018-01-23 BDC's obligations, secured by the Government of Canada, are issued to |

National Angel Capital Organization

The National Angel Capital Organization (NACO Canada) was established in 2002 as the only national industry association for angel investors in Canada. Its national network now includes 4,200 angel investors, 45 incubators and accelerators, and 44 angel groups. Since its formal incorporation as National Angel Organization (NAO) in 2002, NACO Canada has published The Primer for Angel Investment in Canada (2002) and Age of the Angel: Best Practices for Angel Groups and Investors (2007), and A Practical Guide to Angel Investing, 2nd Edition, published in 2017. NAO changed its name from NAO to NACO in 2008. History NACO Canada was formed after the second Angel Investor Summit (2002), convened by CHIN UP Fund and chaired by Henry Vehovec. Since then NACO Canada has continued to annually organize an angel investor summit to encourage networking, education, co-investment and sharing of best practices. NACO has spawned the creation of numerous angel groups across Canada, established the Co-I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment’s rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The internal rate of return on an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exit Strategy

An exit strategy is a means of leaving one's current situation, either after a predetermined objective has been achieved, or as a strategy to mitigate failure. An organisation or individual without an exit strategy may be in a quagmire. At worst, an exit strategy will save face; at best, an exit strategy will deliver an objective worth more than the cost of continuing the execution of a previous plan considered "deemed to fail" by weight of the present situation. In warfare In military strategy, an exit strategy is understood to minimise losses of what military jargon called "blood and treasure" (lives and material). The term was used technically in internal Pentagon critiques of the Vietnam War (cf. President Richard Nixon's promise of Peace With Honor), but remained obscure to the general public until the Battle of Mogadishu, Somalia when the U.S. military involvement in that U.N. peacekeeping operation cost the lives of U.S. troops without a clear objective. Republican cri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Investment

Return on investment (ROI) or return on costs (ROC) is a ratio between net income (over a period) and investment (costs resulting from an investment of some resources at a point in time). A high ROI means the investment's gains compare favourably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments.Return On Investment – ROI , Investopedia as accessed 8 January 2013 In economic terms, it is one way of relating profits to capital invested. Purpose In business, the pur ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Dilution

Stock dilution, also known as equity dilution, is the decrease in existing shareholders' ownership percentage of a company as a result of the company issuing new equity. New equity increases the total shares outstanding which has a dilutive effect on the ownership percentage of existing shareholders. This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising stock options, or by issuance or conversion of convertible bonds, preferred shares or warrants into stock. This dilution can shift fundamental positions of the stock such as ownership percentage, voting control, earnings per share, and the value of individual shares. Control dilution Control dilution describes the reduction in ownership percentage or loss of a controlling share of an investment's stock. Many venture capital contracts contain an anti-dilution provision in favor of the original investors, to protect their equity inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overconfidence

Confidence is a state of being clear-headed either that a hypothesis or prediction is correct or that a chosen course of action is the best or most effective. Confidence comes from a Latin word 'fidere' which means "to trust"; therefore, having self-confidence is having trust in one's self. Arrogance or hubris, in comparison, is the state of having unmerited confidence—believing something or someone is correct or capable when evidence or reasons for this belief are lacking. Overconfidence or presumptuousness is excessive belief in someone (or something) succeeding, without any regard for failure. Confidence can be a self-fulfilling prophecy as those without it may fail or not try because they lack it and those with it may succeed because they have it rather than because of an innate ability. The concept of self-confidence is commonly defined as self-assurance in one's personal judgment, ability, power, etc. One's self-confidence increases as a result of experiences of havin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)